The best tax relief companies provide valuable services for consumers who find themselves in trouble with the Internal Revenue Service (IRS) or their state tax authority. These firms can help you figure out your best strategy moving forward, including which programs you qualify for to help reduce taxes and any penalties you owe.

For the purpose of this guide, we compared dozens of tax relief companies to find the best of the best. Not only did we compare services offered, but we pored over third-party reviews and rankings, investigated any guarantees these companies advertise, and checked their websites for overall transparency.

Community Tax came out ahead of the pack due to its personalized tax relief services, excellent reviews, and A+ accreditation with the Better Business Bureau (BBB). Community Tax also offers a free consultation and a 100% money-back guarantee.

Get Started With Community Tax

However, we also feel we can recommend several other top tax relief services that offer similar services, including Anthem Tax Services, Optima Tax Relief, Urgent Tax Help, and more.

If you are struggling with debts to the IRS due to federal income taxes you owe and you need third-party help to find a resolution you can live with the best tax relief companies might be your best hope. Below you’ll find a further explanation of our ranking along with individual reviews of each of the tax relief companies that made the cut.

Table of Contents

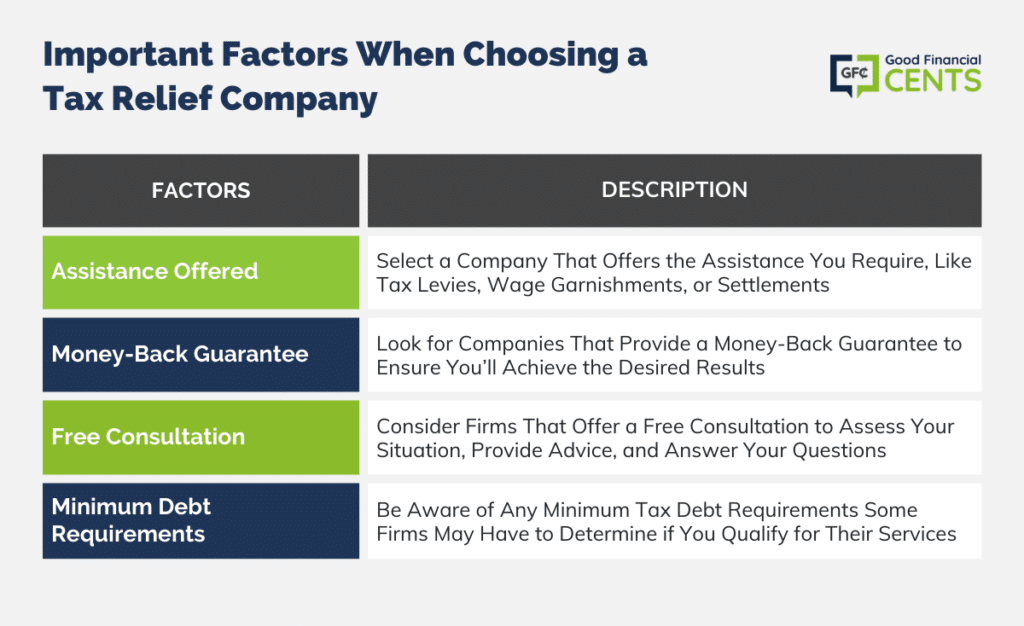

Most Important Factors When Choosing a Tax Relief Company

As you compare tax relief companies, it’s crucial to understand the type of help they offer as well as any guarantees they have. Keep an eye out for hidden fees, as not all companies are transparent about them. Read reviews, look at results, and pay attention to the following factors:

- Assistance Offered: You may need assistance with a tax levy or wage garnishment, or it’s possible you need tax relief services to help you negotiate a settlement for less than what you owe. Some companies specialize in one area of tax relief, so make sure to choose a firm that offers the type of help you need most.

- Money-Back Guarantee: The top tax relief services tend to provide a money-back guarantee that ensures you’ll get the results you need. We recommend checking companies for this type of guarantee before you commit.

- Free Consultation: The best tax relief companies also offer a free consultation that gives consumers a chance to receive instant advice on their situation. This initial consultation is also a good time to ask questions and gain insights into your next best steps.

- Minimum Debt Requirements: Also note that some tax relief firms require a minimum amount of tax debt to get started, although other factors may be considered as well. If you don’t owe a lot, some of the tax relief companies may not be able to work with you. Also, be aware that many tax relief companies offer a form on their website that you can fill out to see if you qualify upfront.

The Best Tax Relief Companies of March 2024

The best tax relief help is attainable, flexible, and easy for consumers to access. We compared all the top companies to find firms that promise tax relief services and deliver on a consistent basis. If you’re struggling with overdue taxes and need help figuring out what to do next, we suggest starting your search with the companies we highlight below.

| Company | Highlights | |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |

Which Companies Didn’t Make the Cut

Tax relief services can be immensely helpful if you’re struggling to resolve a stressful tax situation. However, you should make sure to avoid tax relief companies that promise the world and don’t deliver.

