When it comes to buying insurance for your pet, there are several different companies to choose from.

Embrace Pet Insurance offers policies that cover dogs, cats, puppies, and kittens, each of which is underwritten by American Modern Insurance Group.

The company claims its core values center around honesty, customer satisfaction, personal responsibility, and giving back.

Embrace comes in at #4 on my list of top Pet Insurance Providers:

Table of Contents

How Embrace Pet Insurance Works

Like other types of insurance, pet policies from Embrace Pet Insurance are intended to protect you financially if your pet becomes sick or injured.

Embrace Pet Insurance offers a simple and comprehensive plan with benefits that will help your pet get the care they need if they face an unexpected health issue.

Embrace Pet Insurance allows you to choose your own annual maximum, annual deductible, and reimbursement percentage for a truly personalized policy.

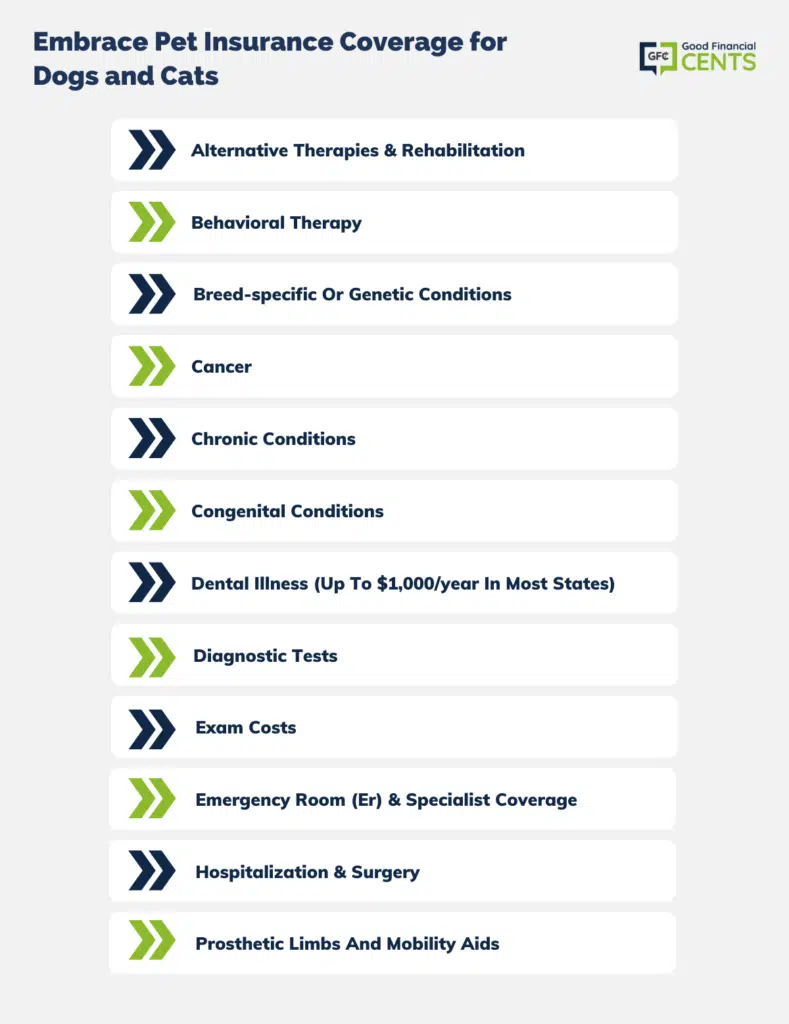

Pet insurance from Embrace covers the following issues with both dogs and cats:

- Alternative therapies & rehabilitation

- Behavioral therapy

- Breed-specific or genetic conditions

- Cancer

- Chronic conditions

- Congenital conditions

- Dental illness to $1,000/year (Accessible in most states)

- Diagnostic tests

- Exam costs

- ER & specialist coverage

- Hospitalization & surgery

- Prosthetic limbs or other devices like mobility aids

Embrace Pet Insurance also offers prescription drug coverage.

This coverage is available with every policy, and it reimburses FDA-approved and homeopathic drugs prescribed for coverage conditions, including medicines such as antibiotics, allergy medicine, insulin, and eye drops.

When it comes to what is not covered by Embrace Pet Insurance, you probably won’t be surprised to hear the company does not cover pre-existing conditions.

However, there is an important variable here since Embrace does cover what they consider to be “curable pre-existing conditions.”

If your pet has shown symptoms for a condition that is curable (respiratory infections, urinary tract infections, vomiting, diarrhea, etc.) prior to enrolling with Embrace Pet Insurance, you will need to go through a 12-month waiting period before related conditions are covered.

