There are an endless number of ways you can make money online, and sometimes, I feel like I have tried them all. I have built digital products, and of course, I have a blog that has helped me earn millions of dollars over the years.

I’m also a YouTuber with more than 370,000 subscribers to my channel, called Wealth Hacker. After years of trying nearly everything, I have found that most online income strategies can work — that is if you understand upfront that you’ll probably fail a few times along the way.

Not everyone knows this, but I also have an online course that is geared toward financial advisors who want to build up their online presence. I created this course since that’s exactly what I did.

Believe it or not, I was once a financial advisor who wore a suit every day and met with clients in person. But thanks to the internet, I sold my financial planning practice and focused on blogging and other online work instead.

Why I Created an Online Course

While my online course is targeted at a niche group of people (financial advisors), I was still able to earn more than $200,000 over the course of a few years.

That’s pretty amazing when you think about it, mostly because I didn’t really know what I was doing at first and because I had to make quite a few adjustments along the way.

Why did I originally create an online course?

To be honest, I got the idea from Ramit Sethi. If you’re not familiar with him, he’s a personal finance expert and New York Times best-selling author who is known for his books and his website, I Will Teach You to Be Rich.

Sethi has a ton of courses, and I know all about them because I bought his first one.

That made me want to build my own course, but I just wasn’t sure about the topic at first. The thing is, I was eventually shown very clearly what my first course should be about.

Recognizing the Demand

At the time, I was getting contacted by financial advisors from all over the United States who wanted to know how I broke into the online space.

And since I was so excited about blogging and my success, I would frequently get on the phone with people for 30 or 45 minutes — and all for free!

But over time, I started recognizing that most of the people I spoke to weren’t doing anything with the information I was sharing. Some of them would even come back again and again with more questions, yet they never put anything into action.

At one point, I started just charging for those phone calls… starting at $100 per hour until I got up to $500 per hour and then $1,000 per hour. At that point, I realized people were more than willing to pay for the information I was sharing.

I also realized the type of people who were willing to pay were also the most likely to implement the strategies I suggested.

From there, my first successful course was born — The Online Advisor Growth Formula. I built the course to help financial advisors figure out how to build an online brand they could use to grow their business and build new revenue streams.

I started with a beta version that cost just $500, but I wound up charging almost $2,500 for the final product.

The rest is history. Over the course of two years, I made more than $200,000 with this course, and I learned a ton in the process.

How You Can Build an Online Course

It is definitely not too late to build an online course that people are willing to pay for. In fact, a recent study of the global e-learning market showed that this industry is expected to be worth $374.3 billion dollars by 2026, up from $144 billion in 2019.

Imagine if you could get just a little slice of that money, from a few thousand to a few hundred thousand bucks of your own. That amount of money could be enough to change your financial situation forever, or even enough that you never have to work a regular “job” again in your life.

