A VA loan is a VA loan, right? Generally speaking, yes. But rates can vary from one lender to another and are often affected by personal factors, like your credit score and even the loan amount you are applying for.

In this guide, we’ll explain the nuts and bolts of VA loans and provide information on how you can get the best VA loan rates.

But first, let’s take a look at today’s VA mortgage rates.

How to Get the Lowest VA Rates

Table of Contents

- How to Get the Lowest VA Rates

- What Is a VA Loan?

- Eligible Property Types

- Down Payment

- Loan Limits

- Credit Requirements

- Employment and Income Requirements

- VA Funding Fee

- Who Is Eligible for a VA Loan?

- What Are the Benefits of a VA Loan?

- What Are the Drawbacks of a VA Loan?

- How Do VA Loan Rates Compare With Conventional and FHA Loans?

- Where to Get a VA Loan

- The Bottom Line – How to Get the Best VA Loan Rates

Getting the lowest rate on a VA mortgage is a multi-step process. You should plan to use the following strategies:

- Maximize Your Credit Score: Like other mortgage types, VA loans charge lower rates if you have good or excellent credit. Get a copy of your credit report, examine it carefully, and look for errors.

If you find any, dispute them with the lender and have them corrected or removed from your report. That will increase your credit score and get you better pricing.

- Apply With the Right Lender: While VA loan rates are standard, there are variations in the annual percentage rate (APR).

These differences reflect fees charged in connection with a loan by each lender. A higher APR means the lenders charging higher rates than a competitor. Choose a lender with a low APR.

- Make a Down Payment: Even though VA loans don’t require a down payment, making one equal to 5% or 10% of the purchase price of the property may entitle you to a lower interest rate.

- Buy Down the Rate: Most lenders will allow you to get a lower interest rate by paying additional points upfront. Each point is equal to 1% of the loan amount, so be sure the extra points you’ll be paying will be justified by the interest rate savings you’ll earn.

What Is a VA Loan?

VA loans work similarly to conventional and FHA mortgages, but they do involve significant differences. The most important is that they are available only for current members of the US military and eligible veterans and their families. They are not available to the general public.

If you intend to apply for a VA loan, you should be aware of the following VA requirements and limits:

Eligible Property Types

VA loans are available only for owner-occupied, 1-to-4-family properties that will be the buyer’s primary residence. They are not eligible for second homes or investment properties. They can be used for financing either the purchase or refinance of an owner-occupied home.

Down Payment

This is the feature VA loans are best known for. They provide 100% financing, which means the buyer is not required to make a down payment on the property.

In addition, the property seller or other interested party can pay the buyer’s closing costs for an amount of up to 4% of the purchase price of the home.

The combination of the two can enable a veteran buyer to purchase a home with no money out-of-pocket whatsoever.

Loan Limits

Eligible borrowers can borrow up to $766,550 or up to $1,149,825 in areas designated to be high-cost areas and be eligible for 100% financing.

However, VA loans permit higher loan amounts, which are sometimes referred to as a “VA Jumbo Loan.” This is any loan amount that exceeds the limits listed above.

But there is a catch. To be eligible for the higher loan amount, the borrower must make a down payment equal to 25% of the amount by which the purchase price exceeds the standard loan limits.

As an example, if the maximum conforming loan limit in a region is $700,000, but the veteran purchasing a property at $1 million, he or she will need to make a down payment of $75,000.

That can be calculated as follows:

$1 million purchase price – $700,000 maximum conforming loan amount = $300,000 X 25%

That calculation will enable a veteran to borrow $925,000 on the purchase of a $1 million home.

Credit Requirements

The VA does not have a hard and fast minimum credit score requirement. But most lenders will impose a minimum, which is typically 620, though some may go lower if you have an otherwise strong financial profile.

Those can include low debt-to-income ratios, a declining house payment, or substantial savings after closing.

Employment and Income Requirements

You’ll be expected to show a stable employment history for the past two years. However, lenders will typically include recent college or military service as part of the requirement.

As to income, your new house payment, plus recurring monthly non-housing debts, should generally not exceed 43% of your stable monthly income. (This is known as your debt-to-income ratio.) But once again, lenders make exceptions.

They may go as high as 50%, or even higher, if you have a strong financial profile, including making a down payment, having savings available after closing, or if you have excellent credit.

