In our first article on money orders, How to Get Money Orders Near Me, we covered how and where to get them.

In this article, we’re going to focus on the flip side of that arrangement – cashing and depositing money orders at locations close to home.

But in case you didn’t read that first article, let’s start with a brief review of the topic of money orders. They’re not as popular as they once were, and they’re rarely used by the majority of people.

But there are times when sending or receiving a money order can be a preferred method of payment.

Table of Contents

What Are Money Orders and How Do They Work?

Money orders are negotiable instruments, similar to checks. They can be used to make payments when cash, checks, or debit or credit cards are either unavailable or undesirable.

They’re frequently used by people who don’t have regular bank relationships. But also in situations where you need to make a payment, but don’t want to provide any of the personal information that appears on checks or credit cards. Money orders are not attached to bank accounts, so they don’t display account numbers.

On a practical level, money orders work much like checks. You can purchase them from thousands of different outlets across the country. They can be purchased in denominations of up to $500 or $1,000. If you need to make a payment that exceeds those limits, you’ll need to purchase multiple money orders.

They’re typically available for purchase at fees ranging from $1 to $5. You can purchase them using cash, credit or debit cards. You can also use transfers from a bank account if you purchase them at one where you have an account.

Since money orders are funded at purchase, the amount transferred is virtually guaranteed. That makes them equivalent to certified or cashier’s checks for payment security. And since they’re pre-funded, they can’t bounce.

Though money orders are widely accepted, it’s important to check with the payee first, since acceptance is not universal. Also, money orders generally cannot be used to make online purchases.

Once again, please refer to our article How to Get Money Orders Near Me to see where you can purchase money orders, as well as the fees and terms for each.

How to Cash or Deposit Money Orders

If you receive a money order, you can often (but not always) cash it anywhere money orders are sold. Cashing them is very similar to cashing a check, except you’ll have more options as to where to do it. (We’ll cover those options later.)

To cash a money order, you’ll need to sign the back of the document, just as you would a check. But don’t sign until you’re at the institution that will cash it, as some require witnessing your signature for validation purposes.

Whatever institution you go to cash the money order, be sure to bring proper identification. ID requirements will vary from one institution to the next. You can generally figure a state-issued driver’s license, current passport, permanent resident card, or military ID will be acceptable.

WARNING:

Some institutions may require the payment of a small fee to cash a money order.

If you prefer to deposit a money order into a bank or credit union account, you should be able to do so the same way you would a personal check. The bank or credit union may not request ID information, since (in theory) they know who you are.

If you do deposit the money order into a bank or credit union account, access to the cash will be subject to the fund’s availability policy of the institution. Generally speaking, the funds will be fully available on the next business day. However, some institutions will allow you to take a small portion of the deposit – generally $200 – on the day of the deposit.

Watch Out for Fraudulent Money Orders!

Since they’re fully paid at the time of purchase, it may be hard to imagine how a money order can be fraudulent.

But just as is the case of personal checks – or just about any negotiable instrument – a money order can also be fraudulent. The likelihood is even greater if the money order is payment for an item you sold on eBay or some other online platform. The fact that the sender is so far away from you – and completely unknown to you – increases the possibility.

As a general rule, you can minimize the chance of incurring money order fraud by taking a few simple steps.

First, accept them only from local individuals, preferably those you’re familiar with.

Second, get a copy of their driver’s license or other identification – just in case the money order proves fraudulent. And sometimes just asking for ID can short-circuit a fraud situation before it happens.

Signs of a Fraudulent Money Order

Once you receive a money order, be on the lookout for any of the following:

- Visible Watermarks: Money orders typically include watermarks that will only be visible when the document is held up to the light, or at certain angles. But if a watermark is obvious on the money order, the money order may be nothing more than a photocopy.

- Alterations: Money orders are not only prepaid but they’re also preprinted. If any information on the document is either altered or handwritten, it’s probably fraudulent.

