Learning how to make money while you sleep is, quite frankly, the ultimate goal of financial independence. After all, earning passive income is one of the best ways to escape the grasp of your 9-to-5 job.

Warren Buffet is famous for making this crucial point about building wealth:

But how do you make money while you sleep? And what are the best ways to build passive income streams to replace the income from your regular job?

It boils down to your individual talents, goals, and whether you have any cash to invest upfront.

17 Ways to Earn Money While You Sleep

If you want to make money while you sleep, there are an endless number of ways to go about it. Here are 17 top strategies you can try today.

Table of Contents

- 17 Ways to Earn Money While You Sleep

- #1: Invest in Short-Term Savings

- #2: Invest in Digital Real Estate

- #3: Affiliate Marketing

- #4: Buy a Certificate of Deposit (CD)

- #5: Invest in Series I Savings Bonds

- #6: Invest in Stocks

- #7: Invest in Real Estate Investment Trusts (REITs)

- #8: Become a Landlord

- #9: Dive Into Alternative Investments

- #10: Create a Product You Can Sell

- #11: Write an eBook

- #12: Create an Online Course

- #13: Start a Membership Site

- #14: Start a YouTube Channel

- #15: Rent Out Space in Your Home

- #16: Rent Your Parking Space

- #17: Rent Out Your Car

- Making Money While You Sleep: The Bottom Line

#1: Invest in Short-Term Savings

A high-yield savings account won’t net much passive income, but it can help you secure a decent savings return. It’s also a great place to store your emergency fund. Savings accounts keep your cash liquid and readily accessible, so you can get your hands on your money if needed.

Money in a regular savings account is also FDIC-insured, so you won’t lose your assets. You’re protected up to $250,000 per depositor, per institution) if your bank defaults or goes out of business.

The Fed has been raising interest rates due to inflation, which means higher returns than in previous years. Wondering which online savings accounts offer the best return on your money with little to no fees?

At the moment, I recommend Discover, Citi Accelerate Savings, and SoFi Money.

Money market accounts can also help you earn passive income, and they don’t tie up your cash. They’re like a mix between savings accounts and CDs, but they don’t tie up your cash the way CDs do. You often earn a higher yield, you can access your cash anytime without penalty, and they are FDIC-insured.

Money market accounts with the highest yields come from mostly online banks. These include options like Discover, Ponce Bank, and Quontic Bank.

With Save Better, for example, you can earn 5.26% APY on savings with no annual, account maintenance, or hidden fees. You can even get a bonus of up to $300 when you open a new account with direct deposit.

5.26%

Interest Rate

varies

Min. Initial Deposit

#2: Invest in Digital Real Estate

Real Estate Investment Trusts (REITS) are pooled investments that use physical real estate as an underlying asset, but there are other ways to invest in virtual real estate.

Sure, you can buy a plot of land in the metaverse, but I’m not talking about that.

When I speak of investing in digital real estate, I’m really talking about digital assets:

- Authority websites that focus on a specific niche;

- eCommerce stores that sell physical products;

- Digital products like eBooks and courses;

- Domain names you can buy and sell on websites like Flippa;

- Email lists you can build and sell to others;

- Subscription sites that require monthly or annual fees;

- Mobile apps;

- YouTube channels that are ultimately monetized;

- Social media channels that are monetized over time.

My favorite digital asset is the website you’re reading – GoodFinancialCents.com. I started this website over a decade ago, and since then, I’ve used it to earn millions of dollars.

It wasn’t easy – I earned almost nothing for the first year I spent blogging while juggling a full-time job. However, I eventually turned this website into the money-making machine it is today.

If you’re curious about how to start a website you can monetize, make sure to check out the following blog post:

Also, consider signing up for my Make $1k Blogging course, which is 100% free. It’s designed to help you get your blog set up so you can earn your first $1,000 online.

You can sign up using your email address and be on your way to making money blogging in no time.

#3: Affiliate Marketing

If you decide to start your own blog, you’ll want to check out affiliate marketing.

But what is affiliate marketing? Mostly, it’s a strategy that helps you earn money when someone clicks on affiliate links you promote.

Let’s say you write a blog post about the best travel backpacks, and you fill it with links that earn you a commission when someone makes a purchase. That, my friends, is affiliate marketing.