VA Funding Fee

The VA funding fee is the equivalent of private mortgage insurance (PMI) on VA loans. It’s the premium paid by the borrower to cover the cost of the VA insuring the loan against borrower default. This is the core of VA loans and the reason why lenders will make loans to borrowers under such favorable terms.

The VA funding fee is a one-time charge, which is generally added to the loan amount. For example, if you purchase a home for $300,000, and the funding fee is 2.3%, your total loan amount will be 306,900. However, the funding fee can also be paid by the property seller or by a gift provided by a family member or other eligible party.

Alternatively, you can also choose to pay the fee out of pocket rather than adding it to the loan amount.

One of the major advantages of the VA funding fee is that, unlike FHA and conventional loans, there is no monthly premium payment. The upfront payment is the only one you’ll make. The absence of a monthly fee results in a lower monthly house payment.

The VA has several funding fee levels, depending on the veteran’s status and the type of loan. But the fees for eligible veterans, active-duty service members, and National Guard and Reserve members for purchase and construction loans are as follows:

| If Your Down Payment Is… | Your VA Funding Will Be… | |

|---|---|---|

| First Use | Less Than 5% | 2.3% |

| 5% Or More | 1.65% | |

| 10% Or More | 1.4% | |

| After First Use | Less Than 5% | 3.6% |

| 5% Or More | 1.65% | |

| 10% Or More | 1.4% |

You may be exempt from the VA funding fee if any of the following apply:

- You receive VA compensation for a service-connected disability, OR

- You are eligible to receive VA compensation for a service-connected disability, but you’re receiving retirement or active-duty pay instead OR

- You’re the surviving spouse of a veteran who died in service or from a service-connected disability or who was totally disabled, and you’re receiving Dependency and Indemnity Compensation (DIC) OR

- You’re a service member with a proposed or memorandum rating before the loan closing date, saying you’re eligible to get compensation because of a pre-discharge claim OR

- You are a service member on active duty who, before or on the loan closing date, provides evidence of having received the Purple Heart.

Be sure to check with your lender to see if you are eligible for an exemption.

Who Is Eligible for a VA Loan?

To be eligible for a VA loan need to provide evidence of that eligibility by obtaining a Certificate of Eligibility (COE). If it wasn’t provided to you upon discharge from the service, a mortgage lender can easily obtain it directly from the VA.

VA loans are available only to eligible veterans and active-duty members of the military and their families. That said, there are specific requirements for qualification: specific requirements for qualification:

- If You Served During Designated Wartime Before September 8, 1980: You must have served at least 90 days of active service or less than 90 days if you were discharged for a service-connected disability.

- If You Served Before September 8, 1980, but Not During Designated Wartime: You’ll be eligible if you served at least 181 continuous days of active service or less than 181 days if you were discharged for a service-connected disability.

- If You Served After September 8, 1980, and Until August 1, 1990: You’ll be eligible if you served at least 24 months of active service or the full period of at least 181 days for which you were called to active duty.

- If You Served After August 2, 1990: You’ll be eligible if you served at least 24 months of active service, or the full period of at least 90 days for which you were called or ordered to active duty, or at least 90 days if you were discharged for a hardship, a reduction in force, or for convenience of the government, or less than 90 days if you were discharged for a service-connected disability.

Meanwhile, current active-duty members are eligible after 90 days of continuous service.