- Machine-Printed Issue Date, Dollar Amount, and Serial Number: Machine-printed numbers have a distinct look. If the numbers on the money order look too ordinary, it may be a fake.

- The Money Order Should Contain Multicolored Reflective Threads: This feature is specifically added to money orders to distinguish them from copies and forgeries.

- The Amount of the Money Order Exceeds the Requested Payment: The payor then asks you to refund the difference in cash or electronically. This is a dead giveaway of a scam. The presenter of the money order is looking to get money back from you on a totally bogus money order.

If you’re unsure of any of the above, go online and look up a copy of a money order from the issuing institution. If there are any significant variations between the one presented to you, and what you see online, it might be a fraudulent document.

On a more practical level, be sure to cash or deposit a money order as soon as you receive it. In addition to the fact that money orders usually contain an expiration date, if one is fraudulent, the more quickly that’s determined, the more options you’ll have to pursue the issuer.

Places that Cash Money Orders Near Me

Once again, you can generally cash a money order where they’re issued. And there are thousands of such issuers across the country, with probably many located in your own community.

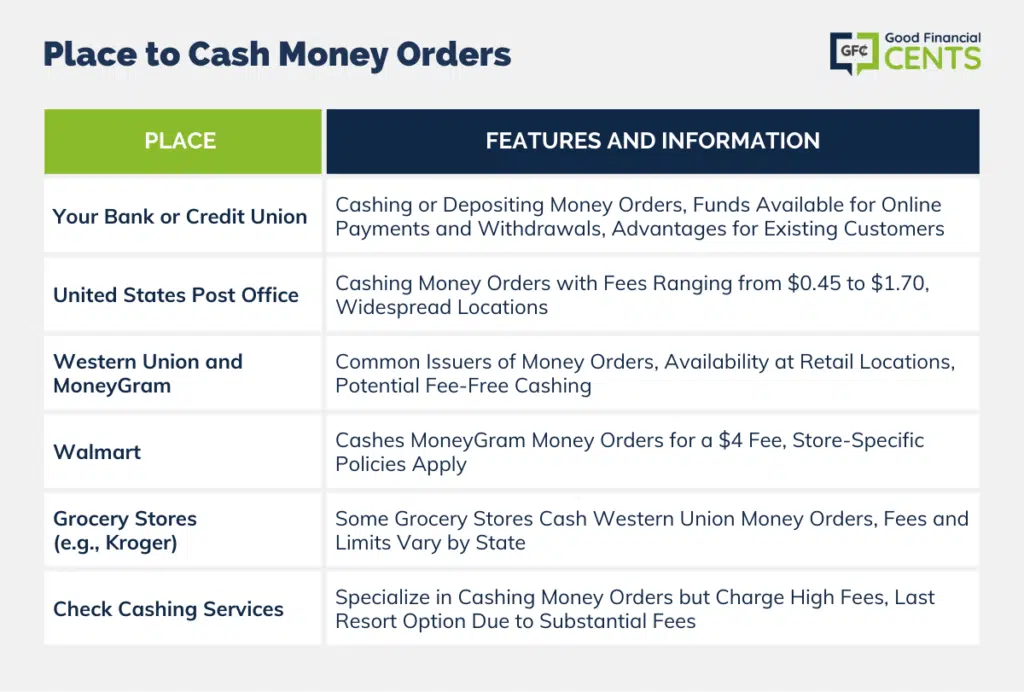

Here are some of the prime examples:

Your Bank or Credit Union

You should be able to cash or deposit a money order at any bank or credit union where you have a banking relationship.

What’s more, they should allow you to cash or deposit the money order free of charge. (You may be able to cash a money order at a bank where you don’t have an account, but they’ll likely charge you a fee.)

Using your bank or credit union has several advantages:

1. You can either cash or deposit the money order.

2. As just mentioned, you should be able to cash or deposit the money order free of charge.

3. Since you likely have other business at your bank or credit union, you won’t need to make a special trip just to cash or deposit the money order.

4. Your bank or credit union will represent a “second pair of eyes” to review the money order for potential fraud. And since you’re a customer, they may be able to help you resolve it.

