With all the many different investment apps and robo-advisor platforms available today, brokerage accounts may be in danger of getting lost in the shuffle.

But rest assured, brokerage accounts are alive and well. They’re the primary investment platforms used by self-directed investors to trade and invest in the largest number of securities possible.

Table of Contents

- What Is a Brokerage Account?

- What Is a Brokerage Margin Account?

- How Margin Investing Works

- What Kinds of Investments Can You Hold in a Brokerage Account?

- Brokerage Accounts We’ve Reviewed on Good Financial Cents

- Alternatives to Brokerage Accounts if You Don’t Want to Manage Your Own Investments

- Is a Brokerage Account a Good Idea?

What Is a Brokerage Account?

Brokerage accounts are offered by major investment firms and even a lot of smaller ones. Though they often offer one or more managed portfolio options, their primary purpose is self-directed investing.

You open a brokerage account with the primary purpose of managing your own investments and choosing your own securities.

Most brokerage accounts today are fully online, allowing easy self-directed trading. Most also offer mobile apps providing all the same services available with the web-based platform.

There are two major types of brokerage firms: discount and full-service brokers. However, the lines between the two have dulled in recent years.

While there are still a number of small, truly full-service brokers, they seem to be disappearing fast. You may call in an order to a live account representative who will execute trades for you.

Or the account representative may even choose the securities you’ll invest in. Because of the live assistance factor, you may pay a commission of anywhere from $20 to $50 per trade.

With the rise of online trading, the vast majority of brokerages – particularly the larger ones – fall into the discount brokerage category. But there’s a big difference here as well.

There are some discount brokerages that charge very low trading commissions but also offer very little in the way of life assistance.

More common are discount brokers that offer full-service assistance. For example, they may charge very low commissions on trades but offer a wealth of trading tools and resources, as well as extensive customer service.

Brokerage Account Security

Brokerage accounts lack the FDIC insurance that protects bank accounts, but they almost always offer coverage from the Securities Investor Protection Corporation, or SIPC, which performs a similar function.

Your brokerage account is protected for up to $500,000 in cash and securities, including up to $250,000 in cash. The coverage protects against broker failure and not against losses due to market factors.

Many brokerage firms also offer additional coverage from private insurance companies. The additional coverage may extend to portfolios of many millions of dollars.

This will be an important feature if you have an account balance over $500,000, and you should investigate this additional coverage if you do.

Brokerage Accounts Can Be Used for Taxable Accounts or Retirement Accounts

Brokerage accounts are typically available for both taxable accounts and tax-sheltered retirement accounts. Taxable accounts can be maintained as either joint or individual accounts.

Contributions to these accounts are not tax-deductible, and you will pay taxes on investment gains earned through the account.

Most brokerages also offer trusts, custodial accounts, and 529 college savings plans.

Retirement Plans Available for Brokerage Accounts

Increasingly popular in recent years are tax-sheltered retirement plans held in brokerage accounts. These are accounts that can be funded with tax-deductible contributions and allow your investment income to grow on a tax-deferred basis.

The major limitation is that brokerage accounts are designed for self-directed retirement plans, not employer-sponsored plans (though some do offer their services through employer plans).

Examples of tax-sheltered retirement plans available with brokerage accounts include:

- Traditional IRA: You can generally make a tax-deductible contribution of up to $7,000 per year, or $8,000 if you’re 50 or older. You can begin taking withdrawals subject to ordinary income tax, beginning at age 59 ½.

- Roth IRA: This is a variation of the traditional IRA, with two major exceptions: your contributions are not tax-deductible, and withdrawals may be taken tax-free once you reach age 59 ½, and have been in the plan for at least five years.

- SIMPLE IRA: This is an enhanced IRA, that allows tax-deductible contributions up to $16,000 per year, or $19,500 if you’re 50 or older.

- SEP IRA: Provides for tax-deductible contributions of up to 25% of your income, up to a maximum of $69,000.

- Solo 401(k): This is basically a 401(k) plan for an individual. You can contribute up to $23,000 per year, or $30,500 if you’re 50 or older, as an employee contribution.

But you can also make employer contributions up to 25% of your income. Total employer and employee contributions can be as high as $69,000.

