If you’re looking for a way to ramp up your income, starting a blog can be a smart move. Sure, you can get a part-time job instead, but where’s the fun in that? And who wants another J-O-B anyway?

While most regular jobs require you to report to a physical building each day, you can run a blog from your own home.

Better yet, a blog is something you own. You can put in as much (or as little) effort as you like, but all the spoils of your hard work go directly into your pockets.

When I started my blog years ago, I didn’t make a dime for almost a year! But over time, my income grew to $1,000 per month…then to $2,000 per month….and to $4,000 per month and so on.

And now that I’ve earned more than $1 million dollars blogging, I can honestly say that blogging for profit is the real deal.

Table of Contents

What Is Affiliate Marketing and How Does It Work?

Affiliate marketing comes in so many forms it’s hard to keep track. Not only can you sell the products of others, but you can market other people’s courses and services, too.

You can even sign up for affiliate marketing programs for products you use yourself.

Picture yourself as a salesperson who only sells stuff they love. Just by writing about new products or services, you can educate your readers on what they could benefit from. And when they make a purchase, you make money.

That’s pretty simple, right? Once you’re ready to get started, here are the basic steps you’ll take for your first affiliate sale:

Step 1: Start a Blog or Website

To make money with affiliate marketing, you need to have a website of your own. It can be a blog or a review website of any kind, but it needs to be yours. And if you think there are too many blogs out in the world, think again.

Remember, there are billions of people in the world, and you only need a few thousand to check out your website each day to earn a real income. (Learn how to start a blog in four easy steps!)

Step 2: Build an Email List and Readership

It’s hard to make money with affiliate marketing when hardly anyone is reading your blog.

Before you can ramp things up, you need to build up your following and social media presence. I also suggest starting a simple email list right away. MailChimp lets you manage your first 2,000 email subscribers for free.

Step 3: Sign Up for Affiliate Programs

Before you can start raking in cash with your blog, you need to partner with various companies and their affiliate programs. While some products and services have their own programs you need to apply for, big affiliate websites like Commission Junction, Impact Radius, and Flex Offers can connect you with a ton of affiliate programs in one fell swoop.

Step 4: Start Promoting Products

Once you’re approved for affiliate programs, you’ll have a set of affiliate links to use on your own website. You can start promoting products right away, using your affiliate links to guide readers toward the purchase of a product or service.

Step 5: A Follower Clicks Through Your Link and Decides to Buy Something

Eventually, a reader will decide to click through your link and purchase a product or service. This is where your profit comes into play.

Step 6: You Earn a Commission

Affiliate programs pay out various percentages or flat-rate commissions based on the product or service.

Where some affiliate programs offer a percentage of each sale (i.e., 40 percent of $100 sale = $40 per sale), others offer a flat payout for each signup.

Some payouts are worth hundreds of dollars, while others cough up pennies per sale. But remember, it all adds up!

Step 7: Let the Money Pile Up

While earning a commission may get you crazy-excited, it takes a while to get money in your hands. Most affiliate programs delay payment for at least 30 – 45 days. After their first affiliate cycle rolls up, you’ll start receiving a steady stream of income.

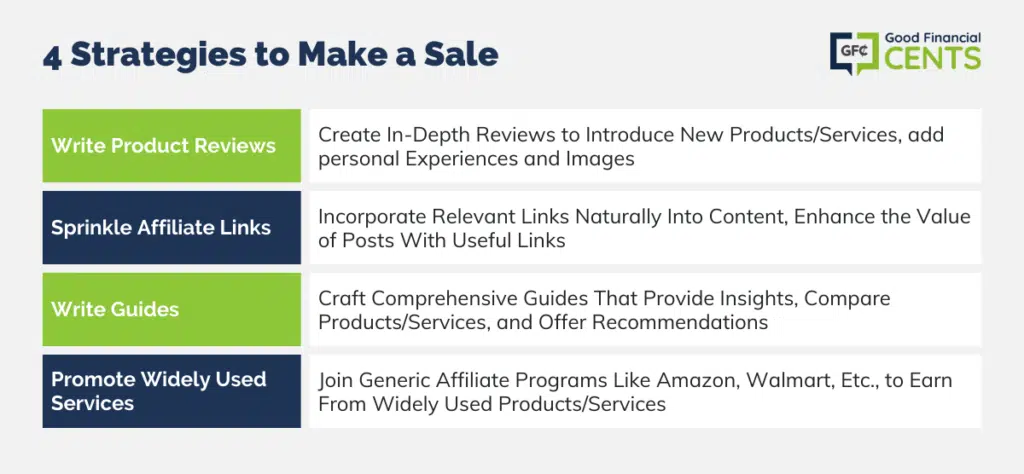

4 Ways to Make a Sale

If signing up for affiliate programs and adding a link or two made people rich, everyone would be a millionaire!

Unfortunately, it takes a little more legwork to create an affiliate strategy that helps you earn a sizable income.

Here are the best ways to provide your readers with the value they need while also promoting your own affiliate interests:

#1: Write Product Reviews

In-depth product reviews are a great way to introduce your readers to a new product or service while offering your own take on how the product works.

A product review can be created to market nearly anything. Maybe you love an awesome blender you purchased on Amazon.com.

By writing an in-depth review of that blender and including your own pictures and funny stories, you could convince your readers that they need it, too. Pop in a few Amazon affiliate links, and the money is sure to follow.

On the flip side, you can also review a service.

This TD Ameritrade Review is the perfect example:

Since I use TD Ameritrade myself, it was easy to type up an in-depth analysis of the company and how it works. And yes, I earn quite a few commissions with this review – even though I only update it around once per year.

