Permanent life insurance provides lifelong coverage, offering financial protection and peace of mind for policyholders and their beneficiaries. Unlike term life insurance, which covers a specific period, permanent life insurance remains in effect for the insured’s entire life, provided premiums are paid.

Life insurance is a bit of a touchy subject for many. After all, the point of the whole thing is to provide some sort of financial coverage to help you pay your final expenses and take care of your loved ones too.

The people who pursue one form of life insurance or another are those who want to take care of household expenses, debts, and other burdens in the event they die. Several types of life insurance can be purchased today. They include term life, whole life, and universal life.

Of course, with each type, there are certain advantages and disadvantages. Life insurance is something that can be tailored to fit your particular needs and circumstances. One of the aspects that will be discussed here is the concept of permanent life insurance rates. If you want to know more then you need to learn something about universal life insurance.

Universal life is known as a permanent life insurance option. The biggest advantage of this form of coverage is that it has a remarkable level of flexibility when it comes to how payments are paid, the costs of the premiums over time, and the short-term interest rates can be reset each year. Additionally, the rates are normally much lower than other types.

Table of Contents

Understanding Permanent Life Insurance

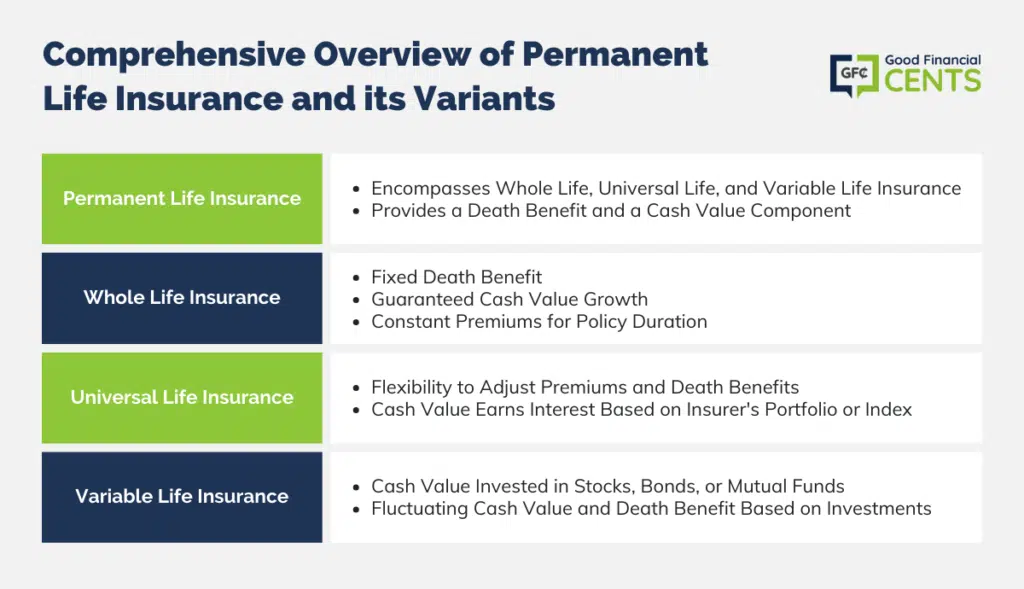

Permanent life insurance encompasses various policies, including whole life, universal life, and variable life insurance. Each type offers unique features, but they all provide a death benefit and a cash value component. The cash value grows over time, and policyholders may borrow against it or even surrender the policy for its cash value.

Whole Life Insurance

Whole life insurance provides a fixed death benefit and a cash value component that grows at a guaranteed rate. Premiums remain constant throughout the policy’s duration, making it a predictable option for policyholders. The insurer invests some of the premiums, and the returns contribute to the policy’s cash value.

Universal Life Insurance

Universal life insurance offers more flexibility, allowing policyholders to adjust their premiums and death benefits within certain limits. The cash value earns interest based on the insurer’s portfolio or a market index, and the interest rate may vary.

Variable Life Insurance

Variable life insurance allows policyholders to invest the cash value in a selection of investment options, such as stocks, bonds, or mutual funds. This means the cash value and death benefit can fluctuate based on the performance of these investments, introducing a higher level of risk and potential reward.