The Federal Trade Commission (FTC) warns that many tax relief companies make false claims and take money upfront, but then fail to take the steps to resolve their client’s tax debts on their behalf. That’s why we only looked at companies that receive excellent third-party rankings and reviews, as well as companies that have exhibited their ability to resolve tax debt for clients.

Reviews of the Best Tax Relief Companies

Ready to compare all the top tax relief services? The reviews below explain each company’s offerings as well as any advantages you can gain by seeking out their services. We’ll also go over any major downsides you should be aware of as you compare each firm.

Community Tax

Community Tax offers tax relief help for consumers who are receiving letters from the IRS, having their wages garnished, or having a lien placed against their property. The company is accredited by Consumer Affairs, and it also boasts an A+ rating with the BBB.

Get Started With Community Tax

Why It Made the List: This company promises a free consultation that can help you determine potential resolutions before you commit. They also offer a 100% money-back guarantee for their services.

What Holds It Back: Community Tax has excellent rankings from third-party reviewers, but they don’t explain the specific tax resolution services they offer clearly on their website.

Anthem Tax Services

Anthem Tax Services offers a tailored tax resolution service that can help you resolve old tax debts and settle for less than what you owe. Services offered include Offer in Compromise (OIC) assistance, tax resolution help, tax preparation services, garnishment and levy rescue, and more. They can also help you negotiate and set up a realistic payment plan with the IRS without the need for garnishments or bank levies.

Get Started With Anthem Tax Services

Why It Made the List: Anthem Tax Services has resolved millions of dollars in tax debt for clients, and this firm still holds an A+ rating with the BBB. They’re also accredited by the National Association of Tax Professionals (NATP), the California Tax Education Council (CTEC), the National Association of Enrolled Agents (NAEA), and more.

What Holds It Back: This firm doesn’t offer any information about the cost of its services on its website. To find out how much you’ll have to pay for help, you’ll need to fill out their contact form or call in to speak with a qualified tax professional.

Optima Tax Relief

Optima Tax Relief is yet another tax relief service that receives excellent reviews from users and has an A+ rating from the BBB. This company claims to have helped resolve over $1 billion in tax debt to date, and they offer all the traditional tax resolution services consumers typically seek. This includes Offer in Compromise, tax lien discharge assistance, bank levy release, assistance with installment agreements, and more.

Get Started With Optima Tax Relief

Why It Made the List: Optima Tax Relief offers a free consultation and a 15-day money-back guarantee for their services.

What Holds It Back: The money-back guarantee this company advertises is only good during the “investigation phase” and no longer applicable once the company begins working to resolve your tax debts.

Tax Hardship Center

The Tax Hardship Center boasts an A+ accreditation from the BBB as well as many five-star reviews on user review sites like Trustpilot. This company offers popular tax resolution help with Offers in Compromise (OIC), installment agreements, tax audit representation, penalty abatements, and more.

Get Started With Tax Hardship Center

Why It Made the List: Tax Hardship Center makes it easy to answer a few questions online to see if you qualify. They also offer a free consultation with a qualified, in-house tax professional.

What Holds It Back: Like other tax relief firms, the Tax Hardship Center doesn’t offer any information on their pricing or plan costs. While this is common among tax relief services, it’s still a major downside.

Victory Tax Lawyers

Victory Tax Lawyers is a tax relief firm that helps individuals and corporations settle unresolved and problematic tax debts. They help their clients set up installment agreements, tax lien resolutions, Offers in Compromise (OIC), tax levy resolutions, and more.

Get Started With Victory Tax Lawyers

Why It Made the List: Victory Tax Lawyers offer a free consultation that can help you figure out your next best steps. Also, note that all consultations and tax relief help come directly from tax relief lawyers.

What Holds It Back: Unlike other tax relief services that made our ranking, Victory Tax Lawyers does not offer any sort of money-back guarantee.

Urgent Tax Help

Urgent Tax Help promises assistance from a team of tax attorneys and specialists who have years of experience resolving problematic tax debts. They offer an array of services, including the resolution of liens and wage garnishments. They can also assist you as you apply for the IRS Fresh Start Program, apply for a penalty or interest abatement, and more.

Get Started With Urgent Tax Help

Why It Made the List: This company offers a free consultation for clients who want to talk over their options before they commit.

What Holds It Back: This firm doesn’t advertise a money-back guarantee of any kind, unlike some other tax relief services that made our ranking.

