When it comes to investing for retirement, there are more than a few strategies to consider. Many investors play it safe by leaning heavily on their work-sponsored 401(k) accounts while others diversify with a Roth IRA or traditional IRA. Some investors who want to get fancy with their retirement buy annuities or invest in peer-to-peer lending opportunities like Lending Club.

Then there are investors who feel bold enough to take the reins with a self-directed IRA. With this option, individuals can invest their funds in any number of ventures while gaining meaningful tax advantages.

What Is a Self-Directed IRA?

Table of Contents

Before we dive into the intricacies of using an IRA to invest in real estate, let’s first talk about the investment vehicle that allows this to happen – the self-directed IRA. While it might sound daunting, a self-directed IRA isn’t that different from any other type of IRA. What makes these plans unique is the fact that you have many more investment options available, and the overall direction of your investing plan comes from you.

While most IRAs only allow you to invest in stocks, bonds, CDs, and mutual funds, self-directed IRAs let you invest your money into other, more flexible investments. Options can include real estate, notes, and tax lien certificates, to name a few. While a self-directed IRA won’t work for everyone, it can be a smart option for individuals who are extremely knowledgeable about certain industries.

When you’re able to “invest in what you know,” you have the potential for greater returns over time.

Why Invest in Real Estate Through an IRA?

With real estate prices near all-time highs throughout the country, it’s no wonder many people have considered investing some of their self-directed IRA funds into housing or commercial property. By investing some of your IRA funds in real estate, you can defer or potentially eliminate taxes while having the potential for a robust return on your money.

While your primary residence may not be seen as a real “investment” since you have to live there, income-generating rental or commercial real estate properties can be prudent investments that bring in solid returns while also growing in value.

The benefit of investing self-directed IRA funds into real estate is simple. Not only will the property you purchase have the potential to appreciate in value, but all of the income that you receive will be tax-deferred. This includes both rental income and capital gains. Investing in real estate is also a smart way to diversify your retirement portfolio such that it is less reliant on stocks and bonds. With all of these perks, it’s no wonder that investing in real estate has become a popular option.

Unfortunately, there are some rules governing self-directed IRAs that make investing in real estate a difficult proposition. Due to these stipulations, there’s more to using a self-directed IRA for real estate investing than just selecting a property.

For example:

- You can only invest self-directed IRA funds into property used for business purposes. You cannot use your IRA to buy a second home, an occasional rental, or a personal residence.

- You need enough money to buy properties in cash. Because IRA rules prohibit the use of a mortgage within them, you cannot borrow money to purchase property within your IRA. You must have the funds to purchase properties outright. This could be a difficult feat depending on real estate prices and how much you want to invest.

- The process may take months or years. Individuals who want to invest their self-directed IRA funds into real estate should plan on spending months or years to bring their idea to fruition. Not only will you have to open the proper accounts and roll your assets over, but you’ll have to search for the right property, too. In a hot real estate market, it can take months to find a property that fits your goals. Once you do, it takes more time to get an offer accepted, and then even longer for the sale to close.

- You cannot take advantage of your IRA investments until you retire. Due to the way self-directed IRAs are set up, your real estate investment cannot be altered to meet your personal needs. For example, you cannot move into the property if you wish to live there later on.

- Being a landlord isn’t for the faint of heart. Even if buying real estate within a self-directed IRA seems smart on paper, you should not underestimate the time investment required. It takes time to find tenants, and you’ll be responsible for initiating repairs and upkeep. All money used for repairs will be paid out of the IRA, but you’ll need all expenses approved by the IRA custodian. There’s quite a bit of paperwork involved with holding real estate in a self-directed IRA, all of which will fall into your hands.

Another Way to Invest in Real Estate: Fundrise

I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own.

| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

If you’re an investor who likes the idea of investing self-directed IRA funds into real estate but doesn’t necessarily want to become a landlord, keep in mind that there’s another way. With the real estate investing platform Fundrise, you can invest in real estate offerings that provide exposure to diverse pools of real estate investments.

With Fundrise, you can invest in real estate without actually buying physical real estate. This strategy allows you to enjoy the upsides of real estate investing (strong returns, potential for growth, etc.) without enduring the potential downsides of renting property or dealing with tenants.

