Taking prescription medications has become so common that most of us may not give it a second thought. But if you’re applying for life insurance, you can be sure that the insurance company won’t have the same casual view.

There are certain risks associated with the use of prescription medications that can affect if you can get approved for life insurance, and often at what rate.

Here are the reasons why…

Table of Contents

Too Many Meds – Is Too Many Meds

These days, it is not at all unusual for people to be on multiple prescription medications. They might be taking one prescription to deal with a respiratory condition, two to deal with hypertension, one to deal with shoulder pain, and still another to deal with digestive issues.

While each of these medications may be justified on an individual basis, an insurance company will be concerned with the number of medications that an applicant is taking.

The company could take the position that the different medications are each designed to treat a symptom of a greater but undiscovered underlying health condition.

In addition, some doctors – and their patients – seek out a prescription as the first and only solution to a given medical condition. But in many circumstances, lifestyle changes will be an even more effective remedy.

An excessive number of medications could be an indication that you are relying primarily on prescriptions to improve your health, rather than being proactive in making necessary lifestyle changes.

Negative drug interactions are yet another concern. Though any single medication that you are taking may be completely safe by itself, drugs can sometimes interact with other medications that you are taking, and cause complications.

If you have a long history of taking multiple medications, it may be just a question of time before such a negative interaction will occur. While many of these problems can be cured simply by removing the offending medication, some interactions are so serious that they result in death.

Prescriptions Aren’t Being Monitored and Regularly Updated

Many people go on a prescription medication early in life and then continue taking the medication forever.

The problem with this type of regimen is that the effectiveness of a medication will change over time, due to age, changing health circumstances, advancement (or retraction) of the health condition, or even a change in weight or physical activity.

For these reasons, you must be closely monitored any time you’re on any type of prescription medication. Failure to do so could increase the chance that the medication itself will eventually become a problem.

Sometimes this is a result of a physician who does a whole lot more prescribing than un-prescribing. And sometimes it’s because patients have a way of getting the desired prescription, and then not coming back to the doctor on a regular basis.

Few prescription medications are ever an absolute cure-all. They must usually be taken in conjunction with other therapies, including lifestyle changes, in order to be completely effective. And that effectiveness can only be determined through constant monitoring.

It could well be that you are on one or more prescription medications that are now completely unnecessary. And if such is the case, the medication could be doing you more harm than good. A life insurance company will not overlook any of these factors.

Adverse Side Effects

If you spend much time watching TV and seeing the hundreds of commercials for prescription medications that come on every day, you’ve probably heard the long list of potential adverse side effects that can come from taking any one of them.

Side effects on just about any medication run the gamut, from skin rashes and watering eyes to cancer and death.

While you as a patient may ignore these potential side effects in hopes of being cured of your condition, a life insurance company does not have the same luxury.

Since at least one of the adverse side effects of many, many prescription medications is death, the more medications that you are on, the greater the risk to the life insurance company will be.

Life insurance companies are also aware that the use of certain prescription medications can even be the cause of a new illness or condition.

This is why life insurance companies must consider not only the medications that you are on but the combinations and their potential risks. Any one of them holds the potential to force a life insurance company to do the one thing that it doesn’t want to do, and that’s to pay a death claim.

Using Medications for Other Than the Recommended Purpose

Prescription medications are sometimes used for purposes other than that which has been recommended by the manufacturer. For example, a person could be on a medication that treats digestive issues, when in fact they’re using it instead for weight control.

This is not entirely unusual since many prescription medications are reclassified for other purposes after the fact. But if you are using a drug for a purpose other than that which the manufacturer has created it, the life insurance company could have an issue with it.

The life insurance company is very likely to give you a higher risk rating for the health condition that the medication is designed to treat.

It will not matter that you don’t actually have that condition, they will see the medication as evidence that you do. For this reason, you should be very careful about medications you are using, and the specific purposes that you are using them for.

Don’t Get Caught in THIS Trap

In an attempt to receive a better rating, and a lower premium, applicants for life insurance will often attempt to avoid disclosing certain health conditions, or the prescription medications they are taking in order to treat them.

But you can be virtually certain that the insurance company will be able to determine any medications that you are taking, and then assume that you have the underlying condition that they are designed to treat.

The life insurance company only needs to do a prescription database search, and they will know what type of medications you’ve been taking in the past and when. That will represent the starting point for a deeper search into any type of health condition that you are attempting to avoid disclosing.