Complete Tax Debt

Complete Tax Debt is another tax relief service to consider if you are hoping to resolve your tax liabilities for less than what you owe. This company features an A rating with the BBB, and they promise to get you back on track toward compliance with the IRS.

Get Started With Complete Tax Debt

Why It Made the List: Complete Tax Debt offers consumers a free consultation and tax analysis with a qualified tax professional without any obligation to pay for services.

What Holds It Back: Complete Tax Debt offers scarce information on its website about the exact tax relief services it offers. This means you’ll have to complete a free consultation to find out which tax remedies they suggest and assist with.

Landmark Tax Group

Finally, don’t forget to consider Landmark Tax Group for personal or corporate tax debt relief. This firm offers services like the Offer in Compromise (OIC), relief for penalties and interest, and assistance with overdue payroll taxes. They also offer a bounty of information and resources on their website that can help you do some research on your own.

Get Started With Landmark Tax Group

Why It Made the List: Landmark Tax Group has some of the best resources for tax relief on its website. This company also offers a free, no-obligation consultation that can help you decide if this is the company for you, as well as a 15-day money-back guarantee.

What Holds It Back: This company doesn’t appear to be registered with the BBB, nor do they have many media mentions. This is likely due to the fact this company was founded fairly recently, in 2012.

What You Need to Know About Tax Relief

Tax relief is a tricky industry where companies don’t feel obligated to be transparent when it comes to the fees they charge. That’s why it’s crucial to compare companies based on their reviews, their results, and their overall integrity.

There’s nothing wrong with paying out-of-pocket for help with tax relief since you could easily save thousands of dollars if your debts are settled for less than you owe. However, you should be careful to only work with reputable companies that know what they’re doing.

Here are some other important industry issues you should know about:

There Are Many Strategies Used to Resolve Tax Debt on Both the State and Federal Level

First, it’s important for consumers to understand that there is more than one way to resolve tax debt issues, just as there are myriad tax problems that may need resolving. One of the most common tax relief solutions is the Offer in Compromise (OIC), which is a strategy used to help you settle your tax debts for less than you owe. However, tax relief help comes in many forms, and not all consumers will qualify for OIC. Other strategies tax relief companies might suggest include IRS installment plans and negotiations to remove or reduce wage garnishments and tax levies.

Tax Relief Scams Are Common

The Federal Trade Commission (FTC) warns that scams are rampant within the tax relief industry and that consumers need to be careful before they sign up for this type of help. Some tax relief companies charge pricey upfront fees but never take any steps to help resolve your debt, they note.

Other companies promise access to programs consumers can’t even qualify for. Make sure you know the company you plan to work with is reputable, and that they have a long history of qualified customers.

The IRS Offers Its Own Plans That Can Help You Resolve Tax Debt

Consumers should also be aware that they don’t have to seek third-party help in order to resolve tax debt. The IRS offers its own plans that can help consumers directly, including installment agreements and the Offer of Compromise.

While tax relief companies can assist you as you apply for these programs, the IRS Fresh Start Program has made it easier for consumers to set these programs up themselves. Also, note that you can even negotiate your own penalty abatement with the IRS if you can prove financial hardship.

You Can Take Part in a Free Consultation With More Than One Company

While many of the best tax relief companies offer a free consultation, don’t forget that you can take advantage of this perk more than once. Consider speaking with several firms that offer tax relief help in order to hear more than one viewpoint and set of potential solutions. Free consultations can also help you find out which companies you feel most comfortable with, as well as compare pricing and fees.

How We Chose the Best Tax Relief Services

Tax relief companies definitely have a bad rap due to all the scams the worst players try on consumers, but there are plenty of reputable companies to choose from. We compared all the top tax relief services to find ones that offer high-quality assistance that helps consumers resolve their tax debts so they can move on with their lives. Here are the main criteria we considered in our ranking:

Free Consultation

We feel very strongly that tax relief companies should offer consumers a free consultation. As a result, we prioritized firms that offer this benefit above all others. A free consultation is recommended and crucial for you to take part in before you give one of these firms access to your financials as well as financial compensation.

Money-Back Guarantee

We also looked for tax relief companies that offer a money-back guarantee, preferably one without a lot of fine print. A money-back guarantee can provide peace of mind as you begin the process, and it can ensure you’ll get your money back if the tax relief help you were offered doesn’t play out as promised.

Reputation and Reviews

We also considered rankings from third-party companies like the Better Business Bureau, as well as user reviews from Trustpilot and Consumer Affairs. Companies that are affiliated with the National Association of Tax Professionals (NATP), the California Tax Education Council (CTEC), the National Association of Enrolled Agents (NAEA), and other professional organizations also received high marks.

Summary: The Best Tax Relief Companies of 2024

| Company | What It’s Known For | |

| Get Started | |

| Get Started | |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |

|

| Get Started |