The pandemic has changed the way we live in so many ways — including how people are working. As the coronavirus runs its course, record unemployment is causing many people to pick up freelance work or piece together side gigs in lieu of traditional employment.

According to a report by Demand Sage, there are currently 73 million freelancers in the US.

One factor that many newly self-employed workers don’t know about, however, is quarterly estimated taxes.

Unlike full-time workers who have taxes automatically withheld from each paycheck by their employer, freelancers have to manually pay taxes every quarter. Keep reading to learn more about this essential task.

Table of Contents

- Who Needs to Make Quarterly Estimated Tax Payments?

- When Are Quarterly Estimated Tax Payments Due?

- How to Calculate Your Estimated Tax Payment

- Where to Submit Quarterly Estimated Tax Payments

- Other Things to Know About Estimated Taxes

- Paying Your Quarterly Estimated Tax

- The Bottom Line – How To Make Quarterly Estimated Tax Payments

Who Needs to Make Quarterly Estimated Tax Payments?

If you’re working in a different way right now, you might be wondering if you fall into the category of workers who need to pay quarterly tax payments.

IRS guidelines state that individuals, including sole proprietors, partners, and S corporation shareholders, must make estimated quarterly tax payments if they expect to owe at least $1,000 in taxes when their tax return is filed.

Meanwhile, the threshold for corporations is $500 in anticipated taxes owed.

If you earn a salary or wage from an employer, on the other hand, your employer should be withholding an appropriate amount of money from your paycheck to cover income taxes.

Here’s an example that illustrates who’s considered self-employed versus a company-employed worker:

- Company-Employed Worker: Someone who delivers pizza for one pizzeria and receives a paycheck from that business is not self-employed, and thus not subject to paying estimated tax payments

- Self-Employed Worker: Someone who delivers pizza and other meals through an app, like DoorDash or GrubHub, is considered self-employed and subject to quarterly tax payments

Another example:

- Company-Employed Worker: An in-staff writer who earns a salary from one company doesn’t need to pay quarterly tax payments

- Self-Employed Worker: A freelance writer who manages multiple clients and accepts direct payments is self-employed, and thus needs to pay quarterly

When Are Quarterly Estimated Tax Payments Due?

The IRS notes that tax due dates that fall on a Saturday, Sunday, or legal holiday are flexible to the next day that isn’t a weekend or legal holiday date.

The following chart shows the tax due dates throughout the year, and the periods they cover:

Quarterly Estimated Tax Payments Due Date

| PAYMENT PERIOD | DUE DATE |

|---|---|

| January 1st to March 31st | April 15th |

| April 1st to Might 31st | June 15th |

| June 1st to August 31st | September 15th |

| September 1st to December 31st | January 15th of the Following Year |

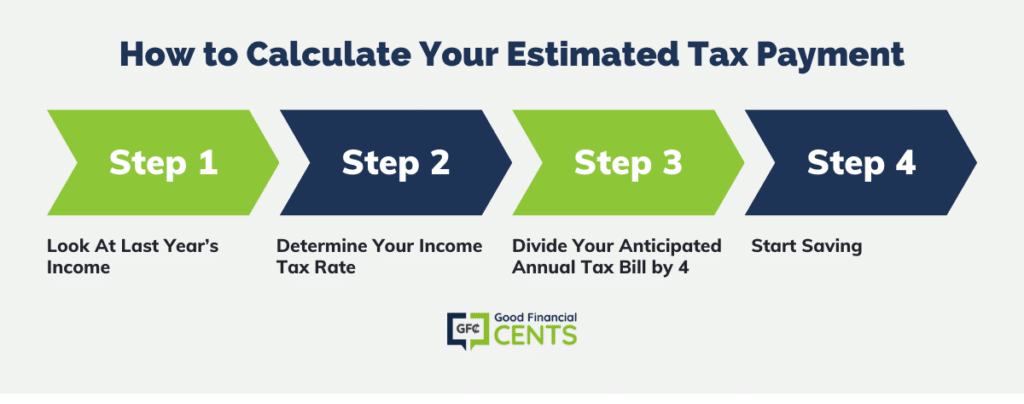

How to Calculate Your Estimated Tax Payment

Calculating your estimated quarterly tax payments isn’t always easy, and that’s especially true when you’re not entirely sure how much you’ll earn for the year. However, there are some basic steps you can follow to get you close to the right amount.

1. Look at Last Year’s Income

If you were self-employed last year, looking at the previous year’s income and tax return can provide insight into how much you should pay this year.

You’ll need to figure out your adjusted gross income (AGI), your taxable income, the deductions you qualify for, and the tax credits you’ll qualify for the year.