United States Post Office

The US Post Office is one of the most common places to both buy and cash money orders.

According to the fee schedule of the US Post Office, you’ll pay $2.00 to cash a money order of up to $500, and $2.90 for one up to $1,000. The fee is just $0.63 for postal military money orders issued by military facilities. However, if the money order was issued by the US Post Office, they generally will not charge a fee to cash it.

One of the major advantages of cashing a money order at the post office is that they have locations in nearly every community across the country.

Western Union and MoneyGram

Western Union and MoneyGram are two of the most common issuers of money orders. Many of the outlets where you can purchase and cash money orders offer the service through one of these two companies.

Western Union is a common issuer of money orders and is widely available at retail locations across the country. However, not every location that sells money orders will also cash them. You’ll need to check the Western Union location page to find a Western Union agent, then call to make sure they also cash money orders.

Fees to cash a money order will vary by location, but you may not be required to pay a fee at a Western Union agent if the money order was provided by Western Union.

MoneyGram works similarly to Western Union. They have many thousands of agent locations across the country, and will generally – but not always – cash money orders where they are available for purchase. Once again, check for a MoneyGram location, then contact that location and ask if they also cash money orders.

The fee situation is the same as it is with Western Union. There may be no fee to cash a money order issued by MoneyGram, but fees will apply to other issuers. Once again, check with the local MoneyGram agent to see if there are any fees for the particular money order you want to cash.

Be aware however that just because a retail location sells money orders doesn’t mean they also cash them. There’s a long list of companies that sell them, but the list of those that cash them is much shorter.

Some of the major local agents that work with either Western Union or MoneyGram, to both buy and cash money orders, include the following:

Walmart

Many people are asking can you cash a money order at Walmart? The good news is, that Walmart both sells and cashes MoneyGram money orders (they don’t indicate if they can cash money orders from other issuers, so call the store to verify before making the attempt).

They charge a fee of $4 to cash a money order. That will naturally apply to each money order you present if you’ve been paid in multiple money orders.

Most Walmart stores do cash MoneyGram money orders, but be sure to check with any location you plan to visit to make sure.

Grocery Stores – Kroger

Grocery stores are not only a common source to purchase money orders, but you can often redeem them at one as well. Be careful, however, as many stores that sell money orders don’t cash them. Safeway and Publix are two examples.

One commonly asked question though is, “Does Kroger cash money orders?”, and to your benefit, one major source of cashing money orders is Kroger, the largest grocery store chain in the country. They work with Western Union money orders. You’ll need to check with the local store since fees and limits vary by state.

There may be other grocery store chains that also cash money orders. But before making the attempt, first, call the store and verify that they do. Further, make sure they cash the type of money order you have. If they work with Western Union, they probably won’t cash MoneyGram money orders.

Check Cashing Services

Check cashing services specialize in providing banking-type services for those who do not have regular bank relationships. That includes both issuing and cashing money orders.

However, the main disadvantage of using check-cashing services is that they charge the highest fees possible. If you do try to cash a money order at a check-cashing service, be prepared to pay 10% or more of the amount of the money order. Many will also have a minimum charge on smaller money order amounts, that could easily exceed 10%.

As a general rule, check-cashing services should be seen as a last resort, and only if you’re prepared to give up a substantial portion of the money in order to pay the fees.

Final Thoughts on Where to Cash Money Orders Near Me

If you’re paid by money order, your first choice to cash it should be your bank or credit union. Since you have an account relationship with them, they’ll give you the option to either cash or deposit the money order, usually free of charge.

The next best option is to cash a money order with an agent location that works with that particular issuer.

For example, if you’re paid by a Western Union money order, you should cash it at a Western Union agent. The same should apply to MoneyGram money orders. If you do, you should be able to cash the money order without paying a fee. Same situation with a US Post Office money order. If you receive one, you should cash it at the post office.

Use check-cashing services only as a last resort, since the fees are ridiculously high.