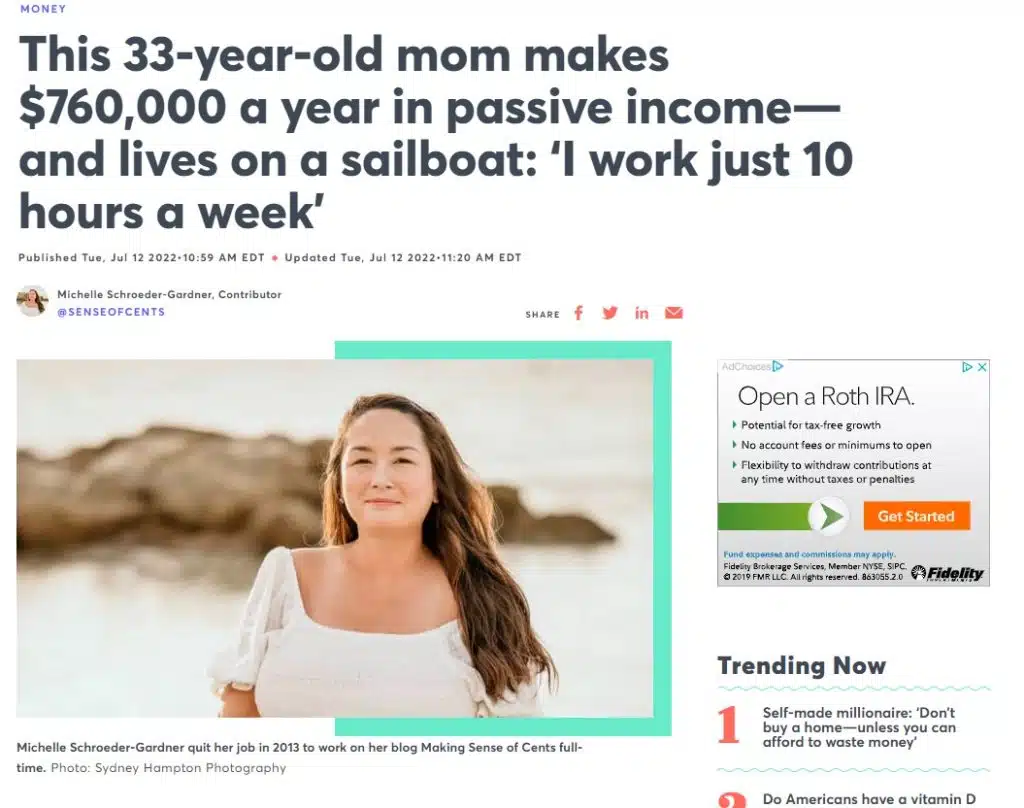

My friend Michelle from Making Sense of Cents is a master of affiliate marketing who has earned millions of dollars with her website over the years. She recently had her first child, yet she still earns $760,000 annually.

The best part? She lives on a sailboat year-round, and she spends the majority of her time sailing around the Bahamas while working just 10 hours per week.

#4: Buy a Certificate of Deposit (CD)

A certificate of deposit (CD) earns more money than a savings account, but you need to “lock up” your money for a fixed period – usually at least six or 12 months. This is because, unlike savings accounts, CDs are purchased for a specific term.

Once you begin researching options to find the best CD rates, you’ll discover that banks like Capital One offer yields well above 3% for their longer CDs. You’ll earn less if you buy a CD with a shorter timeline, but you can open online CDs with terms as little as six months and some pretty decent rates.

Just keep in mind that if you open a CD, you’ll need to commit to keeping your cash locked away for the duration of the CD term. If you have to access your money early, you’ll get hit with early withdrawal fees and miss out on some of the interest you would have earned.

Find The Highest Yield CD Rates on SaveBetter

#5: Invest in Series I Savings Bonds

If you want to secure an exceptional yield of up to $10,000 (or $20,000 for a couple) and you’re able to lock your money away for at least 12 months, you should consider Series I Savings Bonds. These government-backed savings bonds are currently earning 9.62%, and individuals can purchase up to $10,000 total in these bonds every calendar year.

That’s a lot of interest you can earn in your sleep, but you should know that you cannot access the money you invest in these bonds until at least 12 months have passed. You can access your money after that, but you’ll pay a penalty of three months of interest if you cash out your Series I Savings Bonds before five years pass.

