Have you ever wondered how much your annual salary would be if you earned 25 dollars an hour? The fact is, too many people who earn an hourly wage don’t know how much they make in a year.

This information is critical if you want to create a budget and manage your money correctly. In this article, I’ll show you how to calculate your annual income by converting a $ 25-an-hour wage to a yearly salary. I’ll also share some budgeting and side hustle tips so you can get the most out of the money you earn.

Table of Contents

- $25 an Hour Is How Much a Year?

- How Does $25 an Hour Compare?

- Paid Time Off for Hourly Employees Earning $25 per Hour

- How Much Is $25 An Hour After Taxes?

- Tips for Budgeting On a $ 25 Per Hour Wage

- Types of Jobs That Pay $25 per Hour Salary

- Side Hustles To Supplement Your $25 Income

- Final Thoughts on $25 an Hour

$25 an Hour Is How Much a Year?

When converting an hourly rate, like $25 per hour, to an annual salary amount, you need to start with the number of hours in your work week. In the example below, we’ll use a standard 40-hour work week.

Sample Calculation

1. An average full-time workweek is 40 hours, and there are 52 weeks in a year.

2. Multiply 40 hours by 52 weeks to get the number of hours worked in a year: 40 x 52=2,080 hours

3. By multiplying the hourly rate of $25 by 2,080 hours, we arrive at the gross annual salary: $25 x 2,080 hours = $52,000/year.

Note:

Part-Time Work

If you make $25 per hour working part-time, the calculation is the same, you just need to adjust the weekly hours. For example:

20 hours x 52 weeks = 1,040 working hours in a year.

$25 x 1,040 hours = $26,000/year

How Does $25 an Hour Compare?

As mentioned, $25 an hour equates to $52000 per year for a full-time worker. But how does that compare to the average income in the U.S.?

$52,000 is relatively lower than the national average income per worker of $53,490 (2023) as well as the median income of $74,738 annually.

Is $25 a Good Hourly Rate?

The answer to this question depends on various factors, such as the cost of living in your area and your desired lifestyle. However, we can compare this hourly rate to the national poverty level.

For a single person, the 2023 federal poverty level for a single person without dependants was $14,580. If your family has dependents, the poverty level increases. For example, the poverty level of a family of four is $30,000. Based on these numbers, we can conclude that earning $25 an hour places you well above the poverty line, especially if you are single.

It is important to note that while $25 is not a high hourly rate, it is still possible to live on this salary with careful budgeting and financial planning. By being mindful of your expenses, you can ensure that your income is enough to cover your needs and allow for a modest lifestyle.

Paid Time Off for Hourly Employees Earning $25 per Hour

Whether or not your employer offers paid time off can significantly impact your annual income. Assuming a 40-hour workweek over the course of a year, let’s explore two scenarios: with paid time off and without paid time off.

Scenario #1: With Paid Vacation

Many hourly employees starting at a new job receive two weeks of paid vacation each year. In this scenario, your annual income would still be $52,000, no change from the annual salary example given above.

Scenario #2: Without Paid Vacation

Sadly, paid vacation is not extended to all hourly employees by their employers, which is why it’s important to plan ahead for a temporary reduction in your income.

If your annual salary is $52,000, but you take two weeks off without pay, you would only work 50 weeks of the year instead of 52. This equates to 2,000 working hours (40 hours x 50 weeks). Your annual income would be reduced to $50,000 (2,000 hours x $25 per hour).

How Much Is $25 An Hour After Taxes?

It’s important to understand the effect income taxes have on your hourly wage. Everyone’s situation is unique, but for this article, we’ll use the following basic assumptions:

- Federal tax rate: 12%

- Social Security and Medicare (FICA) rate: 7.65%

- State tax rate: 4%

Gross Annual salary: $52,000

Based on these assumptions, here’s what your tax deductions would look like:

- Federal Taxes: $6,240

- Social Security and Medicare (FICA): $3,978

- State Taxes: $2,080

Net Annual Salary: $39,702

After accounting for taxes and deductions, your take-home pay would be approximately $39,702, which is less than $40,000 per year.

Remember that these calculations are just estimates, and your actual tax rate and deductions may differ.

Note: Some states in the US don’t apply state taxes to salaried income. In that case, you will only have to pay federal tax and FICA.

The following eight U.S. states don’t charge state tax:

1. Alaska

2. Florida

3. Tennessee

4. Nevada

5. South Dakota

6. Texas

7. Washington

8. Wyoming

Note: New Hampshire taxes interest and dividend income but does not tax salaried income.

