Wells Fargo was founded on March 18, 1852, in San Francisco, CA. The financial institution offers a variety of home loan products, including fixed and adjustable-rate mortgages, FHA and VA mortgages, jumbo loans, home improvement loans, and new construction loans.

Founded in 1852, Wells Fargo is one of the largest lenders in the U.S. According to the Q2 Wells Fargo fact sheet, it services one in three households in the U.S.

Wells Fargo faced a scandal in 2016 when the organization let go of thousands of employees who created fraudulent accounts. Since this incident, the lender has been working hard to regain consumers’ trust.

The bank’s flexible loan options do not require many qualifications, aside from the borrower’s credit score, debt-to-income ratio, and a government-issued ID.

Wells Fargo is a well-recognized name in the banking industry, but just because you know the logo doesn’t mean they are a good option. Maybe a smaller bank would be a more affordable option.

Table of Contents

Wells Fargo Mortgage Facts

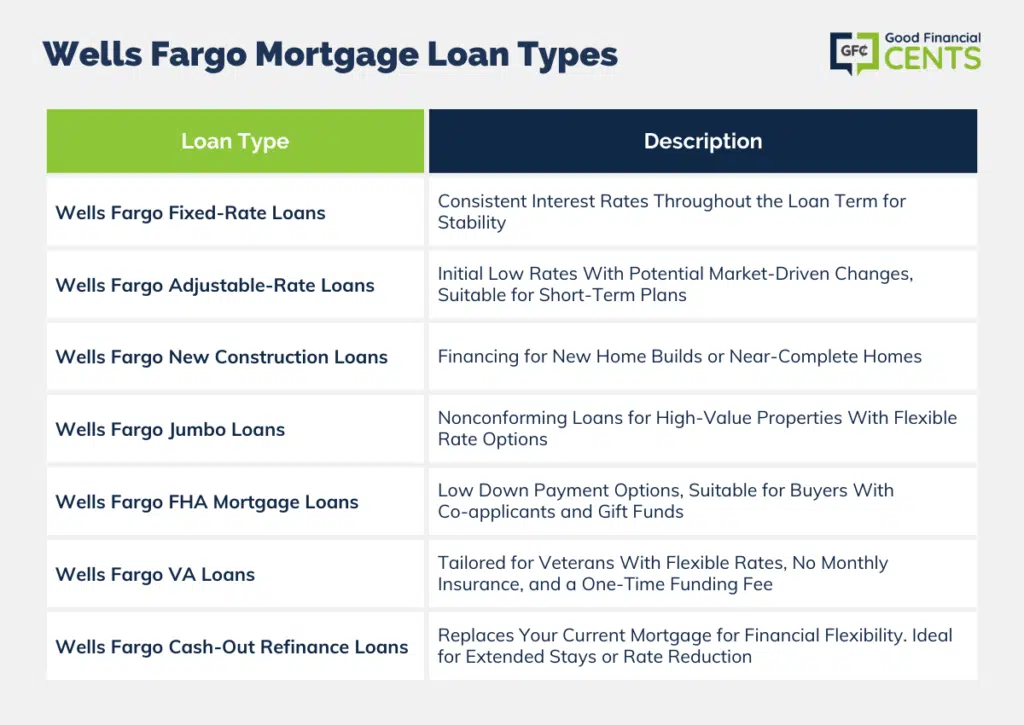

- Offers fixed-rate mortgage down payments as low as 3 percent.

- Provides borrowers with a variety of loan options, from conforming fixed-rate and adjustable-rate mortgages to VA and FHA loans and jumbo mortgages.

- Extends mortgage options for new construction homes.

- The Union Plus Mortgage program is available to 30,000 local unions and 59 national and international labor unions.

- My Home Roadmap offers free credit counseling to customers who were turned down due to poor credit.

- My FirstHome® Education program teaches first-time homebuyers what to expect when taking out a mortgage.

Wells Fargo Loan Specifics

Wells Fargo Fixed-Rate Loans

These types of loans have interest rates that stay the same throughout the life of the loan. These predictable costs protect borrowers from rising interest rates and make it easier for them to budget their finances.

Fixed-rate mortgages are most beneficial for homebuyers who plan on staying in the home for several years. In addition, people with secure finances might want to take out a fixed-rate loan if interest rates are historically low at the time of purchase.

