Recession-proof stocks – is there even such a thing? In an absolute sense, the general answer is no.

Recessions are an economy in decline, resulting in lower revenues and profits for most companies. That commonly translates into a flat (at best) or declining stock market.

Does that mean you, as an investor, are doomed to lose money in your portfolio during a recession?

Not necessarily. While there certainly are no stocks that are guaranteed to continue rising during a recession, there are some that have a history of at least holding their own even in the worst economies.

And just as is the case in booming markets, it’s often better to go with certain investment sectors than on individual stocks.

Bet on the Long-Term

Table of Contents

Before making any major investment shifts in anticipation of a recession, it helps to revisit your bigger picture investing goals.

First and foremost, investing is a long-term process. You’re not investing for the next few quarters, or even the next couple of years. No, you’re Investing for the very long-term. Your time horizon should be anywhere from several years to several decades.

That means recognizing recessions as more of a bump along the road than the signal to change direction. There’s little doubt recessions – and the stock market declines they often bring – can cause declines, sometimes even steep ones. But this is when it becomes absolutely critical to remember the benefits of long-term investing.

Based on the S&P 500, the stock market has returned an average of about 10.91% per year between 1923 and the end of 2023. No other investment can compete with those returns over nearly 100 years.

Keep that in mind as you watch events unfold, and attempt to minimize short-term declines, while keeping yourself positioned for the inevitable recovery.

Adjust – But Don’t Gut – Your Portfolio

With that said, recessions and stock market downturns are nonetheless an excellent opportunity to change the lineup in your portfolio. That doesn’t mean liquidating your entire portfolio and going to cash (if you do, you just might miss the rich returns when the next bull market launches!). Instead, make adjustments favoring certain sectors over others.

“Consumer staples and utility sectors work well in a recession,” advises Sankar Sharma, Investing Authority and Founder of RiskRewardReturn.com. “Healthcare sector stocks, especially pharmaceuticals, low-priced retailers, and waste management companies also perform well. People need food and use utilities as they are necessities.”

But Sharma also warns avoiding certain sectors that may have worked in previous recessions. “In the past tobacco stocks and alcoholic beverages were used to perform well but this time around it may be a good idea to avoid them.”

At the opposite end of the spectrum, other sectors are performing especially poorly.

Based on the NASDAQ 100 Technology Sector Index (NDXT), the tech sector has fallen nearly 31%, from 9565 at the beginning of the year, to 6628 through July 8. This compares unfavorably with the 18.19% loss in the S&P 500 over the same timeframe.

That isn’t to say it’s time to abandon tech stocks wholesale. But since the sector seems to be particularly hard hit, maybe lean toward a solid strategy to reduce your tech exposure in favor of other sectors that are providing stronger performances.

Overall, the goal of managing your portfolio during a recession should be to minimize losses. In that way, you’ll be preserving your capital to buy stocks at bargain basement prices as the economy begins to stabilize and the stock market starts to turn up. When that happens, it may be time to load up on tech stocks once again.