Factors Influencing Permanent Life Insurance Rates

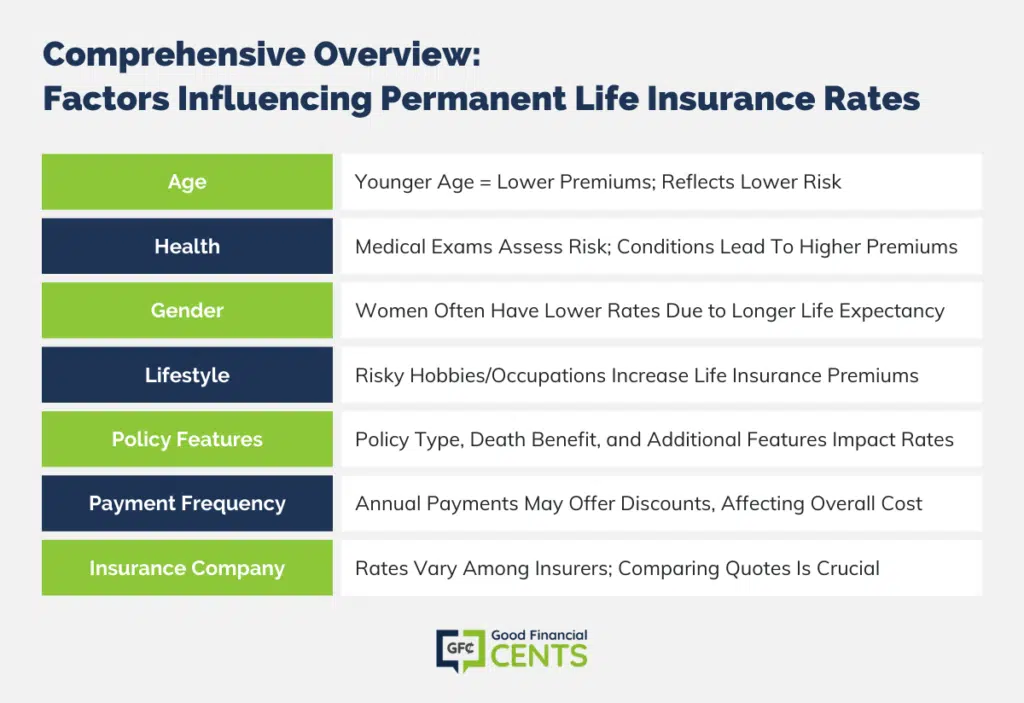

Age: Age is a critical factor in determining life insurance rates. The younger you are when you purchase a policy, the lower your premiums will typically be. This is because younger individuals generally present a lower risk to insurers.

Health: Your health status plays a significant role in rate determination. Insurers usually require a medical exam to assess your health and identify any potential risks. Pre-existing conditions, smoking, or a family history of certain diseases can lead to higher premiums.

Gender: Statistically, women tend to live longer than men, which often results in lower life insurance rates for women.

Lifestyle: Your lifestyle choices, including occupation, hobbies, and habits, can impact your life insurance rates. High-risk activities such as skydiving or scuba diving can result in higher premiums.

Policy Features: The type of permanent life insurance policy you choose, along with the death benefit amount, will influence your rates. Additional features or riders, such as accelerated death benefits or long-term care riders, can also impact the cost.

Payment Frequency: How often you pay your premiums—monthly, quarterly, or annually—can affect your overall costs. Some insurers offer discounts for annual payments.

Insurance Company: Different insurance companies have different underwriting guidelines and rate structures. Shopping around and comparing quotes from multiple insurers can help ensure you get the best rate for your specific situation.

Premium Structures of Permanent Life Insurance

Level Premiums

Whole life insurance typically features level premiums, meaning the premium amount remains constant throughout the policy’s duration. This predictability is a significant advantage for policyholders who prefer stable payments.

Flexible Premiums

Universal life insurance offers flexible premiums, allowing policyholders to adjust their payments within certain limits. This flexibility can be beneficial for individuals with fluctuating incomes.

Single Premium

Some permanent life insurance policies allow policyholders to pay a single lump-sum premium upfront. This option eliminates the need for ongoing premium payments but requires a significant initial investment.

Calculating Permanent Life Insurance Rates

Insurers use complex algorithms to calculate life insurance rates, taking into account various factors including age, health, gender, lifestyle choices, and the policy’s features. Actuaries play a crucial role in this process, using statistical data to assess risk and determine appropriate premium amounts.

Getting the lowest rates possible

Regardless of the type of policy, you’ll want to get the lowest rates possible for the best coverage. Millions of people are buying more than they need. The number one method to saving is using a broker or independent agent who can serve quotes from lots of companies.

Why You Need Life Insurance

If you’re like the majority of Americans, you would leave behind a mountain of debt if you were to pass away. When you die, what’s going to happen to that debt? They will be passed on to your family.

Every year thousands and thousands of families go through the pain of losing someone close to them, and then on top of that, they find themselves struggling to pay for mortgage payments, car loans, and credit card bills.

Conclusion

Permanent life insurance offers lifelong coverage, a death benefit, and a cash value component, providing a comprehensive financial safety net for policyholders and their beneficiaries. Understanding how permanent life insurance rates are determined is crucial for making an informed decision and finding a policy that suits your needs and budget.

Age, health, gender, lifestyle, and the chosen policy type and features significantly influence premium amounts. Additionally, the premium structure, whether level, flexible, or a single premium, will impact your overall costs. By carefully considering these elements and comparing quotes from multiple insurers, you can secure a permanent life insurance policy that offers both protection and value.