A $50,000 annual salary is around $24 per hour based on a standard 40-hour work week. Of course, this is only an estimate as many people work over 40 hours per week or are self-employed with variable income that may total $50,000 per year.

In this article, I’ll let you know how much money you can expect to take home (after taxes) if you earn $50,000 annually, depending on where you live in the US. This can help you determine if $50,000 will be enough for you to live on.

Table of Contents

- $50,000 a Year Is How Much an Hour?

- Is $50k a Year Considered a Good Salary?

- Is $50,000 Annually a Good Return for Your Time?

- What Will Your Paycheck Be at $50K a Year?

- The Impact of Vacation Time on Your Annual Salary

- How to Make More While Working Less

- $50,000 a Year Is How Much After Taxes?

- State-By-State After-Tax Income If You Earn $50,000 a Year in 2024

- Factors That Affect Your Take-Home Pay

- What Types of Jobs Pay $50,000 Per Year?

- How to Live on $50,000 a Year

- Sample Monthly Budget for Those Earning $50,000 a Year

- Final Thoughts on a $50,000-a-Year Salary

$50,000 a Year Is How Much an Hour?

Converting $50,000 to an hourly wage requires a couple of simple calculations and depends on how many hours you work per year. Someone who makes $50k but only works 20 hours per week will have a much higher hourly rate than someone who works 40 hours per week for the same $50k.

Here’s a breakdown of the calculation for different work scenarios:

Scenario 1: Full-Time Workweek of 40 Hours a Week, 52 Weeks a Year

Step 1. 40 hours/week x 52 weeks/year = 2,080 Total hours worked in a year

Step 2. $50,000 ÷ 2,080 hours/year = $24.04/hour

Scenario 2: Part-Time Workweek of 20 Hours a Week, 52 Weeks a Year

Step 1. 20 hours/week x 52 weeks/year = 1,040 Total hours worked in a year

Step 2. $50,000 ÷ 1,040 hours/year = $48.08/hour

As you can see, the annual income remains constant at $50,000, but the hourly wage can vary greatly based on the number of hours worked.

The takeaway is that the fewer hours you can work to earn more income, the better. By being efficient and productive, you may be able to accomplish your job quicker and earn more, maximizing your income and time. Ask yourself how you can work smarter and not harder. It could be the difference between earning $24.04 an hour and $48.08 an hour (or somewhere between).

Is $50k a Year Considered a Good Salary?

The better question is whether $50,000 will be enough to support your desired lifestyle. And that depends on your budget and where you live.

A $50,000 annual salary is above the U.S. national average salary of $48,672 but below the median household income of $68,703.

Remember that even if you currently earn $50k per year, you may be able to increase your earnings by taking on more responsibility within your company.

Is $24.04 a Good Hourly Rate?

It depends on several factors, like the cost of living in your area and what other people are earning who perform the same job that you do. However, in many parts of the US, $24.04 per hour is a viable hourly wage for an individual to live on.

The federal poverty level for a single person without dependents was $13,590, or $6.53/hour at 40 hours per week. If you have dependents, the poverty level increases accordingly. For instance, a family of four in 2022 had a poverty level of $27,750.

Technically, you are above the poverty level if you earn $24.04 per hour. However, this hourly rate is not considered high, so careful budgeting will be necessary to meet ends. With sound financial management, getting by on this income is possible, but saving for future financial goals may be difficult.

Is $50,000 Annually a Good Return for Your Time?

Time is money, so value your time appropriately.

There’s more to a job than whether you can pay the bills. How much is your time worth to you?

As mentioned, someone working 40 hours a week will spend over 2000 hours a year at work. But what if you can find a way to earn the same annual income while working fewer hours? Your hourly rate will increase, and you’ll have more free time outside work.

In addition to how much a job pays, you should consider the type of work and your quality of life. Time is money, so value your time appropriately.

What Will Your Paycheck Be at $50K a Year?

To determine your bi-weekly paycheck (before deductions) if you earn $50,000 a year, divide your annual salary by the number of bi-weekly pay periods.

Assuming a full-time role with a standard 40-hour workweek, your gross bi-weekly pay would be approximately $1,923.08 ($50,000 divided by 26 bi-weekly pay periods).

