Are you worried about a surge in inflation? What about hyperinflation? The prices of goods and services have been steadily rising, while the value of the dollar has been declining. This can be concerning for anyone who is looking to protect their wealth and make a profit.

The CPI (Consumer Price Index) soared to an increase of 9.1% from last year. This is the largest increase in inflation the economy has endured since 1981.

As inflation creeps up, many people begin to worry about the state of the economy as a whole. The Consumer Confidence Index also fell to its lowest level in over a year.

With the stock market being so volatile as of late, it’s no wonder people are worried about their investments.

However, there are still some good investments out there that can help you hedge against inflation and make a profit.

Table of Contents

What Is Inflation?

Inflation is defined as a sustained increase in the general level of prices for goods and services. It is usually measured as an annual percentage change.

In the past, inflation has been caused by factors such as wars, natural disasters, and oil shocks. More recently, central banks printing money has also been a major driver of inflation.

Consumers often feel inflation the most when they go to the grocery store and find that the prices of their favorite items have increased.

Inflation can also have an impact on investments. For example, if you are invested in a fixed-income investment such as a bond, the value of your investment will decrease as inflation increases.

This is because when inflation goes up, the purchasing power of the dollar declines. This means that it takes more dollars to buy the same amount of goods and services.

As an investor, you need to be aware of how inflation can impact your portfolio and make sure that you are investing in products that will maintain their value or even increase in value as inflation increases.

| This especially becomes true in the distribution phase of your retirement when you are relying on your portfolio to provide income. |

I had many clients who began to feel the pinch of rising costs after they retired. Most were able to adjust their budgets accordingly but still felt the impact.

What Causes Inflation?

Inflation is caused by a variety of factors, but the most common is an increase in the money supply.

When the money supply grows faster than the economy, it leads to inflation. This is because there is more money chasing the same amount of goods and services.

Other factors that can cause inflation include:

- Wars or natural disasters that lead to increases in the prices of goods

- Increases in oil prices

- The government spends more than it takes in through taxes

- Poor economic conditions

How Can Inflation Affect My Financial Strategy?

Inflation can have a major impact on your financial strategy. If you are retired or close to retirement, inflation can erode the value of your savings. This is because the purchasing power of your money will decline as prices increase.

I’m sure you’ve noticed gas prices increasing lately. That’s just one example of how inflation can eat away at your savings.

In addition, if you have debt, inflation can make it more difficult to repay what you owe. This is because the amount you owe will be worth more in real terms than when you originally took out the loan.

“Inflation can be scary, but like any financial movement, there are winners and losers,” says True Tamplin of Finance Strategists, a popular financial education website.

“During periods of high inflation, we should be doubling down on looking for where to invest because the dumbest place you can keep your money is in cash.”

What to Invest in During High Inflation?

The rise in food prices is a recurring problem for American consumers.

In comparison to the CPI inflation rate of 6.5 percent recorded in December 2022, the CPI inflation rate witnessed a decline of 3.1 percentage points, reaching 3.4 percent by December 2023.

As inflation increases, it’s not as long, and consumer sentiment about Inflation hits a record high, with 7 in 10 saying inflation is a problem.

