Did you know that the average American has a nearly 70% chance of needing some form of long-term care upon reaching age 65? But did you also know that you may be able to prepare for the event by purchasing long-term care insurance? That’s why we’ve prepared this guide of the 7 best long-term care insurance of 2024.

Before getting into our reviews of the seven best long-term care insurance providers of 2024, scan the table below to see which company you think will work best for you:

Our Picks for Best Long-Term Care Insurance

Dozens of insurance companies offer long-term care insurance, but below is our list of the top seven and what each is best for:

- GoldenCare: Best All-Around

- LTC Resource Centers: Best for Asset-Based Long-Term Care

- Mutual of Omaha: Best for Unlimited Lifetime Benefit

- New York Life: Best for Low-Cost Premiums

- Nationwide: Best for High Lifetime Maximum Benefit

- Brighthouse Financial: Best for Hybrid LTC Policy

- CLTC Insurance Services: Best Long-Term Care Insurance Aggregator

Best Long-Term Care Insurance – Company Reviews

Table of Contents

Maximum Benefits: Varies by provider

Benefit Period: Varies by provider

Waiting/Elimination Period: Varies by provider

GoldenCare, also known as National Independent Brokers, Inc., is a privately held long-term care insurance brokerage firm and one of the leading firms in the industry. They provide policies from the top-rated insurance companies in the industry.

The list of companies they work with includes the following:

GoldenCare also offers critical illness insurance, Medicare supplements and Medicare Advantage plans, prescription drug plans, life insurance, annuities and final expense policies.

Maximum Benefits: Varies by provider

Benefit Period: Varies by provider

Waiting/Elimination Period: Varies by provider

Like GoldenCare, LTC Resource Centers is also an insurance brokerage specializing in long-term care insurance. Based in Cape Coral, Florida, the company has been in business for more than 40 years. They provide long-term care insurance, short-term care insurance, linked or combination products, Medicare supplements, life insurance, critical illness insurance, and annuities.

A specialization they offer is what is known as asset-based long-term care. It’s a strategy that uses a whole life insurance policy or annuity to provide long-term care coverage, which eliminates the need for an expensive, dedicated LTC policy. A pricing comparison is presented in the screenshot below:

As a broker, they work with multiple long-term care insurance providers. That means to get detailed information, you’ll need to set an appointment with a long-term care insurance specialist and make the request. The company is licensed to operate in all 50 states.

Maximum Benefits: Up to $400 per day or $10,000 per month

Benefit Period: Up to 5 years, or unlimited lifetime benefit

Waiting/Elimination Period: 0, 30, 60, 90, 180, or 365 days

Mutual of Omaha is one of the top individual providers of long-term care insurance. They offer some of the best plans in the industry, including lifetime benefit coverage, multiple elimination periods, and inflation protection. They are a full-service insurance company providing coverage in all 50 states and virtually all types of insurance policies.

Mutual of Omaha also offers premium discounts. For example, you can save 15% when you purchase a policy for both you and your partner. You can also save 15% if you’re in good health. There’s even a 5% discount if you are married but your spouse does not purchase a policy.

Maximum Benefits: Up to $7,000 per day, up to a $250,000 lifetime maximum

Benefit Period: Up to the maximum daily or lifetime limit

Waiting/Elimination Period: One-time deductible of $4,500 up to $21,000

Like Mutual of Omaha, New York Life is a large, well-established, and diversified insurance company. In addition to long-term care policies, they also offer virtually every other type of insurance policy available. Like Mutual of Omaha, New York Life is a mutual insurance company, which means it’s owned by its policyholders, not shareholders. The company partnered with the American Association of Retired Persons as a preferred provider of long-term care insurance policies.

New York Life provides its NYL My Care long-term care policy. The basic parameters are as follows:

Like other direct insurance providers on this list, New York Life also offers annuities and whole-life insurance policies with long-term care riders.

Maximum Benefits: Up to $750,000 maximum lifetime benefits

Benefit Period: Up to 7 years

Waiting/Elimination Period: 90 days

Nationwide is one of the leading providers of long-term care insurance in America. With a maximum lifetime benefit of up to $750,000, they provide the highest lifetime maximum benefit on our list. They also offer a simple 90-day elimination period. You can choose between two and seven years for the maximum benefit period.

