Fulton Bank was established in 1882 by local merchants and farmers who wanted to service the banking needs of residents and businesses in the Lancaster, Pennsylvania, region.

The bank began acquiring smaller financial institutions in 1948 and quickly grew to the largest banking firm in the Lancaster County.

Shortly after celebrating its 100th anniversary, Fulton Bank formed a holding company and became the flagship bank of the Fulton Financial Corporation.

Among its wide array of products and services, Fulton offers a variety of home lending options such as fixed-rate and adjustable-rate loans, mortgages backed by the Federal Housing Administration, and the U.S. Department of Agriculture, as well as specialized loans designed for first-time homebuyers.

- Overview

- Rates

- Mortgage Options

- Morgage Qualifications

Table of Contents

Fulton Bank Overview

Since 1882, Fulton Bank has supplied reliable financial services to residents and businesses in the Mid-Atlantic region of the U.S.

The bank’s diverse selection of mortgage options is designed to meet the unique needs of homebuyers at every income level, especially low-to-moderate-income residents.

Program eligibility is determined through a host of financial criteria, including credit scores and histories, debt-to-income ratio, and a government-issued ID.

To help lower-income Americans, Fulton offers a range of government-backed mortgages, including FHA, USDA, and PHFA loans.

The bank also assists these borrowers through closing costs and down payment assistance programs, which can drastically reduce the back-end administrative costs.

First-time homebuyers can benefit from Fulton’s exclusive Homebuyer Advantage Plus® Mortgage product and its First Front Door Program. These products/services were designed to support families in their search for a safe and comfortable environment.

As such, they require no private mortgage insurance and allow for up to 97 percent financing on new purchases.

Fulton Bank Mortgage Rates

Fulton Bank Mortgage Options

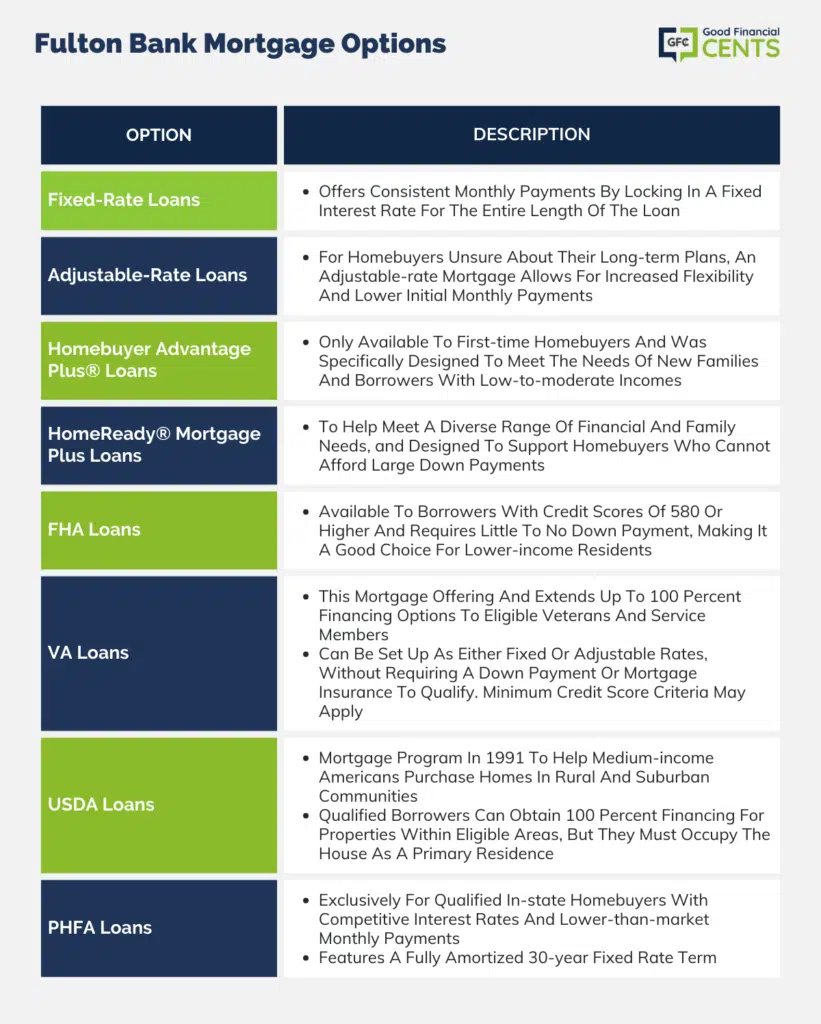

Fulton Bank provides a diverse selection of mortgage offerings that are uniquely tailored to suit the individual needs of its customers.

