Have you ever wondered whether you had sufficient insurance coverage to cover the wide possibilities of loss?

An umbrella insurance policy acts to provide extra coverage on top of your existing policies.

An umbrella insurance policy acts sort of like a safety net that picks up losses not covered by existing insurance policies.

While in previous times, it was mostly the very rich who took out umbrella policies, these days, many more people see the need for such protection.

One of the reasons that umbrella coverage is more important in modern times is the litigious nature of our society. In comparison to earlier days, people are much more likely to sue someone of average means for a wide variety of reasons.

For example, if someone should suffer an injury while walking up to your front door, you could be liable for damages if you have been negligent in some way.

Because people are so much more likely to sue homeowners, car owners, and boat owners, umbrella insurance is no longer simply for the wealthy anymore.

How Does Umbrella Coverage Work?

In order to qualify for umbrella insurance, you must already have traditional types of insurance coverage. For example, a regular homeowner’s policy covers your home, while an auto insurance policy protects you and your car.

The umbrella coverage sits “on top” of these other policies in case they do not provide sufficient protection to cover all costs for liability-related damages.

Umbrella coverage protects the policyholder directly from liability claims. In other words, they cover damages when you are at fault due to some neglect or wrongdoing on your part.

Umbrella insurance will pay for the medical bills, lost pay, and other damages suffered by the injured person due to the negligence of the covered person.

However, the insurance does not pay for any personal expenses of the policyholder. For example, the policy will not pay to repair the policyholder’s car in case of an accident, nor will it pay for any medical bills incurred by the policyholder due to the accident.

The coverage always pays the “other” party that has suffered due to the policyholder’s negligence.

Do I Really Need Umbrella Insurance?

While in the past, the average person would have no need for such coverage, the situation is much different now. Even if you have only modest income and assets, there is still a chance someone might sue you to recover whatever they can in instances where you are negligent.

Some experts recommend that anyone with a total of $200,000 in assets should have umbrella insurance, while others would set the asset level even lower.

Some umbrella policies provide coverage in the hundreds of thousands of dollars, while the top traditional policies will cover damages of $5 million or more.

Generally speaking, the more assets an individual has, the more they need umbrella liability coverage. Additionally, those who feel more vulnerable to litigation should also consider these types of policies.

For example, if you use your home for business purposes and have many visitors, you may want extra liability protection.

Note:

Assessing Your Risk & Real-Life Implications

Here are some things to consider when deciding whether you need umbrella insurance:

- Do you live in a neighborhood in which lawsuits against neighbors are common?

- Do you operate a home business?

- Do you often have guests over to your home or other properties?

- Do you own a boat?

- Do you own, charter, or lease aircraft?

- Do you take long commutes to work?

- I am running a few minutes late; my previous meeting is running over

- Do you often take long vacations with other people watching your home?

- Does your home have tall trees that could fall over in a storm and damage neighboring property?

- Do you have significant liquid assets?

- Does anyone in your household have conditions that might impair their driving ability?

- Do you use your own vehicles, equipment, or other possessions for your business or work?

Some real-life examples. It’s easier to illustrate how an umbrella policy would work using real-life situations. An article by CBS MarketWatch gives several instances that are very common.

Here are some of the examples that could easily happen to anybody.

- You throw a party at your home where alcohol is involved and minors are present. The minor has a few drinks without you knowing, drives home, and gets in a wreck. You could be on the hook even if you didn’t provide the alcohol.

- You act as chaperone of young kids on a field trip to a park where one of the kids gets injured. The parent of the child claims that your kid doesn’t like their kid, and that’s why you let him get hurt.

- Your child borrows a friend’s car to run to McDonald’s to grab something to eat. While hurrying to get back, they ran a stop sign and hit a mini-van with a family of four.

The right umbrella policy could protect you from the incidents listed above.

What’s the cost? For $1 million in coverage, the cost should be around $150-$200 (mine was $180) a year. For each additional $1 million in coverage, you should expect to pay an additional $100.

How to Find Umbrella Insurance

Umbrella policies can differ quite markedly in what they cover and in the amount of coverage. Shopping around and comparing policies is a good idea and can often lead to significant deals.

Internet comparison websites allow consumers to compare policies offered by different providers side-by-side. Most of these sites provide tools that allow users to search according to specific criteria.

Among the items to check when comparing policies are coverage amounts, exceptions, exclusions, and qualifications.

For example, some policies may not provide coverage in certain circumstances, i.e., if the policyholder was under the influence of alcohol when an accident occurred. Since one of the reasons for liability insurance is to protect against policyholder negligence, it pays to check for such exceptions.

Umbrella insurance is an important piece of both personal and small business insurance strategies. Considering the low cost, going without it doesn’t make sense.