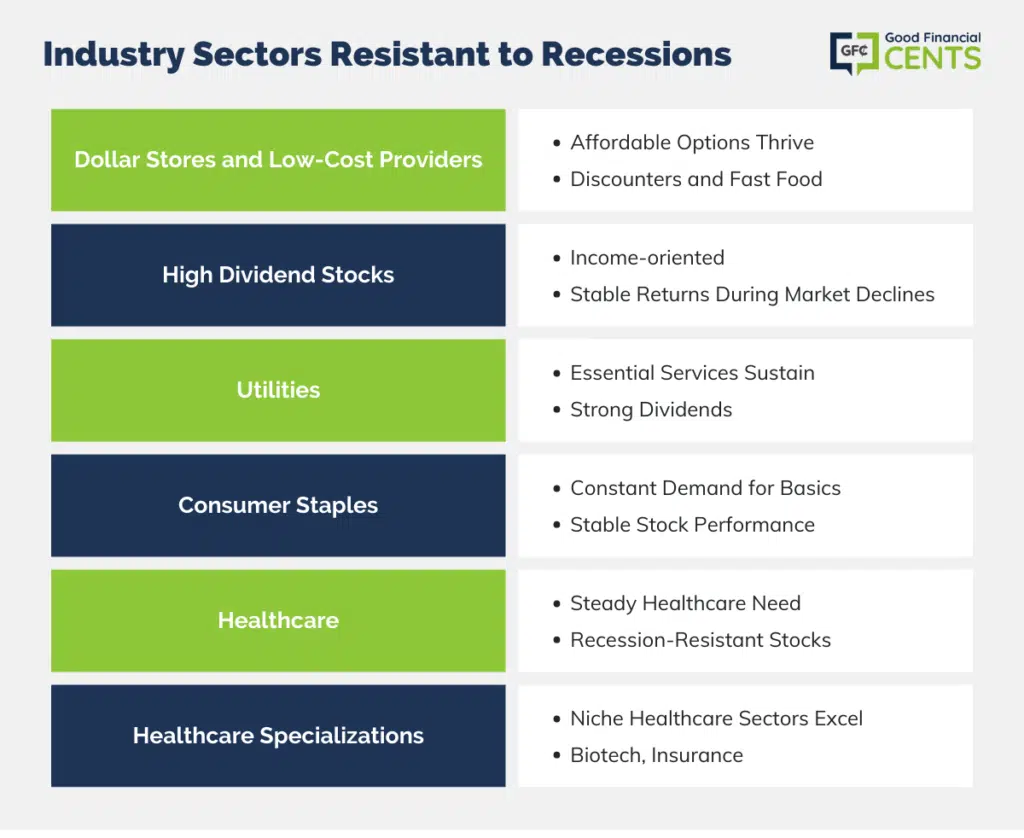

Industry Sectors With a History of Resisting Recessions

It’s not necessarily easy, but what matters in a recession is moving into stock sectors that are either more resilient in the face of economic downturns, or likely to benefit from the slide. At the same time, it’s important to realize no stock or sector is ever completely recession proof.

There are a few sectors that fit the bill.

Dollar Stores and Other Low-Cost Providers

With the uncertainty recessions bring, consumers naturally seek out lower-cost alternatives. People don’t eliminate spending entirely as much as they shift spending priorities.

A prime example of dollars stores. There is something of the lowest common denominator in the retail space. Since they sit at the very bottom price-wise, they tend to be solid performers in recessions.

The big-box discounters, like Walmart, Target and T.J. Maxx, generally, weather recessions better than higher-end retailers. And while higher price, full-service restaurant chains experience revenue declines, fast food establishments – like McDonald’s, Burger King, and Wendy’s – get a bigger slice of consumers dining dollars.

Dollar Tree Inc. (DLTR) opened 2022 at about $141, but is currently trading at $167 (as of July 7). That represents a year-to-date gain of 18.4%, compared with an 18.7% decline in the S&P 500.

It’s major competitor, Dollar General (DG), has taken a similar path. It opened 2022 at $235 but is currently sitting at about $253. That’s a gain of 7.6% on the price, and the stock also has a 0.87% dividend yield.

Fast food giant McDonald’s (MCD) open 2022 at $268, and is currently trading at $253, for a 5.6% loss. Though investors may not be happy about a loss, it’s only about one-third year-to-date loss of the S&P 500. It shows McDonalds is more resilient than the market itself.

High Dividend Stocks

Just as consumers change preferences during recessions, investors often shift gears within their portfolios. For example, while growth stocks may be the preferred sector during bear markets, investors put greater emphasis on income during market declines.

| High dividend stocks can provide that income. And, not coincidentally, they often represent some of the most successful companies in America. |

One prominent fund is the ProShares S&P 500 Dividend Aristocrat ETF (NOBL). It has provided a return of 1.67% in the 12 months ending May 31, and an average of 12.33% per year since the fund began in October, 2013. Admittedly, NOBL has a year-to-date performance of -6.00% (through May 31), but that’s considerably below the loss on the S&P 500 of 17.14% through the same date. Meanwhile, the fund currently has a 1.92% dividend yield.