According to the Bureau of the Fiscal Service at the U.S. Department of the Treasury, Series I Savings Bonds provide an excellent way to grow your savings or supplement your retirement income while protecting your assets from inflation. They’re also incredibly easy to buy online, and you can purchase them for every household member.

#6: Invest in Stocks

Stock investing is one of the best ways to earn passive income. In fact, the S&P 500 (one of the major stock market indexes) provided an average return of 8.91% during the 20 years leading up to the beginning of 2023.

If you would be happy with that return, you should consider investing in index funds. They hold all major companies on the S&P 500, or whichever benchmark your index fund tracks. This saves you from picking individual stocks and offers instant portfolio diversification.

The most popular index funds include the Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), Vanguard 500 Index Fund Admiral Shares (VFIAX), Fidelity ZERO Large Cap Index (FNILX), and Invesco QQQ Trust ETF (QQQ).

Of course, you can also try your luck investing in individual stocks if you’re willing and able to do some research and legwork upfront. You could even turn to a robo-advisor that can help you craft a personalized portfolio.

For example, M1 Finance lets you buy investment pies that are expertly crafted to help you reach your investment goals. Better yet, they let you invest in stock with no fees required, and you can choose from a selection of existing pies or create your own.

You can also lean on help from a robo-advisor like Betterment when it comes to creating a portfolio of stocks to help you make money while you sleep. Betterment lets you start investing with as little as $10, and you can benefit from perks like automated investing and tax loss harvesting.

- * Account Minimum $100

- * Build custom portfolios (or)

- * Choose expert portfolios

- * Stocks, ETFs, REITs

#7: Invest in Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are yet another vehicle that allows you to earn passive income while you sleep. REITs work similarly to stocks in that you can invest a lump sum upfront or regular contributions over time. However, your money is used to invest in income-producing real estate instead of other asset classes.

Ultimately, this means REITs let you invest in real estate without the hassles and stress of being a landlord. REITs also require much less upfront capital than you would need if you were buying physical property.

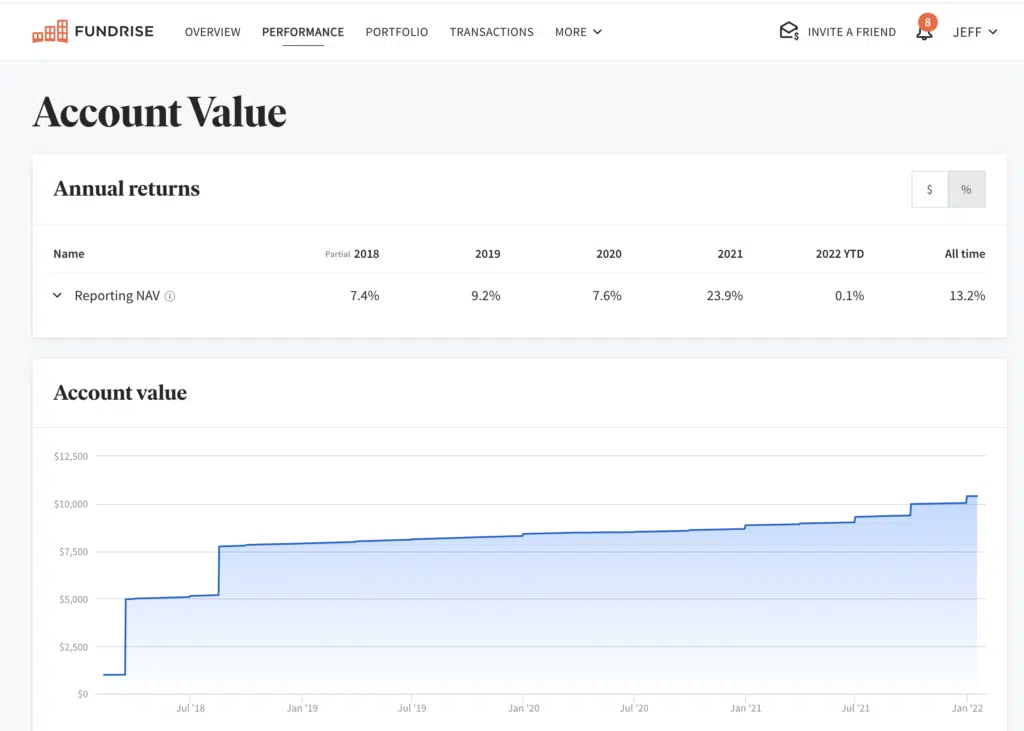

My favorite way to invest in real estate passively relies on an app called Fundrise. With Fundrise, you can begin investing in real estate with a minimum investment of $10, and you can set up automated investments, so your real estate portfolio grows seamlessly over time.