In addition to conventional fixed-rate and adjustable-rate loans, Fulton also offers government-backed mortgage programs like FHA, VA, USDA, and PHFA loans.

This lender is particularly dedicated to helping low- to moderate-income homebuyers find affordable lending solutions within its service region.

Fulton’s down payment assistance programs ensure that residents of Delaware, Maryland, New Jersey, Pennsylvania, and Virginia have access to plenty of financially viable options to choose from.

Fixed-Rate Loans

This popular mortgage option offers consistent monthly payments by locking in a fixed interest rate for the entire length of the loan.

Fulton Bank allows borrowers to select a loan term between 10 and 30 years, even for multi-unit residential homes. This lender accepts down payments as low as zero percent of the purchase price for qualified applicants.

Adjustable-Rate Loans

For homebuyers unsure about their long-term plans, an adjustable-rate mortgage allows for increased flexibility and lower initial monthly payments.

After the set fixed-rate period, the interest rate and payment amounts may increase or decrease based on how the financial index fluctuates.

It offers borrowers a choice between 1-, 3-, 5-, 7-, 10-, or 15-year fixed-rate periods before the interest rate begins adjusting to market conditions.

Homebuyer Advantage Plus® Loans

This loan option is only available to first-time homebuyers and was specifically designed to meet the needs of new families and borrowers with low-to-moderate incomes.

It offers these loans with low down payments, flexible credit requirements, and the ability to finance up to 97 percent.

Borrowers are not required to obtain private mortgage insurance, though household income restrictions may apply.

HomeReady® Mortgage Plus Loans

To help meet a diverse range of financial and family needs, Fulton Bank provides this flexible mortgage option designed to support homebuyers who cannot afford large down payments.

Borrowers can finance up to 97 percent of the purchase amount and co-borrowers are not required to live in the home.

Private mortgage insurance is not required, but homeownership counseling from a HUD-approved agency is mandatory.

FHA Loans

These government-backed mortgages are sponsored by the Federal Housing Administration and can be negotiated as either fixed or adjustable-rate loans.

This option is available to borrowers with credit scores of 580 or higher and requires little to no down payment, making it a good choice for lower-income residents.

VA Loans

The U.S. Department of Veterans Affairs backs this mortgage offering and extends up to 100 percent financing options to eligible veterans and service members.

VA loans can be set up as either fixed or adjustable rates, without requiring a down payment or mortgage insurance to qualify. Minimum credit score criteria may apply.

USDA Loans

The U.S. Department of Agriculture established this mortgage program in 1991 to help medium-income Americans purchase homes in rural and suburban communities.

Qualified borrowers can obtain 100 percent financing for properties within eligible areas, but they must occupy the house as a primary residence.

PHFA Loans

This loan option was created by The Pennsylvania Housing Finance Agency and is only available to qualified in-state homebuyers.

These mortgages come with a fully amortized 30-year fixed rate term and offer competitive interest rates and lower-than-market monthly payments.

Fulton Bank Mortgage Customer Experience

Fulton Bank operates over 250 branches and specialty offices throughout its multi-state service region.

The bank provides online users with a massive amount of free informational resources, including home-buying tips, mortgage checklists, timely articles on the housing market, and even a complimentary Homebuying 101 course.

Through Fulton’s Framework® resource, borrowers can learn which properties they can afford and which mortgages best suit their long-term goals; it’s also an accepted form of education for most first-time homebuyer incentive programs.

Interested borrowers can obtain a rate quote on the Fulton website by submitting their personal information, but this will require entering a social security number.

In addition to rate quotes, Fulton’s site allows homebuyers to initiate a pre-qualification check that helps speed up the mortgage application process.

Once a suitable mortgage has been found, users can immediately start filling out an online application or contact a Fulton lending specialist directly over the phone.

