When you’re a pilot, buying life insurance is a bit complicated.

Many companies will see your occupation and worry that it’s too dangerous for them to cover.

I guess you could say the insurance industry also has a fear of flying.

As you know, flying a plane responsibility is not a dangerous activity. Statistically, you are safer flying your plane than driving a car.

Fortunately, there are so many highly-rated insurance companies in the U.S. that understand this point. With the right company, not only will your job not be an issue, but it might actually work out to your advantage.

Table of Contents

Problems for Pilots

In order to buy life insurance, you need to fill out an application describing your current situation. This is so companies can measure your risk as an applicant. Insurance underwriters not only consider your current health but also several other factors. Your job is an important part of this analysis.

Many companies consider flying to be an excessively dangerous activity. This is true for both commercial and private pilots. When you mention you are a pilot, there’s a good chance you’ll get rejected by many companies. Should you get a policy, the policy might charge extra because of your job, the same as if you were in poor health or had a bad habit of smoking.

Another issue is a regular insurance company may exclude aviation from your policy. This means that if you die while flying, your policy won’t pay the death benefit. These rules are unfair and you should not have to put up with this treatment.

Crafting the Ideal Policy for Pilots

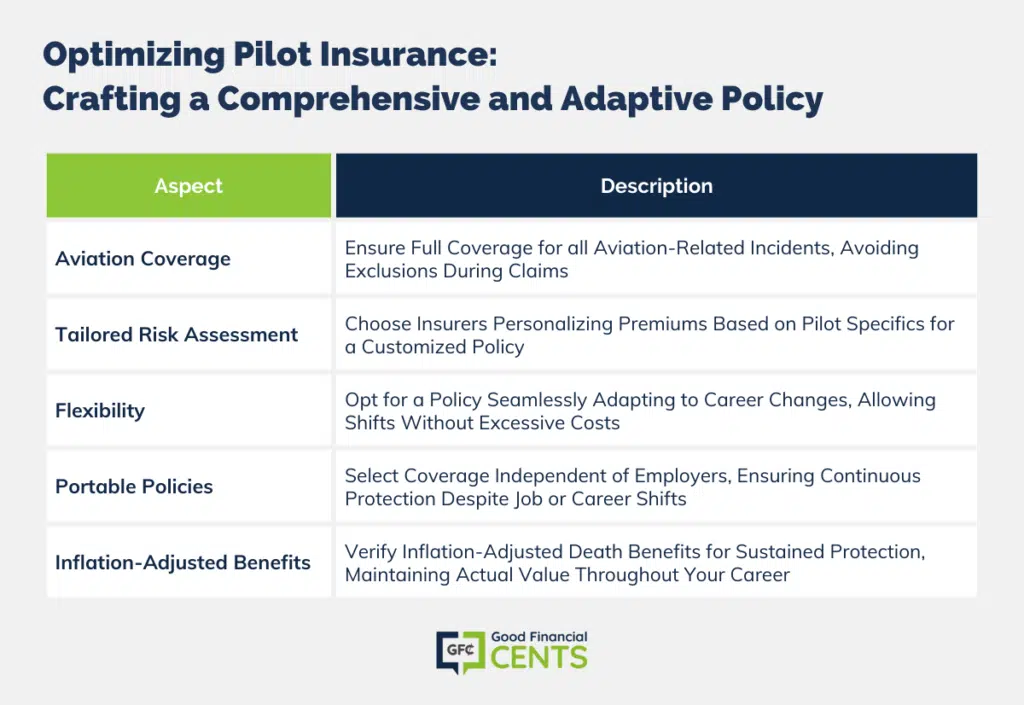

For pilots, crafting an ideal life insurance policy requires a specialized approach that understands the intricacies of their profession. Here’s a guide to constructing the most beneficial policy:

- Comprehensive Aviation Coverage: Ensure the policy encompasses all aspects related to aviation, leaving no room for exclusions during claims related to flying incidents.

