Do you have friends, family, business associates or even clients who are financially toxic people?

You know, those people who seem to live in – or on the edge of – financial disaster, but do it so effortless that it almost seems normal?

While you may think that your association with them is harmless, it isn’t.

Surround yourself with enough financially toxic people, or have one or two of them really close to you, and you may find your own financial situation being sabotaged.

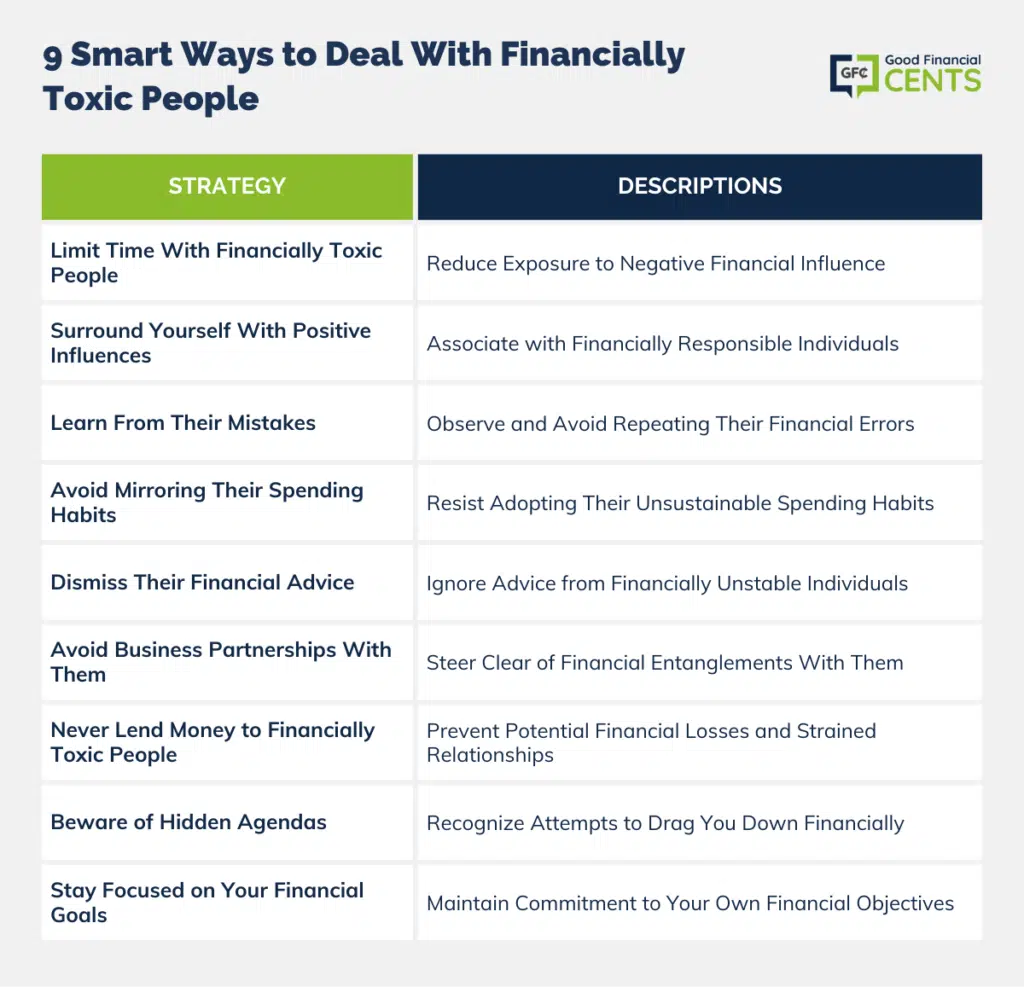

Since it’s not always possible to completely eliminate financially toxic people from your life, here are 9 smart ways to deal with them that will lower their impact on your life.

Table of Contents

- 1. Keep Your Time With Financially Toxic People to a Minimum

- 2. Keep the Number of Toxic People in Your Life to a Minimum

- 3. Use Them as an Object Lesson in What NOT to Do in Your Own Life

- 4. Don’t Try to Keep Up With Their Spending Habits

- 5. Ignore Their Financial Advice

- 6. Don’t Do Business With Them!

