Ideally, you’ll have the cash to pay all of your owed taxes come April 15th, but there are numerous factors that can leave you behind on your tax obligations. Whether you underestimated how much you’d owe or made a mistake on your tax return, you might find you owe the IRS money, plus penalties and fees.

These issues are more common than you might realize. In FY 2022, the IRS assessed $23.8 billion for late returns and collected $2.3 billion from delinquent ones. Taxpayers made 36,022 compromise offers, with the IRS accepting 13,165 worth $234.3 million.

In situations like these, many consumers turn to third-party tax relief services for help.

A tax relief service might help you with an “Offer in Compromise,” which settles your tax debt for less than what you owe. These companies offer additional support from clearing bank levies and tax liens to payroll and wage garnishment challenges.

Table of Contents

How Much Do Tax Relief Services Cost?

If you’re considering reaching out to a tax relief service for help with back taxes, be aware of Federal Trade Commission (FTC)-issued warnings about these companies.

According to the IRS, tax relief services very often charge upfront fees of up to thousands of dollars in exchange for helping consumers apply for IRS hardship programs, whether consumers are eligible or not. Many tax relief companies also don’t provide refunds, so you can lose out on the fees paid even if you don’t receive any tax relief.

Individual tax relief companies don’t disclose how much they charge customers ahead of time. Instead, many offer a free consultation to determine the help you need first. Some tax relief companies charge time-based fees based on the hours they spend on your case, while others charge fees based on a percentage of your debt. Other companies charge a flat fee regardless of the help you require.

The best tax relief services are as transparent as possible, with some offering money-back guarantees or service guarantees. Here are a few tax relief companies’ information about the services they provide and costs and fees for comparison.

| PRECISION TAX RELIEF | WIZTAX | ANTHEM TAX SERVICES | FORTRESS TAX RELIEF | |

|---|---|---|---|---|

| Free Consultation | Yes | Yes | Yes | Yes |

| Fee Information | Varies; flat-rate quote provided upfront, based on individual case needs | Three payments of $199; no additional fees throughout the process | No prices published | Varies; flat-rate fee, based on estimated hours needed for individual case |

| Money-Back Guarantee | Yes, 30-day guarantee | Yes, 30-day guarantee | Yes | No |

| Other Guarantees | Service Guarantee | No | No | Customer Service Guarantee |

How to Find a Reputable Tax Relief Service

When it comes to finding a reputable tax relief service, there are plenty of red flags to watch out for. According to the FTC, some taxpayers who’ve filed complaints about tax relief services said that, after they signed up and paid upfront fees, some companies charged additional fees to their bank accounts or their credit cards.

The FTC says, “Think twice if the entire fee for services is requested upfront with no explanation of how services will be billed or whether a refund of unearned fees will be made.”

Also, beware of tax relief companies that promise to get you relief from tax liabilities, misrepresent how long the process might take, and omit relevant asset information to the IRS. Since tax relief companies can’t guarantee any relief, ignore promises of a tax relief program that can resolve your tax debt.

“Only the IRS or your state comptroller can make that determination,” says the FTC.

If you’re still interested in working with a tax relief service, check to see if a default billing rate applies. This acts as a flat rate that applies to any hours spent by the firm’s employees, not just its tax experts. Some tax relief services might apply this charge if you cancel your services with the company.

With these warnings in mind, the following tips can help you find a reputable company to work with:

- Look for a tax relief service that’s transparent about its costs and fees.

- Don’t sign up for services without a clear contract that outlines potential fees and next steps.

- Look for tax relief providers that offer a free consultation.

- Read reviews offered by the Better Business Bureau (BBB), Google Reviews, and TrustPilot.

- Choose a company with a money-back guarantee or “no fees upfront” practices.

Alternatives to Using a Tax Relief Service

Although tax relief services can help guide you through the process of qualifying for IRS hardship programs, you don’t have to pay for this help. You can take steps to renegotiate your tax debt on your own directly with the IRS.

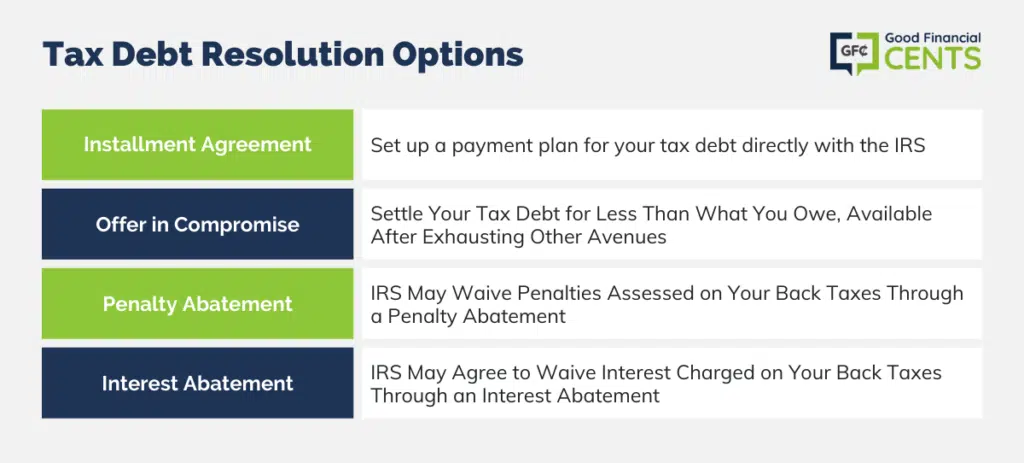

Some of these options include:

- Installment Agreement. This type of agreement is common when individuals need to make a payment plan for their tax debt.

- Offer in Compromise. This tax debt solution lets you settle your debt for less than what you owe. This option is typically only available after other avenues have been exhausted.

- Penalty Abatement. A penalty abatement takes place when the IRS agrees to waive penalties assessed on your back taxes.

- Interest Abatement. An interest abatement takes place when the IRS agrees to waive interest charged on your back taxes.

The IRS website can help you learn more about payment plans for tax debt and other options like the Offer in Compromise process. It’s important to know that you can apply for most tax resolution options yourself, and you don’t have to pay a third party for assistance.

Getting Help for Tax Debt

If you’re overwhelmed with the idea of trying to resolve your tax debt on your own, tax relief companies might be an alternative to a DIY approach. These firms work with you personally to lay out your tax debt options and can be helpful if you want to be able to ask questions and get answers immediately throughout the process.

Conduct due diligence to ensure any tax relief company you’re considering has a good record. This includes checking their standing with the BBB, reading their reviews on sites like TrustPilot, and not signing a contract that’s vague or unclear.

The Bottom Line – How Much Do Tax Relief Services Cost?

Navigating tax debt can be overwhelming, and while tax relief services offer an avenue for assistance, it’s crucial to approach it with caution. Many charge significant upfront fees, and their effectiveness varies. Transparency in fees and a clear contract are paramount.

Additionally, the FTC warns against companies demanding entire payments upfront without clarity in services or those making lofty promises.

Thankfully, there are multiple avenues to explore. From do-it-yourself approaches via the IRS website, which offers solutions like installment agreements and penalty abatements, to hiring reputable tax relief firms.

Ensure thorough research, verify companies’ reputations, and understand all options before committing.