#2: Sprinkle Affiliate Links Throughout Your Copy

While adding random affiliate links won’t always help you earn sales, it never hurts to try. And there are plenty of instances where adding helpful links to a post with a specific angle or purpose can help you earn money.

In this piece written on 21 ways to make money fast, for example, I include affiliate links to a ton of companies that can help people earn cash on their own.

Once readers skim the post, they can learn how to make money by taking online surveys, earn $250+ by opening a new Chase bank account, or drive for Uber.

Here is a good example of adding affiliate links naturally:

The post works so well because it’s helpful, but also because it includes so many affiliates!

#3: Write a Guide (Or a Ton of Guides)

Guides provide readers with valuable information they can use to compare products and services. By writing a comprehensive guide on just about anything, you can share your knowledge while also promoting a handful of products.

Here’s a good example:

I wrote this guide on the Best Place to Open a Roth IRA because

a) Roth IRAs are awesome for people who want to build a stash of tax-free money for retirement and

b) Not all online brokerage firms are created equal.

By creating the guide, I could highlight the companies I trust the most while pointing out some of the pros and cons.

On the flip side, readers are gaining valuable information that can help them choose the best account for their retirement savings. In a lot of ways, a smartly written (and helpful) guide is a win-win for everyone.

#4: Promote Something Everyone Uses

While it’s smart to create affiliate strategies for products or services you use and believe in, you can rack up more earnings by adding some generic strategies to the mix. Everyone uses Amazon.com, for example.

And tons of people shop at stores like Walmart, Target, and Macy’s. By signing up for those larger, more generic affiliate programs, you can earn extra money promoting services nearly everyone uses.

6 Awesome Strategies for Affiliate Marketing Success

If you’ve started a blog, you’re already halfway there. But before you dive headfirst into affiliate marketing, there are some very small (and very important!) details you should know.

To get the most out of your affiliate strategy, follow these instructions:

#1: Promote Something Everyone Uses

While seeking out individual affiliate programs can help you earn money, it’s a lot of work! Fortunately, affiliate networks can give you access to a bunch of affiliate programs in one place.

Consider affiliate networks like ShareASale and Commission Junction, both of which can save you time and stress. Once you join, you can browse all the available affiliate options to see which ones are right for you.

#2: Don’t Forget to Add a Disclosure!

If you plan to promote products on your website, you need a disclosure. A disclosure explains that you receive compensation when people sign up for products or services through your links.

A separate disclosure to protect you from legal issues should also be included on your website. If you’re unsure of what to include in your disclosure, speak with a lawyer or ask other bloggers in your niche about the disclosure they’re using.

Remember:

Make sure you know each program’s rules before you dive in. To make money with affiliate marketing, you have to make sure you’re compliant!

#3: Be Honest and Only Promote Programs You Believe In

While you might be tempted to promote everything under the sun, this is rarely a good idea. Trust me when I say the best affiliate marketing strategy is an honest one.

When people trust your words, they are a lot more likely to use your links.

By promoting products and services you actually use and believe in, you will gain your reader’s trust and make money. Speaking the truth may not be the fastest money-making strategy, but it is the best one.

#4: Check Out Your Competitors!

Unsure which affiliates to promote? The best thing you can do is check out your competitors.

Whether your blog is about pet care, money, or travel, there are plenty of other websites in your niche. By seeing what they are promoting, you can get affiliate ideas for your own blog.

#5: Focus Some of Your Efforts on SEO

While writing reviews or guides is a great way to share your opinions on products and services, they won’t help you earn money if nobody reads them.

One of the most important things you can do is learn about SEO or search engine optimization. By learning more about SEO, you can help your reviews and guides make it to the first page when people search for a term.

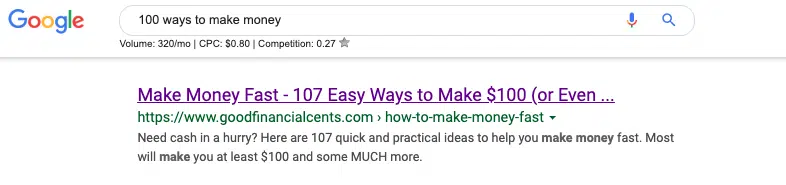

Look at this awesomeness below:

If someone searches for “100 ways to make money,” they’ll find my monster money-making post on the first page of Google.

That’s because this post is doing awesome with a ton of search terms people use all the time.

#6: Don’t Give Up Too Early

Here’s the painful truth about blogging: It’s hard work! If it were simple to set up a page and earn a boatload of cash, everyone and their mom would be rich.

Earning money on the web doesn’t happen overnight; it takes time. It takes months of trial and error to find a few strategies that work well – and work for the long haul.

If your goal is to make money, you should commit to blogging for a full year without worrying too much about the income side of the equation. If you give it a year, you will start earning some side income that can grow over time.

Is Affiliate Marketing Best For Your Blog?

With a blog and a solid affiliate marketing strategy, anyone can earn money online. But that doesn’t mean it’s easy; just like any other entrepreneurial venture, starting a blog is hard.

If you stick with it long enough, however, you can earn money with affiliate marketing and other strategies.

Blogging takes guts, and it definitely takes time. But it all starts with that very first step. When will you take yours?

Bottom Line: Understanding Affiliate Marketing

Affiliate marketing is a lucrative avenue for boosting income through blogging. Unlike traditional jobs, a blog offers flexibility and ownership. Building a blog involves steps like creating a website, growing readership, and joining affiliate programs.

Promoting products through reviews, guides, and naturally embedded links engages readers and drives sales. Authenticity matters—promote what you believe in. Utilize affiliate networks like ShareASale and Commission Junction for efficiency.

Success lies in persistence. With commitment, anyone can earn money and thrive through affiliate marketing. Start your blogging journey today.