Shopping for an extended car warranty may not sound very fun, but having this protection can provide considerable peace of mind. After all, the best-extended car warranties can ensure your car gets fixed during a covered breakdown. Best of all, your extended warranty coverage will actually pay for the repairs.

But which extended car warranty company should you purchase coverage from? Because there are quite a few reputable providers in this space, it’s crucial to compare them based on the warranty coverage they offer, their ratings and reviews, and the perks they offer customers.

While we believe Endurance may offer the best extended warranties out there, we went on to compare the top six companies in this space. If you’re in the market for the best-extended car warranty money can buy, read on to learn more.

Table of Contents

Most Important Factors for Extended Car Warranties

- While price is a major consideration when comparing extended car warranties, you’ll also need to consider the coverage you’re buying and how it compares to other providers. For example, some extended car warranties offer nearly bumper-to-bumper coverage with maintenance included, whereas others only cover certain components of your vehicle.

- As you compare extended car warranties, you should note that some require waiting periods before you can use your coverage. Make sure you know your plan’s waiting period before you move forward.

- While extended car warranty companies let you enter your information to get a free quote online, you usually need to speak with a customer service agent to get pricing for available plans.

- As you compare extended car warranties, make sure you price out coverage plans from at least three or four providers. Doing so is the best way to ensure you get quality protection for a price you can afford.

The Best Extended Car Warranties of July 2024

Endurance

Endurance is one of the largest providers of vehicle service contracts in the United States, and they are backed by an AM Best “A” rated insurance company. This means you can rest assured your extended car warranty will cover claims as they arise and that you’ll have protection against the costs and stress that typically come with auto breakdowns and other failures.

One major benefit of Endurance is the fact they’re a direct provider of their extended warranty coverage. This means you’ll purchase your plan from Endurance and that they will manage your coverage from quote to claim.

Select Auto Protect

Select Auto Protect has been in operation for over 30 years, and they offer a range of extended car warranty plans that can be used at any ASE-certified repair facility. They offer three main extended warranty plans to choose from — Silver, Gold, and Platinum. Where the basic Silver plan provides coverage for basic vehicle components like your transmission and brake system, Platinum coverage offers more robust protection for more components, including your heat system, fuel system, and front and back suspension.

One major benefit of Select Auto-Protect is the fact it covers cars of any age, make, or model. This means you can use this provider for older cars you own or for classic cars, and regardless of your vehicle’s mileage.

CarShield

CarShield was originally founded in 2005, and the company has become a major provider of extended car warranties since then. In addition to offering five different extended warranty plans for eligible vehicles, they also offer extended warranty protection specifically for motorcycles and ATVs.

CarShield offers five main extended car warranty plans for cars, which range from a basic “Aluminum” plan to “Diamond” coverage. Where the most basic coverage options only protect some components of your vehicle, Diamond coverage works similarly to the bumper-to-bumper coverage that comes with a new car.

Complete Car Warranty

Complete Car Warranty was only established in 2019, so there are few places to find user testimonials or reviews about the company online. However, we chose them for our ranking based on the fact their plans are highly customizable. For starters, Complete Car Warranty offers five different levels of CarGuard coverage ranging from Powertrain (basic protection) to robust Platinum coverage. However, the provider also offers more plans to choose from within their Matrix and Royal levels.

Each tier of coverage comes with a unique set of covered components, so you can customize your warranty coverage to your exact needs. All plans also come with roadside assistance, and you can have your car repaired at any certified vehicle mechanic nationwide.

Carchex

CarChex has been in operation since 2003, and the company added extended car warranties to its portfolio of offerings in 2004. Since then, the company has grown to become one of the most trusted extended warranty providers in the United States. They are one of the few companies in this space who is accredited by the Better Business Bureau (BBB), where they also boast an A+ rating.

CarChex offers five levels of extended warranty coverage for shoppers to choose from, ranging from basic Bronze protection all the way up to comprehensive Titanium coverage. Their plans also come with the largest selection of covered benefits, which include towing, rental car coverage, gas delivery, trip interruption insurance, and more.

Autopom!

Autopom! is another extended car warranty provider that has an A+ rating with the BBB. This company also offers a wide range of warranty plans with plenty of included benefits. For example, customers get a 30 to 60-day money-back guarantee, 24-hour roadside assistance, and trip interruption reimbursement coverage as standard benefits.