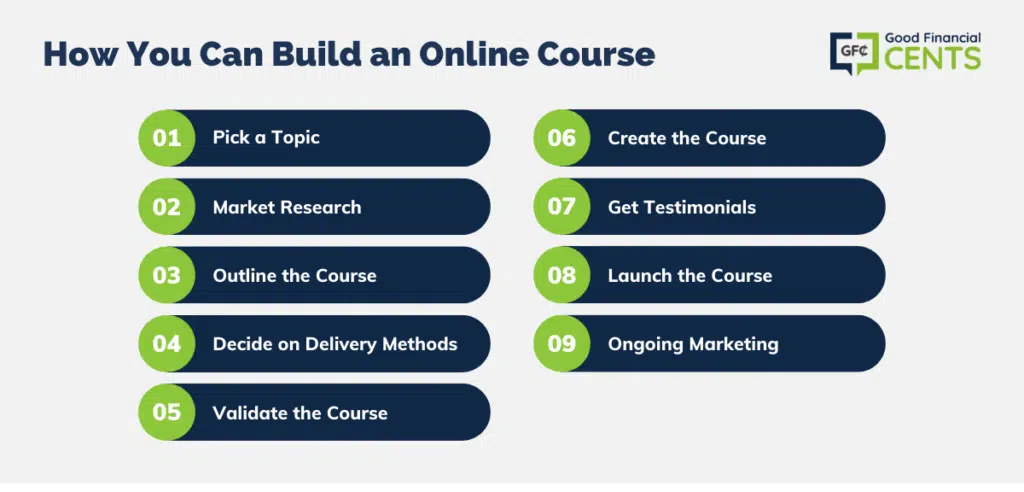

But how do you create an online course? In my mind, there are nine main steps you need to take to turn your dream into reality. Here’s exactly what you need to do to get your course off the ground and start making money while you sleep.

Step #1: Pick a Topic

The first step you need to take is figuring out what your course should be about. This will all depend on your area of expertise, as well as the topics you’re passionate about.

You could create a course that explains how to get started in your favorite hobby, but you could also build a course that relies on your professional credentials. The choice is really up to you, but you should make sure you’re not afraid to think outside the box.

For example, you can find online courses on cooking and baking, investing, pottery, photography, or podcasting. There are popular courses that teach watercolor painting, cake decorating, and the art of paper flowers.

To come up with the best course for you, you have to think about what you’re good at. What do you know that other people want to learn?

Step #2: Market Research

Once you have an idea or two, you need to do some market research. For the most part, this means validating the idea, so you know people will pay for the expertise you want to offer.

Funny enough, there are courses you can take on how to do market research! However, there are plenty of ways to do some market research without a financial investment. For example, you could:

- Create a simple questionnaire using Google Forms and share it on social media, including LinkedIn

- Look for other courses on similar topics to see if they have had success

- Ask people you know for their thoughts on your idea

In the meantime, you’ll also need to think about how much people might pay for your course.

I was able to charge a heftier amount ($500 then $2,500) because my course was targeted to financial advisors who could easily recoup their investment, yet you may be able to charge more or less depending on your niche and your level of expertise.

For example, customers may be willing to pay big bucks for a course that helps them earn money vs. a course that teaches cooking or painting. To get an idea of pricing, it helps to check out other courses that are similar to the one you plan to create.

Step #3: Outline the Course

Once you feel confident you have a course idea that will work, your next step is creating a basic outline for your course. When I did this for my financial advisor course, I got help from a friend who asked me questions about my idea.

With his questions and my answers, I outlined what the course should include and a basic order of the lessons.

If you’re working on your course outline on your own, here are some questions to ask yourself:

- What are the main lessons people want to learn from me?

- Do these lessons need to go in chronological order?

- What is the ultimate goal of this course? And what do I hope people will accomplish?

To use my course as an example, my original outline started at the beginning with how I created a blog to begin marketing my financial planning practice.

I also outlined modules on how to create your own unique brand, compliance for financial advisors, writing compelling content, and using social media. From there, I outlined modules on search engine optimization (SEO), generating leads, monetizing online content, and more.

I basically thought through what people wanted to learn from me and the order of the lessons that made the most sense. While your topic will probably be much different than mine, you need to take on the same strategy.

Step #4: Decide on Delivery Methods

Once you have an outline for your course, you need to think about where you plan to offer it. How will you deliver your course to people who buy it? Also, how will you accept payment and keep track of it all?

Fortunately, there are some platforms that make it easy to format and sell your course, and many will even keep track of payments and course members for you. Some of the best ones to check out include Teachable, Kajabi, and Thinkific.

These platforms don’t have to be expensive, and they can save you a lot of time and effort. With Teachable, for example, a basic course plan for unlimited students starts at just $29 per month, although some additional processing fees can apply.

Step #5: Validate the Course

So you have your course idea, and you have done some market research. After that, you created a basic course outline to get the ball rolling.

At this point, you’ll want to validate your course before you do a full launch. You can do this by finding your biggest fans and by trying to sell a beta version of your course.

I did this with my financial advisor course, and I sold the beta version for just $500. I was able to find buyers because I had an email list for my blog, and these people were able to get the course cheaper in exchange for their feedback.