If your pet doesn’t show any additional symptoms and the condition is over, Embrace Pet Insurance will reinstate coverage for these conditions going forward at their discretion.

But Embrace does not cover traditional pre-existing conditions that are chronic and incurable. This includes bilateral conditions (an illness on one side of the body that will likely take place on the other) as well since they are at high risk of a recurrence.

Embrace Pet Insurance Wellness Rewards

Embrace Pet Insurance also offers a special program called Wellness Rewards that is intended to help you cover your pet’s ongoing routine and wellness care.

Working as a flexible preventative care plan, Wellness Rewards reimburses you for everyday veterinary care, training, grooming, and more.

In a lot of ways, this plan works like a Health Savings Account (HSA) for humans.

When you purchase Wellness Rewards in addition to the basic Embrace Pet Insurance Plan, you can get reimbursement for:

- Wellness exam fees

- Vaccinations & titers

- Flea, tick, & heartworm preventatives

- Spay/neuter surgery

- Fecal & routine blood tests

- Microchipping

- Nutritional supplements

- Grooming

- Medicated shampoos

- Toenail trimming

- Routine anal gland expression

- Wearable pet activity monitors

- Cremation or burial

- Gastropexy

- Preventative teeth cleaning

- Prescription diet food

- Training

- Routine chiropractic care

- Reiki, massage therapy, acupuncture

- Hip dysplasia exams, radiographs, or other OFA testing

Wellness Rewards allows you to choose a level of reimbursement for these charges, with $250, $450, and $650 per policy year allowed.

Keep in mind, however, that Wellness Rewards costs an additional fee over and above your pet insurance policy.

For that reason, it is a forced pet savings account more than a real benefit.

How Much Does Embrace Pet Insurance Cost?

One of the biggest factors that can drive a pet owner’s decision to purchase pet insurance is cost.

Plans that are affordable are typically easy to justify while more expensive plans are difficult to purchase when your pet is in good health.

Like other pet insurance providers, policy costs vary quite a bit with Embrace Pet Insurance based on factors such as the type of pet you have, your pet’s age, your pet’s breed, and where you live.

It also makes a difference if you purchase any pet insurance add-ons such as Wellness Rewards.

Reoccurring or one-time fees for enrollment, claims, or billing also affect the cost of your pet insurance plan. For example, Embrace has a one-time enrollment fee of $25 and a $1 monthly processing fee for those who pay monthly.

For more information about why these variables affect pet insurance costs, check out their coverage page.

The cost of pet insurance for dogs is often more expensive than the cost of cat insurance. Statistically, more claims are filed for dogs than cats – and veterinary care for dogs tends to be costlier as well.

Embrace can’t speak for all pet insurance companies, but our dog insurance cost averages about $30-$40 per month, while our cat insurance costs an average of $15-$20 per month.

How to Get Started

If you decide to move forward with Embrace Pet Insurance, the company does offer a straightforward process.

You can get a quote and apply for pet insurance online. Once your pet is approved and you have paid your first month’s premium, you’re covered provided your pet doesn’t have to wait through one of the provider’s waiting periods.

Keep In Mind:

Once your pet is fully covered, you can take them to see any licensed veterinarian for treatment.

Just make sure you print a claim form and take it with you.

A staff member at your veterinary office should fill out the claim form for you while also providing an itemized invoice.

You can then submit the claim for an invoice by fax, email, or via the Embrace Pet Insurance website.

From there, you’ll be reimbursed for charges based on your plan details within a few weeks.

It’s as simple as that.

The Bottom Line

If you need pet insurance, Embrace Pet Insurance is worth checking into.

The company has mostly excellent reviews, and it offers truly customizable policies that can fit anyone’s pet care needs.

Make sure to get a quote and compare prices with several pet insurance companies before you decide.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Embrace Pet Insurance Product Description: Embrace Pet Insurance offers comprehensive health coverage for dogs and cats, ensuring that pets receive the necessary care without imposing heavy financial burdens on their owners. With customizable plans and an emphasis on wellness rewards, Embrace aims to bring peace of mind to pet owners when their furry friends face medical challenges. Summary of Embrace Pet Insurance Embrace Pet Insurance stands out for its comprehensive coverage options tailored to the individual needs of dogs and cats. By allowing pet owners to customize their deductibles, reimbursement percentages, and annual maximums, Embrace provides flexibility in managing pet health costs. Their unique wellness rewards program also encourages preventative care, reimbursing owners for routine vet visits, grooming, and training. With a user-friendly claims process and a dedicated team, Embrace has become a preferred choice for many pet owners looking for robust health coverage. Pros Cons

Embrace Pet Insurance Review

Overall