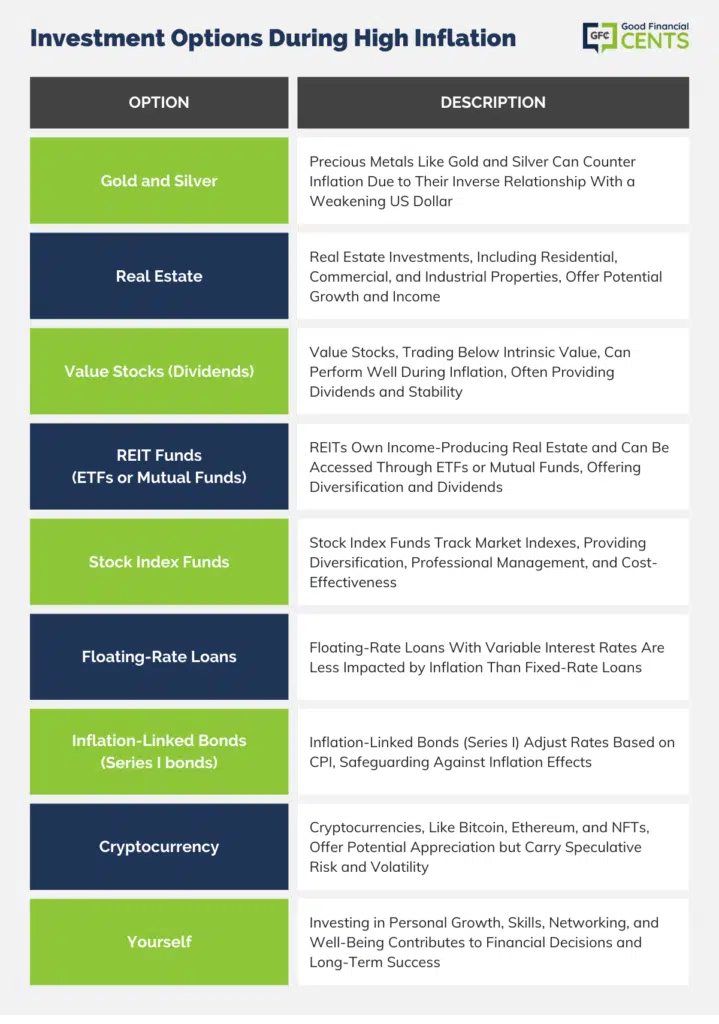

So, what can you do to protect your portfolio against inflation? Here are 9 of the best investments that can help turn a profit during periods of high inflation.

1. Gold and Silver

Commodities are another inflation hedge, as they tend to move inversely to the U.S. dollar when inflation rises. When the dollar weakens, commodities become more expensive, and vice versa.

Investing in commodities can be done through commodity-based ETFs or mutual funds, which offer exposure to a basket of commodities. Alternatively, investors can purchase futures contracts for specific commodities such as oil, gold, or silver.

Gold and silver have been used as a means of exchange and store of value for centuries. In times of economic turbulence, these precious metals have typically maintained their purchasing power, making them ideal inflation hedges.

Over the last ten years, gold has returned an average of 7% per year, while silver has returned an average of 10% per year. In comparison, the S&P 500 has returned an average of 14% per year over the same period, which is higher than the lifetime average of 10%.

Different ways to invest in gold and silver are through buying physical metals, mutual funds, or ETFs (exchange-traded funds). The popular gold ETF is the SPDR Gold Trust (GLD), and the popular silver ETF is the iShares Silver Trust (SLV).

| COMPANY NAME | ETF NAME | SYMBOL |

|---|---|---|

| Abrdn plc | Physical Silver Shares ETF | SIVR |

| ProShares | Ultra Silver | AGQ |

| Invesco | DB Silver Fund | DBS |

| GOLD | ||

| iShares | Gold Trust | IAU |

| World Gold Council | SPDR Gold Shares | GLD |

| Abrdn plc | abrdn Physical Gold Shares ETF | SGOL |

| World Gold Council | SPDR Gold MiniShares Trust | GLDM |

| SILVER | ||

| Invesco | DB Silver Fund | DBS |

| ProShares | Ultra Silver | AGQ |

| iShares | Silver Trust | SLV |

2. Real Estate

Real estate investments are another asset class that can offer protection against inflation. As prices for goods and services rise, so do rents and property values. In addition, real estate provides the potential for income and capital appreciation, making it a well-rounded investment.

Types of real estate investments include:

- Residential Property: This can be in the form of a single-family home, townhouse, condominium, or apartment.

- Commercial Property: This includes office buildings, retail space, warehouses, and mixed-use properties.

- Industrial Property: These are typically manufacturing plants or storage facilities.

If you’re not comfortable owning physical real estate, there are also crowd-funding real estate investment trusts (REITs), which own and operate income-producing real estate.

REITs offer the benefits of diversification and professional management, making them a good option for many investors.