When it comes to the extended warranty coverage this company offers, consumers have four main plans to choose from. Options include Powertrain Plus coverage, which protects only the main components of your car, all the way up to Exclusionary coverage, which is closer to a new car warranty coverage. Most of their plans provide the option to tailor your warranty to your needs.

The Best Extended Car Warranties of 2024

| COMPANY | KEY FEATURES | COVERAGE OPTIONS |

|---|---|---|

| Endurance | * Direct Provider * Backed by an AM Best “A” Rated Insurance Company | * Six Plans Ranging From basic to Advantage Plan With Maintenance Included |

| Select Auto Protect | * Operates for Over 30 Years * Coverage for Cars of Any Age, Make, or Model | * Silver (Basic), Gold, and Platinum |

| CarShield | * Founded in 2005 * Offers Warranty for Motorcycles & ATVs | * Five Plans: Basic “Aluminum” to “Diamond” Coverage (Like Bumper-To-Bumper) |

| Complete Car Warranty | * Established in 2019 * Highly Customizable Plans * Nationwide Repair Options | * Five Levels of CarGuard Coverage (PowerTrain to Platinum) * Matrix and Royal Levels |

| CarChex | * Founded in 2003 * A+ Rating With BBB | * Five Levels: Bronze to Titanium * Includes Towing, Rental Car Coverage, Etc. |

| AutoPom! | * A+ Rating With BBB * 30 to 60-Day Money-Back Guarantee 24-Hour Roadside Assistance | * Four Main Plans: PowerTrain Plus to Exclusionary (Close to New Car Warranty) |

Other Companies We Considered

There are so many extended warranty providers offering plans today that it was hard to select the options for our ranking. The following companies barely missed the cut.

ForeverCar

ForeverCar is an extended car warranty provider that has been in operation since 2015. They offer four levels of extended warranty coverage with included benefits like rental car coverage, 24-7 roadside assistance, and travel expense reimbursement.

Olive

Olive was considered for our ranking based on the fact they are one of the only providers that lets you get a free online quote for extended warranty coverage without speaking to an agent. However, this provider only has three plans to choose from. They also just launched in 2020, so there aren’t many user testimonials or reviews to compare.

How We Found the Best Extended Car Warranties

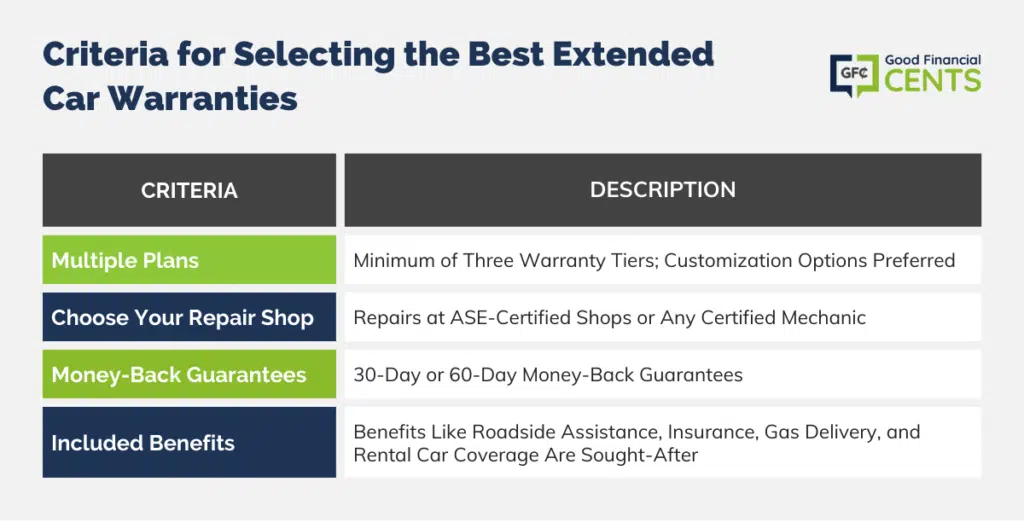

The extended car warranty companies that made our ranking were found to be the “best” among all providers in this space. While some of our analysis was subjective, we compared each company and selected them based on the following attributes.

Multiple Plans

While some of the extended auto warranty companies we included in our ranking offer more plans than others, we only selected providers who have at least three tiers of extended warranty coverage to choose from. We also looked for companies that offer ways to customize your plan to your needs, whether with additional add-on coverage or a more robust selection of benefits.

