This will sound contradictory but the same traits that make you a successful business owner could also cause you to fail. If you understand why, you won’t join the legions of entrepreneurs who had the drive and passion to succeed but ended up going back to work for somebody else.

It’s all about leverage and if you’ve never studied how this largely misunderstood word is pivotal to your success, now is the time.

Table of Contents

What Are These Personality Traits?

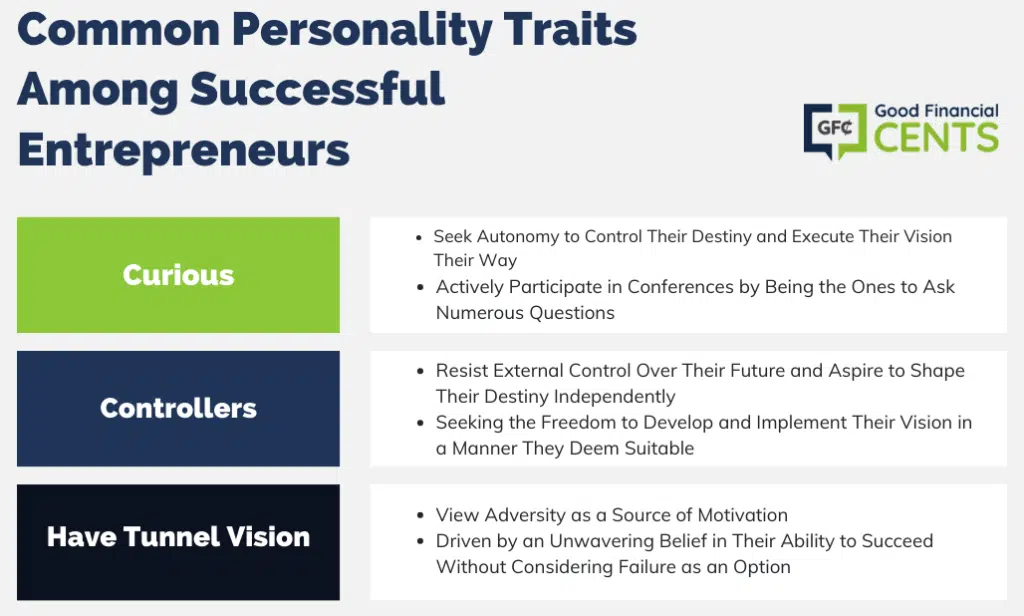

According to Entrepreneur Magazine, successful entrepreneurs have certain personality traits in common.

- They are curious. They’re always reading the latest article, they’re the person who asks all of the questions at the conference, and they never miss a chance to meet somebody new and ask, “How did you do it?”

- They are controllers. They don’t want somebody else controlling their destiny and they want the autonomy to create their own vision and execute it in a way that they think is right.

- They have tunnel vision. A little bit of adversity is fuel. It makes them work harder because it never enters their mind that they might fail.

These are all traits that lead to success but those same traits can limit growth if taken to extremes.

What Is Leverage?

You probably learned about leverage in your high school science classes. Remember how simple machines like levers and pulleys could multiply your strength?

Leverage in business works the same way. If you multiply your resources, you gain an advantage and allow your business to grow. In business, there are three main types of leverage.

Leverage Somebody’s Time

Regardless of who you are, you share a limitation with everybody else in the world: You only have 24 hours each day. You have to sleep, eat, spend time with your family, and tend to your growing business. At some point, probably sooner than you think, you’re going to reach a point where you can’t get everything done.

With your experience and education, how much are you worth per hour? Anybody who has started and grown a business has unique skills that are worth more than the average laborer. Would you say that you’re worth at least $50 per hour?

If your business were to hire somebody like you at a rate of $50 per hour, would you use their talents and experience to grow your business by gaining new clients, streamlining a manufacturing process, or advising you on how to negotiate better vendor terms or would you have them answer the phone, update the Facebook page, and perform data entry?

Those lower-level business tasks are essential but you can hire somebody to do all of those duties for less than $50 per hour. The question becomes, if you wouldn’t pay somebody $50 per hour to do those tasks, why is your business paying you such a large amount to complete them?

By hiring somebody to do those tasks, you’re able to free up time in your schedule to grow your business. In order for your business to grow, you have to delegate tasks to others. You have to transform from the primary laborer to the manager or CEO. Until you do that, your business will only grow as much as you can handle on your own in a 24-hour day.

Leverage Somebody’s Labor

There are tools on the Internet for just about everything and as a result, business owners sometimes believe that it’s faster and cheaper to perform professional tasks in-house. You can build a website, create a flyer, read an article that gives you step-by-step instructions for fixing a refrigerator, and more. Is there anything you can’t find online?

The Internet hasn’t put professionals out of business because successful business owners know that hiring professionals to do professional work not only produces standout results, it saves time in the process. What took you six hours to learn online would take somebody with experience half that time or less. How many hours did you spend attempting to save money?

Hiring professionals will produce better results in less time.

Leverage Somebody’s Money

Here’s a hypothetical situation: You own a self-storage business on the north end of town. It’s so successful that it’s nearly at capacity but even if you were to add more storage units to your current property, you still couldn’t gain business from people who live in the southern portion of your community.

The owner of a self-storage facility in the south end of town is planning to retire. His location is ideally situated but he’s never had the success that you’ve found.

You would like to buy his business but you’ve never believed in taking on debt and paying cash isn’t an option.

Assuming that you’ve done an exhaustive analysis of the business by “leveraging” experts that can help you evaluate the business, leveraging a bank’s money by paying a little interest to make a much larger return is a sound business decision.

Turning away from debt should be applauded but when opportunity appears, debt isn’t always a negative. Most companies grow by leveraging somebody’s money.

Bottom Line

An entrepreneur who can’t give up control and embrace the concept of leverage is one who will always wonder why their business never grew to the size they envisioned. At the beginning stages, performing all business tasks on your own probably made sense but as you grow, you have to embrace leverage. Only then will you see the exponential growth you always expected.

Gerrid Smith is the CEO of the charity-focused coupon website, Save1. They provide coupons and deals from over 5,000 online stores! Each time a coupon is used, they provide a meal to a child in need. You can connect with Save1 on Twitter, Facebook, and Google+.

I agree completely with you. I’ve seen friends and family members going haywire trying to balance everything and wanting 100% success. Well, one can succeed provided one follows such brilliant and time-tested tips.

I think a lot of entrepreneurs naturally struggle with delegating simpler tasks to others. It’s not even always a question about money – many don’t want to give up control over certain business elements which they developed themselves from the grown up.

Yet, as the article correctly pointed out, leveraging time and labor is a necessity for rapid growth.

The tunnel vision aspect seems to be a main factor. This is sometimes criticized as arrogance, but it seems that many simply have one track brilliant minds.

Good article; even entrepreneurial drive and passion can be leveraged. For example, developing a functional business technique or model such as a cash flow method, or expedited customer support system helps entrepreneurs multiply their existing will to succeed. Essentially by utilizing things such as business planning and information technology, business owners have tools to enhance what they bring to the table whether it be vision, talent, know how etc.

You described me to a T. I was a successful entrepreneur and used leverage to build my income property business.