There are a number of characteristics that come with having ADHD, including inattentiveness, fidgeting, and typically issues with organization. These are the traits associated with ADHD that do not cause a rise in insurance rates.

On the other hand, those with more severe cases of ADHD have issues tied to more serious problems such as drug abuse, alcoholism, depression, risky patterns of behavior, and overall addictive personalities.

It is patterns of behavior such as these that lead to much higher insurance premiums.

Table of Contents

What Is ADHD?

Attention Deficit Hyperactivity Disorder, or ADHD, is a mental health disorder that affects people of all ages. According to the CDC, over 6 Million children have been diagnosed with ADHD.

It is characterized by difficulty focusing, impulsivity, and hyperactivity, which can have a significant impact on daily life. Common symptoms associated with ADHD include inattention, short attention span, inability to complete tasks on time, disorganization, and restlessness.

| COMPONENT | DESCRIPTION OF ADHD |

|---|---|

| Definition | A Neurodevelopmental Disorder Characterized by Inattention, Hyperactivity, and Impulsiveness. |

| Symptoms | Inattention (e.g., Difficulty Focusing on Tasks, Forgetfulness), Hyperactivity (e.g., Excessive Fidgeting, Restlessness), Impulsiveness (e.g., Acting Without Thinking, Interrupting Others) |

| Diagnosis | It May Include Medication, Therapy, Lifestyle Changes (e.g., Exercise, Healthy Diet), and Support From Family and Friends. |

| Causes | The Exact Cause of ADHD Is Not Known, but It Is Thought to Involve a Combination of Genetic, Environmental, and Neurological Factors. |

| Treatment | May Include Medication, Therapy, Lifestyle Changes (e.g., Exercise, Healthy Diet), and Support From Family and Friends. |

The exact cause of ADHD is still unknown, but it is believed to be related to genetic and environmental factors. Treatment for ADHD typically includes a combination of medications and behavioral therapy.

Does ADHD Affect Getting Approved for Life Insurance?

The good news for those with ADHD is that affordable insurance companies usually don’t consider it to be a medical underwriting problem unless it can be in some way tied to an external condition. In the case that a person is suffering from a mild case of ADD and does not suffer from another sort of disorder, they will usually have no issue obtaining insurance.

The main goal of a medical underwriter is to determine whether or not a person with ADHD is susceptible to other unhealthy habits or tendencies that would be considered a risk to the insurance company.

The spokesperson for Metlife recently said that people who have ADHD could potentially receive the “best insurance rating”. Additionally, he stated that if there is some external factor outside of the person’s control, they can still qualify for a standard rating. The cost of this plan is about 100 percent higher than a normal plan, so it is not ideal.

Other factors, such as addictions or criminal records, in addition to having ADHD, would usually disqualify a person from receiving any type of insurance. With this being said, it is important to know all of your options going in, as well as have a qualified insurance agent who will be able to locate the best possible plan.

Life Insurance Ratings With ADHD

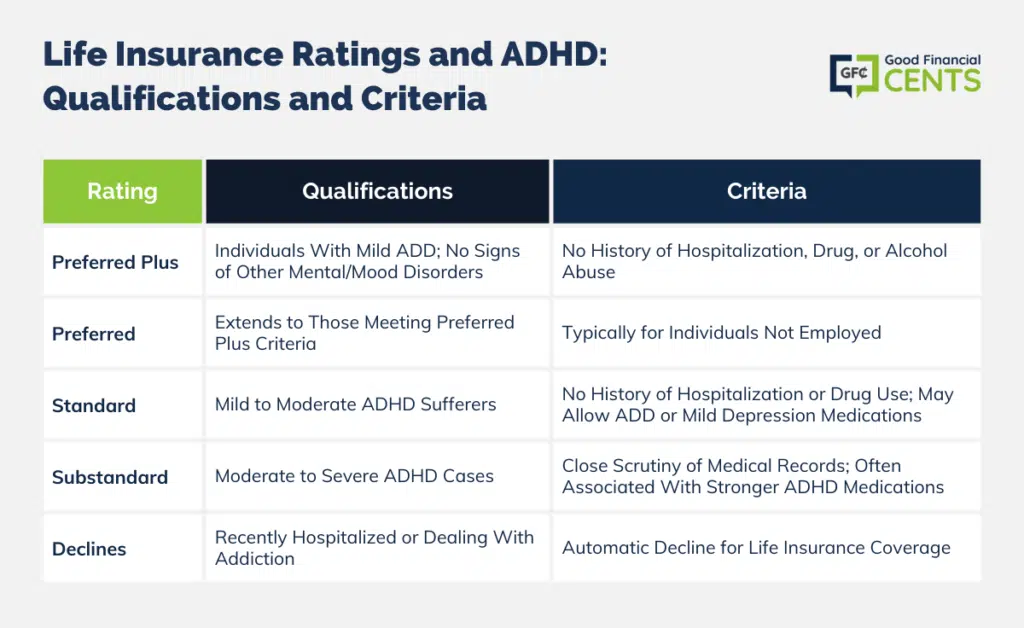

The following bullets outline the general qualifications that people fall under in order to receive different types of life insurance.