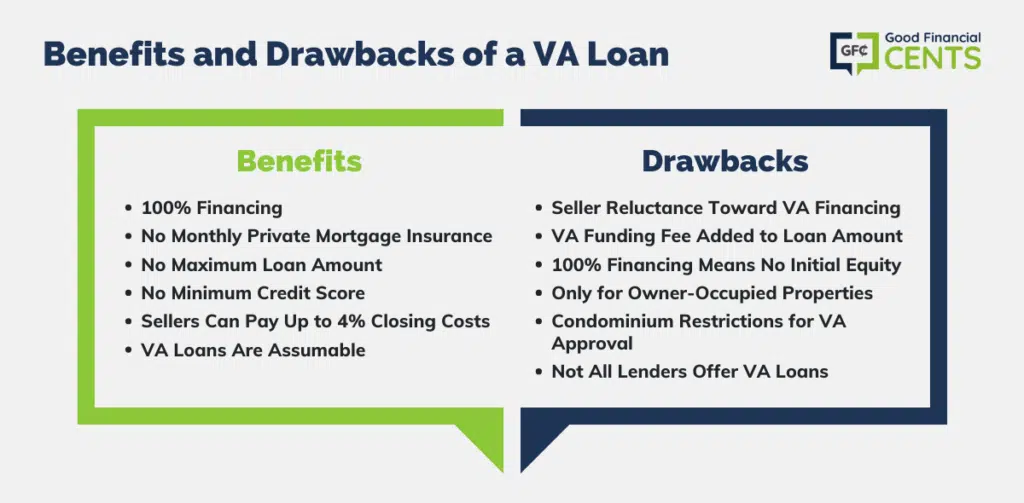

What Are the Benefits of a VA Loan?

VA loans are one of the very best loan programs available. The most specific benefits are:

- 100% Financing. VA loans require no down payment.

- No Monthly Private Mortgage Insurance. This is a feature of both FHA and low-down payment (less than 20%) conventional loans, but it does not apply to VA loans. This will result in a lower monthly payment than a conventional or FHA mortgage with a comparable loan amount.

- No Maximum Loan Amount. VA loans can accommodate jumbo mortgages, though the buyer will be required to make a down payment of 25% of the amount by which the loan exceeds the conforming loan limit.

- No Minimum Credit Score. The VA itself does not require a minimum credit score, though lenders are free to set their own minimum.

- Sellers Can Pay Up to 4% Closing Costs on Purchases. That means the borrower may have no closing costs in addition to no down payment.

- VA Loans Are Assumable. That can enable you to sell your home and offer financing through the assumption.

NOTE ON ASSUMPTIONS:

What Are the Drawbacks of a VA Loan?

Despite the many advantages of VA loans, they do come with a few drawbacks.

- Seller Acceptance. Because VA loans have a history of being more complicated than conventional loans – and sometimes do take longer to approve – some property sellers are reluctant to accept an offer from a borrower who is using VA financing.

- The VA Funding Fee. The fee currently sits at 2.3% for most borrowers and will be added to the loan amount in most cases. That means you’ll owe a little bit more than the original amount of the loan.

- 100% Financing Means No Equity. Because you won’t be putting money down on the property, it will take longer to build equity in your home.

- Owner-Occupied Properties Only. VA loans are not permitted on second homes or on investment properties.

- VA Loans Are Not Always Available for Condominiums. VA requires project approval on a condominium, and not all condominiums have one in place. That may limit your choice of condominiums to buy in.

- Not All Lenders Offer VA Loans. You may find that the bank you’ve been working with for many years doesn’t offer VA loans. While they’re a common type of mortgage financing, they’re not offered by all lenders.

How Do VA Loan Rates Compare With Conventional and FHA Loans?

The table below shows a comparison of interest rates on three popular loan programs for VA, FHA, and conventional loans. The interest rates quoted are as of October 29, 2021, and are for demonstration purposes (note that rates change on a daily basis).