Fulton Bank’s commitment to helping first-time and lower-income homebuyers is reflected in its diverse payment assistance programs.

In partnership with Operation HOPE, Fulton established a closing cost assistance program that provides eligible borrowers with up to $2,500 for closing costs and $1,000 toward mortgage down payments.

Through its First Front Door Program, the bank supplies qualified first-time homebuyers with a grant of up to $5,000 to help with a down payment and closing costs, but some restrictions apply.

Fulton Bank Grades

Over its 137 years of operation in the U.S., Fulton Bank has been considered one of the most trusted banking and lending institutions in the Mid-Atlantic region, earning accreditation as an Equal Housing Lender and a member of the FDIC.

While the Better Business Bureau does not formally accredit Fulton, it currently holds an A+ rating via the BBB website. Since 2020, 31 customer complaints have been reported to the BBB, few of which reference the company’s mortgage lending products or services.

According to the Consumer Financial Protection Bureau website, no enforcement action has ever been taken against this lender.

- Information collected on October 15, 2023

Fulton Bank Mortgage Qualifications

| Loan Type | Interest Rate Type | Down Payment Requirement |

|---|---|---|

| Fixed-Rate Loans | Fixed-rate | No |

| Adjustable-Rate Loans | Variable-rate | Yes |

| Homebuyer Advantage Plus® Loans | Fixed-rate | Yes |

| HomeReady® Mortgage Plus Loans | Fixed or Variable rate | No |

| FHA Loans | Fixed or Variable rate | Yes |

| VA Loans | Fixed or Variable rate | No |

| USDA Loans | Fixed-rate | No |

| PHFA Loans | Fixed-rate | Yes |

Unlike most lenders, this bank does not require substantial down payments for most of its loans, making it a solid choice for first-time homebuyers or borrowers without significant credit histories.

Each of Fulton Bank’s mortgage products has different qualification guidelines, in part because of the specialized nature of many of its offerings.

Most of Fulton’s income-based programs have earning limits that ensure low-to-moderate-income applicants have the best chance of securing an affordable mortgage.

Fulton Bank considers its applicants’ credit scores and credit histories when determining what interest rates it can offer, though options like the FHA loan are open to borrowers with scores as low as 580. This information helps lending experts understand the degree of risk involved.

According to FICO, the industry-standard credit score is 740, but homebuyers with lower scores should still apply or speak with a lending representative to learn more about their options.

Fulton Bank Phone Number & Additional Details

- Homepage URL: https://www.fultonbank.com/

- Company Phone: 1-800-220-9034

- Headquarters Address: 1 Penn Square, PO Box 4887, Lancaster, PA-17602

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability.

Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation.

Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Fulton Bank Review

Product Name: Fulton Bank

Product Description: Fulton Bank, a subsidiary of Fulton Financial Corporation, is a regional banking institution with a strong presence in the Mid-Atlantic U.S. Offering a range of financial products, from personal banking and loans to business services, Fulton Bank prides itself on community-focused values and personalized customer service.

Summary of Fulton Bank

Established in 1882, Fulton Bank has woven itself into the fabric of the communities it serves, expanding over the decades to hold a significant place in the Mid-Atlantic banking landscape. With a network of branches across several states, Fulton Bank balances the resources of a larger bank with the local touch of a community institution. Their services encompass personal checking and savings accounts, mortgages, wealth management, as well as diverse business banking solutions. Guided by a mission of building trusted relationships, the bank emphasizes personalized service, community engagement, and financial education.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Community-Centric Approach: A deep-rooted commitment to serving and uplifting local communities.

- Comprehensive Service Range: Offers a full spectrum of banking and financial services catering to individual and business needs.

- Personalized Service: Being a regional bank, it provides more tailored and personal interactions for its customers.

- Stable Reputation: A history spanning over a century, denoting trustworthiness and resilience.

Cons

- Limited Regional Presence: Primarily serves the Mid-Atlantic U.S., which might be limiting for those outside this region.

- Digital Platform Limitations: While they offer online banking, their digital platforms may not be as advanced or feature-rich as larger national banks.

- Fewer Ancillary Services: Compared to major banks, might lack some specialized services or offerings.

- Branch and ATM Availability: The network might not be as expansive as national competitors, potentially affecting accessibility.