Tax Deductions on $52,000 Gross Annual Income

| TYPE OF TAX/DEDUCTION | RATE | DEDUCTION AMOUNT |

|---|---|---|

| Federal Taxes | 12% | $6,240 |

| Social Security and Medicare (FICA) | 7.65% | $3,978 |

| State Taxes (Example rate) | 4% | $2,080 |

| Net Annual Salary | $39,702 |

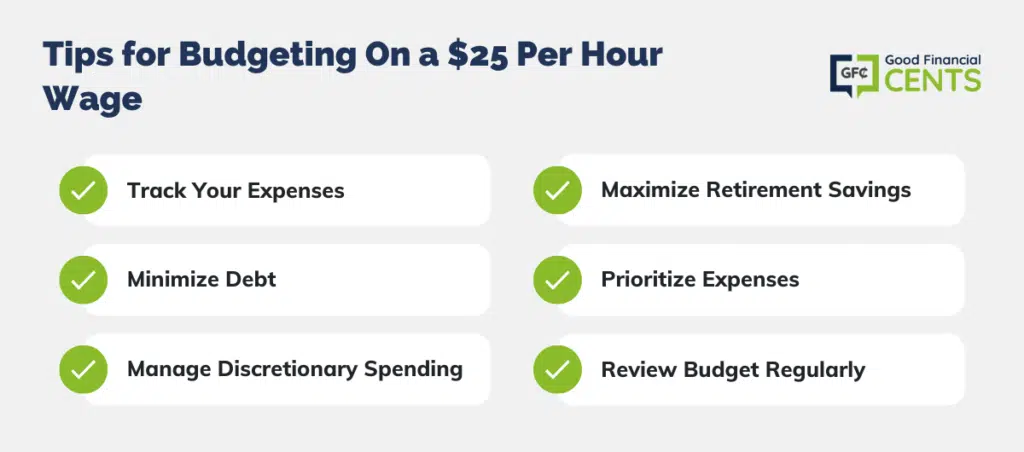

Tips for Budgeting On a $ 25 Per Hour Wage

By creating and sticking to a budget, you can make your $25 per hour income go much further. In your budget, you should plan to set aside money to cover future expenses, such as a vacation, a house downpayment, retirement, etc. You should also create an emergency fund to cover those unexpected costs that are bound to arise.

Taking the time to manage your finances properly will set you up for long-term success.

Taking the time to manage your finances properly will set you up for success in the long term. Here are some practical steps you can take:

Track Your Expenses

Take a look at your bank statement to figure out where you’re spending your money each month. Fixed expenses include items such as rent, mortgage, car payments, and loan installments. On the other hand, variable expenses like groceries, gas, and credit card bills can change from month to month.

Minimize Debt

Part of your budget should be allocated to paying down debt if you have any. I recommend paying off high-interest debt, like credit card balances, first. You can also try negotiating a lower interest rate on your loans with your lender.

Managing Discretionary Spending

Discretionary spending refers to spending on non-essential items, like entertainment or hobbies. It’s recommended to keep discretionary spending to 5-10% of your net income. Prioritize paying your bills and transferring funds to savings, then assess how much you have left to spend on discretionary items.

Maximize Your Retirement Savings

Consider enrolling in an employer-sponsored retirement plan like a 401k, where you can have pre-tax income deductions made each pay period automatically. This will help you stay on top of your retirement planning and ensure that you are taking full advantage of any employer match options.

Prioritize Expenses

Prioritize your expenses and pay the most important bills first. Rent or mortgage, utilities, and food should be at the top of the list, followed by other necessities like transportation, insurance, and medical expenses.

Review Your Budget Regularly

Your expenses and income will change over time, so you should review your budget regularly. Make changes as necessary to ensure that your budget remains in line with your current financial situation.

Here’s a sample budget based on a $25 per-hour wage:

| EXPENSE | BUDGET AMOUNT | PERCENTAGE OF INCOME |

|---|---|---|

| Housing | $825 | 25% |

| Transportation | $265 | 8% |

| Food | $529 | 16% |

| Utilities | $165 | 5% |

| Insurance | $131 | 4% |

| Health Care | $99 | 3% |

| Entertainment | $131 | 4% |

| Savings | $663 | 20% |

| Miscellaneous | $265 | 8% |

| Total | $3073 | 93% |

Types of Jobs That Pay $25 per Hour Salary

Job search websites can be a good resource for someone looking for a job that pays $25 an hour. Here are some jobs that fall in and around this salary range:

- Data Entry Clerks

- Bank Tellers

- Customer Service Managers

- Administrative Assistants

- Entry-Level Marketing Jobs

- Food Services jobs

- Virtual Assistant

- Maintenance Workers

- Security Guard

- Event Planners

- Medical Equipment technician

- Surgical Technologists

- Athletic Trainers

- Freight Broker

- Managers

- Movers

- Class A Truck Driver

- Warehouse Workers

These professions offer a potential salary of $25 per hour or more. With hard work and dedication, it is possible to reach this goal.