Choose Your Own Repair Shop

We only selected companies that let you get your car fixed at a large selection of auto repair shops. Generally speaking, the providers for our ranking allow repairs at all ASE-certified repair shops or with any certified mechanic.

Money-Back Guarantees

Most of the companies on our list offer a 30-day or 60-day money-back guarantee.

Included Benefits

We also looked for extended car warranties that come with included benefits from which consumers can benefit. Perks we looked for include roadside assistance, trip interruption insurance, gas delivery, rental car coverage, and more.

What You Need to Know About Extended Car Warranties

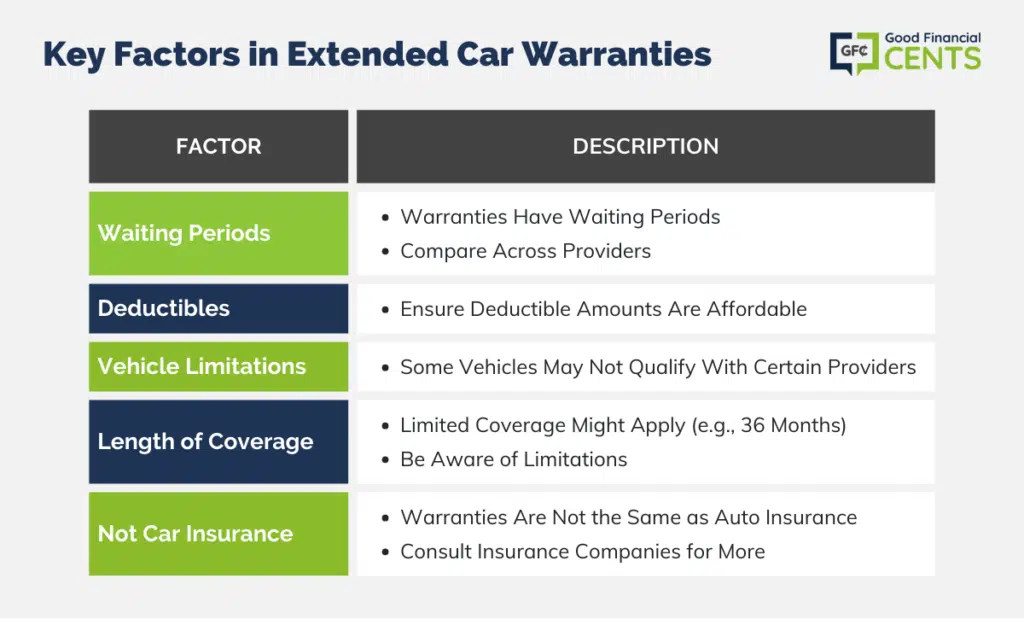

As you compare extended car warranties, there are several factors you need to consider that may be buried in the fine print. Details to look for in your plan include:

- Waiting Periods: Most extended car warranties have a waiting period that applies before you can use your coverage. Make sure you know about the waiting period you’re dealing with, as well as how waiting periods compare across providers.

- Deductibles: You will typically need to pay a deductible to file a claim with your extended warranty company. Make sure the deductible you choose is one you can easily afford.

- Vehicle Limitations: Some vehicle makes and models may not qualify for extended warranty coverage with certain providers.

- Length of Coverage: Finally, note that many companies offer limited coverage for a specific timeline (i.e., 36 months or three years). Make sure you know about potential limitations and what happens next.

- Not Car Insurance: A common misconception is that auto warranties and insurance are the same things. That is not correct. To find out more about auto insurance, see our best auto insurance companies.

The Federal Trade Commission (FTC) also lists some specific “gotchas” to watch out for when choosing an extended car warranty. For example, they point out that few auto service contracts cover all repairs and maintenance and that you should watch out for exclusions and other fine print in your plans.

They also note that service contracts often limit how much they’ll pay for towing or related rental car expenses.

The Bottom Line – Best Extended Car Warranty for 2024

In the quest for peace of mind on the road, extended car warranties have emerged as a popular solution. With numerous options available, discerning which warranty best suits your needs can be challenging.

Endurance stands out as a top contender, but the market boasts other reliable providers like Select Auto Protect and CarShield, each offering unique features.

Key considerations when choosing a warranty include understanding waiting periods, ensuring affordable deductibles, acknowledging vehicle limitations, and recognizing the length of coverage.

Remember, warranties differ from auto insurance; it’s imperative to differentiate the two. Always be vigilant about the fine print to avoid potential pitfalls and ensure a smooth journey ahead.