Doing your own taxes can be an overwhelming and confusing task, especially if you don’t have sufficient experience in tax return filing or if you have a complicated situation.

Since hiring a CPA or other professional can be cost-intensive, many people opt to undertake the task themselves.

Tax software became increasingly popular for preparing and filing federal and state returns, not only because they are reaching new levels of sophistication, but also because filing online saves time and money.

It also makes tax return filing error-free.

FreeTaxUSA is one of the fastest-growing tax platforms and IRS-authorized e-file providers.

Their services are reliable, and they offer free federal filing. Even if you have a complicated financial situation, FreeTaxUSA may be the most suitable tax software for you.

Table of Contents

FreeTaxUSA At A Glance

- Website Is Easy to Navigate and User-Friendly

- Minimal Guidance, Best for Experienced Filers

- Great Pricing

FreeTaxUSA COMPANY INFORMATION

FreeTaxUSA uses an interface that prepares your federal and state returns by taking an online step-by-step interview approach.

As you answer questions and import your information, the software will prepare and fill out your tax return.

Upon completion of your information entry, you can review your return before submitting it to the IRS via mail or e-file. The software interface is user-friendly and intuitive.

If you have no prior experience with tax filing or software, you will be able to find your way through the process with little difficulty.

Keep In Mind

When you enter your information, you can import forms in PDF format from competitor platforms like TurboTax, H&R Block, and TaxAct. You can also import from your internal storage.

When you fill out your information, the interface will not allow you to skip forward.

You will only be able to edit the sections that you are currently working or the ones that you already completed.

FreeTaxUSA supports various complex tax situations, and you will be able to view your tax refund or liability in real-time as you enter your information.

FreeTaxUSA’s Big Features

Affordable Care Act

If you didn’t have healthcare coverage during the tax year, FreeTaxUSA will accommodate any fees that you may have to pay.

The platform will also assist you if you want to claim exemption from the penalty, a valuable asset to many tax filers looking to save.

Refund and Payment Options

You can use a credit or debit card to pay for FreeTaxUSA’s tax preparation and filing services.

If you are eligible for a tax refund, FreeTaxUSA can facilitate the payment through either a direct deposit into your bank account in less than 21 days or through a check, which can take up to six weeks.

Filing After Deadline

If you’ve missed the tax deadline, you may be panicking about getting your taxes filed on your own, let alone getting them filed affordably.

Luckily, FreeTaxUSA offers tax return preparation and filing services at the same price, even after the tax deadline passes.

However, they encourage their clients to file their returns as soon as possible to avoid IRS penalties.

Audit Assist

FreeTaxUSA often receives recognition for the Audit Assist services that they provide to Deluxe clients. With Audit Assist, you gain access to tax and audit specialists that will help you prepare for an IRS audit. They will answer any audit-related questions that you may have.

This service also includes access to FreeTaxUSA’s audit center, which is a knowledge bank that contains information on the audit process.

However, Audit Assist is only applicable to federal returns and not state returns, and FreeTaxUSA doesn’t offer any audit representation services.

Free Tax Calculator

By setting up a FreeTaxUSA account and entering your tax information as well as you can, you can use the platform as a calculator to estimate your taxes, determine your refund or liability, and find deductions and credits like the Child Tax Credit.

After you’ve entered your information, you will see an estimate of your taxes, refund or liability, and credits and deductions.

Since you can view this information without filing your return, you can keep it on record and edit your data before you have to submit.

Accuracy Guarantee

FreeTaxUSA accepts responsibility for all errors on the system’s end. If the IRS imposes interest or penalties for incorrect tax calculations, the company will pay them.

This feature offers peace of mind to filers who don’t want to worry about the financial repercussions of a miscalculation. As long as you’ve entered all your information correctly, you’re covered.

Free Support

Regardless of the FreeTaxUSA version that you use, you can visit their customer support page to search for support topics or email their customer support team if you have a problem.

If you are subscribed to the Deluxe plan, you get access to free support chat and the Q&A database.

Online Backup

FreeTaxUSA backs up all tax returns online and carries information over from one year to the next, even if the client uses the Free version.

If you haven’t used FreeTaxUSA the previous year, you can import your tax information in PDF format from competitor software, your internal storage, or your employer’s platform.

Uploading your PDF in this manner is incredibly easy, and it saves a lot of time.

FreeTaxUSA Plans

FreeTaxUSA offers two versions: Free and Deluxe. There is not a big difference between the two of them regarding the actual process of preparation and filing.

Both support complex tax situations and schedules, and you can use either of them for federal and tax filing. State tax returns, however, cost an additional fee with either version.

One of the significant advantages of FreeTaxUSA as a whole is that both versions support Schedule C filing for self-employment income, Schedule E filing for rental property income, and Schedule D for capital gains transactions.

You can also report several K-1 related income sources with these plans. The difference between the two versions has more to do with the customer support you receive.

Pick a FreeTaxUSA version>>

Free

Clients that select the Free version can prepare and file federal tax returns, they have access to FreeTaxUSA’s e-file service, and their account information is carried over to the next tax year.

Free version clients can also print their tax returns on paper or PDF, backup their completed tax returns online, and file for a federal tax extension.