Below you can find a screen of my own account, which shows my returns over the last few years.

According to Fundrise, their investors enjoyed average returns of 7.31% in 2020, followed by a return of 22.99% in 2021. In 2022 investors enjoyed an average return of 1.50% when Public REITs were down -25.10%. In 2023, Fundrise had its first down year losing -7.45%.

| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

#8: Become a Landlord

While I can recommend REITs, physical real estate offers even more potential. There is more hands-on work involved, but physical properties let you earn rental income while your tenants cover the mortgage payments.

You can also benefit from real estate appreciation, a major boon for landlords over the last few years. A recent report from the National Association of Realtors (NAR) showed that the median sales price for existing homes is 0.7%.

Fortunately, the best mortgage companies offer plenty of ways to get funding for investment real estate. You can even use an FHA loan if you’re looking for a multi-unit property (up to four units) and you plan to live there.

Rental properties let you earn income while your tenants cover the mortgage payments.

#9: Dive Into Alternative Investments

You can also consider alternative investments that help you earn money while you sleep, including options like Masterworks and Yieldstreet. These options aren’t mainstream, but they can help you earn higher returns than you’ll get with a savings account while diversifying your portfolio into alternative asset classes.

Masterworks

As an example, Masterworks lets you invest in individual pieces of art. In doing so, you can benefit as the value of that art increases over time, whether you buy a piece of a multi-million dollar painting or something truly unique from an up-and-coming artist.

According to Masterworks, your returns can be exceptional, too. They claim that contemporary art has increased in value at a rate of 13.8% per year over the last 25 years. Learn more in our Masterworks review.

Yieldstreet

In the meantime, Yieldstreet lets you invest in private markets spread across alternative investments in commercial real estate, marine projects, and even art. You can also invest in short-term notes.

The minimum investment with Yieldstreet starts at $500, and you can choose the types of investments or the funds you put your money in.

Vint

Another option is Vint, which lets you invest in highly valuable fine wines. Fine wine tends to appreciate in value over time, just like art, and Vint lets you get a piece of the pie.

The creators of Vint claim the value of fine wines has gone up more than 50% over the last five years and more than 25% over the last year. You don’t have to enter your credit card or banking info to invest, and Vint will help you craft a profitable portfolio that makes sense for your long-term goals.

Other alternative investments include multi-family REITs through a platform called DiversyFund and crowdsourced commercial real estate for accredited investors with EquityMultiple. Both platforms let you invest as little as $500 with real estate as the underlying asset, which makes them similar to how Fundrise works.

#10: Create a Product You Can Sell

You can earn passive income while you sleep by creating a product you can sell repeatedly. This could be a physical product you create in bulk and then sell on an online marketplace, but it could also be a digital product you create once so you can sell it online around the clock.

A physical product can be anything. For example, my friend Steve Chou started an online website that sells a specific type of linens that are somewhat difficult to find. He has since earned millions of dollars running Bumblebee Linens, and all from the comfort of his home.

Then there are online-only products, which could also be nearly anything you can dream up!

Examples of digital products you could sell include:

- An online course;

- A pay-per-view webinar;

- Printables people can download online and print from home;

- Educational products;

- Music or art; and

- Licenses to use digital assets you own.

There are so many benefits to creating a digital product you can sell. To begin with, start-up costs can be low, and your profit potential is sky-high since you don’t have any materials to buy.

You can also automate many processes, and there’s no ceiling on the number of customers you can gain when you sell a physical or digital product online.

#11: Write an eBook

Another digital product worth considering is an eBook. Believe it or not, you can make big money writing and selling books on various online platforms.

Your book could be about anything, whether you want to write children’s tales or create a how-to book on a topic you know a lot about.

