If you’ve been to the doctor in the past 20 years (or even), then you probably know how expensive those trips can be. There is nothing that you can do about the rising cost of health care, but there are several ways that you can protect yourself from those massive expenses.

Thanks to Medicare, there are millions of seniors who are getting health care coverage that they wouldn’t be able to afford otherwise. While it’s a great way to get health care, but it doesn’t cover everything. There are dozens of holes in the coverage that could leave you with a massive bill. Those bills can drain your bank account and turn your retirement daydream into a nightmare.

Table of Contents

The two best ways to protect yourself is to purchase supplemental coverage, either through a Medigap plan or a Medicare Advantage policy. Both of them are excellent options for additional protection, but this article is going to focus specifically on Medicare Supplement Plan N.

What is a Medigap Policy?

Medicare Supplement Plans are sold by private insurance companies, and they help fill in the holes that your Medicare Part A and Part B don’t pay for. There are ten different policies, all of which are denoted by a letter of the alphabet, A through N. Each of them pays for different expenses or a portion of those expenses. Before you apply for one of these policies, it’s important that you compare all of the Medigap plans to decide which one is going to give you the protection that you need.

All ten plans are standardized by the government, which means that all the plans are going to have identical coverage, regardless of which company you choose. The only difference between the companies is how much they are going to charge you every month. Some companies have higher premiums, while others are going to be more affordable.

After you purchase one of these plans, you will pay the monthly premiums to the insurance company. With a Medigap plan, you will still have to pay your traditional Part A and Part B premiums. Some people are confused about how they pay the premiums, or they assume that a Medigap plan replaces their original Medicare coverage. Even if you have a Medigap plan, you are still responsible for your Medicare payments. Not paying those premiums can lead to some serious fees.

Medigap Plan N Coverage

As we mentioned, there are ten different policies, and all of them are different. There is no “one plan fits all” that will work well for every applicant. In this article, I’m going to detail the pros and cons of Plan N, which is one of the popular options for supplemental coverage.

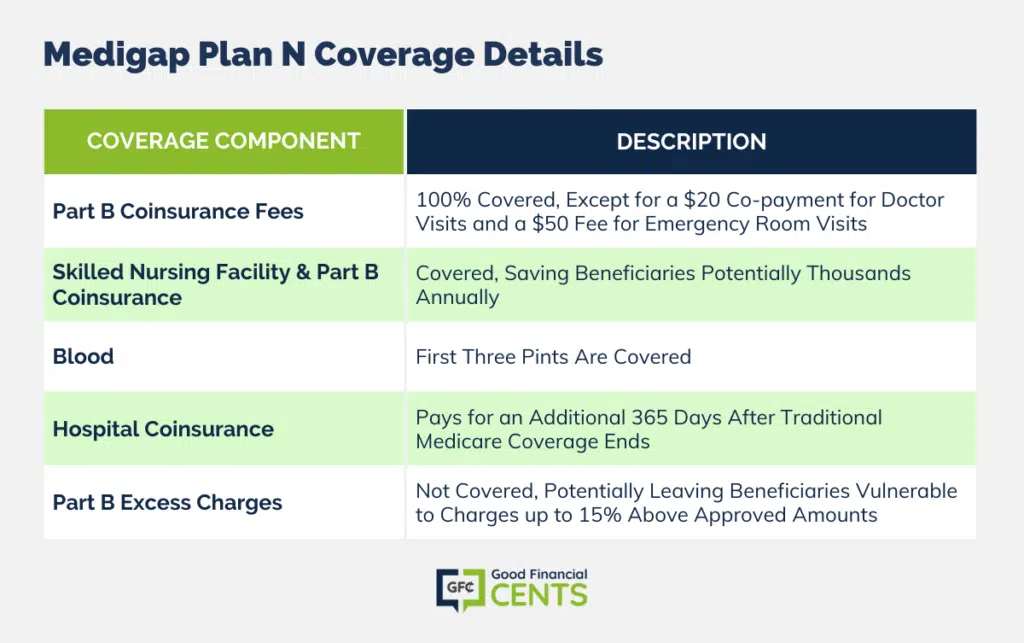

Plan N is one of the larger policies, which means it’s going to cover more of the holes left behind. There are several key coverage categories that you should be aware of if you are going to purchase this option. One of the first things that you should realize is that 100% of your Part B coinsurance fees are paid for, except for a $20 co-payment fee for a doctor’s visit and a $50 fee for emergency room visits. These are relatively small fees, as long as you don’t go to the emergency room a dozen times every year.

One of the key components of a Plan N is that it will pay for skilled nursing facility coinsurance and Part B coinsurance. Both of these coverage groups can save you thousands of dollars every year. If you end up needing any skilled nursing facility assistance, it can quickly become costly, but having the coinsurance coverage can keep more money in your pocket.

One of the most notable pitfalls of a Plan N is that the policy doesn’t cover any Part B excess charges, which can be a devastating coverage gap. When you go to the doctor or visit the hospital for any treatments or services, there is a pre-approved amount that Part B will pay. Legally, those doctors and hospitals are allowed to charge 15% above that amount. In most cases, those excess charges won’t break your bank, but depending on the procedure or service that you get, it could put a strain on your bank.