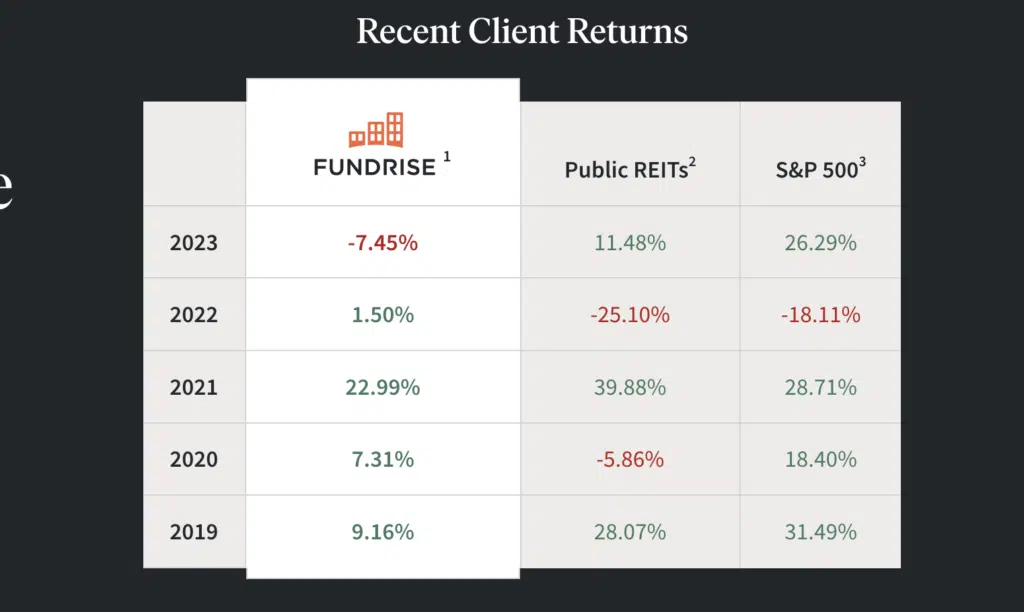

And, so far, the returns have been amazing. Fundrise reports average returns between -7.45 percent and 22.99 percent over the last five years.

If you’re up for investing your self-directed IRA funds with Fundrise, you’ll do so via Fundrise’s partnering IRA custodian, Millennium Trust Company. Here are the steps involved:

Advantages of Investing With Fundrise

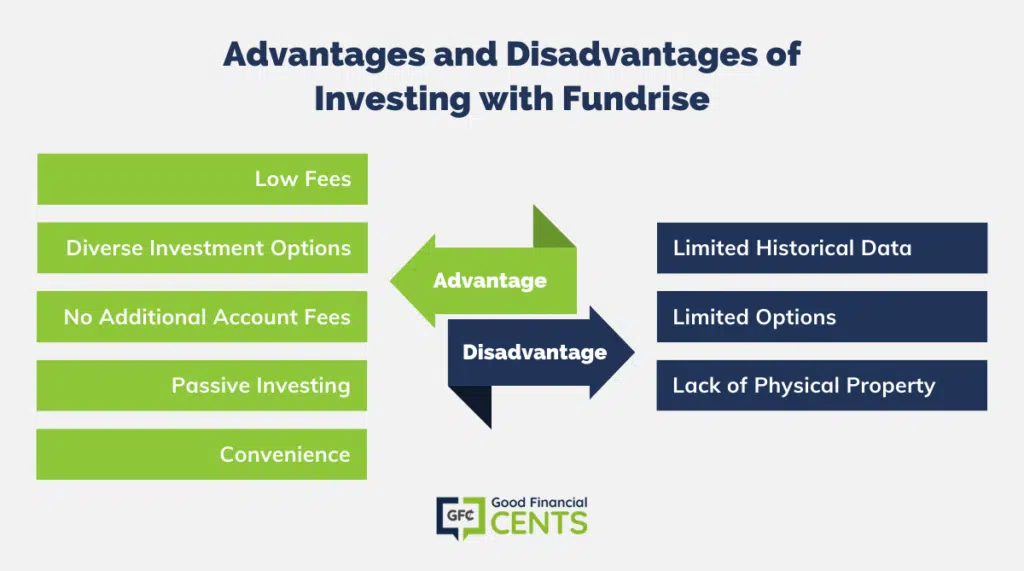

While no investment on Earth is foolproof, investing in Fundrise comes with a ton of advantages that are difficult to secure elsewhere. Here are some of the biggest benefits that come with investing your self-directed IRA funds with Fundrise:

- Fundrise charges fairly low fees for their services. Fundrise charges investors a 0.15% advisory fee, which means over a 12-month period, investors will pay a $1.50 advisory fee for every $1,000 they have invested. If you’re keen on minimizing fees and don’t want all the expenses that come with owning physical real estate, this is a good alternative.

- You can invest in multiple funds. Fundrise offers a variety of investment options to choose from. For instance, you can invest in geographically focused funds that target assets in specific regions of the country such as the East or West Coasts, or you can invest in thematic funds that follow a specific investing strategy, such as using opportunistic equity ownership to maximize long-term appreciation potential.

- Fundrise accounts are free. While Millennium Trust Company does charge an annual fee for managing your real estate investments, Fundrise has negotiated a favorable fee structure on behalf of its investors. In addition to this benefit, there are no special or added fees charged by Fundrise for investing through an IRA account. Moreover, you are welcome to sign up for an account, explore investment options, and get your questions answered without any commitment.

