What are a few financial goals you’re aspiring to reach?

Perhaps you want to pay off debt, save $2 million for retirement, or give more than you ever thought possible.

One of the best ways to get where you want to go in life is to look at the lives of those who have arrived.

How did they accomplish these goals? What made the difference for them? Are these things you can do, too?

Sometimes, it’s easy to put limitations on ourselves. We think that because of this or that circumstance, we’ll never reach our goals. Why think like that? Is that helpful? Of course not.

Table of Contents

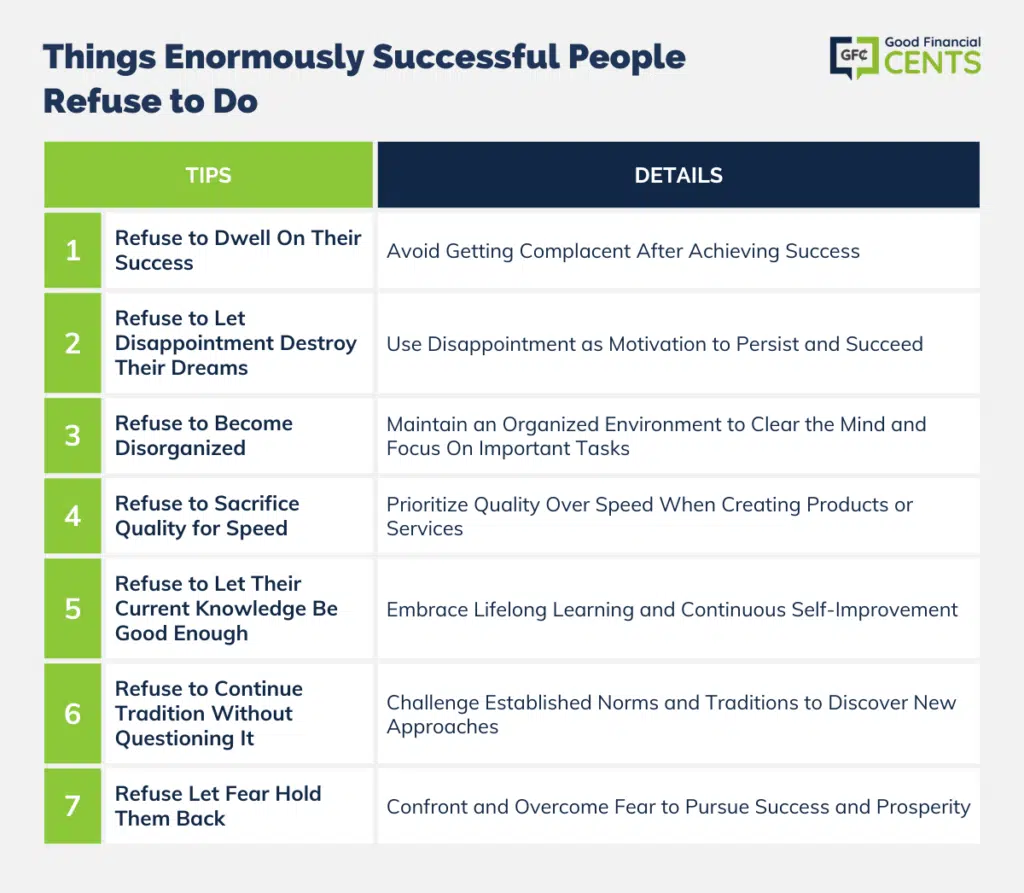

- 1. They Refuse to Dwell on Their Success

- 2. They Refuse to Let Disappointment Destroy Their Dreams

- 3. They Refuse to Become Disorganized

- 4. They Refuse to Sacrifice Quality for Speed

- 5. They Refuse to Let Their Current Knowledge Be Good Enough

- 6. They Refuse to Continue Tradition Without Questioning It

- 7. They Refuse Let Fear Hold Them Back

The truth is, that ordinary people, can do extraordinary things. But it’s not just what they choose to do that matters, it’s what they refuse to do that matters as well.

Let’s take a look at some things enormously successful people refuse to do.

1. They Refuse to Dwell on Their Success

Imagine you’ve done something and seen some success. Maybe you started a business and are making decent money. Perhaps you built something nobody has ever built before. You might have even landed your dream job.

It can be tempting to dwell on success to the point that innovation comes to a screeching halt. After all, you’ve made it, right? Well, not quite yet. If your goal is to be enormously successful with your finances, it’s best to take this advice from Steve Jobs:

I think if you do something and it turns out pretty good, then you should go do something else wonderful, not dwell on it for too long. Just figure out what’s next.

The founder of Apple certainly lived up to his advice. He also built an incredible team at Apple that was motivated to work on something new all the time – motivated to innovate and not settle for even the great success they discovered.

