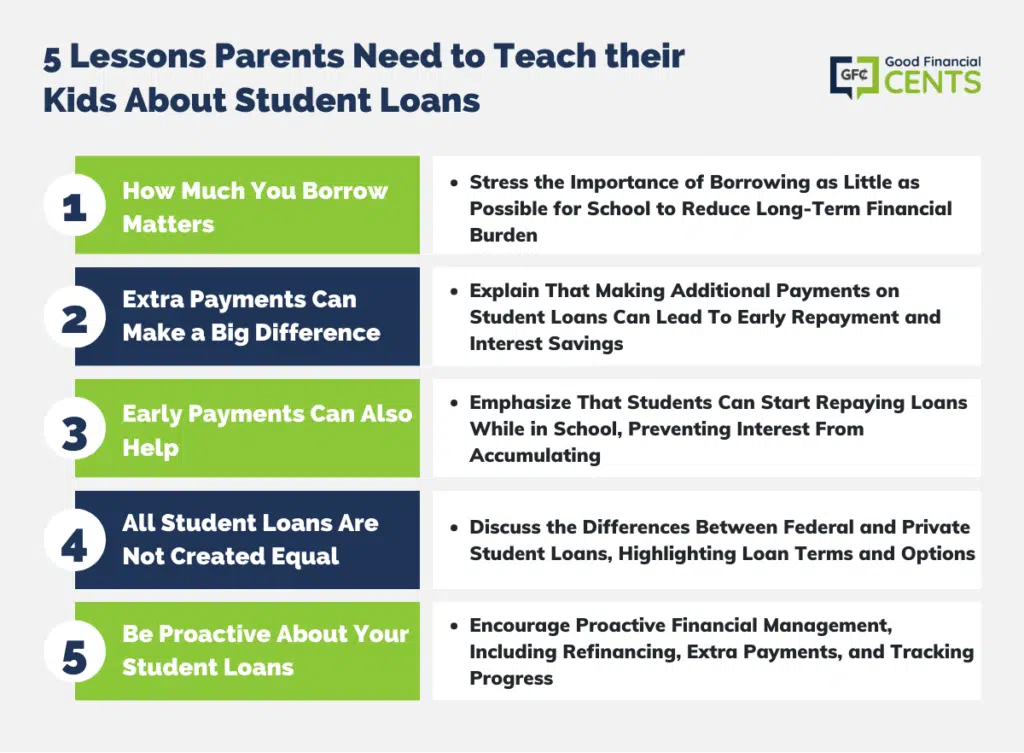

Student loan debt has become a serious problem nationwide, yet there aren’t any obvious solutions to this issue. The reality is that most of us are on our own when it comes to figuring out how to use student loans to our advantage. While you can borrow in a way that harms your finances, student loans are still a valuable tool that can help families afford to invest in a college education.

But, parents have a real job ahead of them if they want to help their kids borrow in a responsible, reasonable way. If you have kids approaching college age and you want to make sure they understand how student loans can work in their favor, here are the main lessons you need to share:

Table of Contents

How Much You Borrow Matters

Too many young people believe that the amount they borrow for school won’t matter because they’ll have a job to pay it back later. This is the same reason young people go out and rack up credit card debt or finance new cars. They believe that, if they can earn more money, later on, all their financial problems will disappear.

However, how much you borrow for school does matter, and students should strive to borrow as little as they can. After all, how much money you borrow for school has a direct impact on the monthly payment amount you’ll have to fork over for the next 10+ years, as well as how much interest you’ll pay over the long run.

Extra Payments Can Make a Big Difference

Just like when you’re paying off a mortgage or an auto loan, paying more than the minimum amount you owe can make a huge impact. Parents should teach their kids that making extra payments on their student loans can help them pay them off early and also save them money. With student loans, however, borrowers need to contact their loan servicer to make sure their extra payments go toward the principal of their loan balance and not toward future payments.

How much difference can extra payments make? Let’s say you owe $40,000 in student loan balances with an APR of 6%. If you plug those numbers into a student loan calculator, you would see that the monthly payments on this balance would work out to $457.40 per month on a 10-year repayment plan. If you made the minimum payments, your total loan cost would work out to $54,888.54 over 10 years.

But, here’s where extra payments come into play. If you paid an extra $50 per month, you would knock 15 months off the repayment timeline and save $1,740.82 in interest. If you paid an extra $100 per month, on the other hand, you would pay your loans off 26 months sooner and save $3,055.51 in interest payments.

Early Payments Can Also Help

Students should also know they don’t have to wait until they graduate to begin repaying their student loans. You have the option to make payments while you’re still in school and doing so can help you save money and get out of debt faster.

Early payments can be especially important for unsubsidized federal student loans since they accrue interest that is capitalized while you’re still in school. If your college student can make payments while they’re in school, they can help keep accruing interest at bay, which will help prevent their loan balance from ballooning by the time they graduate.

All Student Loans Are Not Created Equal

Borrowers should also know that not all student loans are created equal and that it’s important to understand loan terms and underlying costs. Federal student loans tend to be a good deal for borrowers since they come with competitive fixed interest rates and protections like deferment and forbearance. Federal student loans can also be moved to income-driven repayment plans like Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR), which let borrowers pay a percentage of their discretionary income for 20 to 25 years before having their remaining loan balances forgiven.

With that being said, it’s also possible to apply for private student loans, which can come with lower rates and better loan terms than federal student loans. With private undergraduate student loans from College Ave, for example, variable rates and fixed rates start at 4.74%. You can also repay your new loan over 5 to 20 years, which can help you choose a monthly payment that works for your needs. With that kind of flexibility, private student loans tend to be a good option for people with good credit and strong incomes who want to pay off their student loans on their own terms. Private student loans are also a good option when federal loans don’t provide enough funding to get you through school.

Either way, parents and students should take the time to learn all about the student loan options on the market today. With some time spent on research, families will be in the best position to make an informed decision.

Be Proactive About Your Student Loans

Finally, parents should let their kids know that it pays to be proactive when it comes to their student loans and their finances at large. Being proactive can include steps like refinancing student loans to get a better deal, using a student loan calculator to figure out how much you could save with extra payments, or even tracking your student loan progress to make sure you’re reaching your potential.

When it comes to money, the best step for young adults is taking the reins on their finances and not waiting around to see how it all works out. Refinancing student loans and making extra payments each month can make a dramatic difference in a young adult’s future finances, but they have to be proactive instead of waiting for someone to plan these moves for them.

The Bottom Line

At the end of the day, financial education starts at home, and the lessons we teach our kids have the potential to impact them for decades to come. Student loans can be a huge blessing when it comes to affording a college education, but they can be a curse if you irresponsibly use them. As parents, it’s our job and our responsibility to teach our kids the difference.