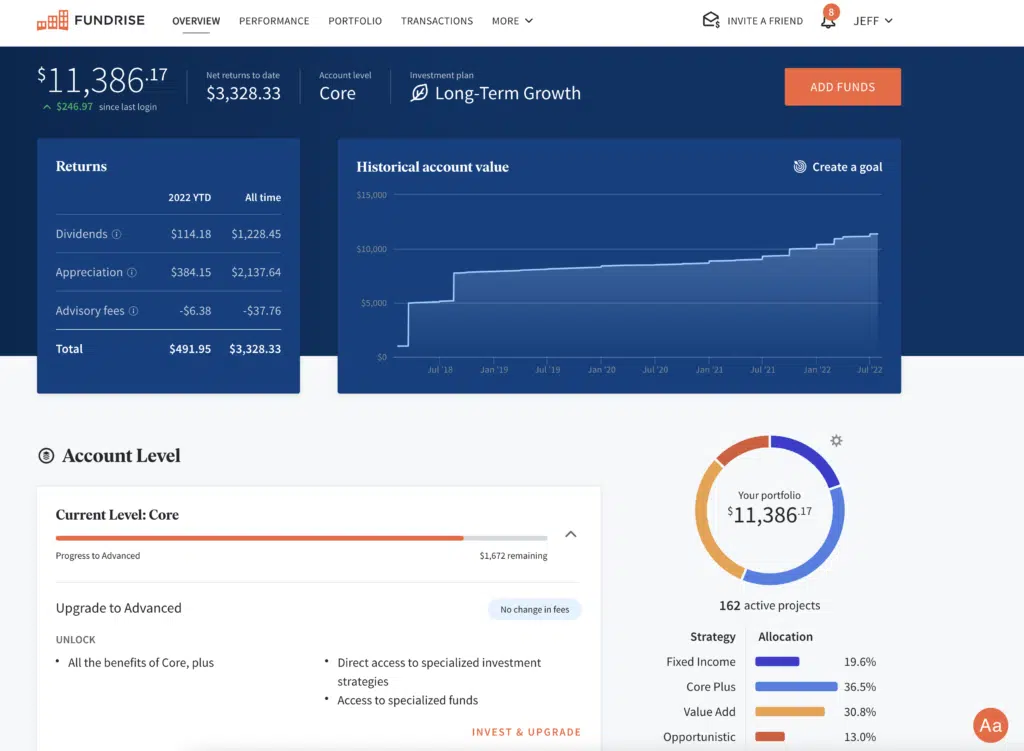

A popular option is Fundrise, an online platform that makes it easy to invest in REITs. With as little as $500, you can get started investing in a diversified portfolio of commercial and residential properties.

A competitor of theirs, Roofstock, focuses exclusively on investing in rental properties.

These are just examples of REITs you can invest in on the crowdfunding side. We’ll discuss other REIT options later in this article.

3. Value Stocks (Dividends)

Value stocks are those that are trading at a discount to their intrinsic value. In general, these companies are out of favor with investors and tend to be less volatile than the overall market.

Value stocks tend to do well during periods of inflation as investors seek out companies that can maintain or grow their dividend payments.

In addition, many value stocks are in cyclical industries, such as basic materials and energy, which tend to do well when inflation is rising.

Value stocks that pay dividends are just the icing on the investment dessert cake – yummy! In addition to providing a source of income, dividends can also help buoy the share price during periods of market turmoil.

The Dividend Aristocrats are a group of companies in the S&P 500 that have increased their dividends for 25 consecutive years or more. This list includes many blue-chip companies, such as Johnson & Johnson (JNJ) and Procter & Gamble (PG).

| You can read more about how to make $1,000 per month from dividend stocks. |

Examples of value stocks that also pay good dividends include :

| COMPANY NAME | STOCK DIVIDEND | CURRENT QUARTERLY DIVIDEND ($) | DIVIDEND YIELD (%) |

|---|---|---|---|

| AT&T (T) | $18.53 | $0.28 | 5.99% |

| Exxon Mobil (XOM) | $89.98 | $0.88 | 3.91% |

| General Electric (GE) | $68.36 | $0.08 | 0.47% |

| Philip Morris International (PM) | $95.84 | $1.25 | 5.22% |

| Verizon Communications (VZ) | $44.75 | $0.64 | 5.72% |

Billionaire investor Warren Buffett is a big proponent of investing in value stocks. In fact, his holding company, Berkshire Hathaway (BRK.A), is a prime example of a successful value stock portfolio.

