Margin is debt. You borrow capital from your broker to buy more assets, in most cases, stocks.

This gives you leverage. You are making a bet that your returns on the investments you buy on margin are going to be greater than the interest rate you pay your broker for the privilege, net of commissions.

If they are, you pocket the difference. If not, then you have to make your broker whole.

Since the broker uses the assets you already own in your account as collateral to satisfy your margin, investing on a margin is very similar to buying a house on a mortgage.

The only difference is that when you invest, you do not have to make monthly margin payments, and the broker is generally not too worried if you ever make any effort to reduce your margin as long as there is sufficient value in your investments to cover for it.

The similarity does not end here. Taking on a mortgage to buy a house can be good or bad. It depends a lot on who, how, why, and the level of financial savvy of the borrower. Investing in margin is the same way.

Table of Contents

If you understand how it works, use it judiciously, and can manage your risk well, it can help you generate nicer returns. On the other hand, if you are not disciplined enough, misuse it, or get carried away chasing a hot stock, it can drain your account dry.

When to Not Use Margin?

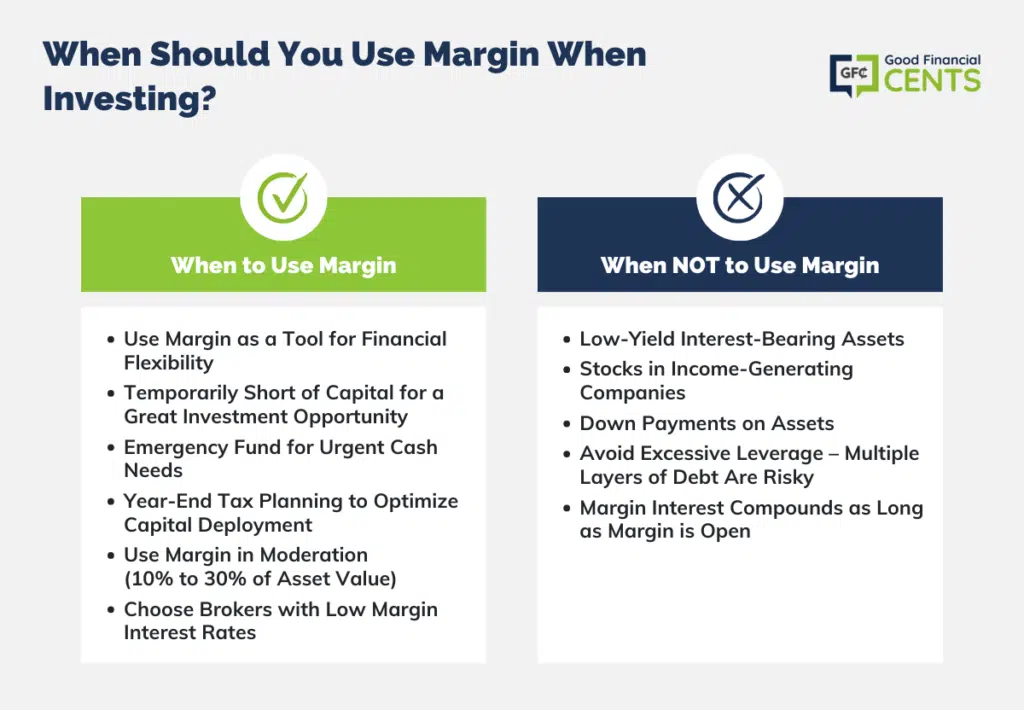

In this case, I think it makes better sense to eliminate the situations where margin should not be used before we talk about the situations where it makes sense to use it. Sure, there are always exceptions, but these principles hold true for most common investing scenarios.

Principle #1: Do Not Use Margin to Buy Interest-Bearing Assets That Yield Lower Than Your Margin Interest

Yes, you can buy bonds of all varieties, treasuries, and many other assets that throw out reliable yields. Most of the time, because of the perceived safety of these instruments, the brokers will allow you to lever up more than 1x, which means that $1 of your collateral might allow you to buy $3 of municipal bonds (as an example).

Theoretically, if the yield on this muni is more than 1/3rd of the interest rate on your margin, you could possibly make a few basis points of supposedly “risk free” income.

The problem arises if the interest rates move, and the slim window of profit can quickly flip into a cash flow drain. Besides, anything that complicates your investing so much for returns so small is not worth doing.

Principle #2: Do Not Use Margin to Buy Stock in a Utility Company, REIT, MLP, or Other Type of Trusts

Similar principle as above. Any stock that is mostly used to generate a current income in the form of dividends is not a candidate to buy using margin. In most cases, the yield will be lower than your interest rate, and capital appreciation may not be enough to make up for it.

If you are buying stocks for income, you are likely a conservative investor, and margin just adds more risk that you should not carry. Dividend investing is not a bad thing; it is just not recommended on margin.

