- Key Takeaways:

- – Clear timeline for the tax relief process

- – Fully remote appointments available

- – Offers a suite of services including tax preparation and consultation

- – Client bill of rights sets clear expectations

For the many Americans who owe a tax debt to the federal or state government, even just thinking about filing a return or sorting out how to pay their taxes can take an emotional toll.

IRS numbers show that in 2022 there were 98.4 billion in unpaid assessments which includes unpaid taxes and accrued penalties and interest.

Knowing how much tax you owe — and how to pay that debt — can be overwhelming, which is why many people turn to tax relief services when trying to get out of tax debt.

Since there are so many tax relief services in operation, it’s important to carefully review candidates before moving forward with any company. If you’ve been considering Optima Tax Relief, here’s what you need to know.

About Optima Tax Relief

Like many of its competitors, Optima Tax Relief offers tax negotiation and settlement services in addition to tax preparation. They’re experienced in IRS audit defense and committed to a smooth, honest client experience.

Optima Tax Relief takes its free consultation a step further than competitors by involving tax specialists and chartered accountants who create a clear, transparent plan so you know what to expect upfront.

Optima Tax Relief Services

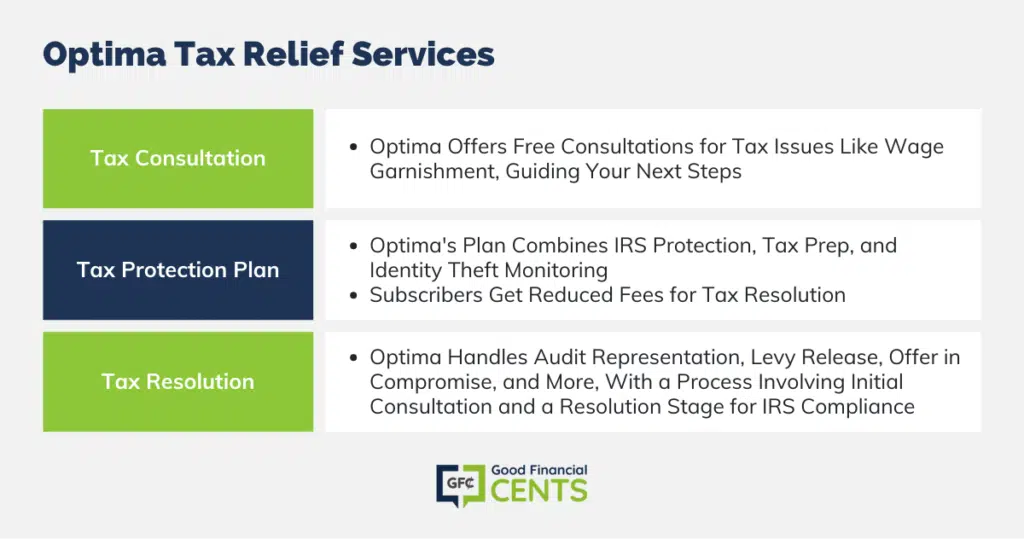

Optima Tax Relief can help you negotiate or resolve a tax debt, and offer other services to explore.

Tax Consultation

Optima Tax Relief offers a free tax consultation to people who are experiencing difficulties with their tax situation. For example, if you’re potentially facing wage garnishment from the IRS. The goal of tax consultation is to provide you with a road map to solve your tax problems.

Optima draws on its team of attorneys, enrolled agents, and chartered accountants to review your plan.

During your consultation, you’ll discuss topics such as removing tax liens, ending wage garnishment, tax planning, initiating an installment plan, or even helping with tax preparation.

You can use the information from your discussion to move forward with resolving your tax issues on your own, with a different service, or with Optima Tax Relief.

To get started, you can call Optima Tax Relief at 800-536-0734 or you can fill out their online form. You’ll need to answer questions such as how much tax debt you’re in, how you earn your income, how many years of unfiled taxes you have, and what state you live in.

Tax Protection Plan

Optima’s tax protection plan is a multi-tiered service that combines IRS protection with tax preparation and identity theft monitoring.

All tiers of the service offer what Optima calls “IRS protection.” What it includes as part of this service is monitoring IRS collections and balances, and performing a tax withholding analysis.

If you need help with a tax resolution, you’ll also qualify for lower fees if you’re a subscriber to its protection plan.

The tax preparation component is where the basic, standard, and professional plans separate themselves. In the Basic Plan, you’ll have to prepare your taxes on your own, but you’ll have access to Optima’s software. You can use the software for one return annually.

For additional returns, you’ll have to pay another fee. Note, if you’re just planning to use the product for their tax software, be sure to compare it against top tax software competitors first.

With the Standard Plan, Optima will file your taxes if you’re a wage earner. It also offers a $10,000 preparation guarantee. If you’re an independent contractor, you’ll need to get the Professional Plan. In this tier, Optima will also help you determine your estimated quarterly payment amounts.

Each tier also comes with a level of ongoing ID theft protection, with the Standard and Professional plans offering credit monitoring.

Tax Resolution

Tax resolution is where Optima’s expertise truly rests. They’re equipped to help with many tax resolution scenarios.

Here are just a few of the areas they are equipped to help clients in:

- Audit Representation

- Levy Release

- Innocent Spouse Relief

- Offer in Compromise

- Tax Lien Removal

- State Tax Issues

To get started with Optima Tax Relief, you’ll complete your initial consultation. Then, you’ll enter phase one, the “Investigation Stage” which lasts about two to four weeks. During this step, they’ll make contact with the IRS and review your options.

