M1 Finance is an investment app that offers a wide range of financial products and services, including a Robo-advisor investment platform where you can buy ETF and stock portfolios, retirement accounts, and portfolio analysis tools – you can even open a checking or high-yield savings account with M1 Finance.

M1 Finance may be a popular investment platform, but does that make it a safe place to invest your money?

In this article, I’ll explain how M1 Finance protects its customers and let you know whether they are safe and legit.

- Commission-free investing

- Allows fractional shares in stocks, ETFs

- Small minimum investment: $100

Table of Contents

About M1 Finance

M1 Finance was founded in 2015 and is headquartered in Chicago, Illinois. The company currently holds close to $7 billion in AUM (assets under management) and serves more than 750,000 members.

While the company’s growth has been impressive, by comparison, industry giant Fidelity currently manages more than $4.5 trillion in customer assets.

Is M1 Finance Secure?

The answer is yes. M1 Finance is a legitimate financial services company regulated by the FINRA (Financial Industry Regulatory Authority) and the SIPC (Securities Investor Protection Corporation).

The company’s website states that it uses “industry-leading security protection” and is FDIC-insured. You can rest assured that your deposits with M1 Finance are safe.

While M1 Finance is a safe and legitimate company, the market investments you hold through M1 Finance are not guaranteed. No market investment is risk-free, so it’s important that you do the proper research before investing.

What Services Does M1 Finance Offer?

M1 Finance offers the following products and services to its customers:

- Investment accounts (Individual, joint, crypto, custodial)

- Margin and personal loans

In addition to the products listed above, M1 Finance provides investment management services such as portfolio rebalancing, tax-loss harvesting, and automatic deposits.

Their portfolio analysis tools can help you understand your risk tolerance and invest accordingly. And you can track your progress to see how your investments are performing.

Is M1 Finance Free?

Yes, M1 Finance is free to use. There are no fees for opening an account, transferring money, or managing your portfolio. Additionally, there are no minimum balance requirements. You can start investing with as little or as much money as you want.

How Does M1 Finance Make Money?

One of the ways M1 Finance makes money is through the premium services it offers customers. These premium services include tax-loss harvesting and advanced analytics tools.

They also make money through interest earned on cash balances in customer accounts and from select securities transactions.

What Is SIPC?

As mentioned, M1 Finance is a member of the Securities Investor Protection Corporation (SIPC). This nonprofit membership corporation protects the customers of its members in the event of the failure of a member brokerage firm.

It provides funds to cover customers’ missing securities and cash up to certain limits.

Since its inception over 50 years ago, the SIPC has helped recover over $141 billion in assets for over 770,000 investors. SIPC does not cover losses due to market fluctuations.

If you opened an account with M1 Finance and the company went bankrupt, SIPC would help you recover your money. However, SIPC would not cover losses due to a drop in the market value of your investment or bad stock picks.

What Is FINRA?

The Financial Industry Regulatory Authority (FINRA) is a self-regulatory organization that oversees the brokers and firms that conduct business in the securities industry in the United States. FINRA ensures that firms comply with federal securities laws and regulations.

FINRA regulates M1 Finance to protect investors from fraudulent or abusive practices. The main functions they regulate include:

- Licensing

- Discipline

- Marketing

- Trading practices

- Sales practices

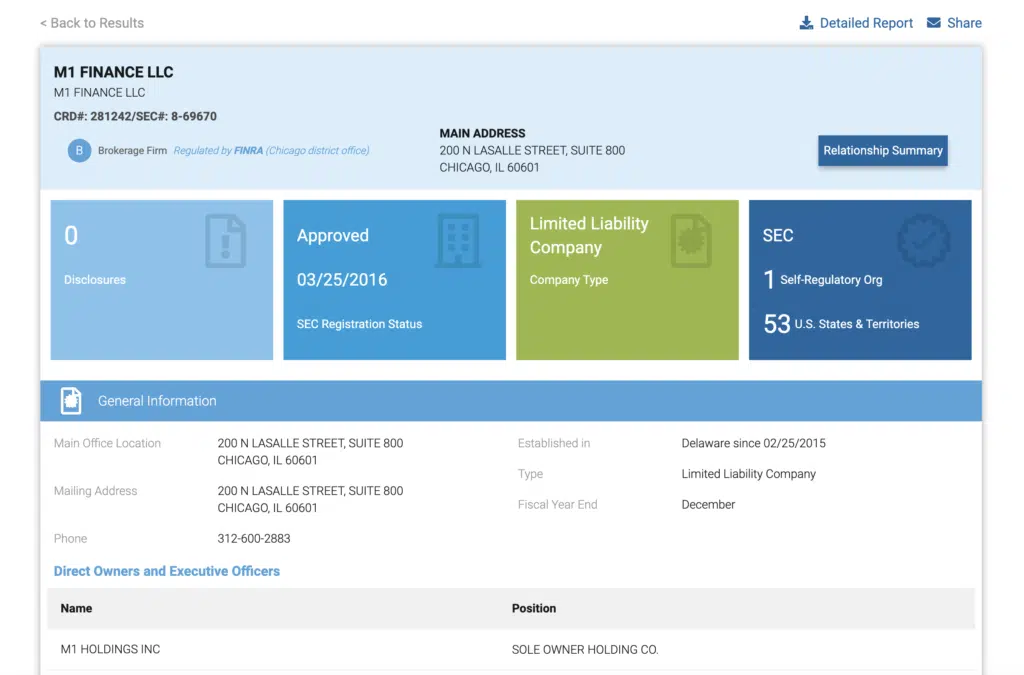

FINRA also runs the Central Registration Depository (CRD), a database of information on brokers and firms. Below is a screenshot of their M1 Finance’s FINRA listing:

You’ll notice two registration numbers: CRD#: 281242 and SEC#: 8-69670. M1 Finance is also regulated by the SEC since they are registered in 53 states and U.S. territories.

