I’ve always heard how evil PayDay cash loans are. They have been called “scams“ and “ripoffs.” I, personally, never had a run-in with them until recently. I met with a 60+-year-old woman who was having a hard time making it work financially.

She was still employed and trying to take care of her elderly son, who had his fair share of hard times. Thinking she had no other options, she turned to one of those Quick Cash PayDay loan services.

When she showed me her statement, my jaw almost hit the desk. She had taken out a 9-month loan of $400 (or so), and her interest rate was 521%! I really thought it was a typo at first. The loan accrued a $5.35 interest charge per day. $5.35 PER DAY!

I don’t remember the exact payoff amount, but I remember it being somewhere in the neighborhood of $1400 for a 9-month loan. If that doesn’t convince you to stay away from PayDay cash loans, then what will?

To shed more light on the topic, Miranda Marquit offers her take on why you should avoid these quick cash loans (better known as PayDay nightmares).

The lure of easy money is alive and well, even after the financial crisis and recession we have had. Indeed, with credit standards tighter than ever, it is little surprise that many are looking for ways to get their hands on money without having to go through with an onerous credit check.

Payday loans seem perfect, allowing borrowers access to money, usually without a credit check.

In many cases, all you need to get a payday loan is a bank account and proof that you have a job. You head into the payday loan place with this information, fill out a form, and write a check for the amount of money you want, plus the fee that payday loan places charge.

Table of Contents

Payday Cash Loans Are Dangerous

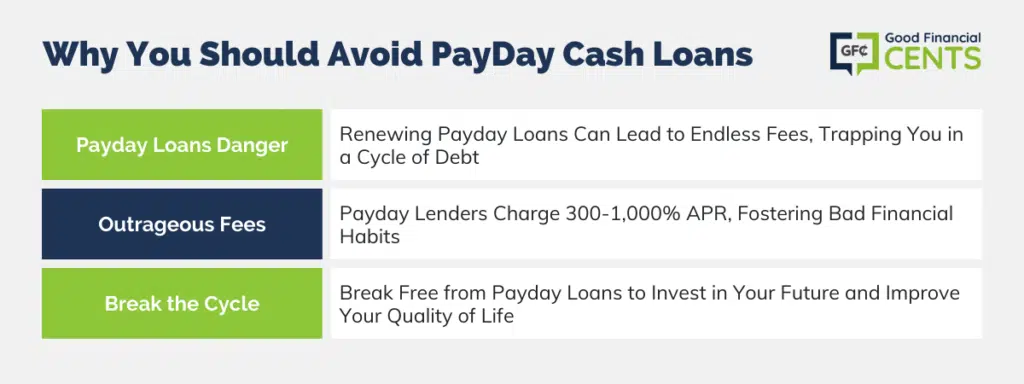

With payday loans, though, the real danger isn’t in a one-time loan that you pay off. The real danger is renewing that loan regularly as the fees pile up. Payday loan companies make it easy to renew your loan.

All you have to do is come in before your check goes to the bank or before your payment is due (most payday loan places offer terms of between two weeks and two months) and ask for a renewal.

You pay the fee, and your loan term is extended. While it doesn’t seem like much to come in with $25 twice each month to renew a $500 payday loan, the money starts to add up. In 10 months, you have already repaid the $500, but that’s just in the fees; you still owe the original $500.

Imagine, though, if you get that loan from a place that charges $50 each time you renew. Or $100.

Payday Cash Loans Have Outrageous Fees

When you work out the fees, you find that payday lenders charge, on average, what amounts to between 300% and 1,000% APR. That gets expensive! On top of that, you are developing very bad financial habits.

Instead of living within your means, paying off your obligations, and building wealth, you soon find yourself trapped in a lifestyle that leaves you scrambling every month to make ends meet.

You are afraid to pay that $500 (or $750, or $1,000) obligation to the payday loan company because you are afraid that you won’t have enough money for other expenses.

So you keep making the smaller, more manageable payments. In some cases, borrowers get so entrenched in the payday loan lifestyle that they take out more payday loans to cover other expenses.

If you need to take out a loan to help with expenses, we recommend applying for a personal loan through a bank.

Break the Cycle!

It can be very hard to break the cycle of payday cash loans because they are so expensive. However, it is vital that you try. All of the fees that you pay go directly into someone else’s pockets.

That is money that you could be using to invest — literally — in your future, building wealth (or at least a decent emergency fund). You could be using that money to go on a family vacation or buy something that improves the quality of your life.

When you continually pay large amounts of interest, you are not getting anything of value in return. You are simply paying for the privilege of borrowing money for things that you may not need.

The Bottom Line – Why You Should Avoid PayDay Cash Loans

In the realm of financial solutions, PayDay cash loans stand out as a perilous choice, characterized by exorbitant interest rates that can trap unsuspecting borrowers in a relentless cycle of debt. The allure of quick cash, devoid of stringent credit checks, makes these loans seemingly appealing.

However, the true cost reveals itself in the form of astronomical fees, equivalent to between 300% and 1,000% APR.

These loans foster poor financial habits, pushing individuals further away from financial stability and growth. Rather than succumbing to the false security of payday loans, consider healthier alternatives such as bank-provided personal loans.

Prioritize breaking free from this expensive cycle and direct your funds towards meaningful investments in your future.