- 7. And NEVER Lend Them Money

- 8. Recognize That They May Have a Hidden Agenda

- 9. Stay Focused on Your Own Agenda

- The Bottom Line – 9 Smart Ways to Deal with Financially Toxic People

1. Keep Your Time With Financially Toxic People to a Minimum

Because financially toxic people are often important in our lives, it’s impractical to completely end your association with them. But you can keep the time you spend with them to a minimum.

Bad habits, negative behaviors, and destructive psychological vibes are usually transferred from one person to another in a gradual, almost imperceptible way.

It happens most effectively when you spend a lot of time with toxic people. The negative or self-destructive way that they talk about money, the freewheeling way that they spend it, and a complete disregard for saving and investing it, can negatively affect your own attitude toward money.

A good example is when you’re at a time in your life when you are either trying to get out of debt, or save money for an important goal. If you spend too much time with people who spend money freely, you’ll lose your focus. You’re being pulled away from your goal, while the toxic person is just doing what they do naturally.

Carefully control the amount of time you spend with anyone you consider to be financially toxic. This is especially important if you are working on major financial goals in your own life.

2. Keep the Number of Toxic People in Your Life to a Minimum

It’s been said that you’re the average of your five best friends. Are any of your best friends of the financially toxic variety? If they are, then they’re dragging your average down. And if there’s more than one, you’ll be down even more, get it?

Brearin Land, financial adviser and CEO of Irvine Wealth Management adds, “If you want to take yourself to the next level financially and are looking to streamline that process, you need to surround yourself with individuals that live the kind of lifestyle you want to live.”

If three of your five best friends can be considered financially toxic, then there’s at least a 60% chance that you are engaging in some seriously toxic financial behavior yourself. You can’t even keep it from happening – you just do it because it’s normal in your social circle.

Everyone of us have people in our lives who are financially toxic, and sometimes you have no choice in associating with them. But as a matter of your own financial self-preservation, you need to make sure that the number of them who you consider to be friends is at an absolute minimum.

Zero would be even better, if that’s possible.

3. Use Them as an Object Lesson in What NOT to Do in Your Own Life

If you do have financially toxic people in your life, use them to some sort of advantage. Observe their financial situation, and their financial behavior.

Recognize the toxic influences. Then mentally record how the negative behavior results in the poorer outcomes. Use that behavior as a lesson for yourself in how not to do things.

Sometimes the best way to learn good financial habits to see what happens to people with bad financial habits.

In that way, your financially toxic friends will be doing you an unconscious favor.

4. Don’t Try to Keep Up With Their Spending Habits

This is a very easy trap to get caught up in, not the least of which because conspicuous consumption has become something of a social norm in our culture. As a way of fitting in with the group, you might adopt their spending habits. When you do, that takes you completely off of your own financial game. The more time you spend imitating someone else’s spending habits, the farther you are moving from your own goals.

This is where it’s important to understand that financially toxic people often overspend as a way of denying their own financial problems. For example, they may spend money freely as a way of convincing themselves that they don’t have a serious debt problem.

If you have well-established financial goals, you can’t let yourself get distracted in the web of someone else’s coping strategy. It hasn’t helped your financially toxic friends, and it can’t possibly help you either.

5. Ignore Their Financial Advice

Yet another coping device of the financially toxic set is the “do as I say, not as I do” routine. Financially toxic people often pontificate with financial advice, even when no one asked them for it. Spouting off solid-sounding financial advice is another tactic that makes them feel better about their own tattered financial circumstances.

It’s unlikely that you’ll gain any wisdom from people who are nowhere in the vicinity of being financially stable. You wouldn’t turn your money over to an investment advisor with a long history of underperforming the market, so why would you trust the financial advice of a person drowning in money problems?

When you’re around financially toxic people, you should work to keep the conversation away from anything that is remotely financial. The advice will be a complete waste of your time.

6. Don’t Do Business With Them!

If you jump in the water with a drowning person, there’s a very good chance that you’ll drown too. And so it is with business dealings. Doing business with people who have serious financial problems has the potential to spill over to you.

Of course, what I’m talking about here are more intimate business arrangements, like partnerships and joint ventures. The financially toxic partner’s money problems will impair his ability to uphold his responsibility in the venture, and eventually lead you into a money losing situation.