Wells Fargo Adjustable-Rate Loans

Adjustable-rate mortgages begin with a low initial interest rate, but these costs might rise and fall with market fluctuations after this fixed period ends. These loans include an interest rate cap, which limits how much the interest rates can increase.

Homebuyers who plan on selling their home or refinancing in the next few years should consider this mortgage option.

Wells Fargo New Construction Loans

This type of mortgage provides buyers with the finances they need to build their new home. Typically, these loans only last for the time it takes to construct the house. These loans are beneficial to buyers moving into a new construction home or a house that is nearly complete.

Wells Fargo Jumbo Loans

A jumbo loan is a nonconforming loan that allows homebuyers to take out larger loan amounts than the typical limits set by lenders Fannie Mae and Freddie Mac. According to the Federal Housing Finance Agency, the minimum jumbo loan amount is $766,550.

Wells Fargo offers jumbo loans with fixed-rate and adjustable-rate payment options. Jumbo mortgages can help people with the financial flexibility to cover large monthly payments on high-value properties.

Wells Fargo FHA Mortgage Loans

Wells Fargo mortgage rates can be both fixed and adjustable for Federal Housing Administration (FHA) loans. This mortgage is best suited for those looking for a low down payment loan option.

Buyers can secure FHA loans with a down payment of just 3.5 percent. They can also qualify for an FHA mortgage with a co-applicant who won’t live in the house and use gift funds to finance the down payment and closing costs.

Wells Fargo VA Loans

VA loans are offered to finance veterans and other qualifying VA program borrowers. They are available in the form of fixed- and adjustable-rate options. VA loan applicants can use gifts and grants to cover closing costs.

Many homebuyers find VA loans desirable because of their flexible rate and term options, and because they do not require monthly mortgage insurance. However, VA homebuyers typically pay a one-time funding fee that can go directly toward the loan amount.

Wells Fargo Cash-Out Refinance Loans

This form of refinancing replaces a current mortgage with a new loan that can help pay off the outstanding mortgage balance. This type of loan is ideal for homeowners looking to refinance their homes in any of the following instances:

- They decided to stay in the home for longer than expected.

- Interest rates have dropped since they first took out a mortgage.

- They would rather pay lower interest rates with extended loan terms.

Wells Fargo USDA Loans

The U.S. Department of Agriculture’s Guaranteed Rural Housing Program offers finance to low- to moderate-income homebuyers in rural areas. These loans can fund up to 100 percent of the purchase price and may not involve a down payment.

Eligible buyers can pay a one-time guarantee fee as well as an annual fee to the USDA. The best candidates for these types of home loans are homebuyers on a tight budget looking to move to rural areas.

Wells Fargo Mortgage Customer Experience

According to JD Power’s 2017 Primary Mortgage Originator rankings, Wells Fargo received an overall satisfaction score of three out of five stars. Its strongest score was in the category of problem resolution, at four out of five stars.

The company’s commitment to helping consumers can be seen in its helpful FAQ center where customers can find the answers to some of the most common mortgage-related questions.

For instance, while Ellie Mae claimed an average time of 44 days to close on mortgage applications in Sept. 2018, Wells Fargo reported that its closing times can range from 30 to 90 days.

Consumers can also contact customer service or mortgage specialists at Wells Fargo if their questions cannot be found in the FAQ. This lender even offers informative articles that can help customers learn more about the different types of loans and decide what mortgage option is right for them.

The institution also offers an online mortgage calculator that can determine buyers’ rates and payments for home loans and refinances. By inserting the home value, down payment, borrower’s credit score, and property location, Wells Fargo can offer an estimated loan amount.

Aside from this, the bank also offers step-by-step guidance for customers who decide to apply online. However, borrowers cannot obtain an online quote. Instead, they must directly contact Wells Fargo mortgage specialists at 1-877-291-4333, or customer service personnel at 1-800-357-6675.

Just as with most lenders, borrowers looking for a loan with Wells Fargo may have to provide a government-issued ID number when applying for a loan. Common accepted IDs include:

- Social security number

- Taxpayer ID number

- Green card

- Foreign visa

- Alien ID card

- Foreign passport number

When researching customer reviews online, the results can be relatively polarizing, especially in the face of this lender’s well-publicized recent issues. In August 2018, the San Francisco Business Times reported a Wells Fargo software glitch that accidentally foreclosed on hundreds of homes.