The best part is you can market and sell your eBook online, alongside all the popular books from traditional authors. In fact, eBooks are one of the best strategies people use to make money on Amazon.com.

#12: Create an Online Course

Another way to make money online involves building an online course around something you know. Take my own course – The Passive $1K Formula™ – as an example.

I know a lot about building a passive income using digital assets (like my website and YouTube channel), so I built this course around this exact topic.

With the Passive $1K Formula™, students can learn about all the best ways to earn passive income entirely from home and on their own terms, while I earn passive income with each sale I make.

But, enough about me. We’re talking about your passive income, right? To build a profitable online course, you just have to think about the topics you know the most about.

Examples of popular online courses include ones on:

- Welding basics;

- Strategies to make money on YouTube;

- Learning how to garden; and

- Cooking and baking courses.

There are even courses on how to make courses! Either way, you can build your own online course using a platform like Teachable and watch the money roll in from there.

#13: Start a Membership Site

Have you ever considered starting a membership site or even a paid Facebook group? This option works as a standalone money-making venture, but you can also offer a paid group as a companion to an online course or a digital product.

And no, I’m not talking about starting an OnlyFans🤣.

I’m talking about starting a membership site on a topic you know a lot about, whether it’s investing, flipping real estate, or making homemade vegan meals.

For example, a travel blogger named Nomadic Matt started his own membership site as a companion product for his other offerings. With Nomadic Matt Plus, members get access to exclusive content, books, and discounts that can help them travel better for less.

This membership costs people $5 to $25 per month, which isn’t a huge investment on the part of the consumer. However, imagine how much passive income Nomadic Matt is earning for providing this extra content!

If he has 100 monthly subscribers, he earns $500 to $2,500 per month in membership fees.

If he has 200 subscribers, he’s earning $1,000 to $5,000 per month!

If Nomadic Matt has 1,000 subscribers, he’s earning a minimum of $5,000 to $25,000 in passive income with this revenue stream alone.

#14: Start a YouTube Channel

Next up, you can try your hand at making money on YouTube. While earning real income with this video platform isn’t as easy as it looks, you can earn money while you sleep if you are willing to invest some time and work upfront.

I should know. I started my Wealth Hacker YouTube page several years ago, and it’s become one of my most reliable income streams. I kept grinding away even when it felt like I wasn’t getting anywhere. With a significant amount of sweat equity put in over the years, I now have nearly 400,000 faithful subscribers.

If you’re interested in something and want to start a YouTube channel on the topic, you should find out what’s involved and the steps you need to take immediately. My step-by-step guide on How to Make Money On YouTube can help you do that.

#15: Rent Out Space in Your Home

If you’re comfortable letting a stranger crash in your place, consider renting a room in your home via Airbnb.

Rent out your entire house, an extra bedroom, or that garage apartment you spent time converting yourself.

Maybe you have a basement that could be rented out if you added a kitchenette. Whatever space you have, decide on a price, then list it on Airbnb to see if you get any action.

#16: Rent Your Parking Space

If you have a parking space that sits empty most of the time, you can rent it out via SpotHero. It works best in a big city with limited parking, like Chicago or New York. However, it can also work if you live near a major airport or train station.

The best part is you can rent out your space for limited periods of time based on your schedule. If you’re going on a two-week vacation and you won’t use your parking space that entire time, for example, you can open your rental calendar for those dates and cash in if someone takes you up on the offer.

#17: Rent Out Your Car

Finally, consider renting out your car using a website like Turo.com. It’s a ride-sharing platform that connects car owners with people who need to rent a vehicle.

How much can you earn? It depends on where you live, the dates your vehicle is available, and the type of car you’re renting out. If you own a Tesla, you could earn more than $130 daily. If you own an expensive sports car, like a Porsche, even more.

Jeeps are also popular on the site, with many owners charging more than $75 per day to rent their rides. Even if you can only rent your car a few days per month, it might be worth it.

Making Money While You Sleep: The Bottom Line

As you can see, there are an endless number of ways to make money while you sleep. Some require an upfront investment of cash, others let you get started with creative thinking or one great idea. The best part is you can implement several of these income-producing strategies at once.

Whatever you do, don’t sit on the sidelines to see if passive income starts trickling in on its own. Unless you win the lottery, the chances of that happening are slim to none.