That makes a strong case for doing good background check on anyone you are looking to partner with in business. At a minimum, this should include getting a copy of the current credit report. But it’s not a bad idea to review independently prepared financial statements as well as a series of recent bank statements. If they don’t look right, find another business partner!

Never do business with someone whose financial situation you haven’t thoroughly investigated first.

7. And NEVER Lend Them Money

There’s a reason why banks and other lenders run credit reports on new loan customers. Experience has shown that if a borrower has a history of defaulting on loans to other lenders, there’s an excellent chance that the outcome will be repeated.

And so it should be with you. If you shouldn’t do business with financially toxic people, you shouldn’t lend money to them either. Doing so is just inviting trouble. If they can’t repay the loan, not only will you be out the money you loaned them, but it will almost certainly end any personal relationship that you had with them before.

8. Recognize That They May Have a Hidden Agenda

Financially toxic people are usually more than casually aware of their own monetary distress. Given the human tendency to resent people who are a better position in life, there may be more than just an accidental effort to tear you down.

It happens in situations where people come to view their own circumstances as insurmountable. Their reaction to people who are in a better place is often to try to tear them down, and in doing so to bring you down to their level.

This effort isn’t always obvious. In fact, some people are so good at hiding it that you won’t even know that it’s happening.

The clues are subtle, and often look something like this:

- You Find Yourself Feeling a Little Bit Down After Meeting With Your Financially Toxic Friends

- You Notice Disinterest Anytime You Share Good News

- The Friend Has an Obvious Tendency to Discourage You From Following Through on Your Own Plans

- He or She Can Usually Quickly Reel off a List of a Half-Dozen or More Reasons Why Whatever You’re Contemplating Won’t Work

- When You Share Your Plans or Good News, the Conversation Is Quickly Redirected Into a Financially Toxic Subject

Though the methods may be subtle, the financially toxic friend has one objective: to sabotage your efforts to continue moving forward toward greater prosperity.

He has no sense that he can join you in your quest for a better future, so he pulls out all stops to prevent you from moving forward.

9. Stay Focused on Your Own Agenda

We all have financially toxic people in our lives. Most times we can only minimize our contact with them, but we can never eliminate them completely. For that reason, you must stay focused on your own agenda. That means never allowing yourself to get sucked into the financially toxic party’s plans.

You must recognize that despite any other common ground that you may share, your financial destinies are heading in very different directions. Yours is the higher road – the superior direction. Never allow it to be compromised by someone who is going the wrong way.

There’s a secondary benefit to this strategy, that is, if the financially toxic people in your life are willing to seize on it.

Because you are on the right path in your life, you have the potential to be a positive influence on the people who aren’t.

Recognize your way as the better way, and never be prepared to surrender it or even to water it down for the benefit of financially toxic people. It’s a win for everyone involved.

This post originally appeared on Credit.com.

The Bottom Line – 9 Smart Ways to Deal with Financially Toxic People

Dealing with financially toxic individuals requires caution. Limit your time spent with them and avoid adopting their spending habits or financial advice. Use their behavior as a lesson on what not to do. Keep business dealings and lending money to them off the table to protect your own financial stability. Recognize hidden agendas and stay focused on your financial goals, serving as a positive influence if possible. Though you may not eliminate them from your life, maintaining a strong financial path is vital.

I HAVE A FRIEND WHO TELLS ME THAT SHE HAS A FRIEND WHO IS ALWAYS IN FINANCIAL CHAOS….. SHE WOULD VISIT AND ALWAYS DROP A COUPLE OF HUNDRED BUCK, SO HER FRIEND WOULD ALWAYS BE CALLING HER TO COME OVER, TO THE POINT THAT IT WAS ALMOST ANNOYING.

Number 1, 2 and 4 are absolute gold. Even though it may be difficult, sometimes you just have to cut people off if they don’t align with your goals.

Financially toxic people might be your family or your coworkers – people who you are “obligated” to spend time with… that’s why limiting your time around them is so important. You can fulfill your familial/business duties without getting dragged into the pit of financial despair.

To me, this is so much easier said than done. I’m sure reading this post will help a lot of people. I had to do this a few years ago. I firmly believe you become the average of the 5 people you spend the most time with, and I certainly don’t want to become financially toxic!