FDIC Coverage

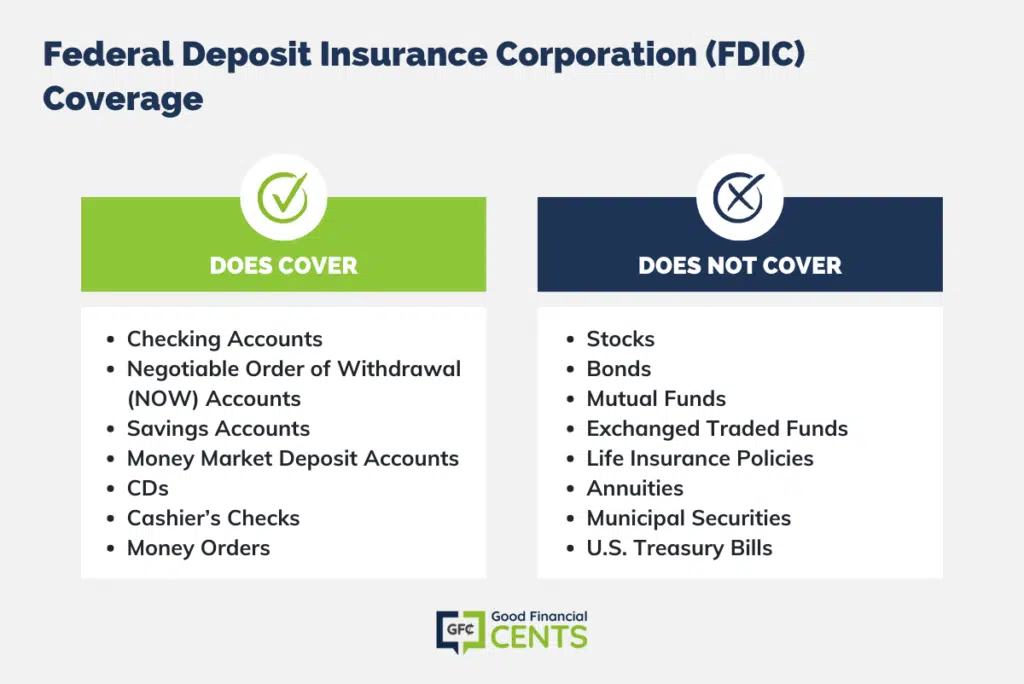

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the US government that provides deposit insurance for banks and credit unions. FDIC coverage protects depositors up to $250,000 per account in case of a bank failure.

FDIC coverage can be confusing. Below is a table that shows what type of investments the FDIC is responsible for and what falls out of their jurisdiction. Note that market investments, like stocks, mutual funds and ETFs, are not covered by the FDIC.

How Does FDIC Coverage Work?

Here’s an example of how FDIC would work in the event of a bank closure:

Case Study:

If the bank you have your accounts with is FDIC-insured, then your personal and business checking accounts would be covered up to $250,000 each, for a total of $500,000 in coverage.

If the bank fails, the FDIC will reimburse you up to $250,000 for your personal checking account and up to $250,000 for your business checking account.

It’s important to note that FDIC insurance covers depositors’ accounts up to at least $250,000 per depositor per insured bank, so you would need to make sure that the bank you have your accounts with is FDIC-insured to be eligible for FDIC insurance coverage.

Now that you understand how FDIC coverage works let’s look at how it affects M1 Finance investors.

Does M1 Finance Carry FDIC Coverage?

First, you must understand M1 Finance is NOT a bank. They use Lincoln Savings Bank for all their banking products (M1 Checking). But Lincoln Savings Bank IS an FDIC member so any eligible M1 Finance deposits will qualify for FDIC coverage.

You can read more about M1 Finance FDIC coverage here.

What Type of Security Protection Does M1 Finance Use?

M1 Finance uses multiple layers of security to protect its members. The first is SSL or Secure Socket Layer. SSL encrypts the data sent between your computer and M1’s servers, ensuring that your personal and account information is safe and secure.

M1 Finance also uses two-factor authentication (2FA), which requires users to enter a unique code to log in to their accounts. The code is usually sent to your phone via text message or an app.

The Bottom Line – Is M1 Finance Legitimate?

Yes, M1 Finance is a legitimate financial services company. They are regulated by FINRA and a member of the SIPC. And through their relationship with Lincoln Savings Bank, eligible M1 Finance deposits are covered by FDIC.

But there’s another way to know whether companies like M1 Finance are legit: check to see if they’ve had any “Disclosures” posted against them.

A reportable disclosure could include information about criminal, civil, or customer complaints involving any M1 Finance brokers, employment termination disclosures, and bankruptcy discharges.

As of this writing, M1 Finance has had no such disclosures. They have a clean track record, which is an excellent sign.

It’s comforting to know that M1 Finance is a legitimate and reputable company. But before you sign up, research all the best investment apps to ensure M1 Finance is the best investment platform for your needs.

For more information, read our M1 Finance review, or if you’ve decided that M1 Finance is the right investment app for you, you can use the link below to open an M1 Finance account today.

- Commission-free investing

- Allows fractional shares in stocks, ETFs

- Small minimum investment: $100