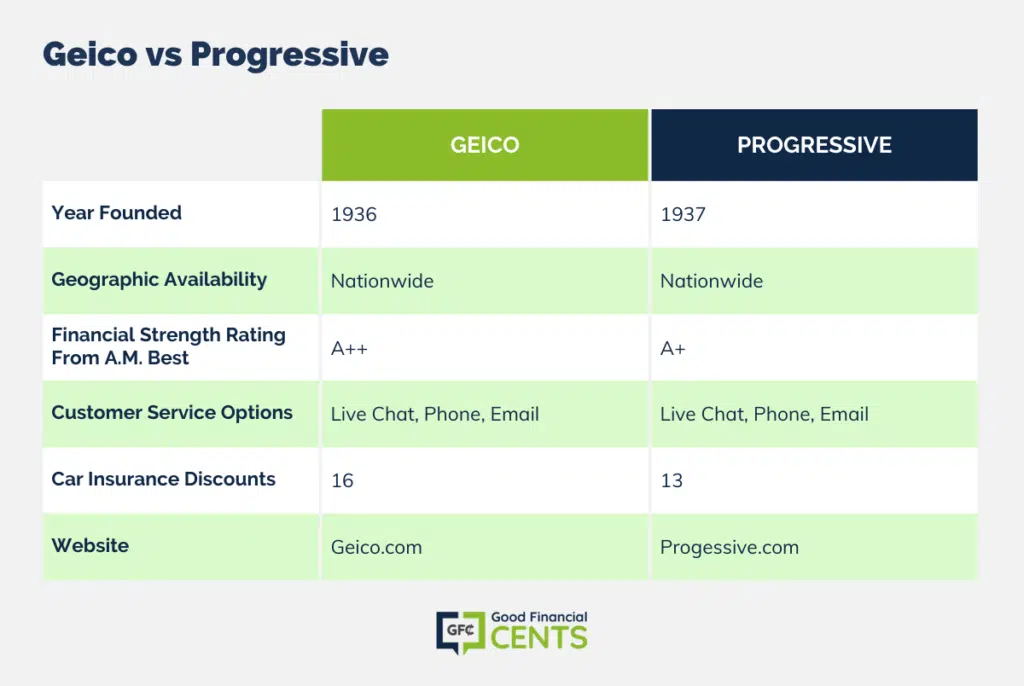

Geico and Progressive are two of the most popular insurance companies in operation today, and they both offer a range of useful insurance products. For example, Geico and Progressive offer auto insurance, homeowners insurance, renters insurance, and umbrella insurance. Both companies also offer a range of discounts that can help you save on premiums, and they both make it possible to get a free quote for car insurance online.

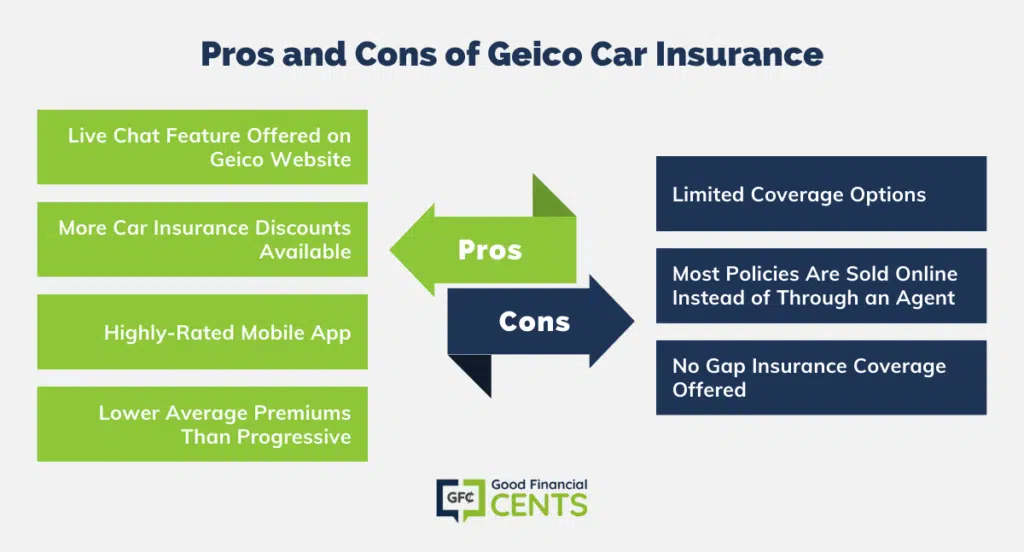

Still, there are definitely some instances where one of these companies comes out ahead. For example, Geico car insurance rates came in considerably lower than quotes from Progressive across four different driver profiles we compared. Geico also offers more insurance discounts overall, although Progressive offers more types of coverage you can use to tailor your car insurance company to your needs.