- Preferred Plus: Sufferers of ADD are definitely capable of receiving a preferred plus status, and it is not necessarily a rare occurrence. Someone with ADHD can qualify for this status if they suffer from mild ADD and show no other signs of mental or mood disorders. Medical underwriters also like to verify that there have been no previous hospitalizations or drug or alcohol abuse.

- Preferred: Anyone who qualifies for preferred plus also qualifies under this status. It is meant for those who are not employed usually.

- Standard: Most likely applied to mild to moderate sufferers of the illness. As is the case with preferred plus, there must be no history of hospitalization or drug use. It is usually the case that people falling under this category are users of some form of ADD medication. Some insurance companies even allow the use of mild depression medications.

- Substandard: This is saved for those with moderate to severe cases of ADHD. This is usually determined by a close examination of medical records. Stronger medications used for ADHD are typically associated with some under this status.

- Declines: Anyone who has been recently hospitalized or is otherwise suffering from addiction would be declined life insurance.

What if You Get Denied for Coverage?

All is not lost if a person with ADHD is either denied insurance or offered it at a steep premium, though. Medical underwriters want to see that a person has their illness managed; the length in terms of the illness is really a non-factor.

Those who partake in at least a year’s worth of treatment or have otherwise gotten their problems under control with medication can reapply for insurance at that time.

Time is of the essence when treating any condition, and it is certainly no different with ADD. The earlier it is detected, the more time a person has to learn the best methods for treatment and management. This is especially important in adulthood when it comes time to obtain a life insurance policy, as it will end up saving you thousands.

Four and a half million people were diagnosed with ADHD in 2020, and since then, the diagnosis rate has been consistently climbing at 3% per year. Of these yearly diagnoses, 60% will still have ADHD into adulthood.

How Much Life Insurance Do You Need?

Before you start calling companies or looking at options, you need to do some basic groundwork. Do the math to figure out how much insurance your spouse and children need.

To start, gather all of your bills and major debts and combine them. Whatever the number is, this is your starting block. Make sure your life insurance plan is larger than this number.

The next thing you’ll need to do is multiply your annual income by 7 to 10. Not only will your family get your debts, but they will no longer have your salary to pay off those debts. Make sure your life insurance can replace your paychecks for several years.

Are you trying to get life insurance for ADHD? Give us a call; we can make it quicker and easier than trying to do it alone.

Optimizing for Better Insurance Rates

With these facts under consideration, it is important to know all of the information when it comes to getting insurance. Time is the most valuable tool when it comes to treating ADHD. Learning how to treat and manage ADHD is the end goal when trying to obtain affordable life insurance.

You can help yourself get the lowest insurance rates for you and your family’s protection. One of the first ways you can do that is by making some healthy lifestyle changes to improve your overall health.

The medical exam is how the insurance company determines your health and then your premiums. The better your health is during the exam, the better premiums they will grant you.

If you’re dedicated to getting those lower premiums, you’re going to have to make some changes to your health. Mainly your diet and your physical exercise. Make better diet choices and get up and go for a run.

If you’re really dedicated, you can make some even more improvements. If you’ve been smoking for several years, you’ve probably tried to quit in the past. It’s hard, but it’s worth it.

Quit smoking, and you’ll see your life insurance premiums cut in half.

Each insurance company has different systems for rating their applicants with ADHD, which means you could receive drastically different quotes from various carriers. It’s easy to see why it’s important to get quotes from dozens of companies.

The Bottom Line – Life Insurance With ADHD

Understanding the relationship between ADHD and life insurance can seem complex, but with the right information, it becomes clearer. ADHD alone is not a barrier to obtaining affordable insurance; however, its associated risks and behaviors can influence rates.

By managing ADHD symptoms effectively, seeking early treatment, and making healthy lifestyle choices, individuals can secure favorable insurance premiums. Furthermore, consulting with knowledgeable insurance agents and shopping around ensures that you obtain the best rates tailored to your circumstances.

Remember, every insurance company evaluates differently; be proactive, informed, and advocate for your best interests when seeking life insurance.

Research Articles Cited

- CDC.gov (n.d.) Data and Statistics about ADHD. Retrieved from https://www.cdc.gov/ncbddd/adhd/data.html