The policy will also cover home healthcare, hospice, adult day care, household services, home safety improvements, and even family care. And in a unique twist, nationwide also provides international benefits. If you live out of the country during the benefit period, the policy will pay 50% of the maximum monthly benefit.

Maximum Benefits: Up to $250,000 maximum lifetime benefit

Benefit Period: Up to maximum lifetime benefit limit

Waiting/Elimination Period: 90 days

Brighthouse Financial is an insurance provider that offers two types of products: annuities and life insurance. Either is available with a long-term care rider. The company has $254 billion in assets and serves about 2 million customers.

Brighthouse Financial provides long-term care insurance through its SmartCare plan. It’s a combination plan that adds a long-term care provision to a whole life insurance policy. You’ll get the benefit of long-term care if it’s needed, but you’ll also have a life insurance benefit to pay to your beneficiaries if it’s not needed or if there are any funds left over after your long-term care stay.

The policy will cover adult day care, hospice, and home healthcare, in addition to nursing homes, assisted living facilities, and skilled nursing care.

Maximum Benefits: Varies by provider

Benefit Period: Varies by provider

Waiting/Elimination Period: Varies by provider

CLTC Insurance Services, or California Long Term Care Insurance Services, is a long-term care insurance aggregator based in San Francisco. Aggregator is a fancy word for an online insurance marketplace. As an aggregator, CLTC will give you access to a large number of long-term care insurance companies.

You can then choose the one offering the plan that will work best for you. The main limitation of this provider is that they offer policies only in the state of California.

In addition to long-term care insurance, they also offer annuities and life insurance policies, both with long-term care riders. These types of policies eliminate the need for a dedicated LTC policy since the cost of long-term care is paid out of the proceeds of the annuity or life insurance. CLTC also offers critical illness insurance.

Long-Term Care Insurance Guide

What Is Long-Term Care?

When an individual reaches a point where they can no longer care for themselves, long-term care becomes necessary. That care can be provided by anyone from family members to nursing homes.

The need for long-term care generally applies when the individual can no longer perform one or more of the six activities of daily living (ADL). This can include the inability to dress, groom, go to the bathroom, bathe, eat, or even move about freely.

In most cases, long-term care becomes necessary after a major health event, like a heart attack or stroke. But it can also be the result of an ongoing, degenerative health condition or simply advancing age.

In most cases, long-term care is provided by a family member. But institutional care may be necessary if the individual is unable to perform several ADLs, which may overwhelm the ability of family members to provide ongoing care.

How to Purchase Long-Term Care Coverage?

We recommend contacting any of the seven best long-term care insurance providers listed in this guide. Otherwise, do a search and identify insurance companies that offer long-term care coverage. But be aware that not all insurance companies offer it, precisely because of the many variables. It involves.

