If your family was responsible for all of your bills, it could be a mountain of debt and would they have any way of paying off any of those expenses? This is how viewing life insurance as an investment makes it vital that you have some financial protection in case you were to pass away.

Table of Contents

Life Insurance With Autism

Do you or a loved one suffer from autism or Asperger’s? Qualifying for life insurance is not impossible. We’ve helped several people get an effective policy before and we’re confident we can do it again.

The insurance company won’t just look at your condition and automatically shove it aside with a decline stamped on it. They know that normally you’re an insurable candidate, but once you apply you’ll have to give them more information about your diagnosis and any other issues that you might also have. The good thing is we’ve compiled some information below and we hope you find it helpful as you go through the process of securing your finances for the future.

Life Insurance Underwriting for Autism/Asperger’s

When you apply for life insurance with autism or Asperger’s, the insurance agent will need to ask several questions about the condition. Applicants need to answer:

- Where do you fall on that autism spectrum?

- Are there any intellectual or psychiatric limitations that you deal with?

- Do you suffer from any muscular ailments?

- How does the applicant get by doing daily activities?

- Does the applicant have any other major health problems?

- What medications is the applicant currently taking?

While there are no medications that apply directly to autism/Asperger’s, applicants may be taking medications for other mental conditions like antidepressants, anxiety medications, and antipsychotic drugs. These medications could be insurable depending on an applicant’s situation.

Insurance companies ask many questions about these conditions because they need lots of information to make a decision. Be sure to provide all this information as insurance companies are more likely to reject an application that looks incomplete.

Life Insurance Quotes With Autism/Asperger’s

Life insurance companies rate applicants with autism or Asperger’s on a few different factors. First, they consider whether an applicant just has autism/Asperger’s or if they have other more serious issues like Rett syndrome or other physical/mental impairments.

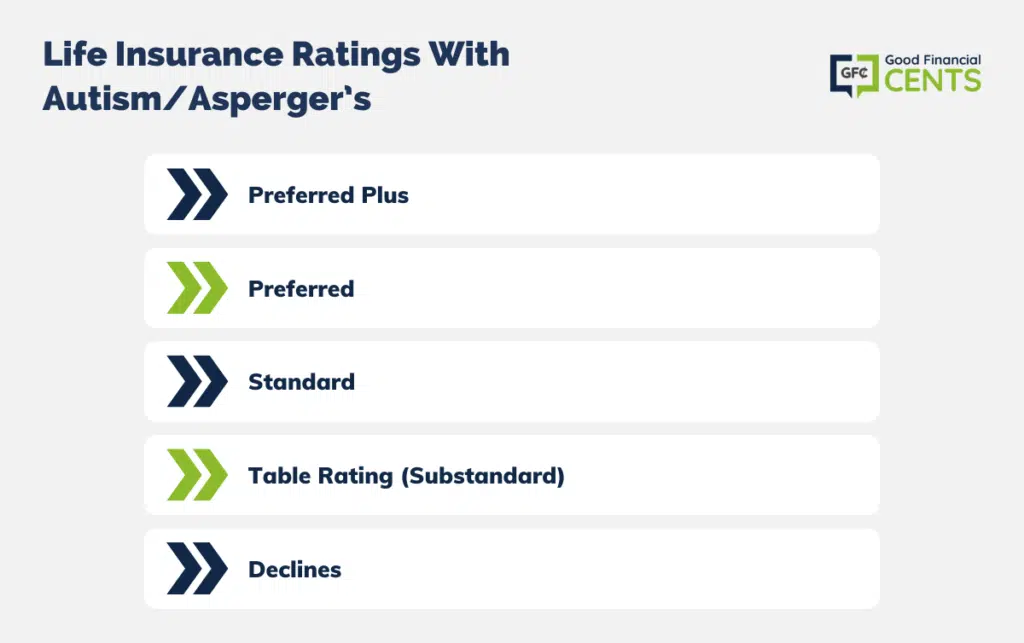

Beyond considering these factors, insurance companies will also review an applicant’s overall health to make a decision. I’ve put together a guideline on how an underwriter might end up rating you.

- Preferred Plus: With problems in the future likely to arise chances are slim for this category.

- Preferred: Another situation where the risk is simply too high for the insurance company to rate you in this section.

- Standard: If you are otherwise healthy, and functioning on the top level this is the best rating you can hope to receive.

- Table Rating (substandard): Most applicants in the spectrum will be rated here. This isn’t a bad thing, but be aware when looking for quotes that give you a preferred or standard rating that you’re price will end up being higher.