Table of Contents

- Geico Car Insurance

- Progressive Car Insurance

- How Do Geico and Progressive Compare?

- Geico vs Progressive Car Insurance Discounts

- Geico vs Progressive Customer Satisfaction

- Geico vs Progressive: Which Is Better Overall?

- The Bottom Line: Geico vs. Progressive: Choosing Your Car Insurance

- Frequently Asked Questions (FAQ)

If you’re in the market for car insurance and considering both Geico and Progressive, you should find out more about their coverage options, discounts, and ratings from third parties. Read on to learn more about Geico and Progressive car insurance offerings and how these two companies stack up.

Geico Car Insurance

Founded in 1936 in Fort Worth, Texas, Geico has been offering various types of insurance since 1936. In terms of their car insurance, they aim to offer affordable rates and world-class customer service. Geico also offers a top-rated mobile app and numerous car insurance discounts that can help you save on premiums.

When it comes to their car insurance offerings, Geico offers bodily injury coverage, property damage coverage, and uninsured motorist coverage as standard in their policies. Add-ons that can help you customize your car insurance policy include:

- Collision coverage

- Comprehensive coverage

- Medical coverages

- Emergency roadside assistance

- Rental reimbursement coverage

- Mechanical breakdown insurance

- Rideshare insurance

Progressive Car Insurance

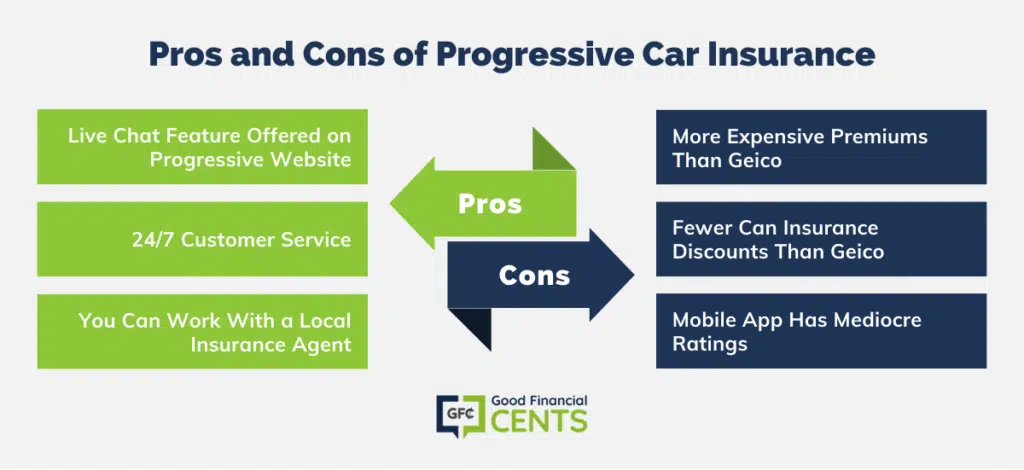

Progressive Insurance was founded in March of 1937, and the company actually got its start as a car insurance company. However, Progressive added more coverage options over the years, and they now offer a range of insurance products geared to homeowners, car owners, and families. Like Geico, Progressive offers some standard insurance coverage options, including bodily injury liability and property damage liability. However, you can also customize your policy with add-ons such as:

- Comprehensive coverage

- Collision coverage

- Uninsured and underinsured motorist coverage

- Medical payments coverage

- Loan and lease payoff coverage

- Rental car reimbursement

- Custom parts and equipment value

- Rideshare coverage

- Roadside assistance

Read our Progressive Auto Insurance Review for more details.

How Do Geico and Progressive Compare?

Geico vs Progressive Car Insurance Quotes

Price is one of the biggest factors to compare when you’re shopping around for car insurance. After all, you want to make sure you’re getting the best deal, and that you’re paying a fair price for the types and amount of coverage you really want.

With that in mind, we got quotes from both Progressive and Geico for different types of drivers, including a 23-year-old male, a 23-year-old female, a 53-year-old male, and a 53-year-old female.

For the purpose of these quotes, we said the drivers are single and live in Houston, Texas (Zip Code 77001). We also said they drive a 2018 Toyota Camry and put on approximately 12,000 miles per year. None of the drivers have had any accidents or violations in the past three years, they all rent their homes, and they all have a college degree.

