Thanks to technology and the internet, there are a plethora of crowdfunding platforms that work as an intermediary to streamline the process.

This is part of the reason recent research shows crowdfunding, in general, is expected to increase at a compound annual growth rate (CAGR) of 58.10% from 2023 to 2030.

Generally speaking, crowdfunding takes place when you ask other people to contribute small (or large) sums of money to fund a project or a goal. However, the purpose of major crowdfunding platforms varies widely.

Some of the best crowdfunding platforms can help you raise money to cover funeral expenses or to continually fund your entrepreneurial endeavors.

Some crowdfunding platforms even let you raise money so you can launch a new product people believe in and want or consolidate and pay down your debt. And there are others that help you become a real estate investor.

If you need to raise money for any reason, comparing crowdfunding platforms is a good place to start. We compared the top crowdfunding platforms out there based on the services they offer, their functionality, and their fees.

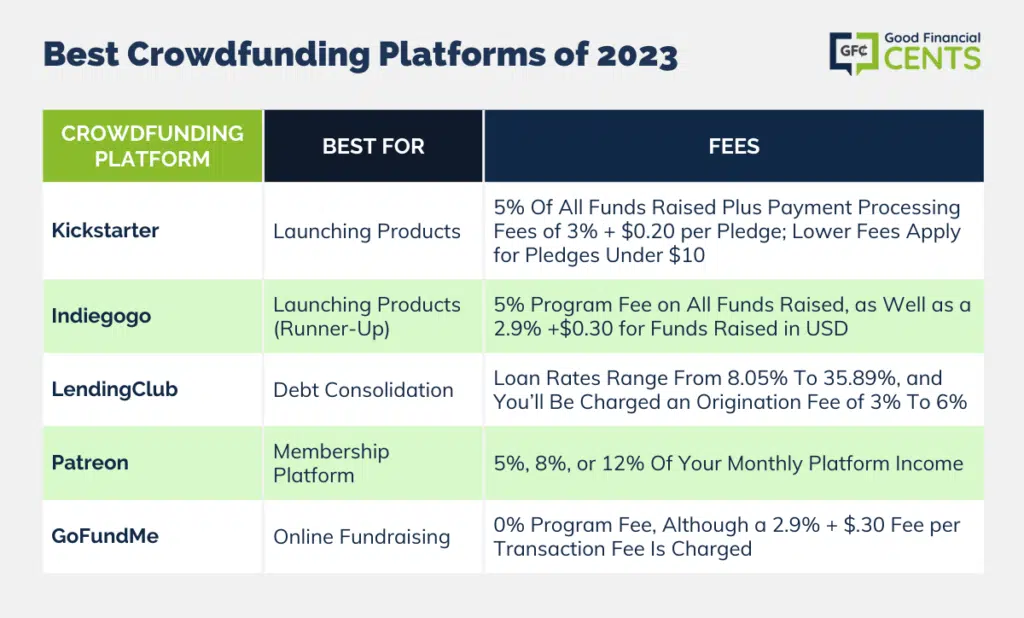

We suggest checking out Kickstarter, LendingClub, Patreon, GoFundMe, and Indiegogo, yet the right platform for you depends on your core fundraising goals.

Table of Contents

The Most Important Factors for Crowdfunding Platforms

- There are many types of crowdfunding, including debt crowdfunding, medical crowdfunding, expense crowdfunding, product crowdfunding, and support crowdfunding.

- Crowdfunding platforms charge fees that vary for facilitating your crowdfunding efforts. These fees usually range from 5% to 12% of money raised plus transaction fees, but take the time to price shop and compare.

- According to Statista, $17.2 billion in funding is generated through crowdfunding each year in the United States. Meanwhile, successful crowdfunding campaigns raised an average of $28,656.

- However, many crowdfunding campaigns do not reach their goals or raise as much money as people wish. As a result, all crowdfunding campaigns raised an average of $824 last year.

Best Crowdfunding Platforms of 2024

The best crowdfunding platform can vary based on your goals. The following platforms are the ones we have chosen for this ranking based on their reputation, features, and fees.