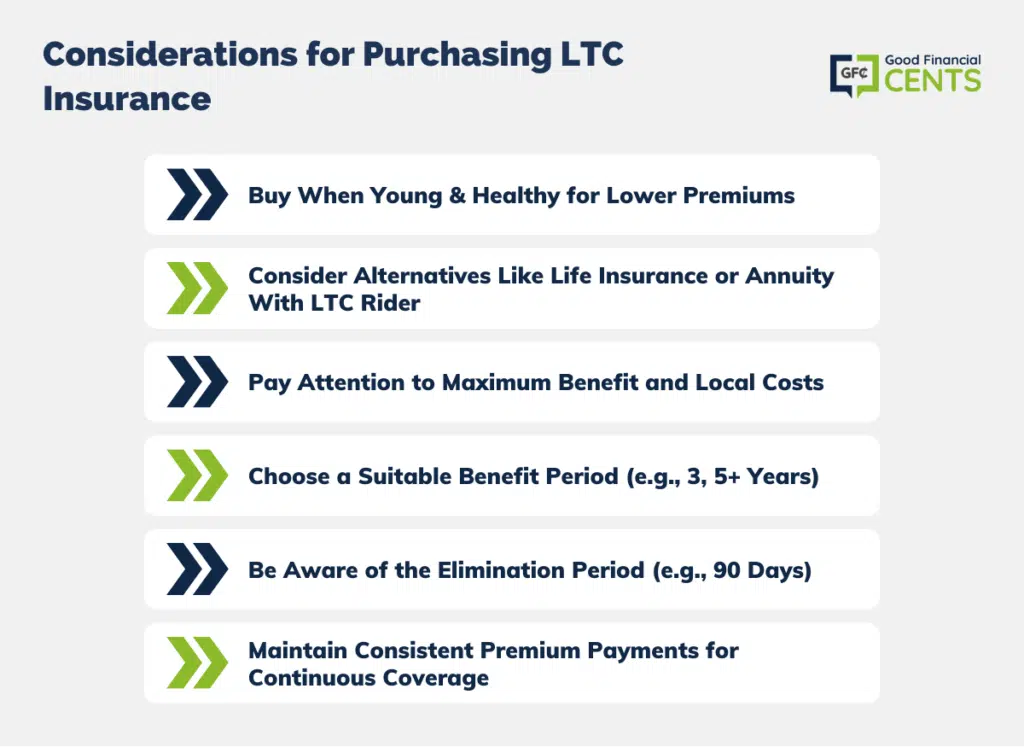

When purchasing a policy, be aware of the following:

- Like life insurance, it’s best to purchase LTC insurance when you’re young and healthy. That’s when the premiums are lowest.

- Consider purchasing a long-term care insurance alternative, like a life insurance policy or an annuity with a long-term care rider (see below). It’s generally much less expensive.

- Pay close attention to the maximum benefit paid, whether daily, monthly, annually, or lifetime. It should approximate nursing home costs in your area. (Be aware that these costs vary greatly from one state to another.)

- Pay close attention to the benefit period. While the typical number of years an individual needs long-term care coverage is three years, there’s no way to tell what you may need. If you can afford the higher premium, it may be best to go with the longer benefit period, say, five years or longer.

- Be aware of the elimination period. The standard is 90 days, but it can be as long as one year. This is not a minor factor, since nursing home care at $8,000 per month could cost you $24,000 with a 90-day waiting period before benefits kick in. The waiting period you choose should match the amount of liquid assets you expect to have available to cover it.

- When you take a policy, be prepared to pay the premium for the rest of your life. If you take a policy at 60, stop making the payments at 80, then you need long-term care at 85, you’ll get no benefits from the lapsed policy.

According to the website Consumer Affairs, long-term care insurance premiums look something like this:

| Age 55 | Age 65 (Preferred Health) | Age 65 (Some Health Issues) | |

| Single Male | $900 | $1,200 | $1,700 |

| Single Female | $1,500 | $1,960 | $2,700 |

| Couple (Combined) | $2,080 | $2,550 | $3,750 |

Now, the table above reflects only sample averages for very specific policies at ages 55 and 65. The actual premium you will pay will be based on a combination of factors, including your age at the time of purchase, any health conditions you have, as well as the dollar amount and term of the benefits your policy will include.

Finally, given how complicated long-term care insurance is, it wouldn’t be overkill to have the policy reviewed by an attorney before accepting it. If so, an attorney who specializes in elder care will be your best choice.

Who Needs Long-Term Care Coverage?

The short answer to this question is everyone. The unfortunate reality is that people turning 65 have an almost 70% chance of needing some type of long-term care services during their lifetimes. Approximately 37% will require institutional care. And statistically, women and single individuals are more likely to require long-term care than men and married individuals.

If you’re unsure if you need long-term care, check out Jeff’s post, Long-term care insurance: Do you really need it?

Though it isn’t well known outside the industry, there are two basic types of long-term care coverage available. The first is a standalone long-term care insurance policy.

Like a life insurance policy, medical underwriting will be performed. The insurance company will consider your age, your health condition, your family health history, your occupation, requested benefit levels, and other factors in approving your application and setting the premium level. This is the more costly of the two options.

The other is a hybrid policy. Most commonly, this is life insurance with long-term care benefits. You’ll purchase a basic life insurance policy, then add a long-term care rider to the policy. This will increase the premium on the life insurance policy, but it will be much less expensive than a standalone long-term care policy.

Meanwhile, you’ll also have a death benefit from the life insurance policy, in addition to long-term care coverage. But the policy may also include using some or all of the death benefits to pay the long-term care benefits. Your beneficiaries will receive only the amount of the unused death benefit upon your death.

Most of the best life insurance companies offer life insurance policies with this rider.

Another variant of this option is to use an annuity with a long-term care rider. Annuities are designed to provide an income stream, very similar to a pension. But similar to a life insurance policy with a long-term care insurance rider, you can also add the rider to an annuity.

Again, it will be less expensive than purchasing a standalone long-term care policy. And the long-term care benefits may reduce any death benefit in your annuity. But the provision will be much less expensive than purchasing a standalone long-term-care policy.