One of Buffett’s best value plays was investing in Coca-Cola (KO) when it was trading at a discount to its intrinsic value. In the 20 years since he first invested, Coke has returned over 1,200%.

This is why they say “Buy it like Buffett!”

4. REIT Funds (ETFs or Mutual Funds)

Real estate investment trusts (REITs) are companies that own and operate income-producing real estate such as office buildings, retail space, warehouses, and apartments.

REITs offer the benefits of diversification and professional management, making them a good option for many investors.

In addition, REITs are required by law to distribute at least 90% of their taxable income to shareholders in the form of dividends, making them an attractive choice for income-seeking investors.

Like other types of investments, REITs can be purchased individually or through an ETF or mutual fund. They can also be purchased as individual stocks.

Here are a few examples of popular REITs: Realty Income Corp (O), Duke Realty Corp (DUK), and Annaly Capital Management Inc. (NLY).

5. Stock Index Funds

Stock index funds are a type of mutual fund that tracks a specific market index, such as the S&P 500 Index.

Index funds offer the benefits of diversification and professional management, making them a good option for many investors. In addition, they tend to have lower costs than actively managed mutual funds.

Index funds can either be purchased as mutual funds or ETFs. Vanguard is a popular provider of index mutual funds and ETFs. Another option is Fidelity Investments, which offers a wide variety of index funds and ETFs.

The largest index fund is the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 Index. Vanguard’s largest index fund is the Vanguard S&P 500 Index Fund (VOO).

You can purchase both of these through any online broker, such as Robinhood or M1 Finance.

6. Floating-Rate Loans

A floating-rate loan is a type of loan that has a variable interest rate, which means that it will fluctuate in response to changes in market interest rates.

Floating-rate loans are often used by borrowers who expect interest rates to rise in the future. In addition, they offer the benefit of being less affected by inflation than fixed-rate loans.

One downside of floating-rate loans is that they tend to have higher interest rates than fixed-rate loans. In addition, they may be subject to prepayment penalties if the borrower decides to pay off the loan early.

One floating-rate loan ETF is the Invesco Senior Loan ETF (BKLN). This ETF tracks an index of senior floating-rate loans.

Another option is the iShares Floating Rate Bond ETF (FLOT), which invests in a variety of different types of floating-rate bonds.

These are just two examples of ETFs that invest in floating-rate loans. There are many others available, so be sure to do your research before investing.