- Kickstarter: Best for Launching Products

- Indiegogo: Best for Launching Products (Runner-Up)

- LendingClub: Best for Debt Consolidation

- Patreon: Best Membership Platform

- GoFundMe: Best for Online Fundraising

Crowdfunding Platform Reviews

The best crowdfunding platforms make it easy to share your campaign and raise money fast, yet they all do things their own way. The reviews below explain how each of the top crowdfunding platforms works, the features they offer, their fees, and more.

Kickstarter: Best for Launching Products

Kickstarter was originally founded in 2009, and since then, 20 million people have used the platform to fund a project. During that time, $5.8 billion dollars has been pledged, and more than 201,000 projects have been funded.

For the most part, Kickstarter exists to help bring creative projects to life — and to the masses. For example, many have used the platform to help fund the release of a new game they created, a book or a series of books, or a new product that is meant to solve a problem.

With Kickstarter, those who contribute to the project can expect to receive a reward. This reward could be a shout-out on a company website, the product that was funded, a T-shirt, or something else. However, users of the platform can also donate to the project without asking for a reward.

Either way, you can promote your Kickstarter campaign via social media integration and other means. The platform makes it easy for users to contribute online or using their mobile devices.

Fees:

Where It Falls Short:

Indiegogo: Best for Launching Products (Runner-Up)

Indiegogo was founded in 2008, so it has been around as long as Kickstarter. Both platforms also have the same general goal — helping users raise money to fund their products or innovations.

According to Indiegogo, 10 million people visit their platform every month, during which 19,000 new campaigns launch on the platform.

This website is popular for launching tech products, as well as art projects, social impact campaigns, and projects intended to help the environment.

Interestingly, Indiegogo does not have an “all or nothing” rule, so you’re able to keep your campaign funds regardless of whether you reach your goal.

However, you do have the option to opt for a “fixed funding” campaign that only releases the money you raised if your campaign is successful.

Fees:

Where It Falls Short:

LendingClub: Best for Debt Consolidation

LendingClub is a different kind of crowdfunding platform because it is geared toward people who want to borrow money for a variety of reasons.

Its users can borrow money to start a business, but others aim to use their loan funds for debt consolidation or paying for a car or a home improvement project. On the other end of the process, individual investors crowdfund the loan requests instead of traditional lenders and banks.

LendingClub boasts more than three million customers so far and has borrowed more than $60 million dollars since the company’s founding in 2006.

Since you take out a loan through LendingClub, you’ll pay an APR that depends on your creditworthiness and other factors. Investors who fund the requests also earn interest for crowdfunding loans.

Fees:

Where It Falls Short:

Patreon: Best Membership Platform

Patreon is unique among crowdfunding platforms because it is more of a membership platform than a fundraising platform. Content creators can create their own communities of paid users who pay a monthly membership fee in order to hear from them or experience their art. Although anyone can use Patreon, current users include podcasters, musicians, artists, political commentators, journalists, and more.

The goal of using Patreon is to create a recurring income stream with your membership. Obviously, you’ll earn a lot more over time the more you can charge each month and the more members you get to join your Patreon club.

Fees:

Where It Falls Short:

GoFundMe: Best for Online Fundraising

GoFundMe was originally launched in 2010, and it has grown by leaps and bounds since then. Over the last decade, this platform has helped to raise $9 billion dollars across more than 120 million separate donations.

Unlike some other crowdfunding platforms, people can (and do) use GoFundMe to raise money for whatever they want.

Common reasons to launch a GoFundMe campaign include raising money for medical expenses or emergencies, fundraising for funeral expenses, and building up scholarship funds.

GoFundMe does ask you to create a goal for your campaign, but you get to keep all funds raised (minus fees) regardless of whether you reach your goal.

Like other crowdfunding platforms, GoFundMe also makes it easy to share your message and campaign with social media integration, emails and texts, and a dedicated website page for your cause.