Finding the Right Policy

Long-term care insurance is one of the more complicated insurance types. It also includes more potential variables than other policies. For example, not only will you not know if you will need the coverage at all, but you won’t know when, to what degree, what level of care will be required, or how long it will be needed.

Because of all these variables, the cost of a long-term care insurance policy can be all over the place. But it may be better to pay a little bit more for a more comprehensive policy than to price-shop for the least expensive plan.

Before deciding to purchase a long-term care insurance policy, first review Jeff’s Podcast episode: Long Term Care Insurance – How Much Do You Need? Given how complicated long-term care insurance is, it’s best to go in with as much knowledge as possible.

How We Found the Best Long-Term Care Insurance Companies

We used the following criteria to determine the best long-term care insurance companies of 2024:

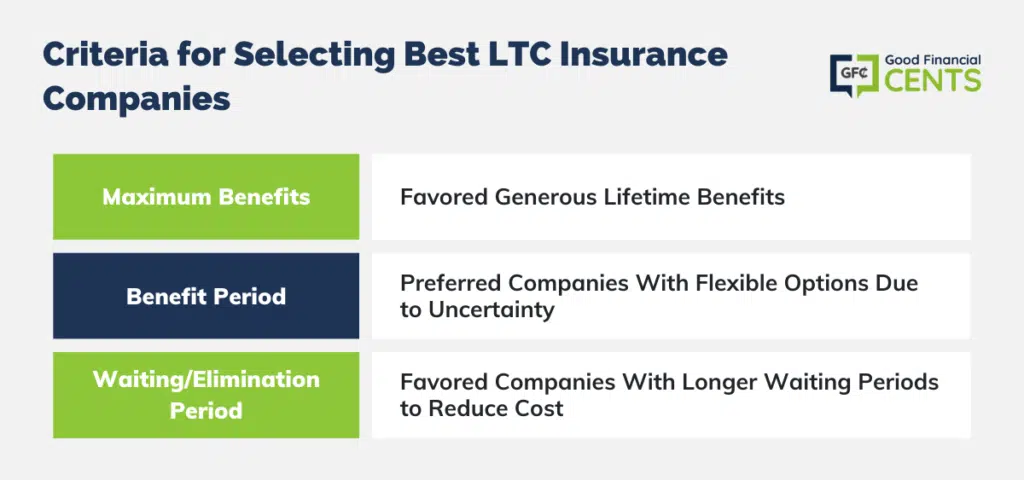

- Maximum Benefits: Given that the cost of long-term care can easily run into hundreds of thousands of dollars, we favored companies with the most generous lifetime benefits.

- Benefit Period: One of the most basic problems with long-term care is uncertainty. There’s no way to know in advance what level of care you might need or how long it might be necessary. For that reason, we favor the companies that provide the most flexibility in this area.

- Waiting/Elimination Period: Just as most insurance policies have deductibles, long-term care insurance uses the waiting period in much the same way. The standard delay on benefits is 90 days. But we prefer companies that offer longer waiting periods since this will represent an opportunity to lower the cost.

Speaking of cost, as much as we would like to provide a list of average costs per provider, this information simply is not available. That’s because long-term care insurance is highly customized. There’s nothing approximating a “one-size-fits-all” policy, as each policy premium is determined by a multitude of factors.

These include your age at the time you purchase the policy, your general health condition, your family health history, the length and amount of coverage you need, and many other factors. The only way to get a reliable premium figure will be to contact one of the companies listed above and get a quote.

Summary of the Best Long-Term Care Insurance Companies

Let’s wrap up this guide by giving you one more look at our list of the seven best long-term care insurance companies of 2024:

- GoldenCare: Best All-Around

- LTC Resource Centers: Best for Asset-Based Long-Term Care

- Mutual of Omaha: Best for Unlimited Lifetime Benefit

- New York Life: Best for Low-Cost Premiums

- Nationwide: Best for High Lifetime Maximum Benefit

- Brighthouse Financial: Best for Hybrid LTC Policy

- CLTC Insurance Services: Best Long-Term Care Insurance Aggregator

Long-term care insurance isn’t inexpensive. But given the unusually high likelihood that it will be needed at some point in your life, it’s a policy worth having if you can afford it. And if you can’t, consider taking an annuity or a whole life insurance policy with a long-term care provision.