So often, we find ourselves in the shop or browsing online, enticed by a new gadget or fashion piece, convinced that we “need” it, only to discover later that it’s not really something we use again or something that was truly necessary.

Our consumer culture fuels this habit, and it’s an issue many of us fall prey to.

Table of Contents

Considerations Before You Buy

Before you reach for your wallet, it’s wise to critically evaluate your potential purchase. Is it something that fits in with your long-term financial priorities? Is it aligned with your values and life goals? Is it a want rather than a need? These are essential questions to ponder.

Reflecting on Your Needs

When you’re about to buy something that you “need,” take a reflective pause. Spend a moment to determine whether you should buy that item at all. Emotions and social pressures can often lead us to make impulsive decisions. Instead, take time to weigh the pros and cons.

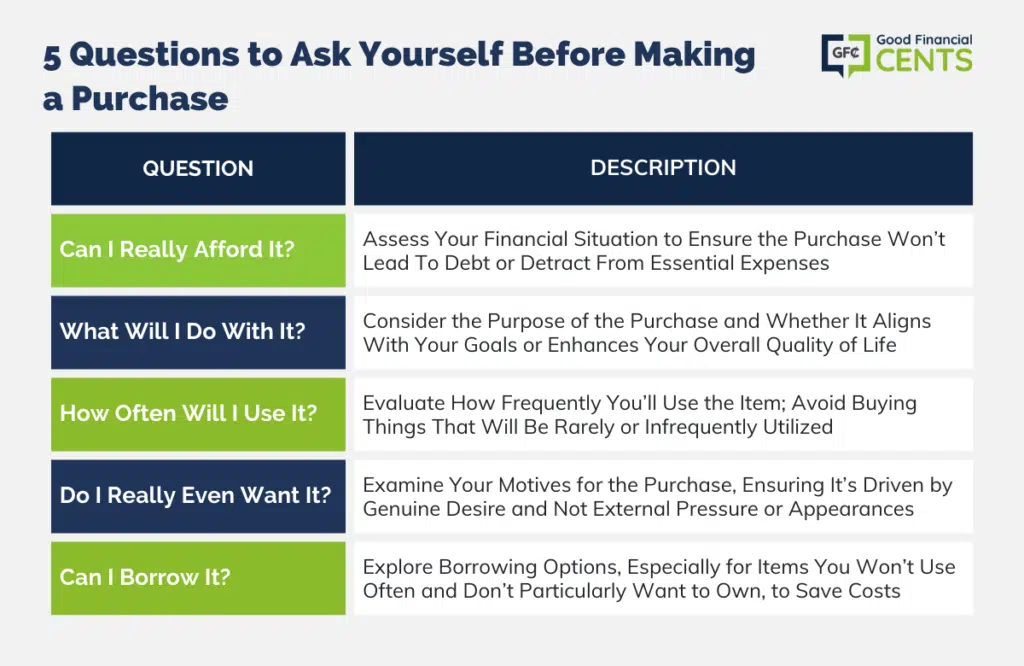

Ask Yourself These 5 Questions

Here are 5 detailed questions to guide your thinking — answer honestly:

Can I Really Afford It?

First, you need to determine if you really have the money for the item. Can you truly afford it? You need to make sure that the purchase isn’t going to land you in debt.

Additionally, you don’t want the money you spend on this item to detract from something else you might want to buy — or something that you truly do need. Make sure that the item is actually affordable before you buy.

What Will I Do With It?

What are your plans for the purchase? Really think about what it will accomplish in your life. Will you be able to forward a specific goal you have? Will using the item contribute to your overall quality of life? Really think about your plans for the item, and consider a realistic plan for its use.

How Often Will I Use It?

Next, determine how often you will use the item. If you are buying something that you are unlikely to use more than once or twice, it doesn’t often make sense to complete the purchase. There are other ways you can get what you need for a one-time use.

Be honest about how often you are likely to use something.

You might realistically use a coffee maker every day, so it makes more sense to buy one as opposed to buying a blender that you might only use a few times and then set aside.

From a treadmill to high-end cross-trainers to a new book, think about how often it will be used. Don’t buy items that you probably won’t actually use much.

Do I Really Even Want It?

Figure out why you want to make that purchase. Examine your motives. Do you want to buy the item because you want it? Or are you trying to impress someone?

Many of us think we want something, when really what we want is to look good in front of friends and family. Before you buy something, do some serious consideration.

If you are making a purchase primarily because you think you “should” have it, and not because you actually want it, or you believe it will make your life better, then reconsider.

Can I Borrow It?

If the item is something you won’t use much and something that you don’t particularly care to own, it might be worth it to borrow it. If you can borrow something, it doesn’t make sense to buy it — especially if you can borrow it for free, or for a low cost.

If you aren’t sure whether or not you will like a book, check it out of the library first. Borrow power tools that you don’t use much. When something needs to be hauled (which isn’t often), we borrow my parents’ van.

The Bottom Line – Questions Before Making a Purchase

The questions above are more than just a buying guide; they are a compass for mindful consumption. Take the time to reconsider before you make a purchase.

Consult with friends or family, do some research, and always align your spending with your core values and long-term vision. You just might find that you don’t need to buy it after all.

In a world filled with temptations and marketing pressures, being a discerning consumer is not just a financial virtue but an ethical stance. Let’s all strive to make purchases that resonate with our true selves and our deeper needs.

Another question that I don’t think enough people ask is: do I already have something like this? I know shopping with frugal friends (you know the kind who DON’T encourage you to buy everything you lay your eyes on) is helpful because they can remind you that you already have a five t-shirts, vases that are perfectly pretty, and a dish to use when you have people over. So often when people are buying things that aren’t really needs, they don’t really need it because they already have it, or something that can work just like it!

So true. I have had a lot of t-shirts, some you buy from gift shops from vacation, but often I picked the “best of available tshirts because I should bring a souvenir back” and found I didn’t really love it as much once it sat among my other shirts. thing is I love graphics like cute animals, so when I see a neat image I want, it tempts me badly. Bonus if the color looks great on me too..even harder >_<.

I try to remember what certain style I already have, and in what colors. If I already have a long black dress, because black isn't my big thing, I certainly don't need 5 more. My biggest struggle is hoodies and outerwear jackets, I don't "need" more, but I do wear hoodies a LOT, I get cold easily…but I have enough of them.

I think the worst though is that I'm downsizing and trying to sell of a lot of clothes, so bringing in more makes no sense…but…but…lol. But it's a special exclusive hoody from a gift shop I work in, so, I see it EVERY day XD