Most brokerage accounts will also allow you to do rollovers of employer-sponsored retirement plans into any of these account types.

| RETIREMENT PLAN | DESCRIPTION |

| Traditional IRA | Tax-Deductible Contributions, Taxable Withdrawals From Age 59 1/2 |

| Roth IRA | Non-tax-Deductible Contributions, Tax-Free Withdrawals From Age 59 1/2 and 5 Years |

| SIMPLE IRA | Enhanced IRA With Tax-Deductible Contributions, Taxable Withdrawals From Age 59 1/2 |

| SEP IRA | Tax-Deductible Contributions up to 25% of Income, Max $69,000, Taxable Withdrawals From Age 59 1/2 |

| Solo 401(k) | Individual 401(k) With Employee and Employer Contributions, Taxable Withdrawals From Age 59 1/2 |

What Is a Brokerage Margin Account?

Most brokerage firms offer two types of accounts: a cash account and a margin account.

A cash account is a basic investment account in which the amount you can invest is limited to the amount of cash you deposit into your account. For example, if your account has $100,000 in it, your investments will be limited to no more than $100,000.

A margin account brings leverage into the picture. It functions similarly to a cash account, except you’re able to purchase investments on margin. That is, you can purchase security, which is partly a cash investment and partially a loan provided by the broker.

There are strict limits to margin accounts under federal law.

First, the maximum you can borrow on any security purchase is 50%, with the remaining investment coming from your own funds.

Second, you must have a minimum investment of 25% in the security at all times. Many brokers impose a higher limit, typically 30%.

If your investment falls below 25% or 30%, you’ll be subject to a margin call. That’s where the broker informs you that you must deposit additional cash to bring your investment up to the required minimum.

How Margin Investing Works

The advantage of a margin account is that you can purchase more stock with less cash. For example, if you have $5,000, you can purchase $10,000 of a specific stock using a margin account.

You’ll be required to pay interest on the borrowed portion, payable to the broker, for as long as you own the margined position.

But if the stock rises to $20,000, you’ll make a $15,000 profit (minus interest paid on the margin loan) on your $5,000 cash investment. That’s a gain of nearly 300% on your original investment.

By contrast, purchasing the same stock all cash at $5,000 would produce only a $5,000 profit. That’s a gain of just 100% on your initial investment.

You should also be aware that it’s possible to lose 100% of your investment if the stock you purchase were to suddenly fall by 50% or more. It’s high-risk investing, and best left for very experienced investors.

Also, be aware that margin accounts are not available with retirement accounts. This is because borrowing to purchase investments is not permitted in retirement accounts.

What Kinds of Investments Can You Hold in a Brokerage Account?

The range of investments you can hold in a brokerage account is practically unlimited.

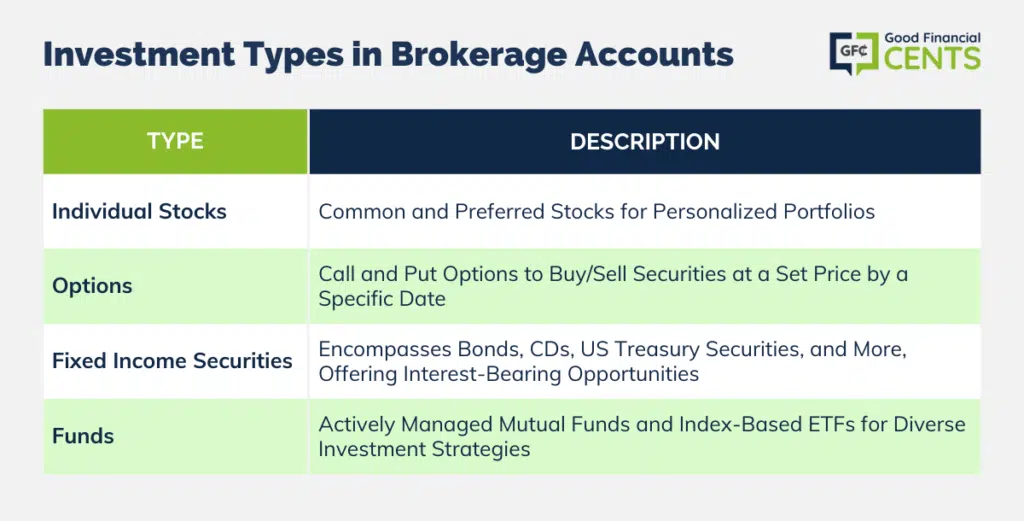

Some of the most common examples include:

Individual Stocks

These include both common stocks and preferred stocks. You can even create a portfolio of individual stocks you hold in your account.

