Cushing’s syndrome is a medical condition that can lead to obesity, weak bones, hypertension, diabetes, and other serious problems. As a result, life insurance companies are stricter with applicants who have this condition.

If you have Cushing’s syndrome, you still might be able to qualify for coverage, though. It really depends on a few different factors. To learn more about the underwriting process for this condition, be sure to keep reading this guide.

Table of Contents

Life Insurance Underwriting for Cushing’s Syndrome

Your advisor will have some questions for you once you let him or her know that you’re ready to start researching your options.

These are a few of the topics they’ll go over.

- When were you diagnosed with Cushing’s syndrome?

- What evaluations have you had of your condition (MRI, urine test, and/or blood test)?

- What were the results?

- Has your syndrome led to hospitalization?

- Are you taking steroids for another medical condition?

- Are there any other health issues we need to know about?

- Are you currently taking any medications?

- Are you using tobacco currently or in the last year?

Possible medications for someone with an adrenal insufficiency include Nizoral, Lysodren, Metopirone, and Korlym. These medications could be insurable, depending on the severity of your condition.

It’s important to answer all these questions honestly and with as much detail as possible. Underwriters get nervous when they see an incomplete insurance application, especially when someone has a condition like Cushing’s syndrome.

A complete application gives you the best chance of qualifying for coverage.

Life Insurance Quotes With Cushing’s Syndrome

When you apply for life insurance with Cushing’s syndrome, insurance underwriters will first consider the cause of your condition. Your chances are better if your Cushing’s syndrome was caused by a benign pituitary disorder or steroid usage than by cancer.

If your Cushing’s syndrome clears up after treatment, your rating also improves the longer you wait after your treatment.

Each company wants a full picture of your health, and even though most of them have differentiating standards, we can speculate with a high percentage what your insurability rating will be.

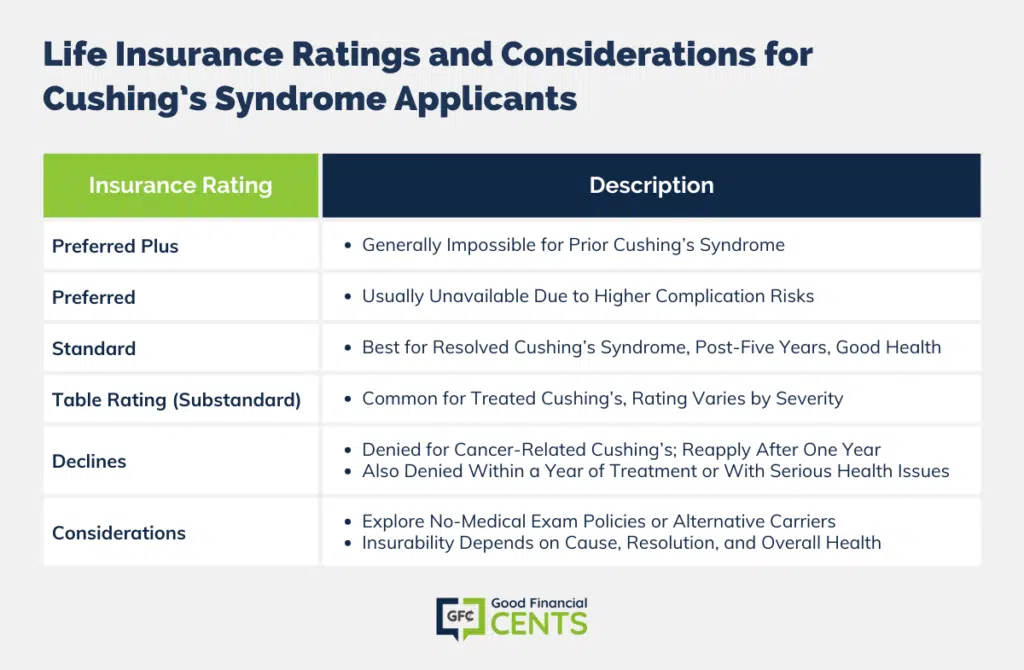

Preferred Plus: Usually impossible for someone who has had Cushing’s syndrome.

Preferred: Also usually impossible for someone who has had Cushing’s syndrome. The chances of this condition leading to something more serious are too high for insurers to consider giving a discounted policy.

Standard: Most likely, the best possible rating for someone who had Cushing’s syndrome from a pituitary disorder, but the condition was resolved after treatment. The applicant would need to wait at least five years since the condition was resolved, plus be in very good health otherwise to qualify for this rating.

