You may do it with your phone, Internet, and TV services.

You may do it with your bank accounts, too.

But should you also bundle your insurance policies with one company to save money?

Like so much else in life, the answer depends, in part, on your unique situation.

Table of Contents

- First: The Potential Problem With Bundled Policies

- How to Bundle Insurance AND Get the Right Coverage

- When Should You Seek Out Bundled Policies?

- Other Ways to Save on Insurance Premiums

- Even When Bundled, Your Insurance Should be Customized

- Final Thoughts – Can You Really Save Money by Bundling Insurance Policies

First: The Potential Problem With Bundled Policies

Yes, you can save money by bundling policies. We’ll get to that.

But first, let’s acknowledge how bundling policies could lead to problems if you aren’t careful.

Unlike with your TV channels and your phone service, for example, you don’t get instant feedback from your insurance company.

When Bundling Products Works

Let’s say you are saving $30 a month by using the same company for your Internet and cable TV channels.

Things go smoothly for a few months. The Internet connection is fast enough. You’re happy with the TV channels.

But for some reason, one night, after sitting down to watch your favorite show, you discover the TV service has stopped offering your favorite channel.

What do you do?

- Call customer service every day until the channel comes back.

- Lose the bundled discount by canceling your service and using a different TV provider.

- Keep your bundle but supplement its TV service with one of the new online providers since it offers your favorite channel.

A sensible customer could take any of those actions to solve the problem, and other than losing a little time and the monthly discount, the experience hasn’t cost you too much.

When Bundling Products Might Not Work

Insurance is different. Each time you pay your monthly premium, you’re paying to keep the coverage in place and available, not to actually use it.

Since you aren’t using it, you won’t get immediate feedback about the quality of the coverage you’re buying and how it fits your changing needs. You won’t be prompted to buy supplemental coverage or get an entirely different policy.

Instead, the feedback comes when you file a claim — when you actually need to use your coverage. At that point, unfortunately, it’s too late to fix any problems that may exist in your coverage.

So if you bought a bundled policy based on its price and convenience and not because it met your specific coverage needs, you could be in trouble if disaster strikes.

Instead of finding another TV channel to watch, you may be scrambling to pay for expensive repairs to your car or home — or worse, paying for someone else’s astronomical medical bills after they got injured on your property or in a wreck that the adjustors determined was your fault.

How to Bundle Insurance AND Get the Right Coverage

When you’re shopping for groceries and find a great buy-one, get-one-free offer on yogurt or butter, it’s a great time to stock up on yogurt and butter, right?

Sure it is, assuming you like yogurt and butter and assuming you don’t already have more yogurt and butter at home than you could ever eat.

If either of those things is true, you’re probably wasting money no matter how much you’re saving. Any sensible shopper knows this.

Yet with insurance, it’s harder to make these kinds of common sense decisions unless you first take the time to read the policy’s fine print and find out whether the coverage you’re buying fits your life.