Options

These have become increasingly popular in recent years, even in retirement accounts. You can place both call and put options, giving you the right to buy or sell individual security at a specific price by a designated expiration date.

It gives you the ability to capitalize on a major price swing in the security without putting up a lot of capital upfront.

Fixed Income Securities

Though the common term for these is “bonds,” it actually encompasses a broad range of interest-bearing securities.

This can include bonds issued by corporations, state and local governments, foreign governments and corporations, US Treasury securities, certificates of deposit, and tax-exempt municipal bonds.

Funds

These include both mutual funds and exchange-traded funds (ETFs). Mutual funds are actively managed portfolios of stocks and other securities that attempt to outperform the market. ETFs are generally index-based funds that track popular market indexes.

They don’t attempt to outperform the market, but they don’t underperform it either. Generally speaking, mutual funds have higher investment fees than ETFs.

Real Estate Investment Trusts (REITs)

Essentially, mutual funds for commercial real estate represent a portfolio of many different properties. It’s a way for small investors to invest in a diversified portfolio of properties with a small amount of capital.

REITs tend to pay high dividends, which makes them excellent for income investors and retirees.

This isn’t the entire list of investments available with brokerage accounts, but it does cover the basics.

Brokerage Accounts We’ve Reviewed on Good Financial Cents

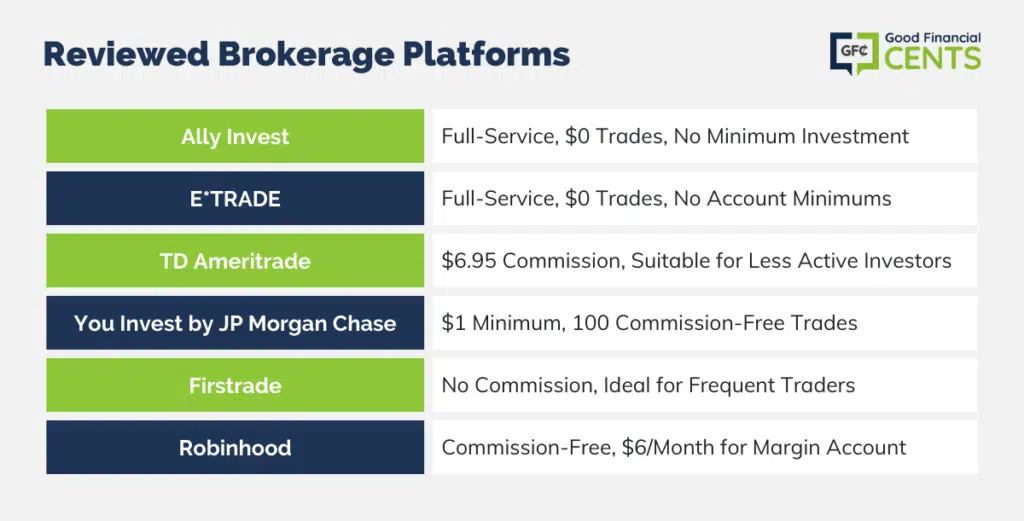

- Ally Invest is a discount broker offering full services. It requires no minimum initial investment, and you can trade stocks, ETFs, and options at $0 per trade.

- E*TRADE is another full-service type discount broker coming in at $0 trades for stocks and ETFs and no account minimums.

- TD Ameritrade has no minimum initial investment and charges a $6.95 commission for trades. It’s a good choice for less active investors, who also want to take advantage of the banking services offered by TD Bank.

- You Invest by JP Morgan Chase is the largest bank in the country and also offers its own brokerage platform. You can open an account with as little as $1, and get 100 commission free-stock and ETF trades for a full year. After that, the commission is just $2.95 per trade.

- Firstrade has no minimum initial investment requirement and currently charges no commission for stocks, ETFs, mutual funds, and options. It may be the ultimate go-to brokerage account for frequent traders.

- Robinhood is another commission-free investment brokerage platform, though they do charge $6 per month if you open a margin account. You can trade in more than 5,000 stocks and ETFs, as well as cryptocurrencies and options.