Principle #3: Do Not Use Margin to Make a Down Payment on a Car, Boat, or a House

Just because you can borrow money from your broker to make a down payment does not mean you should do it. In this case, you are borrowing money, which will become a basis for more debt (car loan, mortgage, etc.).

If you have to do it, that means you are not financially strong enough to buy or invest in these assets. Multiple levels of leverage are financial insanity and can come back to bite you much sooner than you think.

But using margin is not all bad if you know how.

When and How to Use Margin

Too much debt kills, but a little debt can go a long way toward giving you financial flexibility. However, it is important to use margin as a tool only when you have a good investment that you are not able to get into otherwise. Let’s take a few examples.

Example #1: A Great Investment Opportunity Arises and You Are Temporarily Short of Capital

It often happens that your next contribution to your investment account is a few days or perhaps a week away, and it can easily cover the amount you are going to invest in this opportunity. Assuming this is not a hot tip stock and you have satisfied yourself with the merit of the investment, go ahead and use the margin to start your position. In a few days, you will send in more cash, and your margin will be covered.

Example #2: Using Margin as an Emergency Fund

If you have a need for cash that cannot wait – for example, an unexpectedly large tax bill, where the consequences of not paying full taxes on time are greater than the interest on the margin, it is okay to go ahead and borrow on margin. In many cases, you may need time to figure out which investments to sell to cover the margin, or perhaps you can do it over time with your income.

Example #3: Year-End Tax Planning

Let’s say you have a few investments you want to sell so you can redeploy capital in other more attractive investments. If your current investments have significant capital gains, you may want to wait for the new year to sell them so as to not incur additional taxes in the current year.

However, due to traditional tax selling by investors and funds, many investments become quite attractive towards the year-end, which you may want to take advantage of.

Proper use of margin will allow you to bridge the temporary capital gap. For a disciplined investor, margin should always be used in moderation and only when necessary.

When possible, try not to use more than 10% of your asset value as a margin and draw a line at 30%. It is also a great idea to use brokers like TD Ameritrade that have cheap margin interest rates. Remember, the margin interest compounds as long as you keep the margin open.

The Bottom Line – When Should You Use Margin When Investing?

Margin investing is akin to a double-edged sword, offering the potential for greater returns while also increasing the risk of significant losses.

At its core, margin is debt used to leverage investments, with the expectation that returns will exceed the associated interest rate. While there are merits to using margin in specific scenarios, like seizing a timely investment opportunity or bridging a short-term financial gap, it’s crucial to approach it with caution and knowledge.

Abiding by principles, such as avoiding margin for low-yielding assets or for making down payments, can guard against financial pitfalls.

To maximize the benefits and minimize risks, investors should utilize margin judiciously, setting boundaries like not exceeding 30% of the asset value and partnering with brokers offering competitive rates.

About the Author: Shailesh Kumar writes about stocks and value investing at Value Stock Guide, where he offers individual stock picks and ideas to registered members. Subscribe to his free stock newsletter for investment ideas that you can use to research further.

No matter the type or amount of investment goodfinancialcents.com is here to help. Whether it be investing $20,000 or how to invest $500000, we want to help you make the most of your investments!

Jeff,

I was thinking about buying stocks on margin. I don’t want to put too much money at risk. I agree with your comment at the end and don’t wan to use more than 10% of my asset value as margin. However, I could not find enough information to make a decision. For example, let’s say that I have a portfolio of $10,000 and want to buy more shares but want to use margin for that. Can I just borrow $1,000 to buy $1,000 worth of shares without putting money? Can I use all my portfolio as collateral ($11,000 after purchase)? I have seen that the excess is maintained in a SMA, so I’m confused and this can’t be used to meet the margin call (only cash).

Here’s how it works Javier…Margin can’t exceed 50% of the purchase of the securities you’re buying. In order to buy $1,000 of stock on margin, you’d have to have at least $500 in the account, with $500 in margin used on the purchase. The margin call would have to be met out of other available funds if it becomes necessary.

Thanks for the information even though your article is 6 years old the advise is relative still for March 1st 2018.. To the day of your posting exactly 6 years———————————————————————————————————-

I have used margin to buy stock on some occasions and up to this point I was considering buying 300 more shares of BAC on Margin for a long position and that’s why I read your article so I could decide if its the right choice for me.. After reading I’ve decided not do it.. From what I have gathered from your blog Margin should only be a means for getting cash at the moment you don’t have any other avenue to borrow money or when you are between pay checks; also when you borrow using margin you should pay it off as soon as you are able.. Interest Debt can be accumulative problem…Sooner paid off the better!!!

Thanks

Doug

Good move Doug. Margin can double your returns on the way up, but it can come close to wiping you out if it breaks against you.

Jeff, Fantastic explanation of when to use the margin account without deferring to the often spewed, “don’t do it b/c its risky.”

I actually using my margin abilities for the exact reasoning you highlight in #1. For example, today the market was down 200 points or so and since I don’t keep cash in it, I had to use a margin to buy a couple shares. It will be paid back in a couple days, but I got to take advantage of the hopefully temporary dip.