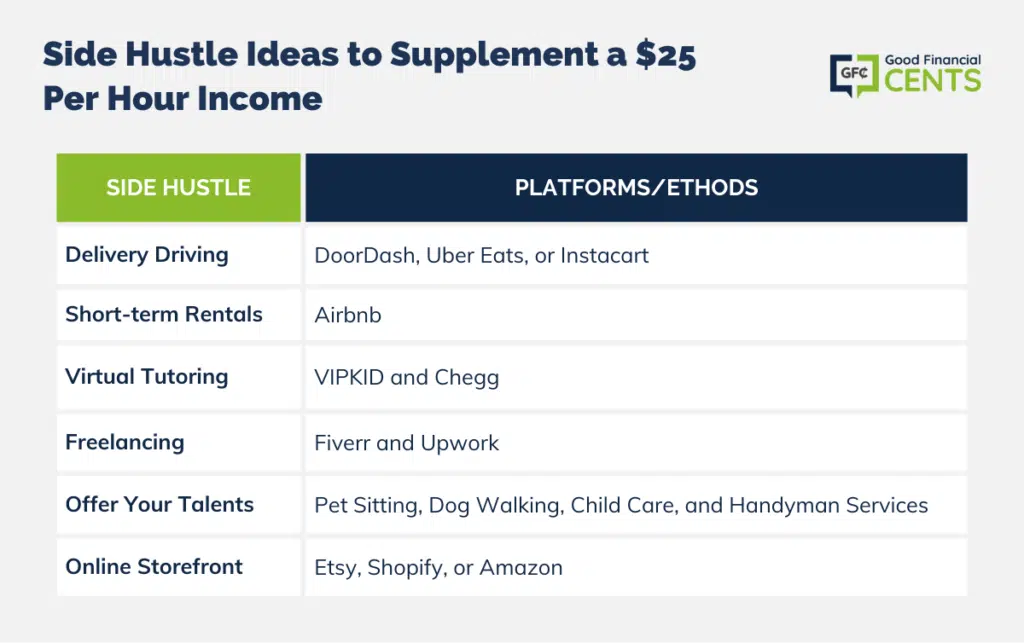

Side Hustles To Supplement Your $25 Income

If you’re making $25 an hour but want to increase your income, a side hustle might be just what you need. Here are a few side hustle ideas that will allow you to earn extra cash in your free time. You never know; you may even be able to earn some passive income.

Delivery Driving

In your free time, consider becoming a delivery driver with companies such as DoorDash, Uber Eats, or Instacart. You can earn more money by working during peak hours, like the dinner rush, and pick and choose the delivery jobs that best suit you.

Short-term Rentals

If you have an extra room with a private entrance, consider listing it on short-term rental platforms like Airbnb. Present the room well, market it effectively, and keep it clean to attract guests and make more money.

Virtual Tutoring

Do you have a degree in a specialized subject? Become an online tutor to students from all around the world and make $25 per hour or more. Top online tutoring websites include VIPKID and Chegg.

Freelancing

Whether you’re skilled in photography, writing, or graphic design, freelance work offers a wide range of opportunities. Get started by offering your services on freelance marketplaces like Fiverr and Upwork. Businesses hire freelancers all of the time to build websites, write blog posts, or provide virtual assistant services.

Offer Your Talents

Put your skills to use and help others in your local community. If you’re good at cleaning, and organizing, have a green thumb, or have other talents, consider providing services such as pet sitting, dog walking, child care, and handyman services.

Online Storefront

Starting an online store doesn’t require specialized talent. You can sell products from print-on-demand businesses, with no capital investment required, using platforms such as Etsy, Shopify, and Amazon.

Final Thoughts on $25 an Hour

Living on a $25/hour salary is possible if you budget carefully, make smart financial decisions, and use the resources available to increase your income. Consider a side hustle or two to supplement your primary job so that you can reach financial stability faster.