After that, you’ll enter the “Resolution Stage” which takes about three to nine months. After the resolution, you’ll have established IRS compliance.

Once you’re a client with Optima, you’ll have access to an online client portal so all of the work you’re doing with your representative stays organized.

Unique Features

There are many tax relief services on the market today — here’s what makes Optima Tax Relief stand out.

- Highly Transparent: Optima Tax Relief is upfront about each stage of the tax relief process, the work they’ll do on your behalf, and how long they expect this to take.

- A+ Better Business Bureau Rating: Optima Tax Relief has an A+ rating with the BBB and they have been accredited since 2012.

- Protection Plan: Not all tax relief services offer ongoing IRS protection and identity theft protection or credit monitoring.

- Client Bill of Rights: Optima Tax Relief has established its own client bill of rights that includes rights such as clear expectations, straight talk, and innovative, smooth client experience.

When to Use Optima Tax Relief

Even though you can technically pursue tax relief by yourself, the tax code can be complicated to decipher. It’s easy to make mistakes when it comes to your taxes and it can be hard to fix problems that occur. That’s where tax relief companies come in, and some are more genuine than others.

Tax relief companies know you’re probably desperate when you’re coming to them for help, and sometimes they can take advantage of that. What’s positive about Optima Tax Relief is its transparency.

Optima Tax Relief is positioned to help clients anywhere in the country. It works with clients in a variety of scenarios — even if you don’t have tax issues. However, its greatest expertise is in helping people resolve IRS or state tax debt.

If you’re overwhelmed or mystified by your taxes, Optima Tax Relief’s two-phase process could offer the necessary clarity.

Optima Tax Relief vs Other Tax Relief Competitors

The tax relief industry has a lot of competitors. Here’s how to compare some of the most popular companies.

| COMPANY | BBB RATING | FREE CONSULTATION? | SERVICES |

|---|---|---|---|

| Optima Tax Relief | A+ | Yes | Tax Resolution, Tax Preparation, Tax Settlement, Protection Plan |

| Anthem Tax Services | A+ | No | Tax Preparation, Tax Resolution, Bookkeeping |

| Larson Tax Relief | A+ | Yes | Emergency and Long-Term Tax Relief |

What You Should Know About Tax Relief Services

A lot of people use tax relief services to resolve their lingering tax issues and leave positive reviews, but this isn’t the case for everyone. Sometimes, tax relief can cause additional headaches.

This is because there are a lot of bad players in the tax relief world. So many people are duped by tax scams that the IRS continually updates its website with new scams as they occur.

These can range from “ghost” tax preparers to fraudulent emails claiming to represent the IRS or a popular tax software preparation company.

These scams are popular year-round, but particularly at tax time. In 2016, for example, the IRS saw a 400% increase in phishing schemes at tax time.

Keep in mind that if your situation is simple enough, you might be able to resolve it on your own. The IRS has many online tools, such as their Offer in Compromise Pre-Qualifier, that you can use to get started. Resolving your tax debt yourself can save you money.

If you don’t feel comfortable trying on your own, there are several free government-sponsored and nonprofit tax resources that you can access.

The Bottom Line

If you’re going to use a tax relief company to help you with your tax issues, Optima Tax Relief offers a clear, transparent approach and their client bill of rights puts the client experience front and center.

However, be sure to shop around before moving forward with any tax relief service. It’s smart to get a free consultation when offered.

Then, compare each plan you’re presented with and go with the company that not only works best for your budget but who you feel is best aligned with your working style.

Not sure where to start? Compare the top companies online before moving forward with a consultation.

How We Review Tax Preparation Software

Good Financial Cents reviews various tax preparation software options, emphasizing user experience, feature sets, and accuracy in calculations. We aim to provide users with a balanced perspective, assisting them during tax season. Our editorial process is transparent and thorough.

We source data from software providers, testing functionalities and evaluating user interfaces. This hands-on approach, combined with our research, ensures a comprehensive review.

Each software option is then rated based on its strengths and weaknesses, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate tax preparation software and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Optima Tax Relief Review

Product Name: Optima Tax Relief

Product Description: Optima Tax Relief offers specialized services to assist Americans with tax-related concerns, including tax debt negotiation, audit defense, and settlement. They prioritize transparency in their processes and boast an A+ rating with the Better Business Bureau since 2012.

Summary

Optima Tax Relief stands out in the tax relief industry with a comprehensive approach to handling tax issues. Beyond offering tax negotiation and settlement services, they are adept in IRS audit defense, ensuring clients receive honest and smooth experiences. One of their signature offerings is a free consultation that engages tax specialists and chartered accountants to devise a clear, transparent plan for clients. Furthermore, their longstanding A+ accreditation with the BBB emphasizes their commitment to excellence and trustworthiness in the field.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Transparent Processes: Optima Tax Relief is upfront about each stage, giving clients a clear understanding of the services rendered and the expected timeline.

- Broad Service Offering: Beyond just tax resolution, they offer tax preparation, IRS protection, and identity theft monitoring.

- Highly Reputable: Their A+ BBB rating and accreditation since 2012 attests to their consistent high-quality service.

- Client-Centric Approach: They have established a client bill of rights, ensuring clear expectations, straight talk, and a smooth client experience.

Cons

- Potential for Additional Costs: Some services, like tax preparation beyond their basic plan, might incur extra fees.

- Industry Challenges: Like many in the tax relief industry, they face challenges from tax scams, though they are committed to combating such issues.

- Not Always Necessary: While they offer extensive services, some individuals with simpler tax issues might find solutions on their own or through free resources.