Thrombocytopenia is when a person has a low blood platelet count.

This can be a significant health problem because it increases the chance of severe bleeding and also could be a sign of other more serious issues.

As a result, if you have thrombocytopenia, you’re going to have to do some extra work if you want an excellent insurance plan.

You can still qualify for a policy at a fair rate with this condition. It depends on a number of factors, including the severity of your condition and how well you manage your application.

To get prepared before you apply, take a few minutes and review our guide to the life insurance rules for someone with thrombocytopenia.

If this article doesn’t answer all of your questions, please feel free to contact us, and we can answer any additional questions that you have about your life insurance protection.

Table of Contents

Managing Thrombocytopenia and Life Insurance Costs

One of the crucial steps for individuals with thrombocytopenia is to consistently manage their condition. Regular check-ups, following prescribed treatments, and maintaining a healthy lifestyle can significantly impact the way insurance companies view your application.

The insurance industry, by its very nature, is risk-averse. Therefore, demonstrating consistent control and management of your condition can ease potential concerns.

For instance, an individual who adheres strictly to their medication schedule and has no significant fluctuations in their platelet count over a year or two might receive a more favorable rating. Also, insurance companies tend to favor those who take preventative measures. Regular exercise, a balanced diet, and abstaining from alcohol or tobacco can paint a comprehensive picture of a health-conscious individual, potentially lowering premiums.

Life Insurance Underwriting With Thrombocytopenia

As a person with a serious health condition like thrombocytopenia, you’re going to face questions a standard applicant won’t:

- When were you diagnosed with thrombocytopenia?

- What were your tested blood marrow results?

- Have doctors discovered the cause of your thrombocytopenia?

- How is your thrombocytopenia being treated?

- When was your most recent CBC? What were the results for Hemoglobin, Hematocrit, White blood count, and Platelet count?

- Do you have any other health issues?

- Are you taking any medications?

Answer in as Much Detail as Possible.

The application is your chance to explain your situation and show that everything is under control. When life insurance companies receive incomplete applications, especially from someone with a condition like thrombocytopenia, they get nervous and may give out a worse rating.

Life Insurance Quotes With Thrombocytopenia

Your rating will depend on a few factors. The insurance company will consider whether you’ve found the cause of your condition or not. If you’ve found the cause, it usually leads to a better rating, especially if there is a treatment that would fix the condition.

They are also going to look at your platelet count. Thrombocytopenia is when your platelet count is below 150,000/mm3. The higher your count, the better your rating will be.

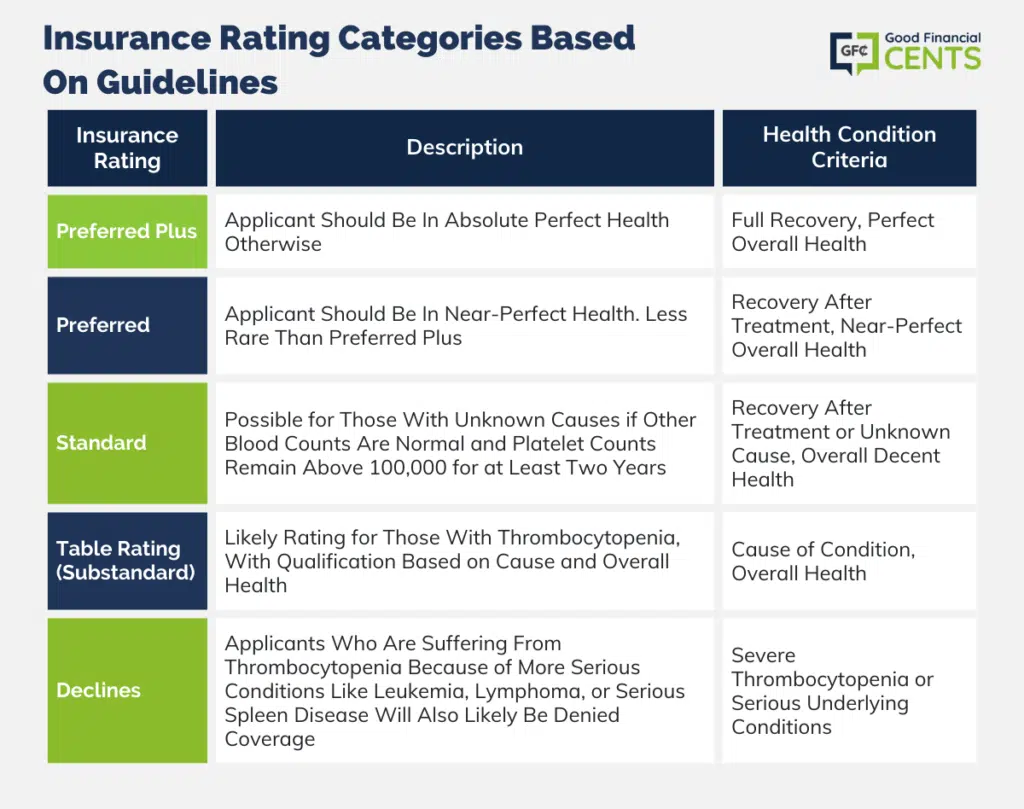

Every company has its own categories; here are some guidelines that can help you predict your insurance rating.