- Declines: Do you have Rett syndrome or childhood disintegrative disorder? Then that will be a decline for most if not all carriers. And if you also suffer from muscular or cognitive impairments then you will also most likely have difficulty getting an application approved.

Additional Factors That Influence Insurance Rate

Life insurance rates aren’t solely determined by the presence of autism or Asperger’s. Various elements collectively paint a comprehensive picture of an applicant’s health, lifestyle, and risk factors, each playing a pivotal role in the final determination of insurance premiums. Here are some crucial aspects that insurers meticulously evaluate:

1. Age: A paramount factor, as younger individuals generally access more favorable rates due to lower associated health risks.

2. Occupation and Hobbies: Jobs or pastimes perceived as hazardous can hike up premiums. Activities like skydiving or occupations involving heavy machinery operation are often flagged as high-risk.

3. Family Medical History: A lineage marred by severe illnesses, particularly those with genetic links like cancer or heart disease, can impact rates.

4. Tobacco and Alcohol Use: Smokers or those with a significant alcohol consumption pattern face steeper premiums due to associated health repercussions.

5. Physical Health: Body mass index (BMI), chronic conditions, and overall wellness are scrutinized. A healthy weight and a body free of chronic illnesses favor more attractive rates.

Understanding these factors enables better preparation and expectation management during the insurance application process, ensuring that individuals can secure a policy attuned to their specific needs and circumstances.

Autism/Asperger’s Insurance Case Studies

Here are two examples of how to navigate the stress of filling out a life insurance application.

Case Study: A 23-year-old female was diagnosed at the age of 8, parents tried purchasing life insurance for her right away but she was denied, no other physical or mental problems

When this applicant was diagnosed with autism at eight, her parents thought it would be a good idea to buy her life insurance right away before anything else happened. When her application was denied, her parents believed she wouldn’t have a policy approved.

After reading our site, they understood her chances right after diagnosis weren’t as good if they had waited for her condition to stabilize. By trying again this time, the applicant received a Standard rating as her autism hadn’t developed into any other problems.

Case Study #2: Male, 25, had Asperger’s since 10, suffered from depression at 20, started taking antidepressants at 22, and recovered.

This applicant had Asperger’s since he was 10 and was also diagnosed with depression at 20 partially due to his mental condition. After taking antidepressants for a year, this applicant recovered from his depression and was in better overall health. His rating though was substandard when he first applied. His past history of depression and were worried that this was too much on top of his Asperger’s.

We recommended he see his therapist and get a note vouching that due to medication and therapy, this client had his depression under control. With this new information, the applicant applied and received a better rating than before.

If you are looking for life insurance for someone with autism or Asperger’s, it might be a good idea to get some professional help with your application. Agents have the knowledge to let you know when an application should be submitted and which carrier views your condition more favorably.

Affordable Life Insurance With Autism or Aspergers

Click here for information and free insurance quotes, or complete the form on the right side of the page. Each carrier has different algorithms that help them with their risk classes and who gets put in each one. To find the plan that best fits your budget you’ll need to receive many quotes before picking the one that works best for you.

Unlike traditional life insurance agents, we are independent agents, and we can represent as many insurers as we want! With tons of life insurance companies in America, we can narrow down the ones that fit your goals best all while saving you valuable time and saving you hard-earned money.

Let us help you get approved for a plan that works with an applicant who has autism or Asperger’s. Even if you’ve been declined in the past, we can help you get affordable life insurance protection through a no-medical exam life insurance plan.

These no-medical exam plans mean you can have financial protection and you don’t have to answer medical questions or go through an exam. Everyone deserves to have the insurance protection that their family needs and your health shouldn’t stop you.

Bottom Line: Life Insurance for Autism & Asperger’s

Securing life insurance with autism or Asperger’s is a nuanced process, but achievable with strategic planning and professional guidance. Insurers assess various aspects, such as the spectrum’s position, daily functioning, and any accompanying health conditions. Each application is unique, allowing for different ratings based on overall health and additional factors like age, occupation, and lifestyle.

Expert assistance can optimize the application process, recommending appropriate timing and selecting carriers that regard your condition favorably. In some cases, a no medical exam life insurance plan might be the suitable option, ensuring essential financial protection is in place, irrespective of health challenges.

Thus, knowledge, professional guidance, and persistence are crucial in navigating the intricacies of securing a life insurance policy suitable for individuals with autism or Asperger’s.