When I sold my beta course, I asked members for more information on what else they wanted to learn. These original members were very generous with their time, mostly because they were trying to get as much helpful information from me as they could.

Step #6: Create the Course

As my beta testers shared their thoughts, I implemented their suggestions and used their feedback to build out the rest of the modules for my course, which I ultimately sold for $2,500.

This is exactly what you need to do once you have a small group of people who are going through your beta course. You need to ask them what is missing and use their suggestions to fill in the gaps.

You also need to decide how you want to share all the information your course has to offer. Will you make video lessons? Audio lessons? Do you need to create a slideshow with graphics that explain the lessons you’re trying to teach?

This is another area where you can check out other courses to see how they formatted their lesson plans. For example, you can look at their course sales pages and see how the modules are laid out.

Once again, using a platform like Teachable or Thinkific from day one can make a big difference. These platforms have tools built in to help you format your course with video or written lessons so you don’t have to build anything yourself.

Step #7: Get Testimonials

Next up, you’ll want to get some testimonials from raving fans and post them on your course page as soon as you can. This is exactly what I did with my course for financial advisors.

I reached out to members who were having success, and I asked them to share with me. At that point, I posted their exact testimonials on my course sales page!

If people love the beta version of your course and have participated in the process of building out the final product, they are usually pretty invested. Getting testimonials is not that hard as a result. Most of the time, all you have to do is ask.

Step #8: Launch the Course

Now that you have built out your final course product with the help of beta testers, it’s time to jack up the price. Of course, that’s not all you have to do. You’ll also want to begin reaching out to your networks to promote your course and let people know it’s ready.

Strategies you can use to launch your course include:

- Social media shares

- Posting on LinkedIn

- Reaching out to your email list

- Learning how to use Facebook ads

- Cross-promoting courses with other course creators in your niche

- Hosting a free webinar

- Promoting your course on YouTube

- Doing podcast interviews about your course or the topic of your course

- Booking speaking gigs at local events

- Promoting your course on TikTok

These are just some of the ways you can initially promote your course, but the rest is up to you. The point is, don’t create your course; then watch it fizzle. Get out there and tell people about it, or they may not find out on their own.

Step #9: Ongoing Marketing

Finally, you’ll definitely want to have an ongoing marketing plan if you want to make course sales into a reliable income stream. There are many ways you can market your course for the long term, and your best bet will depend a lot on the type of course you have.

Some strategies to consider include:

- Creating a free mini course that introduces new people to your topic and helps you gain their trust

- Offering a free webinar that introduces you to potential new customers while providing a “tease” into what the full course offers

- Having course “sales” that last for a limited time

- Creating a Facebook ads marketing plan that targets user types who might be interested in your product

- Getting bloggers to review your course

- Having an affiliate program for your course so other people can sell it and earn a commission

- Starting a Facebook group to help promote your course or the underlying theme of your course

- Advertising your course with YouTube ads or banner ads

These are just some of the ways you can promote your course. Whatever you do, remember that courses rarely just sell themselves and that you have to get out there and let people know what you’re all about.

With some luck, you’ll find the right combination of marketing efforts that sell courses without too much work on your part.

Just remember that you’ll probably have to try a few different strategies to find the right fit and that success may not happen overnight. Like it or not, it rarely does.

Bottom Line – How to Create an Online Course: A Step-By-Step Guide

Creating an online course can be a lucrative venture, as demonstrated by the author’s personal success with “The Online Advisor Growth Formula.”

The journey begins with identifying a niche or expertise, followed by thorough market research and course outlining.

Using platforms like Teachable or Thinkific can simplify the course creation and delivery process. Initial validation through beta testers is crucial for refining the content, which should be supplemented by testimonials to boost credibility.

Upon launching, continuous marketing, from social media shares to Facebook ads, ensures consistent visibility and sales.

Success in online courses doesn’t happen overnight; it demands persistence, adaptability, and unwavering commitment.