It’s important to keep in mind that this does not account for the following:

- Federal, state, and local income taxes

- Pre-tax contributions to retirement accounts

- FICA taxes (Social Security and Medicare)

- Any other regular paycheck deductions.

Monthly Paychecks

A monthly paycheck would be $4,166.67 ($50,000 divided by 12 months) if you make $50,000 a year. Again, this does not account for any taxes or deductions that would be taken out of your paycheck.

The Impact of Vacation Time on Your Annual Salary

Taking a break from work can feel rejuvenating, but did you know it can also impact your salary? Let’s break it down.

Paid Vacation Time

If you are fortunate enough to receive a paid vacation as part of your employment, you won’t see any reduction in your salary. Your annual income remains unchanged, regardless of how many vacation days you take within your annual entitlement.

Unpaid Vacation Time

On the other hand, if you take time off without pay, your salary will be affected. For instance, let’s say you earn $50,000 a year and decide to take two weeks of unpaid vacation. That’s equivalent to one bi-weekly pay cycle, resulting in a $1,923.07 reduction in your annual income.

It’s essential to note that these are rough estimates and that your salary will depend on several factors, including:

- Skills and experience

- Qualifications

- Number of hours worked

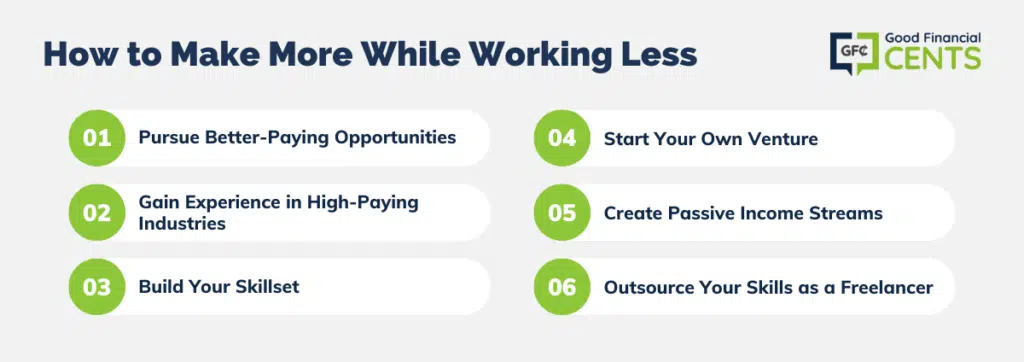

How to Make More While Working Less

Balancing work and life is a key aspect of being successful and happy. However, this doesn’t mean sacrificing income. Here are some strategies to help you increase your yearly salary while reducing your workload.

Pursue Better-Paying Opportunities

One of the easiest ways to increase your salary is by finding a better-paying job. Here are some methods to make it happen:

Career Change: If your current job doesn’t align with your earning potential, it may be time to explore other options. Consider careers in industries that pay more or have a higher growth rate.

Ask for a Raise: If you’re happy with your current role, don’t hesitate to request a raise. Compile a list of accomplishments, demonstrate how you’ve positively impacted the company, and make a strong case for why you deserve higher pay.

Salary Negotiation: Don’t settle for the first salary offer when you start a new job. Be confident and negotiate for a higher salary. This small step can make a big difference in your overall earnings.

Gain Experience in High-Paying Industries

Another way to boost your income is by accumulating experience in a high-paying industry. For example, if you work in retail, consider transitioning to a job in finance (including banking and insurance), or technology. These fields often offer higher salaries, allowing you to increase your earnings without working more hours.

Build Your Skillset

Employers are always in search of employees with in-demand skills. If you have a specialized talent, use it to negotiate a higher salary or hourly rate. For example, if you’re a skilled web developer, you can command a higher rate for your services.

Start Your Own Venture

If you’re an entrepreneur at heart, starting your own business or side hustle may be the perfect path for you. You can earn significantly more money than you would working for someone else while gaining more control over your schedule.

Create Passive Income Streams

Creating digital assets is another way to earn passive income. Consider producing e-books, courses, or software that you can sell online. This provides you with a source of income while you sleep and the potential to continue earning even when you’re not actively working.

Outsource Your Skills as a Freelancer

If you have a skill others require, consider starting a freelance business where you outsource your services. This could include web design, copywriting, or marketing. Most freelance work can be done remotely. All you need is your laptop and an internet connection.