Still another alternative is the Invesco S&P 500 High Dividend Low Volatility Portfolio ETF (SPHD). The fund has a total market value in excess of $3.8 billion and is invested in 51 companies. It currently has a 3.92% dividend yield, with a total year-to-date return (through June 30) of -0.56%.

That’s just a fraction of the 19.96% year-to-date loss on the S&P 500 through the same date. Meanwhile, the fund has returned 3.75% over the previous 12 months, and an annual average of 10.03% since it was launched in October 2012.

Utilities

Utilities have a long history of performing well during recessions (though not necessarily providing big returns). That’s because they provide necessary services. While consumers may cut back on shopping and restaurant meals, they’re pretty well locked in when it comes to electricity, heating, water and sewer, and trash removal.

Utility stocks also have a big advantage in a recession because they pay dividends, often well above average. As is the case with high dividend paying stocks, those dividends tend to cushion the fall, even if the utility stock does decline in price.

One fund worth considering is the Utilities Select Sector SPDR (XLU). It’s a $16 billion fund holding positions in 29 companies. The current dividend yield is 2.92%, and while the year-to-date (through July 7) performance is -0.64%, that’s just a tiny fraction of the year-to-date loss in the S&P 500. However, the fund has a one-year performance of 14.2%, and a 10-year average annual return of 10.31%.

Consumer Staples

Consumer staples are the products and services people buy all the time. Think food, beverages, auto parts and personal goods. Though consumers may cut back spending in other areas, there’s really not much flexibility here. That tends to make this group more resilient in recessions. The best way to play this sector is with funds, since it is a highly diversified group.

The $15.4 billion Consumer Staples Select Sector SPDR (XLP) holds large positions in consumer giants like Procter & Gamble, Coca-Cola, Pepsi, Costco and Walmart. The current dividend yield is an impressive 2.45%. And though the fund has turned in a -5.32% performance through June 30, it’s posted a 5.72% return over the past 12 months, and 10.49% annual average over the past decade.

The Vanguard Consumer Staples ETF (VDC) is another major ETF in the consumer Staples space. The fund holds 103 companies, has a current dividend yield of 2.30%, and an expense ratio of just 0.10%. Though it has had a year-to-date return of -5.37%, its posted a return of 3.89% over the past 12 months, and an average of 10.52% per year over the last 10 years.

The Fidelity MSCI Consumer Staples Index ETF (FSTA) has a dividend yield of 2.27%, and holds positions in 110 companies. As of July 8, the fund has returned 3.06% for the past 12 months, though it is down about 6% year-to-date. The fund was launched in October 2013, and has an average annual rate of return of 9.17% since.

Healthcare

Much like utilities and consumer staples, demand for healthcare is fairly constant. After all, the need to maintain good health doesn’t change with the ebb and flow of the economy. This makes healthcare stocks well-positioned to weather recessions.

The $38 billion Health Care Select Sector SPDR Fund (XLV)is an example of a broad-based healthcare fund. It holds stock in 64 healthcare companies, with concentrations in pharmaceuticals, healthcare providers and services, healthcare equipment, biotechnology and life sciences tools and services. The fund has lost 8.38% since January 1 but has a 10-year average annual return of 14.79%.

An example of an even broader healthcare fund is the Fidelity MSCI Health Care Index ETF (FHLC). The fund holds positions in no fewer than 446 healthcare companies, including UnitedHealth Group, Johnson & Johnson, Pfizer, AbbVie, Eli Lilly, Merck, Abbott Labs, and Bristol-Myers Squibb. The fund has a one-year loss of 3.57% (through June 30), but has returned an average of 12.34% per year since its inception in 2013.

Healthcare Specializations

One of the big advantages in the healthcare sector is that you can invest either in the broad market sector, or in specific niches. The latter can be an excellent strategy if you believe those niches in the industry are likely to outperform the broader field.