Fees:

Where It Falls Short:

How We Found the Best Crowdfunding Platforms

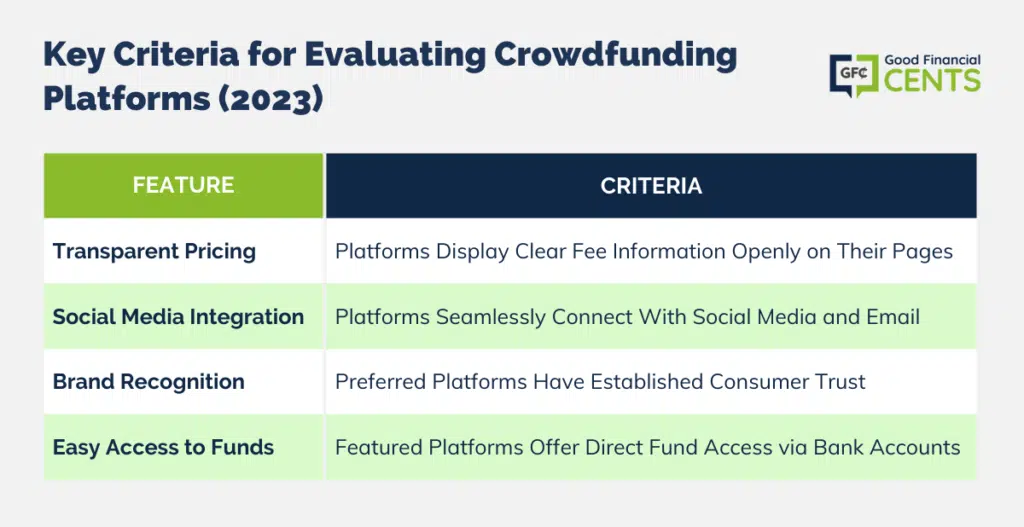

The best crowdfunding platforms are not aimed at the same type of user, yet they all have some common attributes that help them stand out. The following features are ones we looked for when comparing crowdfunding platforms available in 2024.

Transparent Pricing

First, we only chose crowdfunding platforms that are upfront and honest about the fees they charge and when. Each of the companies we highlight in this guide has a dedicated webpage that shows pricing for using their platform, transactions, and more.

Social Media and Email Integration

Successful crowdfunding requires access to tools that make sharing your campaign a breeze. That’s why we only chose crowdfunding platforms that link up to social media and email for easy sharing.

Brand Recognition

Users may be hesitant to donate using a website they have never seen or heard of before. As a result, we gave a premium to crowdfunding platforms that have brand recognition and the most trust from consumers.

Easy Access to Funds

Finally, we looked for platforms that make it easy for users to receive funds raised with their campaign. Platforms featured in this guide offer direct access to funds via a bank account.

What You Should Know About Crowdfunding

Although raising money online can be crucial to your business success or to cover any number of emergencies that have cropped up in your life, there are plenty of details you should be aware of before you select a platform.

The following facts can help you decide if crowdfunding is right for you.

- Not all campaigns are successful. Kickstarter reports that it has had more than 319,000 unsuccessful campaigns so far and that 11% of projects never receive a single pledge.

- Some platforms withhold your funds if you don’t meet your goal. You should also know that some platforms (including Kickstarter) never release your funds if you don’t reach the financial goal you set. If you need money regardless of how much you raise, opt for a platform that lets you access any amount of funds raised.

- Crowdfunding fees add up. Be aware of how crowdfunding fees can add up fast, and consider the alternatives of using a crowdfunding platform for the long haul. If you’re paying 5% in fees, that means you’ll fork over $500 for every $10,000 you raise.

- Time and effort are required. Finally, keep in mind that you won’t raise money without putting in some sweat equity. Creating a fundraising campaign isn’t enough. You’ll also have to share your message profusely while promoting your product or idea. With some campaigns, months or years of effort are required.

Summary: Best Crowdfunding Platforms of 2024

Bottom Line: Top Crowdfunding Platforms 2024

In 2024, crowdfunding has become a thriving avenue for funding various endeavors, with a projected 58.10% CAGR growth from 2023 to 2030.

Catering to diverse fundraising goals, leading platforms offer unique features and fees. Kickstarter, known for creative projects, charges 5% plus 3% + $0.20 per pledge. Indiegogo offers flexibility, with a 5% program fee and 2.9% + $0.30 for USD funds.

LendingClub aids borrowers, charging 8.05% to 35.89% APR and a 3% to 6% origination fee. Patreon excels for memberships, with fees ranging from 5% to 12%. GoFundMe excels in online fundraising, featuring 0% program fees and 2.9% + $0.30 transaction fees.

Transparent pricing, social media integration, brand recognition, and easy fund access define the best platforms, although success requires dedication and strategy.