As mentioned above, they can also use the free platform to prepare and file complex tax returns. State return preparation and filing are not free with this version, however, and the client has to pay $12.95 per state return.

If you are subscribed to the Free plan, you can get additional services at a nominal fee, including:

- Completed Tax Return Amendment

- Priority Customer Assistance

- Professional Return Printing

- Return Printing and Binding

Audit Assist is not available to people who are subscribed to the Free addition as an included or additional service. If you need such assistance, you will have to upgrade to the Deluxe plan.

Deluxe

The Deluxe version costs $6.99 and includes everything in the Free version, as well as Audit Assist and professional printing. As is the case with the Free version, state filing also costs $12.95.

With this version, clients also receive free technical and tax support.

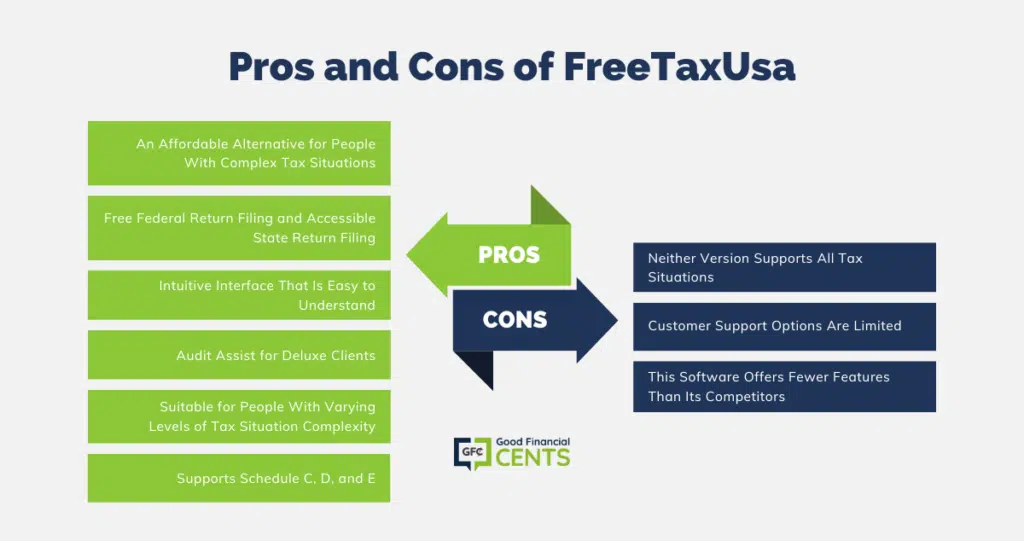

Pros and Cons of Using FreeTaxUSA

How Does FreeTaxUSA Compare?

How does FreeTaxUSA compare to other tax software companies? Check out this table where we compare FreeTaxUSA, Turbo Tax, and H&R Block.

| Company | Best For | Price To File Federal & State |

|---|---|---|

| FreeTaxUSA | Budget-Conscious | $12.95 |

| Turbo Tax | User-Friendly Interface | $29.99 |

| H&R Block | Getting Live Assistance While Filing | $29.99 |

For more information, you can check out the individual reviews of Turbo Tax and H&R Block.

Bottom Line

FreeTaxUSA has a whole host of features to benefit tax filers with both its free and premium versions.

Whether you’re filing the most basic of taxes or facing an impending audit, FreeTaxUSA can help.

Overall, FreeTaxUSA is the best bet for those on a tight budget or those who have a bit of experience filing their taxes.

If you fit one of those descriptions, then FreeTaxUSA could be a great affordable tool for your filing needs.

You can also use my federal income tax guide alongside FreeTaxUSA to work through your taxes this year.

Get started with FreeTaxUSA today>>

How We Review Tax Preparation Software

Good Financial Cents reviews various tax preparation software options, emphasizing user experience, feature sets, and accuracy in calculations. We aim to provide users with a balanced perspective, assisting them during tax season. Our editorial process is transparent and thorough.

We source data from software providers, testing functionalities and evaluating user interfaces. This hands-on approach, combined with our research, ensures a comprehensive review. Each software option is then rated based on its strengths and weaknesses, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate tax preparation software and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

FreeTaxUSA Review

Product Name: FreeTaxUSA

Product Description: FreeTaxUSA is an online tax preparation software that offers a cost-effective solution for individuals and small businesses to file their federal and state taxes. With its user-friendly interface and affordable pricing, it provides a convenient way to complete your tax returns accurately and efficiently.

Summary of FreeTaxUSA

FreeTaxUSA is a feature-rich online tax preparation software that has gained popularity for its affordability and ease of use. It allows users to complete and e-file their federal and state tax returns without the hefty price tag associated with some of the more well-known tax software options. The platform guides users through the tax preparation process step by step, ensuring that all necessary forms and deductions are covered. It also offers a variety of tax tools and calculators to help users maximize their refunds and minimize their liabilities.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Affordable Pricing

- User-Friendly Interface

- Free Federal Filing for Simple Returns

Cons

- Limited Customer Support Options

- Additional Fees for State Filing

- May Not Be Suitable for Complex Returns

FreetaxUSA is not online and our taxes are not finished. What should I do?