The $8.3 billion iShares Nasdaq Biotechnology ETF (IBB) is an example of a healthcare niche, in this case, biotechnology. The fund has positions in 372 companies, including Vertex Pharmaceuticals, Gilead Sciences, Amgen, Regeneron, Moderna and Biogen.

Though the fund has lost nearly 28% in the 12 months ended on June 30, it’s had a 10-year average annual performance of 10.73%. Meanwhile, the companies in the fund average a very conservative 13.46 P/E ratio. This may be an example of an industry sector that has lost steam as the COVID pandemic has subsided but could represent a solid long-term turnaround play.

As the name implies, the iShares U.S. Healthcare Providers ETF (IHF) is a fund concentrated in health insurance companies and healthcare networks. The fund is on the smaller side, with just over $1.5 billion in assets, spread across 71 companies. Those include United Healthcare, CVS, CIGNA, Humana, HCA, and Quest Diagnostics. The fund has a year-to-date performance of -8.83% through June 30, but an average annual return of 15.57% over the past decade.

One thing to be aware of with the IHF fund is that the top five holdings in the portfolio represent about 55% of the fund’s total assets. That includes more than 23% for United Healthcare, and nearly 14% for CVS.

Which Industries Outperform the Stock Market During Recessions?

The stock market is often volatile during recessions, making it difficult to predict which industries will outperform the market. However, there are certain industries that have a history of outperforming the market during economic downturns.

1. Health Care

The healthcare industry is typically one of the best performers during recessions. This is because people will always need medical care, no matter how bad the economy is. Healthcare stocks tend to be less volatile than the overall market, making them a safe bet during uncertain times.

2. Utilities

Utilities are another industry that outperforms during recessions. This is because people continue to need electricity and other basic services even when the economy is struggling. Utility stocks are often seen as defensive investments, which means they can help offset losses in other parts of your portfolio.

3. Consumer Staples

Consumer staples is a broad category that includes essential items like food, beverages, and personal care products. These items are often considered non-discretionary, which means people continue to buy them even when times are tough. That’s why stocks in this sector tend to be less volatile than the overall market.

4. Cosmetics

The cosmetics industry is another one that does well during recessions. This is because people continue to want to look their best, even when the economy is struggling. Cosmetics stocks tend to be less volatile than the overall market, making them a safe bet during uncertain times.

5. Automotive

The automotive industry is another one that does well during recessions. This is because people continue to need transportation, even when the economy is struggling.

Since the pandemic car prices have increased. Even the used car market has increased in value. Have you tried to buy a used truck? It’s nearly impossible! And, if you can find one, the prices have increased by double digits.

Automotive stocks tend to be more volatile than the overall market, but they typically rebound quickly after economic downturns.

6. Technology

Technology is another industry that does well during recessions. This is because people continue to need technology, even when the economy is struggling. Technology stocks tend to be less volatile than the overall market, making them a safe bet during uncertain times.

7. Fine Wine

The fine wine industry is another one that does well during recessions. This is because people continue to want to drink wine, even when the economy is struggling. I mean, do you blame them?

Fine wine investments can offer both stability and growth potential during tough economic times. Fine wine is a luxury good, which means that demand for it is relatively inelastic. That means that people will continue to buy it even when their incomes are tight.

Final Thoughts

As you can see from the year-to-date performances of some of the (generally) better-performing stock sectors, it’s never entirely possible to prevent investment losses during a recession. But at the same time, it’s important to protect the capital in your portfolio, to leave you better prepared for future opportunities.

In the meantime, maintain the proper attitude and outlook. Recessions vary in length and severity, so there’s no way to know for sure how well any stock or sector will perform, or if it will provide a positive return. Being guided by past performance, while not a guarantee, is the best view of the future we can get.

And bigger picture, focus your attention on the inevitable end of the recession and the current bear market. It will come and bring better days with it, especially if you can preserve your capital between now and then.