There is no minimum investment requirement, but the account does come with certain definite limitations.

For example, you can’t open a retirement account. There’s also no ability to trade bonds, mutual funds, or REITs. There’s also very limited customer service, and they don’t permit day trading.

Alternatives to Brokerage Accounts if You Don’t Want to Manage Your Own Investments

Self-directed investing isn’t for everyone. If that description fits you, there are online, automated investment platforms commonly referred to as robo-advisors. They’ll create and fully manage a diversified portfolio of stocks and bonds for you.

Some will even invest in real estate and commodities. It’s all done for a very small annual fee. All you’ll need to do is fund your account, and the robo-advisor will handle everything else for you.

Some of the best robo-advisors available include:

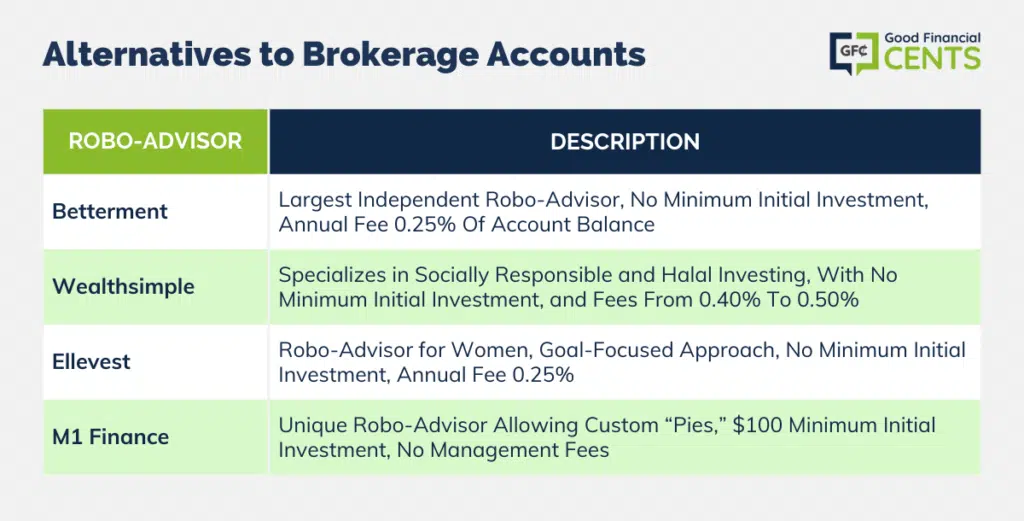

- Betterment is the largest independent robo-advisor in the industry, and perhaps the most innovative. There is no minimum initial investment requirement, and most accounts will be managed for an annual fee of 0.25% of your account balance.

A $10,000 account can be managed for $25 per year, while a $100,000 account can be managed for just $250.

- Wealthsimple works similarly to Betterment, except that it specializes in socially responsible investing, as well as Halal investing for followers of the Islamic faith.

There is no minimum initial investment requirement, and the annual fee is 0.50% for accounts below $100,000 and 0.40% for higher balances.

- Ellevest is a robo-advisor that specializes in investing for women, taking their specific financial concerns into consideration. It uses a goal-focused investment approach, requires no minimum initial investment, and has an annual fee of just 0.25%.

- M1 Finance is unique among robo-advisors. It gives you the ability to create your own mini investment portfolios, referred to as “pies”. They have preselected pies, but you can also create your own.

Once you create a pie, it’s fully managed for you, robo-advisor style. It requires a minimum initial investment of $100 but charges no fees to manage your pies.

Is a Brokerage Account a Good Idea?

In today’s world of expanded investment options, there is a brokerage account to fit just about any investor preference or niche.

You can choose an account that offers low trading fees and plenty of customer support. Or you can go with one that charges no commissions but offers very little customer support.

You can also get virtually unlimited options, investing in individual stocks, bonds, mutual funds, ETFs, REITs, or even options. Accounts are available for both taxable brokerage accounts and retirement accounts.

And if you’re not comfortable choosing and managing your own investments, you can always opt for a robo-advisor.

They provide portfolio creation and full management of every aspect of your account, all at a very low fee. All you’ll need to do is fund your account on a regular basis and watch it grow.

You can even get the benefit of both by holding some of your portfolios with a robo-advisor and the rest in a self-directed brokerage account. And that’s the point – it’s completely up to you!