All of these ideas have the potential to increase your income. However, it’s critical to remember that success is not guaranteed. While some might be able to make more money by working fewer hours, people will experience varying levels of success.

$50,000 a Year Is How Much After Taxes?

Your income after taxes will vary depending on the state you live in and your tax circumstances. To give you an idea, let’s look at an example of someone making $50,000 a year and residing in a state with no state income tax, such as Texas.

Assuming this person claims only the standard deduction as a single filer, here’s a breakdown of their pre-tax and after-tax earnings:

- $50,000: Annual Pre-Tax Income

- $4,315: Federal Income Taxes

- $3,825: FICA Taxes (Social Security and Medicare)

- $41,860: Annual Take-Home Income

Breaking it down further, if this person is paid bi-weekly, they’ll receive $1,610 per paycheck after taxes. If they’re paid monthly, they’ll receive $3,488.33 per paycheck.

Note: These figures are just an example, and the actual amount you take home may differ based on your circumstances.

State-By-State After-Tax Income If You Earn $50,000 a Year in 2024

Your net income will vary depending on where you live. Here’s a breakdown of your annual take-home pay on a $50,000 salary in every state.

| STATE | AFTER-TAX INCOME ($50,000 SALARY) |

|---|---|

| Florida | $41,935 |

| Nevada | $41,935 |

| New Hampshire | $41,935 |

| South Dakota | $41,935 |

| Tennessee | $41,935 |

| Texas | $41,935 |

| Wyoming | $41,935 |

| Washington | $41,715 |

| Alaska | $41,681 |

| North Dakota | $41,440 |

| New Jersey | $40,725 |

| Ohio | $40,683 |

| Arizona | $40,585 |

| Louisiana | $40,391 |

| Pennsylvania | $40,370 |

| Indiana | $40,320 |

| Arkansas | $40,223 |

| Vermont | $40,219 |

| Missouri | $40,156 |

| New Mexico | $40,073 |

| North Carolina | $40,039 |

| Oklahoma | $40,050 |

| Idaho | $39,944 |

| Alabama | $39,887 |

| Colorado | $39,842 |

| Mississippi | $39,850 |

| Iowa | $39,827 |

| Michigan | $39,810 |

| Virginia | $39,777 |

| West Virginia | $39,760 |

| California | $39,758 |

| Kansas | $39,742 |

| Wisconsin | $39,742 |

| Delaware | $39,726 |

| Maryland | $39,674 |

| Kentucky | $39,573 |

| Nebraska | $39,571 |

| Georgia | $39,543 |

| Rhode Island | $39,510 |

| Utah | $39,510 |

| Illinois | $39,460 |

| Maine | $39,460 |

| New York | $39,369 |

| Massachusetts | $39,363 |

| Montana | $39,357 |

| Minnesota | $39,214 |

| Washington DC | $39,085 |

| South Carolina | $38,935 |

| Oregon | $38,334 |

| Hawaii | $38,313 |

| Connecticut | $38,190 |

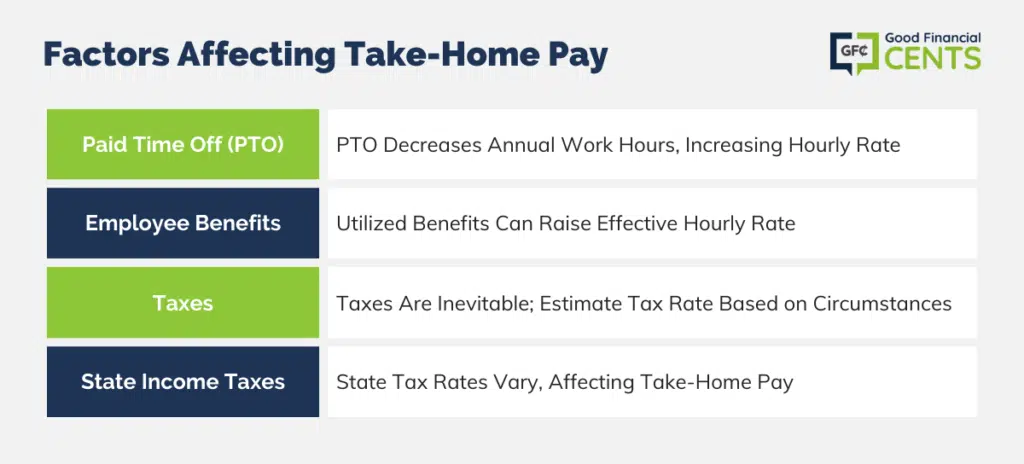

Factors That Affect Your Take-Home Pay

Gross pay is not necessarily equivalent to the amount deposited in your bank account. Your take-home pay is the amount you receive after deductions for taxes, insurance, and other expenses. It’s essential to understand what affects your take-home pay so that you can make informed financial decisions.