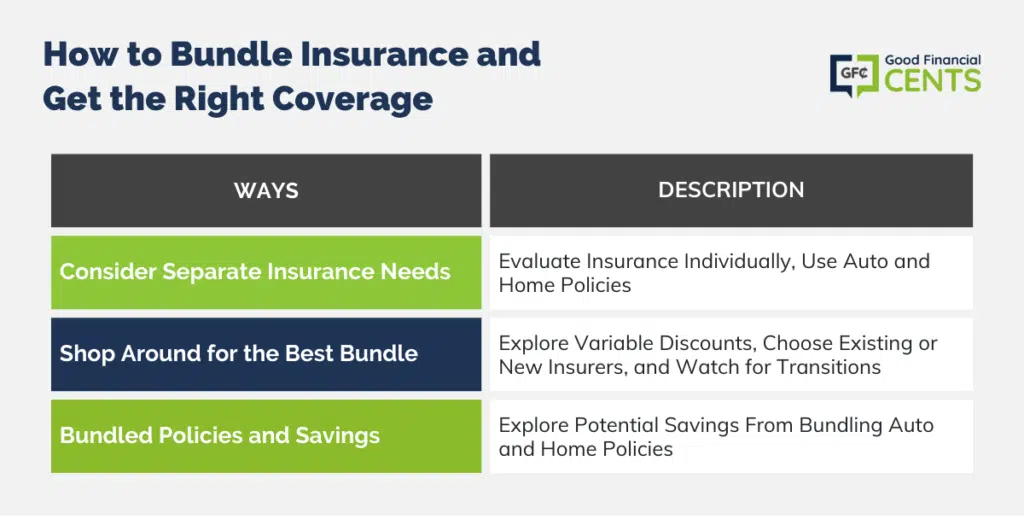

Consider Separate Insurance Needs Separately

So, let’s say you’ve had an auto insurance policy for the past five years, and you’re happy with your agent and the coverage.

Now, you’re about to buy your first house. Your agent sells homeowners policies and has offered you a 15 percent multiple policy discount.

He’ll mail the policy to you today, and you can sign it before closing.

Seems like a great deal: Simple, convenient, and with a discount.

But with something as valuable as your home, you’ll want to make sure your insurance coverage adequately covers your property before taking out the policy.

Here’s how you can go about it:

- Read about how homeowners insurance should work.

- Decide how much coverage you need for your new property.

- Read your agent’s bundled homeowners policy to see how it stacks up.

If the proposed policy meets your needs, you’re in great shape and can enjoy the multiple-policy discount for years to come.

If not, though, that discount could cost you a lot more, and you should continue shopping around.

If, for example, the bundled policy doesn’t offer enough liability coverage on your property and someone got injured and sued you, you could lose your savings or be forced to sell your new property to pay damages.

It works the other way, too: If you have homeowners coverage and need to add an auto policy, consider your auto coverage needs on their own merits, then see if you can take advantage of your insurance company’s multiple policy discount.

Shop Around for the Best Bundle

Not all multiple policy discounts are created equally. If you have a homeowners policy and you need a new auto policy, it may seem natural to add the new coverage with your existing company.

You could also take the opposite route, though. If you can save more by bundling policies with an entirely new insurer, why not do that?

Just watch out for cancelation fees and the possibility that one of your coverages could lapse during the transition to the new company.

Bundled Policies. Braided Policies. Tangled Policies?

A two-policy bundle that includes auto and home coverage can save you an average of $500 a year. Since rates and insurers vary from state to state, you may be able to save even more in some states.

And the more insurance you need, the more you can potentially save by keeping all your policies in one place.

Your company may offer life insurance, boat insurance, renters insurance, pet insurance — you get the idea.

But how much bundling is too much bundling?

Again, it goes back to considering individual insurance needs individually.

Let’s imagine, for example, you don’t know a whole lot about life insurance. You check your mail one afternoon and see an offer from your auto insurance agent.

It says, “Because you’re a loyal customer, we’re offering a special deal on life insurance. Get up to $50,000 in coverage for $100 a month with no medical exam or medical questions! Offer good only for selected clients.”

You’ve been wondering about life insurance, and on the surface, this may sound like a good solution.

But truth be told, depending on your age and health condition, you may be able to get up to $1 million in life insurance coverage for less than $100 a month.

Some knowledge about what you’re buying goes a long way. It can keep you from turning your bundled policies into a costly tangle of policies.

When Should You Seek Out Bundled Policies?

Chances are your insurance company will let you know about multiple policy discounts through advertisements, direct mail, or email.

As any consumer can imagine, bundled policies benefit your company, too, or else they wouldn’t offer the discount.

You don’t have to wait for an offer from an insurance company, though.

You can seek out a bundled policy, especially when doing so gives you a specific benefit.

The Discount, of Course

We probably don’t have to say it again, but just in case:

Multiple policyholders seek bundled plans to save money.