Table Rating (substandard): The most common rating for someone who has or had Cushing’s syndrome from a pituitary condition or steroid treatment. An applicant’s rating would depend on whether their condition was treated, the severity of their condition, and their overall health.

Declines: Applicants with Cushing’s syndrome from cancer will usually be denied coverage. This combination is just too serious for life insurance. Applicants who apply within one year of treatment are also usually denied and told to reapply later.

Finally, applicants with Cushing’s syndrome and other serious health problems are also usually denied. If you do not fall into any of these categories and are still denied, a no-medical exam policy might be the best option, or we can help you shop around for a more favorable carrier.

Cushing’s Syndrome Insurance Case Studies

We put together these case studies so you can understand the importance of how your condition can affect your chances of being approved and how to navigate the process of filling out the application.

Case Study #1: Female, 49 y/o, diagnosed with Cushing’s syndrome at 42 due to a pituitary condition, recovered after surgery at 43

This applicant was diagnosed with Cushing’s syndrome at 42 because of a benign pituitary condition. Fortunately, after surgery, her condition went away with no complications.

At this point, she tried applying for life insurance and was denied. She thought this was because she was uninsurable, but after reading our website years later, she realized that wasn’t true.

Her standard rating was helped because we know what carriers look at her condition more favorably.

Case Study #2: Male, 57 y/o, diagnosed with Cushing’s syndrome due to steroid use, used to be overweight and smoked

Before being diagnosed with Cushing’s syndrome, this applicant was not taking very good care of himself. He developed Cushing’s syndrome after taking steroids to treat another medical issue.

At this point, he realized he needed to turn things around. He quit smoking, lost weight, and started leading a much healthier life.

However, his application was declined, we believed, because the carrier probably put most of the risk on the way he used to live his life. That is understandable, but we knew he had since become healthier.

We told him to ask his doctor for a note that described his changes in health and lifestyle. In the end, this step allowed our client to be approved for life coverage.

Getting Cheap Life Insurance With Cushing’s Syndrome

Getting affordable life insurance protection for your family is still something to aim for, even with Cushing’s. Your family knows that it’s important to have coverage, so it’s time to make that great decision. It is also good to know that there are a few other ways to make sure your premiums aren’t high.

The first thing that you should do is cut out any tobacco that you currently use. As we mentioned in the example above, being a smoker is going to hurt your chances of getting approved for life insurance, and it’s going to cause your rates to go up.

Coupled with Cushing’s syndrome, being a smoker could cause your premiums to go through the roof. Your premium will already be rated high, but smoking could double that.

Get healthy! Lowering blood pressure, working on your cholesterol, and reducing your weight. All these things could keep your premiums lower.

Making small lifestyle changes will lead to big savings on the back end.

Guaranteed Issue Plans

Qualifying for life insurance with Cushing’s syndrome isn’t always easy, but it is possible. Let us provide you with the information to find the best companies for your needs.

However, if the situation where approval for a standard policy is unattainable, we suggest a guaranteed issue policy that doesn’t require a medical exam.

These guaranteed issue plans are an excellent option for a lot of applicants, but they are a unique type of coverage that doesn’t work well for everyone. It’s important that you understand all of the pros and cons of each type of plan before you decide which is best for you.

There are a few serious drawbacks to these guaranteed issue plans that you should take note of before you purchase this style of coverage. The most notable is how limited your face value will be. Most guaranteed issue plans will only offer around $25,000 worth of coverage.

For the vast majority of families, that won’t be nearly enough insurance protection. Purchasing too small of a life insurance policy can be a terrible mistake that you could ever make.

Another drawback of these plans is that they cost you a lot every month. You’ll pay more for every coverage dollar than a standard policy.

The purpose of the medical exam and the health questions is to give the insurance company an idea of how much risk you are. Without that info, all of the risk is going to the insurance company.

These plans should only be considered as a last resort option for life insurance protection. Even if you’ve been declined for life insurance in the past, it’s still possible to get affordable insurance protection.

Every company is different, and all of them are going to view a Cushing’s syndrome diagnosis differently. Finding the perfect company is the difference between getting an affordable policy and getting rejected for coverage.

The Bottom Line – Can You Buy Life Insurance With Cushing’s Syndrome?

Navigating the intricacies of life insurance with Cushing’s Syndrome can be challenging. However, with the right knowledge and approach, securing coverage is attainable.

While Cushing’s Syndrome may make the underwriting process stricter, understanding how insurance companies view the condition can significantly enhance your chances of approval.

Moreover, adopting healthier lifestyle choices and being well-informed about alternative insurance options can be game-changers.