2. They Refuse to Let Disappointment Destroy Their Dreams

When you are disappointed, do you feel like giving up? Probably. Should you feel that way? No way!

Let disappointment encourage you to try harder to become successful.

Jerry Seinfeld has been said to have been booed off stage the first time he walked out in front of an audience at a comedy club. Imagine that! This is Jerry Seinfeld, someone who today is enormously successful because he refused to give up. Amazing.

What are your dreams? What would you love to do in your life? Chances are, you can think of a couple of disappointing circumstances that might discourage you from reaching your goals – but why let them weigh you down?

3. They Refuse to Become Disorganized

Look around at your office right now. Is it organized? Is it nice and tidy, or is it a mess?

Organizing your office space – and your home – can help clear your mind and allow you to focus on reaching your ultimate goals.

Think about it. When you sit down to write a masterpiece, are you distracted by clutter? The truth is, when you have a pile of papers on your desk or your email inbox is a mess, it’s difficult to focus on the things that matter most.

You might be wondering why it’s difficult to focus when you’re surrounded by clutter. Good question.

In other words, you need mental space to think.

David Allen, author of Getting Things Done, often talks about the importance of capturing everything on your desk and in your mind that needs attention and organizing it. Many successful entrepreneurs have followed this advice and found success. You probably would too.

4. They Refuse to Sacrifice Quality for Speed

Apple, here, is another good example. They were not the first to come out with a smartphone. Remember BlackBerry smartphones?

You see, Apple could have seen other companies in the smartphone market and felt in a rush to create something for their customers. They could have whipped something together in a flash. Did they? Oh no.

Instead, Apple took quite a long time to craft their smartphone. They wanted something that was easy to use and fun. They wanted something that would enjoy using. Then, they made it: iPhone.

Yes, in order to be financially successful as a businessperson, you eventually have to put your product or service out into the world, but you should never do so because you feel pressure. Instead, take the time necessary to make something great. Make something that sells itself. You’ll be really glad you did.

5. They Refuse to Let Their Current Knowledge Be Good Enough

You have access to knowledge at your fingertips. Why not use it?

One common trait you’ll find in those who are enormously successful is that they want to learn everything they can about their business and beyond. They are lifelong learners and thinkers. They believe that they can do incredible things with their minds.

Tim Ferriss is one of those amazing entrepreneurs who has a passion for learning. In fact, Tim not only believes in learning, but he also practices accelerated learning. He has been able to learn how to dance, cook, and so much more. He has even written on how to learn (but not master) any language in one hour. Crazy amazing.

Tim took his love for learning and created a business teaching others how to do the same thing. He refused to let his current knowledge be good enough and pushed himself to the max. Why not try something similar?

6. They Refuse to Continue Tradition Without Questioning It

Have you heard of John Legere? He’s the CEO of T-Mobile USA.

Under his leadership, he has truly shaken up the cellular service industry with new plans and unique offerings. T-Mobile no longer has two-year contracts and abolished overage fees. Amazing.

Still, other carriers have good offerings, but T-Mobile has truly questioned the traditions of carriers and given customers something different to consider.

What can be learned here? If your business is struggling, why not question the traditions and processes that have been put in place and see if you can discover something new? It doesn’t hurt to try, and it might just make you enormously successful.

7. They Refuse Let Fear Hold Them Back

Fear. It’s what can hold you back from a successful, prosperous life.

There are so many things to be afraid of, folks. I don’t need to remind you of them. But you know what? It’s unlikely that most of your worries and concerns will ever happen. Don’t be afraid.

One way to get past fear is to write down your fears on a piece of paper, put it in an envelope, and write on the front: “Do not open until [year from now].” Then, put it somewhere safe where you’ll remember to take a look.

Then, for the next year, attack your fears. Do those good things you ought to do. Strive for success. When the year is over, open the letter and see if any of your fears come true. You’ll probably be surprised to find that not many of them did come true – if any of them at all!

Remember: It’s not just what you do that matters, it’s what you refuse to do that matters as well. Learn from those who are successful. Take them out for lunch. Read their material. Develop some grit. You’ll be better off for it.

This post originally appeared on Daily Finance.

Those that are successful are always pushing the limit. They are busy being thinkers, tinkerers & early adopters. They have a foresight many don’t have and are willing to take some risk to realize their dream. Once they realize success, they aren’t complacent, they want to keep climbing the ladder of success.

For those that are looking to reach some financial goal, always remember it is attainable! You first need to make clear of the financial goal you want to achieve and start considering ways and forging paths to achieve your financial goal. You may not be looking to reach the level of Steve Jobs’ financial success, but setting a reasonable financial goal will help you along the path to success.

Excellent advice Robert, thanks!