- Investing through Fundrise requires limited legwork. Where owning a rental property can be a huge headache, investing in real estate through Fundrise is as passive as it gets. You’ll never have to deal with leasing, scheduling repairs, or handling the daily hassles that come with owning physical real estate.

- Invest from the comfort of your home. Where shopping for physical real estate can be tiresome and time-consuming, investing in real estate through Fundrise is a breeze. You won’t have to leave your home or travel the country to find the best real estate deal. You can go through the entire process online without ever leaving your home.

Disadvantages of Investing in Fundrise

While investing in Fundrise can be a smart idea for some people, that doesn’t mean it’s the right option for everyone. Here are a few reasons you should think long and hard before opening a self-directed IRA and/or investing in Fundrise.

- Fundrise is still fairly new. Since Fundrise wasn’t founded until 2012, there’s not enough historical data to say where returns could go in the next five, ten, or twenty years. Since your IRA is a long-term investment vehicle that is meant to fund your retirement, you’ll need to be sure Fundrise will be around for the long run.

- There are limited investment options available. Fundrise has limited investment options available, and that’s especially true when it comes to investing through your self-directed IRA. If you want to choose from hundreds of different investment options, Fundrise isn’t the best choice.

- You won’t get to pick individual investment properties. While there are notable advantages that come with passive and diversified real estate investing through Fundrise, it isn’t the same as purchasing real estate outright. If you like the physical component of buying a property you can walk through and touch, Fundrise may not be for you.

Is Investing in Fundrise for You?

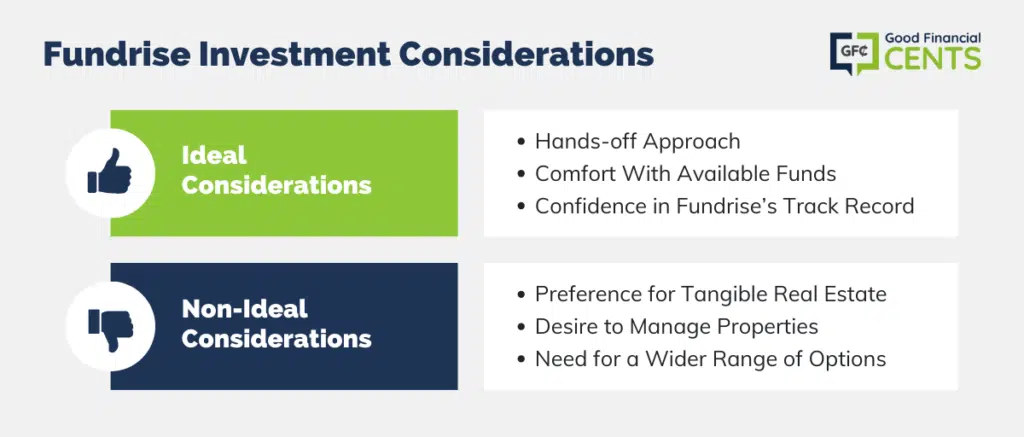

While there is no perfect formula for the ideal Fundrise investor, there are some signs to look for that can help you determine whether this strategy is a good fit for your lifestyle and portfolio.

Considerations in Investing Your Self-Directed IRA Funds

- You want to take a “hands-off” approach to real estate investing;

- You’re comfortable with the real estate funds and eREITs available through the platform; and

- You feel confident in Fundrise’s track record.

Instances Not to Consider Investing in Fundrise

- You want to buy real estate you can touch;

- You prefer to deal with the everyday tasks of managing real estate; and

- You want to choose from a more expansive array of options.

The Bottom Line

If you’re an accomplished investor who feels comfortable opening a self-directed IRA, then Fundrise might be the ideal investment for you. By investing your money on the platform, you can diversify your portfolio while setting yourself up for impressive gains that have exceeded many other investment options over the last five years.

Still, it’s important to educate yourself on Fundrise and why it’s advantageous for investors. If you want to dig a little deeper into how the platform works, I highly suggest that you look over their website, and specifically their FAQs.

The best part about investing on this platform is that you can get a taste of real estate without the hassle and stress of becoming a landlord. You won’t have to get your hands dirty, deal with leasing vacant space, or evict anyone – ever.

Like any other investment, however, there are risks involved with investing in Fundrise. Make sure you understand how the platform works, the benefits of using a self-directed IRA, and the pitfalls you may face before you sign up. While investing your self-directed IRA funds into real estate can be a boon for your finances, you should make sure that any decision you make is an informed one.

Thanks for the post Jeff I never really knew how a self directed IRA worked this is some great information.

I’m not sure how sustainable these nice returns are since like you mentioned the company has only been around since 2012. The next market correction/real estate drop will really test the mettle of this company.