The internet and new technology have improved our lives in so many ways, but they have also ushered in a new wave of methods for criminals to commit fraud. Identity theft — which takes place when a thief tries to steal someone’s identity or use their personal information for fraud — is one such crime that has only increased along with technology.

According to a 2022 Identity Fraud Study from Javelin Research, new account fraud and account takeover are on the rise, particularly including mobile phone account takeovers. Further, there were 14.4 million new victims of identity theft in 2018, and 23% of them had unreimbursed personal expenses resulting from the fraud.

How do you know you’ve been a victim of identity theft or fraud? The signs of identity theft vary widely, but the Federal Trade Commission (FTC) says these red flags are some of the most common:

- You see bank account withdrawals you don’t recognize

- You begin receiving debt collection calls for debts that are not yours

- The IRS notifies you that a second tax return was filed in your name

- You stop getting bills or other mail

- You find unfamiliar accounts on your credit reports

- You see suspicious charges on your credit cards

- Medical providers send you bills for care you did not receive

Table of Contents

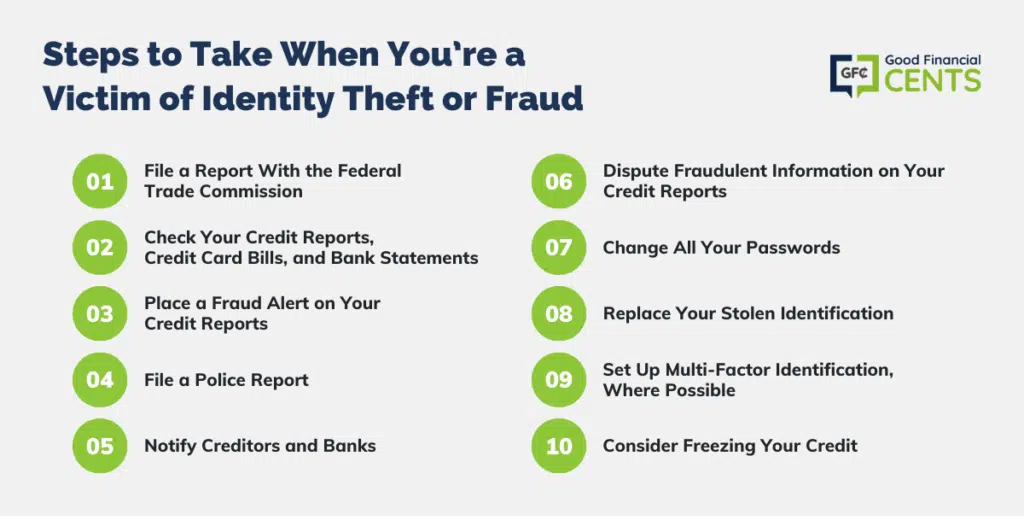

10 Steps to Take Immediately When You’re a Victim of Identity Theft or Fraud

If you have already found you are the victim of identity theft, you need to act swiftly in order to minimize damage and financial losses. Here are the exact steps you should take if you have found evidence of identity theft or you believe you may be the victim of some type of related fraud.

Step 1: File a Report With the Federal Trade Commission

If you believe you’re a victim of identity theft, you’ll want to begin creating a long paper trail of evidence and documentation. This all starts with filing a report with the FTC, which you can do online at IdentityTheft.gov.

To file a fraud report with the FTC, you’ll need to share information on what happened to your identity or your accounts. From there, the FTC will help you create a recovery plan that can help you protect your identity and stop the theft and fraud in its tracks.

While you may not know everything about the fraud that has taken place, sharing as much information as possible with the FTC is your responsibility. The more information you can share, the more advice the FTC can offer to help you spot all instances of fraud so you can get on track to a full recovery.

Step 2: Check Your Credit Reports, Credit Card Bills, and Bank Statements

Another crucial step to take involves checking all three of your credit reports and going over the information they include line by line. Fortunately, you can get a free copy of your credit reports for free using the website AnnualCreditReport.com.

Note that your credit reports with Experian, Equifax, and TransUnion may not all list the exact same information, so it’s crucial to check all three. Your credit reports are also where you may find accounts a fraudster opened in your name, payment history that isn’t yours, or other personal information that is not yours.

In addition to your credit reports, you should also pore over all your credit card bills and bank statements. Look for incorrect information, withdrawals you didn’t make, charges that aren’t yours, and any other suspicious activity. This is all information you’ll want to include in your report with the FTC, and it’s information you’ll want to correct as you move through the following steps.

Step 3: Place a Fraud Alert on Your Credit Reports

You should also take steps to place a fraud alert on your credit reports, which you can do by contacting one of the credit bureaus. Note that when you reach out to one credit bureau to place a fraud alert on your account, that credit bureau is required to notify the two others.

The FTC lists the following contact information you can use for this step:

Setting up a fraud alert on your credit reports is free. Once this alert is in place, businesses will have to take extra steps to verify your identity before issuing credit in your name.

Step 4: File a Police Report

If you choose to do so, you can also file a report with your local police department. Doing so can help you continue building a long paper trail of evidence, which you may need as you work to reinstate your identity later on.