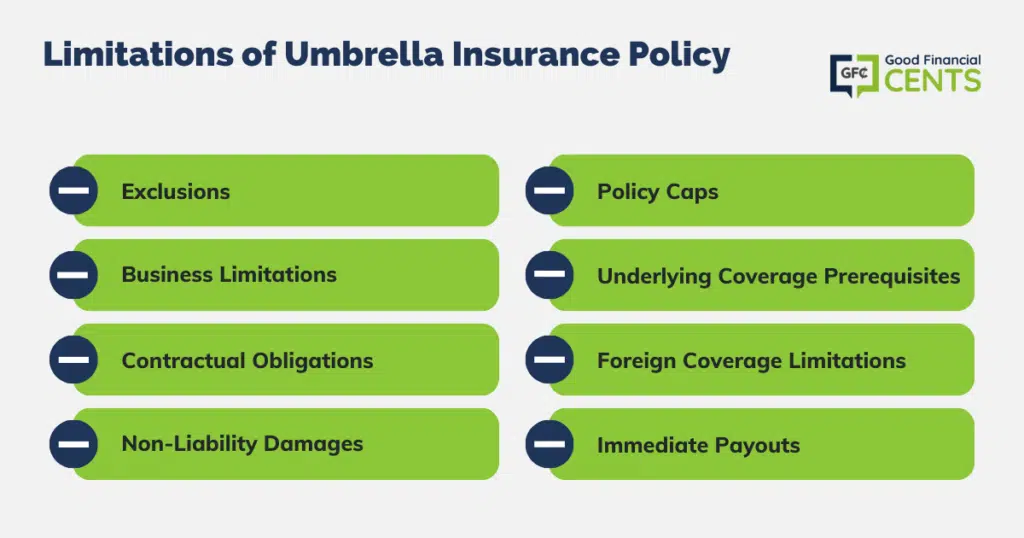

Limitations of Umbrella Insurance Policy

Despite the extensive coverage provided by umbrella insurance policies, there are certain limitations that potential policyholders should be aware of:

- Exclusions: Just like other insurance policies, umbrella insurance has its exclusions. For instance, intentional acts of harm or illegal activities are typically not covered. If you deliberately harm someone or intentionally damage property, your umbrella policy won’t protect you from the resulting liability.

- Business Limitations: Umbrella insurance for personal purposes does not typically cover business-related liabilities unless specifically mentioned in the policy. Entrepreneurs or those operating businesses would need separate commercial umbrella policies.

- Contractual Obligations: If you have certain contractual obligations, such as those in a rental or lease agreement, they might not be covered under an umbrella policy. It’s crucial to understand the specifics of your policy in relation to any contracts you might be involved in.

- Non-Liability Damages: An umbrella policy generally does not cover direct damages to your property. It’s more about safeguarding against liability you might have to others.

- Policy Caps: Every insurance policy, including umbrella policies, has its coverage limits. Even if you have a substantial umbrella policy, there might be cases where the damages or settlement exceed your coverage, leaving you with out-of-pocket expenses.

- Underlying Coverage Prerequisites: Umbrella insurance usually requires the policyholder to maintain certain underlying primary insurance policies with specific minimum limits. If these prerequisites aren’t met, your umbrella policy might not kick in.

- Foreign Coverage Limitations: Some umbrella policies may not offer worldwide coverage. If you frequently travel or have assets abroad, you’ll need to ensure that your policy provides adequate protection in foreign jurisdictions.

- Immediate Payouts: There can be cases where the underlying insurance has not yet reached its limit, but immediate funds are required for legal fees or other expenses. In such cases, the umbrella insurance might not payout immediately, causing potential cash flow concerns.

The Bottom Line – What Is an Umbrella Insurance Policy?

Umbrella insurance has emerged as an essential layer of protection in our increasingly litigious society. While once considered a luxury for the wealthy, the shifting dynamics of liability risks make it a consideration for individuals across various income brackets.

With a myriad of everyday scenarios that could expose one to significant financial vulnerabilities, it’s prudent to understand and evaluate the safety net that umbrella policies offer. Their role in bridging the coverage gap once traditional insurance limits are met cannot be understated.

Moreover, the relatively affordable cost of securing substantial coverage amounts further underscores its value proposition. As personal and business assets grow and as our interactions become more complex, the umbrella policy stands out as a crucial tool for risk mitigation.

Whether you’re safeguarding against potential lawsuits, property damage, or unforeseen liabilities, umbrella insurance remains a key component of a comprehensive financial protection strategy.

Part of me wants to say that umbrella insurance is a good idea. The practical part of me wants to think that it is non-sense. I mean, c’mon… insurance on top of insurance? Umbrella policies do nothing but give the big insurance companies more money. How much insurance do we actually need anyways? You guys should write an article about how much money we waste in our lifetimes on insurance coverage.

I agree with Mike, the asset threshold should be lowered.

I’d also recommend you talk with your agent to discuss how this policy works with your homeowners insurance. Homeowners insurance does not cover what it once did, but many would be surprised about the variety of situations in which it will afford some coverage.

Great post! My coworker and I were were discussing this topic this morning. Thanks for the useful information.

I agree that the assets rule of thumb should probably be set lower, depending on where those assets are housed. Very informative.