| LOAN TYPE / PROGRAM | VA | FHA | CONVENTIONAL |

|---|---|---|---|

| 30-Year Fixed Rate | 2.625% | 2.660% | 3.000% |

| 15-Year Fixed Rate | 2.250% | 2.440% | 2.250% |

| 5-Year Adjustable Rate Mortgage (ARM) | N/A | 2.760% | 2.125% |

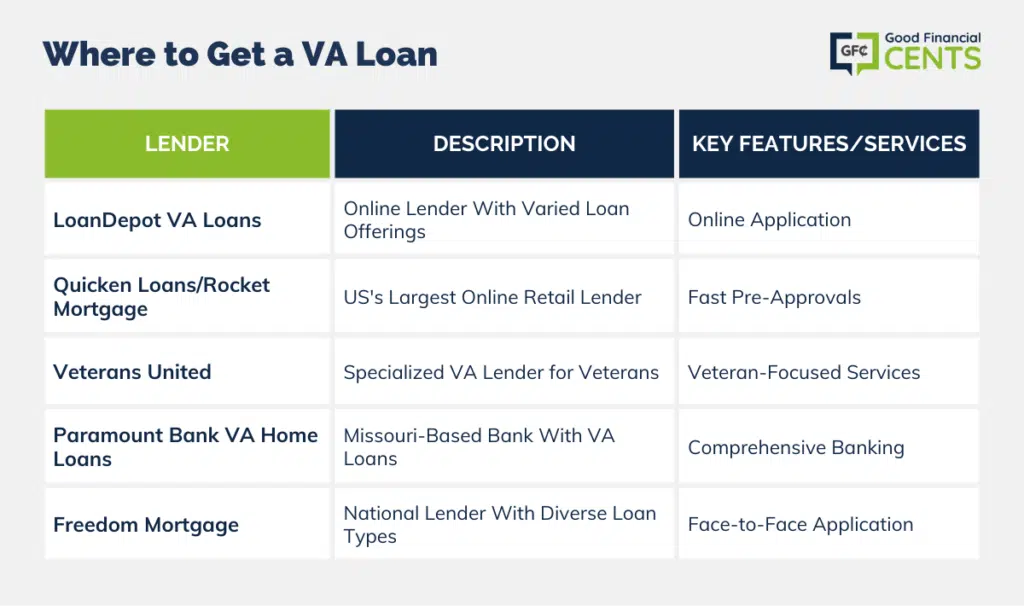

Where to Get a VA Loan

Before applying for a VA loan, you should be aware that not all lenders participate in the program. In addition, some lenders offer the program but have only very limited experience.

Since a VA loan is a highly specialized loan type, it’s always best to work with lenders that regularly provide them.

Below is a list of five major mortgage lenders that not only offer VA loans but also provide them on a regular basis.

loanDepot VA Loans

loanDepot VA Loans offers all types of loans, including conventional and FHA mortgages, in addition to VA loans. It’s an online lender, which means you’ll complete the application and supply documentation through the website.

That is, you’ll be able to complete the process from the comfort of your own home, while the online process itself will speed processing and approval.

Quicken Loans/RocketMortgage

Both are often presented as separate entities, but Quicken Loans and Rocket Mortgage are actually the same company. Quicken Loans has grown to become the largest retail mortgage lender in the US, with Rocket Mortgage as their heavily advertised online application portal.

The combined company is well known for fast pre-approvals and approvals. They’re able to do this because the entire lending process takes place online, but also because they are often able to verify employment, income, and savings by directly contacting the provider.

Other times, you will need to upload documentation to the website.

Veterans United

Veterans United is the single largest VA lender in the US, which is not hard to see given that the company is set up specifically for veterans, as the name implies.

The application process is particularly easy for veterans because Veterans United engages senior enlisted members of all branches of the military. These personnel act as advisors, ensuring the products offered are the best fit for veterans and active duty members of the military.

The company also has its own network of real estate agents that specialize in veteran purchases and financing. This is important because it means both the lender and the real estate agent will be on the same page with regard to the requirements of VA loans.

That will speed up the process and make for a less stressful experience for the veteran and his or her family.

Paramount Bank VA Home Loans

Based in Hazelwood, Missouri, Paramount Bank VA Home Loans offers all types of mortgage financing, including VA loans. But as a bank, they also provide an opportunity for veterans to participate in comprehensive banking services.

They offer interest-bearing checking accounts and deposit accounts, various loan types, as well as business banking services.

Freedom Mortgage

Freedom Mortgage is another of the leading mortgage lenders in the country, offering VA loans in addition to FHA, USDA, conventional, and jumbo loans. The company also lends in all 50 states, so geography won’t be an issue.

And if you like an old-fashioned face-to-face application process, Freedom Mortgage has you covered. Instead of sending you to a website to complete the application process yourself, you’ll work with a live lending representative.

That will not only make for an easy application but will also give you an opportunity to ask any questions that may be on your mind as you go through the process.

The Bottom Line – How to Get the Best VA Loan Rates

Navigating the VA loan process can be intricate, yet the benefits are substantial for eligible veterans and active-duty military members.

From the potential for 100% financing to competitive interest rates, VA loans stand out as a valuable mortgage option.

Personal factors like credit score play a role in securing the best rates, but strategies like maximizing your credit, choosing the right lender, and considering a down payment can also influence the rates you receive.

Moreover, understanding the VA loan’s unique features, from the funding fee to its specific eligibility criteria, can empower borrowers to make informed decisions.

Whether you’re a first-time homebuyer or looking to refinance, leveraging the VA loan’s advantages can pave the way for a brighter financial future.