Geico Car Insurance Rates

| Coverage / Driver Profile | Male, 23 | Female, 23 | Male, 53 | Female, 53 |

| Rate for State Minimum –30/60/25 – Liability Only | $399 | $456 | $278 | $292 |

| With Un/Under-Insured Motorist and Collision & Comprehensive | $1,051 | $1,113 | $714 | $748 |

| 50/100/50 – Liability Only | $435 | $498 | $302 | $317 |

| With Un/Under-Insured Motorist and Collision & Comprehensive | $1,114 | $1,215 | $770 | $816 |

| 100/300/100 – Liability Only | $499 | $561 | $345 | $363 |

| With Un/Under-Insured Motorist and Collision & Comprehensive | $1,112 | $1275 | $854 | $915 |

Progressive Car Insurance Rates

| Coverage / Driver Profile | Male, 23 | Female, 23 | Male, 53 | Female, 53 |

| Rate for State Minimum –30/60/25 – Liability Only | $552 | $522 | $370 | $364 |

| With Un/Under-insured Motorist and Collision & Comprehensive | $1,356 | $1,226 | $838 | $838 |

| 50/100/50 – Liability Only | $588 | $556 | $400 | $390 |

| With Un/Under-Insured Motorist and Collision & Comprehensive | $1,432 | $1,314 | $970 | $892 |

| 100/300/100 – Liability Only | $654 | $616 | $436 | $422 |

| With Un/Under-Insured Motorist and Collision & Comprehensive | $1,548 | $1,444 | $1,012 | $912 |

As you can see from the two quote charts above, Geico comes out ahead in terms of affordability across nearly every driver profile. In fact, Geico is easily hundreds of dollars cheaper for almost every tier of coverage, gender, and age group.

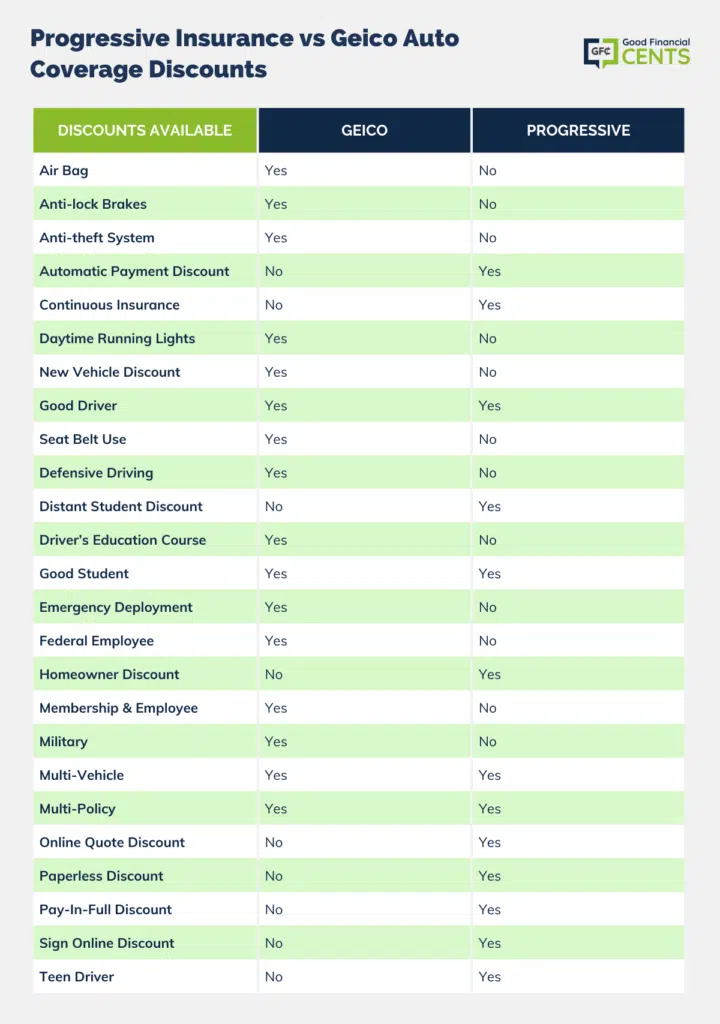

Geico vs Progressive Car Insurance Discounts

When it comes to getting an affordable rate on car insurance, the discounts you can qualify for can play a role. This is especially true since car insurance companies let you “stack” discounts for even more savings.

The more discounts you can qualify for, the lower your car insurance premiums typically go. The chart below shows how Progressive Insurance vs Geico auto coverage discounts compare.