7. Inflation-Linked Bonds (Series I bonds)

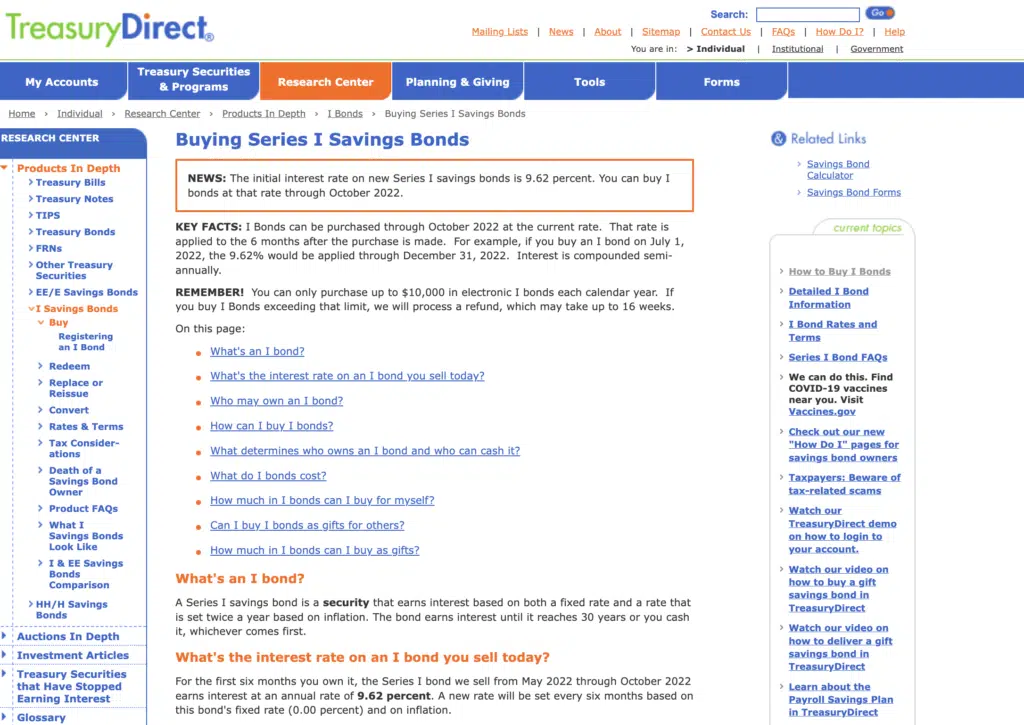

Inflation-linked bonds, also known as Series I bonds, are a type of bond that is designed to protect investors from the effects of inflation.

I bonds have a fixed interest rate plus an adjustable rate that is linked to the CPI (Consumer Price Index). The adjustable rate portion of the I bond’s interest rate is reset every six months, which means that the bond’s interest payments will increase or decrease in response to changes in the CPI.

I bonds are a good option for investors who are looking for a way to protect their portfolios from inflation. In addition, they offer the benefit of being backed by the full faith and credit of the US government.

With the surge in inflation, Bonds have soared in popularity. Currently, I bonds are paying rates as high as 9.62% and can be purchased directly from the US Treasury at TreasuryDirect.gov.

Invesco offers the Inflation-Protected Bond ETF (IPE), which invests in a variety of different types of inflation-linked bonds.

Another option is the iShares TIPS Bond ETF (TIP), which also invests in a variety of different types of inflation-linked bonds.

8. Cryptocurrency

Cryptocurrency is a type of digital asset that uses cryptography to secure its transactions and control the creation of new units.

Cryptocurrencies are decentralized, which means that they are not subject to government or financial institution control. In addition, they are often used as investments, as they have the potential to appreciate in value.

Cryptocurrency is newer to the scene, so the jury is still out on whether it is a true inflation hedge to combat rising interest rates and a volatile stock market. But many Bitcoin maximalists believe fiats allow too much price manipulation from big governments, and Bitcoin will be the only digital currency needed in the future.

That’s why Bitcoin is the most well-known cryptocurrency, but there are many others, such as Ethereum, Litecoin, and Ripple.

Another form of cryptocurrency is NFTs. NFTs are digital assets that are stored on a blockchain and can represent anything from a piece of art to a baseball card.

Cryptocurrencies are a good option for investors who are looking for an alternative to traditional investments. In addition, they offer the benefit of being relatively new, which means that there is still potential for them to grow in value.

In addition, their prices can be volatile, so you could lose money if you invest in them.

Investors who are interested in investing in cryptocurrency should do their research before investing and only invest what they are willing to lose.

9. Yourself

“The best investment you can make is in yourself.”

-Warren Buffett

Warren speaks the truth here. In order to make sound investment decisions, you need to have a firm understanding of your own finances and risk tolerance.

You also need to be honest with yourself about your goals and what you are trying to achieve with your investments and your career.

It’s also a good time to be honest with yourself about your career and your lifetime goals.

- Are you satisfied with your career?

- Do you see yourself doing the exact same thing 10 years from now?

- Are you fulfilled in your current role?

- Is there anything you’ve been putting off for “another day”?

These are tough questions to answer and may help you determine if you need a change. A few ways you can invest in yourself are:

- Taking courses or getting a certification in something you’re interested in

- Taking the time to network and build relationships with people in your industry or field

- Working on developing new skills that can help you in your career

- Investing in your health by eating well, exercising, and getting enough sleep

Earlier in my career as a financial planner, I invested in obtaining the CFP (certified financial planner) certification. It was a notable investment of money and time but the return has been extremely beneficial to my career.

No matter what you decide, investing in yourself is one of the best investments you can make.

The Bottom Line

There are many different types of investments that can be used to hedge against inflation. Inflation-protected bonds, commodities, and real estate are just a few examples.

Investors should consider their individual needs and goals when choosing an investment. In addition, they should remember that all investments come with risk, so they should only invest what they are willing to lose.