- Preferred Plus: Possible in extremely rare cases for someone who had thrombocytopenia but recovered after treatment. The applicant should be in absolute perfect health otherwise.

- Preferred: Possible for someone who had thrombocytopenia but recovered after treatment. The applicant should also be in near-perfect health. This is a bit more likely than Preferred Plus, but still rare.

- Standard: Usually, the best possible rating for someone who had thrombocytopenia but recovered after treatment. Also, an applicant who has thrombocytopenia but doesn’t know the cause could qualify for this rating if the rest of the CDB counts are normal and platelet counts stay above 100,000 for at least two years. Applicants should be in overall decent health.

- Table Rating (Substandard): Most likely rating for someone with thrombocytopenia. Applicants with platelet counts between 30,000 and 100,000 usually qualify for this rating. An applicant’s rating will depend on the platelet count, the cause of the condition, and the applicant’s overall health.

- Declines: Applicants with a platelet count below 30,000 will likely be denied coverage. Also, applicants who are suffering from thrombocytopenia because of more serious conditions like leukemia, lymphoma, or serious spleen disease will also likely be denied coverage.

Other Options and Alternatives

Should a traditional life insurance policy be out of reach due to thrombocytopenia, there are still numerous alternatives to explore. Guaranteed-issue life insurance is a type of policy where the applicant isn’t required to undergo a medical examination. This means that while the premiums might be higher and the coverage lower, those with severe medical conditions, including thrombocytopenia, can still secure some form of insurance protection.

Another option to consider is group life insurance offered by many employers. In many cases, these policies don’t require a medical examination. They might offer a smaller benefit amount, but they can provide a safety net for those with significant health concerns.

Lastly, seeking the guidance of a high-risk life insurance specialist or broker can open doors to policies and companies that might be more lenient or specialized in handling applications from those with medical conditions.

Thrombocytopenia Insurance Case Studies

We want to show you why it’s so important to do some work before you apply. To demonstrate this, here are some stories of clients we’ve worked with before:

Case Study: Female, 51 y/o, diagnosed with thrombocytopenia at age 46, platelet count has always stayed above 100,000, decent overall health

She was in pretty decent health. It was a surprise when she was diagnosed with thrombocytopenia at 46. Her platelet count never fell too low; it was always above 100,000, yet it was still a concern.

None of her other CBCs showed any problems. She applied and got rejected.

She thought she couldn’t get life insurance, but we told her otherwise. Her issue was she applied too early after her diagnosis.

We recommended she try again and pointed her in the direction of a high-risk life insurance company. She did this and got a standard rating.

Case Study #2: Male, 48 y/o, diagnosed with thrombocytopenia at 46, former smoker, used to be overweight and had high blood cholesterol,

He wasn’t in great health. He was overweight, a smoker, and had high cholesterol. After being diagnosed with thrombocytopenia, he realized he needed to change things fast, or his situation would quickly get worse.

He quit, lost weight, and started taking medication for his cholesterol. This helped and kept his thrombocytopenia and other problems from getting any worse.

After he did all this, he assumed he would be approved for coverage with no problems, but he still wasn’t accepted. The company was looking at his past health and thought he was too much of a risk.

The next step we gave him was to go to his physician and ask for a record and letter of his current health and the improvements he made.

The Bottom Line – Is It Hard to Apply for Life Insurance With Thrombocytopenia?

Navigating the complexities of life insurance with thrombocytopenia can seem daunting. However, understanding the intricacies of the condition, coupled with an informed approach, can lead to favorable outcomes.

It’s crucial for individuals with thrombocytopenia to consistently manage their health and remain proactive in communicating their medical history to insurers. By being thorough in your application and showcasing stability in your health, you increase the chances of obtaining a favorable policy.

Additionally, exploring alternative insurance options, such as guaranteed issue policies or employer-provided plans, can provide a safety net. Remember, thrombocytopenia doesn’t automatically preclude you from protection; with diligence, knowledge, and persistence, obtaining suitable life insurance coverage is within reach.

Your health journey is unique, and with the right approach and resources, you can secure the peace of mind that life insurance offers.