This technology issue did not allow customers to modify their mortgages when they requested federal assistance between 2010 and 2015. This followed the issues in 2016 when Wells Fargo was fined hundreds of millions of dollars and laid off thousands of employees for committing account fraud.

Wells Fargo launched an advertising campaign in early 2018 that stated its interest in regaining consumer trust.

Wells Fargo Lender Reputation

Wells Fargo is a bank that was founded in 1852. Wells Fargo has a Nationwide Mortgage Licensing System and Registry ID number of 399801.

Wells Fargo Mortgage Qualifications

| Credit score | Quality | Ease of approval |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat easy |

| 621-699 | Fair | Moderate |

| 620 and below | Poor | Somewhat difficult |

| n/a | No credit score | Difficult |

Borrowers with credit scores above 760 should have no trouble finding good mortgage rates. If borrowers have a “good” credit score, they may qualify for mortgages, but may not get the best rates if their debt and income levels are below average.

If they have “fair” credit, they might pay higher mortgage rates. Those who have credit scores below 620 or have insufficient credit history might have trouble being approved for most mortgages.

| Debt-to-income ratio | Quality | Likelihood to get approved by lender |

|---|---|---|

| 35% or less | Manageable | Likely |

| 36-49% | Needs improvement | Possible |

| 50% or more | Poor | Limited |

Typically, Wells Fargo is most likely to accept applicants with a debt-to-income (DTI) ratio of 35 percent or less. When their DTI is between 36 and 49 percent, they may be eligible for approval if their credit score is excellent.

If buyers have a high DTI ratio, they might have limited lender options and may need to focus on lowering this ratio before applying for a mortgage.

Wells Fargo’s down payment minimum depends on the loan type. The lender typically requires 20 percent down for conventional loans. However, for borrowers interested in making a low down payment or taking out a VA or FHA loan, Wells Fargo allows a down payment of 3 or 3.5 percent.

Wells Fargo Phone Number & Additional Details

- Homepage URL: https://www.wellsfargo.com/

- Company Phone: 1-800-357-6675

- Headquarters Address: Wells Fargo, 420 Montgomery Street, San Francisco, CA 94104

- States Serviced: Wells Fargo services all 50 states, except Hawaii, Kentucky, Louisiana, Maine, Massachusetts, Missouri, New Hampshire, Oklahoma, Rhode Island, Vermont, and West Virginia.

Conclusion

Wells Fargo, a financial stalwart founded in 1852, remains one of America’s most prominent lenders, servicing an expansive portion of U.S. households. With a vast array of mortgage options, ranging from fixed and adjustable-rate loans to VA and FHA loans, the bank tailors its services to diverse client needs. While the bank’s robust offerings and commitment to customer education and service are commendable, its history isn’t without blemishes. Past scandals have somewhat tarnished its reputation, necessitating significant efforts from Wells Fargo to rebuild trust with consumers. Borrowers, while acknowledging the bank’s rich legacy and comprehensive product lineup, are encouraged to diligently weigh the pros and cons and perhaps consider alternative lending institutions to ensure the best fit for their financial circumstances.

How We Review Mortgage Lenders:

Good Financial Cents evaluates U.S. mortgage lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Wells Fargo Product Description: Wells Fargo is a leading financial institution founded in 1852, offering a vast range of banking and financial services. Known for its extensive mortgage options, the bank serves a significant portion of U.S. households. In addition to mortgages, it provides checking and savings accounts, loans, and investment services. Summary of Wells Fargo Wells Fargo, established in the heart of San Francisco, CA, has grown to become one of America’s largest banks. Serving millions, its mortgage product lineup ranges from conventional fixed and adjustable-rate mortgages to specialized offerings like VA, FHA, jumbo, and new construction loans. Beyond home financing, Wells Fargo caters to various financial needs, with products like credit cards, personal loans, wealth management, and commercial banking services. Their online and mobile banking platforms also ensure customers can manage their finances with ease from anywhere. Pros Cons

Wells Fargo Review

Overall