Geico vs Progressive Customer Satisfaction

While the cost of car insurance premiums and eligible discounts are worth comparing, you’ll also want to know about general customer satisfaction ratings across companies you consider. After all, there’s a lot more to having insurance than just purchasing a policy. You’ll want to know what to expect if you encounter a problem or you wind up having to file a claim.

To get an idea of customer satisfaction, we looked at J.D. Power’s 2023 U.S. Auto Insurance Study. This study measured customer satisfaction with auto insurance in 11 geographic regions, and both Geico and Progressive performed rather well. The chart below shows how each company ranked in all 11 geographic regions profiled.

J.D. Power’s 2023 U.S. Auto Insurance Study

As you can see, Geico ranked higher than Progressive in nearly every region across the United States.

J.D. Power’s 2023 U.S. Auto Insurance Claims Satisfaction Study

When it comes to auto insurance claims satisfaction, Geico also scored considerably better than Progressive. In fact, J.D. Power’s 2023 U.S. Auto Insurance Claims Satisfaction Study awarded Geico 8th place overall with 881 out of 1,000 possible points, yet Progressive earned the 17th spot with 862 out of 1,000 possible points.

By contrast, the industry average score in this study worked out to 880 out of 1,000 possible points.

Geico vs Progressive: Which Is Better Overall?

Before you can choose between these two auto insurance providers, you should take the time to get a free car insurance quote from each. Despite the fact that our example quotes showed Geico offering considerably lower premiums, you may find the opposite when you get a quote that takes your age, your location, your driving history, and all other factors into account.

Also consider the instances where one of these companies may work better for you based on coverages you want, your desired consumer experience, and more.

When to Choose Geico Car Insurance

- You can qualify for more discounts with Geico. If you’re a federal employee or you can get Geico car insurance discounts due to the organizations you belong to, you may be better off with this insurance provider.

- You prefer to purchase car insurance online. Geico’s easy online quote progress lets you purchase insurance without leaving your home or having to speak with an agent.

- A highly-rated mobile app is important to you. Geico’s mobile app is rated considerably higher than the comparable app from Progressive Insurance.

- Geico offers lower car insurance rates than Progressive. If Geico offers lower car insurance rates than Progressive when you take the time to get quotes from each company, that’s a sure sign you should choose them instead.

When to Choose Progressive Car Insurance

- You want to purchase gap insurance. If you want to purchase gap insurance, you’ll have to go with Progressive since Geico doesn’t offer this type of coverage.

- You want access to various payment discounts, including paperless billing discounts and discounts for paying six months of premiums in full. It’s possible you could pay lower premiums with Progressive based on the payment discounts they offer.

- You want to work with a local agent to buy coverage. Progressive works with agents in all 50 states, so there’s a good chance a local agent can help you build your policy.

- Progressive offers lower car insurance rates than Geico. If you get car insurance quotes and Progressive comes in considerably cheaper for similar coverage, that’s a good sign you should choose them.

The Bottom Line: Geico vs. Progressive: Choosing Your Car Insurance

Both Geico and Progressive are worth considering as you shop around for car insurance. However, the right car insurance company for you really depends on the types of coverage you want, potential discounts you can qualify for, and the level of customer service you want to receive.

Our advice? Compare car insurance quotes from Geico, Progressive, and a few other companies before you decide. That way, you’ll know you’re getting the best coverage possible for a price you can afford.

Frequently Asked Questions (FAQ)

Is Geico good about paying claims?

In J.D. Power’s 2021 U.S. Auto Insurance Claims Satisfaction Study, Geico earned 8th place overall with 881 out of 1,000 possible points. This compares to the industry average of 880 out of 1,000 possible points. In other words, Geico is about average when it comes to auto insurance claims satisfaction.

Is Progressive good about paying claims?

In J.D. Power’s 2021 U.S. Auto Insurance Claims Satisfaction Study, Progressive earned 17th place overall with 862 out of 1,000 possible points. This compares to the industry average of 880 out of 1,000 possible points. In other words, Progressive scores are lower than average when it comes to auto insurance claims satisfaction.

Is Geico owned by Progressive?

No, Geico is not owned by Progressive Insurance.

Does Warren Buffet own Geico?

Warren Buffet first purchased shares of Geico in 1951. In 1996, Geico became a wholly-owned subsidiary of Berkshire Hathaway.

Is Geico car insurance really cheaper?

Your car insurance rates will depend on factors such as your age, your gender, where you live, your credit score, and your driving history. However, Geico did offer considerably cheaper premiums overall when compared to Progressive in our internal study.