If you’re looking for a way to shave some fixed expenses from your monthly budget, bundling your policies could help.

Again, just make sure you’re in control of the coverage you’re buying so you aren’t paying more in the long run.

Insurance rates vary from state to state, so the amount you could save will vary, too.

Insurance rates vary from state to state, so the amount you could save will vary, too.

Insuring an At-Risk Asset

If you live in Tornado Alley or a hurricane-prone Florida beach, insurance companies may consider your home an at-risk property, especially if the home has already needed multiple claim-financed repairs.

This at-risk status will make the home harder to insure.

Bundling the new homeowner’s policy with your existing auto policy can help your case, especially if you’ve never filed or have seldom filed an auto claim.

Of course, you can find other ways to remedy this problem — agreeing to a higher deductible, for example — but bundling the at-risk policy with other lower-risk policies can help.

For the Sake of Convenience

Bundling policies can save money, but it can also create some extra convenience for you.

You could log into one site and pay three bills, for example, if you had three policies bundled together. If you already spend an hour paying bills online because you still can’t remember all the passwords, this can be helpful.

And if something bad happened, that affected more than one piece of property — if a tree struck your garage and damaged not only the structure but your car, which was parked inside, for example — you could get multiple claims going more easily.

Just like with the discount, make sure the policy you’re buying meets your specific needs and doesn’t offer only convenience.

Other Ways to Save on Insurance Premiums

Bundling policies isn’t the only way to save money on your monthly insurance premiums. In fact, it may not even be the best way, depending on your individual needs. You can also save money by:

Getting a Higher Deductible

A higher deductible means you’d be paying more out of pocket before the insurance company starts paying on a claim.

It also means you’ll pay less per month in premiums.

Find the right balance here, though. A deductible you couldn’t possibly afford can make it difficult to use the insurance coverage you’re paying for.

Buying Only What You Need

Paying for insurance you don’t even need simply means you’re paying too much.

If your house would cost $150,000 to replace, for example, getting $250,000 in coverage means you’re paying for insurance you couldn’t likely ever use, even if your house was totally destroyed.

Insurance is not a one-size-fits-all product. If your policy is too small, you could have trouble replacing or repairing your property. If it’s too big, you could be paying too much each month.

Improving Your Property

Cars with up-to-date safety features cost less to insure for one simple reason: You’re less likely to be in a wreck that results in a claim.

The same holds true for your house.

If you have a security system, a new roof, you don’t smoke, or you have a backup power generator, check with your insurance agent about eligible discounts.

And, believe it or not, the same holds true for your life. If you can improve your health before applying for life insurance, you’ll probably save some on your premiums. If you’re a non-smoker, you’ll save even more.

Even When Bundled, Your Insurance Should be Customized

Insurance companies offer bundled policy discounts because they give customers additional reasons to remain loyal customers.

Your grocery store, bookstore, department store, bank, and maybe even your medical clinic use the same tactic.

But how many times have you…

- bought food you don’t like

- bought a book you’d never read

- or go to a medical specialist who manages a condition you don’t have

…just because it’s convenient, or just because you can save 15 percent?

Probably never.

You should use the same common sense approach with your insurance:

1. Determine what coverage you need.

2. Shop for and compare policies that will meet your needs.

3. Look into discounts and ways to make the coverage more convenient.

This approach puts you in control of your insurance needs so you can make decisions that will protect your property and protect you from liability while also taking advantage of available discounts.

Final Thoughts – Can You Really Save Money by Bundling Insurance Policies

When it comes to bundling insurance, like how you bundle phone and Internet, there’s a chance to save money. But be careful – insurance doesn’t give quick feedback. Think about it like comparing bundled items to insurance. It shows that your needs matter.

Be thoughtful, whether combining home and auto insurance, protecting risky assets, or for ease. Personalizing things is most important. Think about the costs you’re willing to pay, getting the right coverage, and making your property better.