- Tailored Risk Assessment: Choose insurers who evaluate premiums based on pilot-specific variables such as type of aircraft flown, flight hours, and extent of training, for a more personalized policy.

- Flexibility: Opt for a policy that adapts to career transitions, whether you shift between commercial, private, or experimental flying, without necessitating drastic changes or incurring excessive costs.

- Portable Policies: Select a policy independent of specific employers or airlines, allowing for continuous coverage irrespective of job changes or career shifts.

- Inflation-adjusted Benefits: Make sure the policy’s death benefit is inflation-adjusted to maintain its actual value and relevance over a longer career span, ensuring adequate protection for loved ones.

How the Right Company Can Help

When it comes to aviation, not all risks are equal.

- What is your level of experience?

- How much training do you have?

- Do you fly commercially or recreationally?

- What types of planes do you fly?

All these factors make a big difference and should be considered for your insurance policy.

An insurance company that specializes in pilot life insurance understands this and will be sure to collect this information. This process ensures that you will get a fair review and will get the coverage and rating you deserve.

The more experienced the insurance company is with covering pilots, the better your chances of getting affordable rates and getting the coverage your family needs. They understand that flying an airplane is a perfectly safe activity and it isn’t going to cause your monthly premiums to cost a fortune.

Getting life insurance for your family shouldn’t break your bank every month. Your life insurance should be there if you ever need it, but it shouldn’t stretch your finances until then.

Special Insurance Benefits for Pilots

Your being a pilot could actually work out to your advantage. As you know, not everyone can become a pilot, especially a commercial one. It takes a fair amount of training and education to get a license. In addition, you need to be in decent health to fly a plane commercially.

As a result, pilots as a group are healthier and live longer than the general population. Insurance companies that realize this give out discounted policies to pilots.

Another benefit of a good pilot policy is that it will be portable to all jobs. If you get a policy through your work, it might only cover you at that airline. Should you change companies or move to another field, you’ll lose your insurance. With a pilot policy, that won’t happen.

Importance of a Broker

The pilot insurance market is quite large. The best company for your needs depends on many different factors like the type of aircraft you fly and the amount you fly per year. To get the best rate, you need to find a company that matches your situation. However, finding a good match can be very time-consuming.

Working with an insurance broker, like our company, saves you this headache. Our representatives understand the pilot insurance market. They can quickly match you up with the companies that make sense for your situation so you can easily track down the best rate.

Be Sure to Review Your Coverage

If you already have life insurance, congratulations! You’ve taken a big step towards protecting your loved ones. It would still be a good idea to contact our services for a policy review though, especially if it’s been a few years since you bought your policy.

Has your life changed over the past few years? For example, have you had more children or bought another house? Through our free review process, we’ll make sure that your coverage keeps up with your ever-changing life. Not having enough life insurance can be as detrimental as not having a policy at all.

It could leave your family with more debt than they have the resources to pay off, which can put a serious financial strain on your loved ones after you pass away. There are dozens of different factors that could impact your life insurance needs. We can make sure that your plan is up to par. We’ll also make sure that your current policy doesn’t have any of the problems or exclusions because of your status as a pilot.

Regardless if you fly for your job or you fly for fun, you can get affordable life insurance. Your job or hobbies should never keep you from getting quality life insurance protection. A lot of pilots assume they will never be able to buy a life insurance policy they can actually afford, but that’s not true.

Being a pilot is only a problem for life insurance if you don’t plan properly. Make sure you are prepared to get the best possible coverage.

Bottom Line: Pilot Life Insurance

Pilots face unique challenges when seeking life insurance due to misconceptions about their profession’s risks. However, with specialized insurance companies that understand aviation’s intricacies, pilots can secure comprehensive and tailored policies. Emphasizing experience, type of flying, and health can lead to affordable premiums.

By leveraging an informed broker and periodically reviewing coverage to match life changes, pilots ensure optimal protection. Ultimately, a pilot’s profession shouldn’t be a barrier to obtaining quality life insurance; with the right approach, they can confidently safeguard their loved ones’ futures.