It’s far better that you fully disclose any medications that you are taking, as well as any medical conditions that you are or have been treated for in the past.

Your life insurance agent is a professional (that would be me!), and will know the best ways to deal with whatever conditions that you have.

Let him or her (or me) know exactly what’s going on, and then go with the recommendations as the best way to proceed in getting your life insurance policy for the best possible premium rate.

There are a couple of ways that you can get lower insurance rates and keep more money in your pockets.

If you use several types of medications, you are going to be facing higher premiums, but that doesn’t mean that you have to break your bank every month to get life insurance protection.

There are various things you can do to obtain lower prices from the insurer.

The two best methods to help with that will be exercise and having a healthful diet. There is a chance that these lifestyle changes could get you off some of those medications, which will lower your insurance rates.

If your goal is to protect your money, it’s time to hit the gym and skip the extra dessert every night.

Another way that you can save money is to compare dozens of companies before you choose which company is sufficient for you.

All companies are distinct, and they will all view your medications differently, which means that you’ll get very different prices determined by the insurer that you contact.

The Bottom Line – Can You Get Approved for Life Insurance While Taking Prescription Medications?

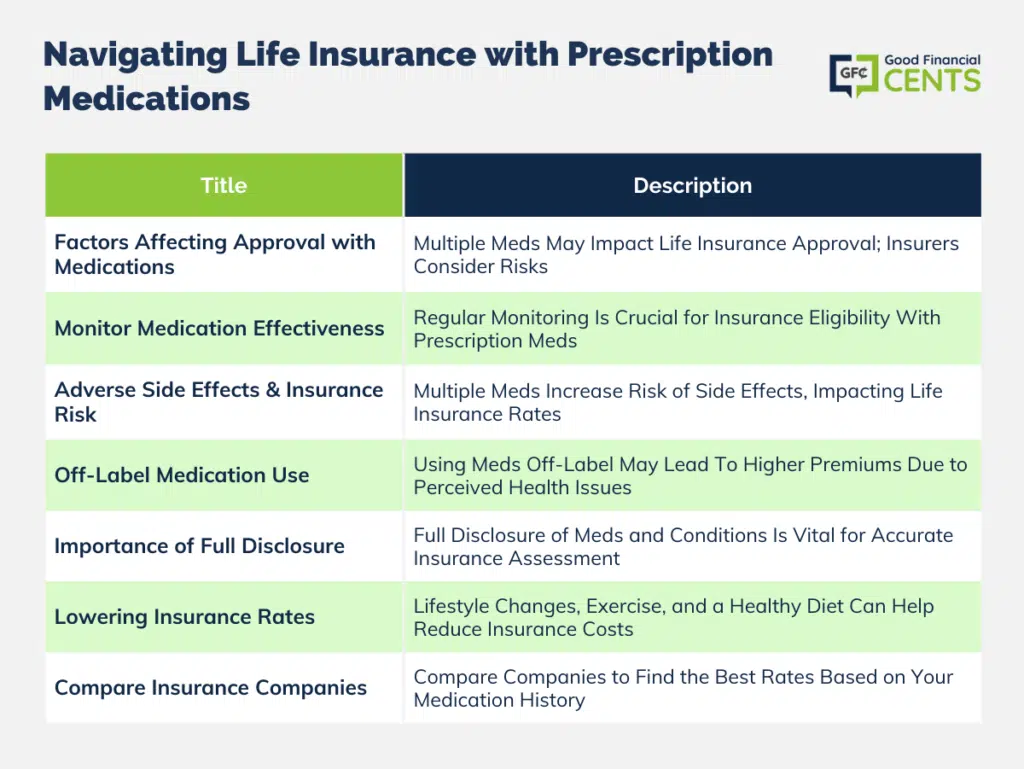

The use of prescription medications can significantly impact your eligibility and premium rates. Insurance companies scrutinize various aspects related to prescription drug usage.

Taking too many medications can raise concerns, as it may signal underlying health issues or potential drug interactions.

Neglecting regular medication monitoring can also affect your insurability, as the effectiveness of drugs may change over time. Adverse side effects and off-label medication use can lead to higher risk ratings.

Attempting to hide medication usage is ill-advised, as insurers can easily verify this information. To secure favorable rates, prioritize health improvements and compare insurers wisely.