2. Determine Your Income Tax Rate

Once you have an idea of the income you’ll be taxed on — after all deductions and credits are taken into account — determine the tax rate your income falls into. You can find information on 2023 marginal tax rates on the IRS website.

Generally speaking, individuals, including sole proprietors, partners, and S corporation shareholders, use Form 1040-ES to figure out how much they’ll owe throughout the year.

This worksheet helps you calculate your estimated quarterly payments based on your tax bill, and the deductions and credits you should take into account.

For those who are self-employed, you’ll need to estimate regular income tax and self-employment tax. First, figure your average tax rate by dividing your income tax, found on Form 1040, by your AGI.

Add your average tax rate to 15.3%, which is the self-employment tax rate. You should have a percentage as an answer.

3. Divide Your Anticipated Annual Tax Bill by 4

Let’s say that your estimated tax liability for the year is $14,000 in income and self-employment taxes for 2023. In that case, divide $14,000 by four to come up with the payments you’ll make during each tax quarter.

You would owe $3,500 per quarter in taxes based on this example, which you’d pay by April 15th, June 15th, September 15th, and January 15th of the following year.

4. Start Saving

One challenging aspect of quarterly tax payments is making sure you have the money saved up to pay them when they’re due. Instead of waiting until your tax payment is imminent, it can help to set aside a percentage of your income throughout the year specifically for tax payments.

If you typically owe 25% of your income in taxes at the end of the year, for example, you could automatically set this amount aside into a high-yield savings account each month. That way, the cash is there when you need it by the quarterly deadlines.

Where to Submit Quarterly Estimated Tax Payments

When it comes to where to send your quarterly estimated tax payments, you have a few options. The easiest option is to pay online using the Electronic Federal Tax Payment System (EFTPS).

However, you can also make quarterly federal tax payments using an electronic funds withdrawal or a same-day wire. You can even pay with a check or money order or cash if you want to.

Note that bank fees might apply if you pay quarterly tax payments using a same-day wire. You can also pay quarterly estimated taxes using a credit card or a debit card online, although a minimum fee of 1.87% is required for credit and you’ll pay a flat fee of at least $2 to pay with a debit card.

Other Things to Know About Estimated Taxes

Paying quarterly estimated taxes might sound like a pain, but over time and with more practice, the process becomes less intimidating. There are still a few considerations to be aware of as you plan your quarterly estimated tax payments.

- Penalties Might Apply: If you underpay quarterly taxes, you might be required to pay a penalty; the amount varies, depending on your situation.

This penalty can also apply for late estimated payments, even if you’re owed a tax refund at the end of the year. The IRS recommends using Form 2210 to see if you owe a penalty.

- Rules Can Be Different for Corporations: Note that the forms you use and the nuances of your tax filing vary depending on the type of business structure you’ve selected for self-employment.

For example, corporations typically use Form 1120-W to figure out how much to pay in estimated tax. Corporations also face a lower threshold to determine if they’re required to pay quarterly tax payments.

- You Can Still Owe More Taxes or Get a Refund: Paying quarterly estimated taxes doesn’t change the fact that you could owe more money to the IRS or receive a refund at the end of the year.

When filing your tax return for the full year, reconcile your estimated quarterly payments with the amount you actually owe. You’ll get money back if you overpaid, but you’ll still owe more money (and potentially a penalty) if you didn’t pay enough.

Paying Your Quarterly Estimated Tax

If you feel overwhelmed by the idea of paying quarterly estimated tax payments, you can hire a tax professional to help you.

Accountants and tax advisors can take a look at your income, and potential deductions and credits, to help determine how much you should pay. These professionals can even file the appropriate forms on your behalf as an added service.

If you’re comfortable tackling your quarterly estimated tax payments on your own, you can save money by studying Form 1040-ES and learning how to estimate your taxes yourself. Paying quarterly tax payments can be complicated and messy, but it’s doable with the proper steps.

The Bottom Line – How To Make Quarterly Estimated Tax Payments

The pandemic has reshaped work, leading to a surge in freelance and self-employment. Freelancers must navigate quarterly estimated tax payments, unlike traditional employees with automatic tax withholding.

IRS guidelines stipulate that self-employed individuals, including sole proprietors and partners, should make quarterly payments if they expect to owe $1,000 or more in taxes.

For corporations, the threshold is $500. Calculating these payments involves considering past income, and tax rates, and dividing the anticipated annual tax bill by four. It’s essential to save for these payments throughout the year.

Payment methods vary, with online options like EFTPS being the most convenient. Understanding estimated taxes, potential penalties, and corporate differences is crucial. Seeking professional advice is an option for those overwhelmed by the process.