The FTC says that you should head to your police department with a copy of your FTC Identity Theft Report that you created in step one, a government-issued ID like a driver’s license, proof of where you live, and any proof of the theft.

The FTC also provides this memo to law enforcement that you should print and bring along. The memo helps explain to local police the importance of your police report, as well as where they can go if they need more guidance and information from the FTC.

Step 5: Notify Creditors and Banks

Next, you’ll want to begin trying to repair any damage that has taken place. This step includes reaching out to any banks and creditors in order to notify them of the fraud, including specific details. You’ll also want to close any fraudulent accounts that were opened in your name.

This is another step where you’ll want to have your FTC Identity Theft Report handy. As you contact banks and creditors to explain what happened, you can send them a copy of your report along with other proof you have.

As you reach out to banks and creditors to ask them to remove fraudulent accounts or charges, keep track of who you contacted and what they told you. Also, ask them to send you a letter that shows the action taken on their behalf.

Also, make sure you keep all documentation and letters from banks and creditors. You’ll need proof of the actions taken if accounts remain on your credit reports, and you need to follow up later on.

Step 6: Dispute Fraudulent Information on Your Credit Reports

Next, you’ll want to take some steps to dispute fraudulent information on your credit reports with all three credit bureaus. The FTC offers this sample letter you can copy and paste and fill with your own specific information and details.

When you send a letter to all three of the credit bureaus, you’ll want to include a copy of your FTC Identity Theft Report and your personal information. You’ll also want to send a copy of your credit reports along with details on which information is incorrect or fraudulent.

Here are the addresses you can use to dispute incorrect information on your credit reports.

Step 7: Change All Your Passwords

You’ll definitely want to change passwords that were compromised right away, but you should really change all your passwords to new ones that would be impossible for fraudsters to figure out on their own. That way, fraudsters cannot use the information they have to hack into other accounts that haven’t been compromised yet.

A password manager like LastPass or Dashlane can be an excellent tool for this purpose since they create unique and complicated passwords for each of your accounts and then store them in a vault that only you have access to. Some password managers offer a free version you can use to get started, but even paid plans cost as little as $3 per month.

Step 8: Replace Your Stolen Identification

You’ll also need to take steps to replace any stolen identification you should have. If your Social Security card was stolen, for example, you can apply for a new one online using this link.

If your driver’s license was stolen and you need a new one, you will need to contact your local DMV branch. If your passport was lost or stolen, you’ll need to contact the State Department at 1-877-487-2778 or TTY 1-888-874-7793.

Step 9: Set Up Multi-Factor Identification, Where Possible

When it comes to making sure fraudsters who have your information can no longer get into your accounts, it’s crucial to increase security in any way you can.

The experts at Javelin Research say that it’s important to move away from SMS one-time passwords specifically. “With the continuing growth of mobile phone takeover, it is becoming increasingly evident that SMS OTPs pose little barrier to determined fraudsters,” they write. “Responsive alerts through ‘tap to approve’ push notifications or out-of-band biometrics requests are significantly more difficult for fraudsters to overcome.

In addition to removing one-time “tap to approve” passwords, you should also set up a second layer of identification where you can. Many accounts will let you enter your phone number so you can receive a text message code before you log into your account, for example. In those instances, you should take the steps to do so.

Step 10: Consider Freezing Your Credit

While the fraud alert on your credit reports can temporarily stop thieves from opening new accounts in your name, you can also consider freezing your credit. This more permanent solution stops all access to your credit reports until you remove the freeze on your own. With a credit freeze, you can’t even open new credit accounts in your name unless you contact the credit bureaus and remove the action.

A credit freeze is free for consumers, but you do have to do it with all three credit bureaus. If you decide to take this more permanent step to protect your credit, you can use the following contact information:

How to Prevent Identity Theft in the Future

The steps above could take a few weeks or even several months to complete, but you’ll be better off if you get started right away. You’ll also want to take some steps to prevent more instances of fraud in the future. After all, when it comes to identity theft, an ounce of prevention is worth a pound of cure.

Best Identity Theft Protection Services

How can you protect your identity moving forward? According to the experts, some of the most important steps you should take include:

- Protecting your personal information, including your Social Security number, by storing it in a safe place

- Collecting your mail every day

- Using account security features available to you

- Reviewing credit card and bank account statements regularly

- Checking your credit reports regularly

- Installing virus detection software on your computer

- Freezing your credit reports to prevent thieves from opening new accounts in your name

While all the advice above is important, you should also consider signing up for identity theft protection services. Companies that work in this realm can help you stop identity theft in its tracks early on, saving you time, stress, and potential damage to your credit score and financial health.

The best identity theft protection companies will monitor your credit reports 24 hours a day, and they will notify you of any movements you should be aware of. They can also monitor the dark web for your personal information or Social Security number, and many companies offer up to $1 million in identity theft insurance as part of your plan.

Since identity theft protection can often be purchased for as little as $7 per month, you don’t want to go without this important coverage.

The Bottom Line

The world is growing increasingly digital, increasing the possibility of internet crimes like identity theft. If you are the victim of identity theft, taking the steps we’ve laid out can help minimize financial repercussions. Move quickly, cover your bases, and consider some form of identity theft protection in the future.