Paid Time Off (PTO)

Paid time off, such as vacations or sick leave, can impact your take-home pay. If you receive three weeks of paid time off, your annual work hours will decrease from 2,080 to 1,960, increasing your hourly rate.

Employee Benefits

Employee benefits such as insurance and tuition assistance can significantly impact your take-home pay. It’s essential to consider only those benefits you plan to use, as they can increase your effective hourly rate.

Taxes

You can’t get out of paying taxes, but it is a huge expense. You can estimate your tax rate using last year’s information unless you expect a significant pay increase or a life-changing event, like having a baby.

It’s essential to consider your state income taxes when estimating your take-home pay. States like California and New York can significantly increase your tax obligation, while states like Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming have no state income tax.

What Types of Jobs Pay $50,000 Per Year?

According to the Bureau of Labor Statistics’ Occupational Outlook Handbook, the following professions offer median wages in the $50,000 range ($40k-$60k) without mandating high levels of education or having stringent admission requirements. Many of these positions offer job-based training and are open to those with no prior experience.

- Athletic Trainers

- Carpenters

- Chefs and Head Cooks

- Credit Counsellors

- Drywall Installers

- Firefighters

- Graphic Designer

- Locksmiths

- Machinists

- Massage Therapists

- Paramedics

- Roofers

- Sheet Metal Workers

- Surgical Technologists

- Teachers

- Tax Preparers

- Travel Agents

- Welders

With the abundance of professions offering a yearly compensation of $50,000 or more, there’s a good chance you can find an occupation that matches your skills or interests. If you pursue certain high-level technology degrees, your wage potential could increase further.

How to Live on $50,000 a Year

If earning $50,000 annually, you can live a fulfilling life by effectively managing your finances. Here are some tips to help you manage your money wisely:

Create a Budget

The first step is creating a budget. Determine the money you need for essential expenses such as housing, food, transportation, and healthcare. This will show you how much you have left for other expenditures.

Track Your Spending

Keeping an eye on your spending habits is crucial to sticking to your budget. You can choose from various methods to track your spending, including using a budgeting app or monitoring it manually.

Cut Unnecessary Expenses

Once you understand where your money is being spent, you can start cutting down on unnecessary expenses. For instance, you can save money by dining out less frequently or reducing your cable bill.

Save Money

Saving money is equally important as it provides a safety net in emergencies. I advise you to save at least 10% of your annual income, more if you are able to. If you don’t have a dedicated savings account, here is a list of the best high-interest savings accounts currently available.

Sample Monthly Budget for Those Earning $50,000 a Year

Here’s a sample budget for an individual or family living on $50,000 annually. Your expenses will differ from the illustration below, but it gives you a general idea of a typical budget.

| EXPENSE | BUDGET AMOUNT | PERCENTAGE OF INCOME |

|---|---|---|

| Housing | $875 | 25% |

| Transportation | $277 | 8% |

| Food | $555 | 16% |

| Utilities | $173 | 5% |

| Insurance | $138 | 4% |

| Health Care | $104 | 3% |

| Entertainment | $138 | 4% |

| Savings | $696 | 20% |

| Miscellaneous | $277 | 8% |

| Total | $3233 | 93% |

Final Thoughts on a $50,000-a-Year Salary

A $50,000 salary is nothing to scoff at, and with careful budgeting and financial planning, you can make the most of your earnings. You can build a secure financial foundation by paying down debts, creating a budget, and saving for the future. Moreover, with proper investment strategies, you can become a successful investor and reap the rewards of increased earnings. With enough effort, you can even land higher-paying jobs with salaries above the $50,000 mark.

Here’s a video that explains how to budget your money using a $50,000 salary as an example.