Deciding Which Policy is Best for You

When you’re trying to decide which plan is best for you, there are several factors that you will need to consider. Each plan has pros and cons, and getting the best supplemental coverage is one of the best decisions that you can make.

The first factor (and the most important) that you should consider is your finances. The purpose of the Medigap plan is to ensure that your family isn’t drained by medical expenses, but your supplemental coverage shouldn’t stretch your finances too thin either. Before you apply for any coverage, take a long and hard look at your budget and determine how much extra you can spend. Everyone would love to have a Plan F, which fills in all of the leftover expenses, but that coverage comes at an additional cost.

The next factor that you should take a look at is your health. If you’re in poor health and you have several pre-existing conditions, then a Medigap plan that is comprehensive is going to be a better investment. The worse your health is, the more money you’re going to spend on medical bills and other health care costs. On the other hand, if you’re in good health with a clean bill of health, then you can consider taking the risk to purchase a small Medigap plan that leaves more holes and saves you money every month.

These are only some of the different factors that you will need to consider. You will need to look at each plan in light of your specific circumstances. Every Medicare enrollee is different, and all of them are going to need a different supplemental plan.

Enrolling in a Medigap Plan

After you’ve decided which Medigap plan is going to work best for you, the next step is to enroll in a supplemental plan. Thankfully, it’s easier than you might think. After you have found the insurance coverage that you’re going to purchase the plan through, all you have to do is contact a Medigap insurance agent. The agent will walk you through the process.

It’s important that you take note of the Medigap open enrollment period. That’s a 6-month timeframe that begins the month that you’re going to turn 65. This 6-month window is one of the most important factors that you should take advantage of when you’re shopping for additional health care protection.

Another advantage of the open enrollment date is that you’ll get the lowest available premiums for your Medigap plan, even if you aren’t in the best health. During the 6-month window, the insurance company can’t raise your premiums, even if you have a severe health problem. After that window is over, your application is going to be treated like any other application, and they can jack up your rates based on your health. Applying during open enrollment can save you thousands and thousands of dollars every year.

If you’ve already missed your open enrollment period, don’t worry, there is still a chance of getting affordable coverage. You might be more expensive, but you can’t put a price on the peace of mind that additional healthcare coverage will bring you.

Want More Coverage?

If a Plan N doesn’t give you all the additional coverage you need, then there are other options. If you want to get the most comprehensive coverage, Plan F is going to be the best choice. Plan F covers every possible gap that is left by the original Medicare. If you want to ensure that you have all the coverage possible, then you should consider buying a Plan F policy.

One of the worst things that you can do is not have enough insurance coverage. If you have subpar coverage, you could be responsible for it, but having the proper Medigap plan will ensure that it doesn’t happen. The older you get, the more that you’re going to spend on health care every year, and all of those bills could ruin your retirement savings account.

Questions or Concerns?

I know that shopping for Medicare supplemental coverage can be difficult. There are dozens of confusing terms and options that you will need to navigate. If you have any questions, you can read some of my other articles and hopefully, they will answer those questions. If you need help applying for coverage or need assistance picking a plan, you can contact Medicare directly using their official site (Medicare.gov), or you can call a local Medicare supplemental insurance company.

The best way to get an affordable Medigap plan is to work with an independent insurance agent. Unlike a traditional Medigap agent, independent brokers work with dozens and dozens of Medicare supplemental insurance agencies across the country. These agents can bring a personalized set of quotes directly to you.

Not only will working with an independent insurance broker save you money, but they will also save you time. If you tried to get all of those Medigap quotes by yourself, you could spend hours and hours calling agents. They can connect you with the best companies to meet your supplemental coverage needs. Additionally, they can give you unbiased advice on which policy is going to meet your needs.

You’ve worked for years and years to reach this stage of your life. Retirement is a special time of life when you can kick back and enjoy all of that hard work. Don’t let those increasing medical bills and hospital fees keep you from fulfilling your retirement dreams.

Hopefully, this explanation of Medigap Plan N has given you the information that you need to make an educated decision about your supplemental coverage. If you’ve decided that the broad coverage of Plan N is not the perfect policy, there are nine other options. If you want more information about the other Medigap plans, I’ve also detailed the pros and cons of the other policies.

Conclusion – Medicare Supplement Plan N

In the vast landscape of healthcare, Medicare offers seniors an affordable way to cover health expenses. However, its coverage isn’t comprehensive. For those looking to bridge the gaps, Medigap policies, such as Plan N, provide added protection. Plan N, while expansive, does have its limitations, notably not covering Part B excess charges.

Factors like financial capability and overall health play pivotal roles in choosing the right plan. Open enrollment periods offer prime opportunities for securing these plans at favorable rates. Still unsure? Independent brokers can guide you through myriad options, ensuring your retirement isn’t marred by unforeseen medical expenses. Remember, the key is to balance protection with affordability to truly relish your golden years.