While physical health and happiness are the most important cornerstones of a successful life, you should also pay attention to your financial health and well-being.

After all, getting in good financial shape can make life considerably less stressful.

Of course, you also want to be able to afford things like braces for your kids, college tuition, and family vacations you’ll always remember.

Unfortunately, not enough people take actionable steps to improve their finances, and the statistics prove it.

A 2023 report from Experian shows that the average credit card balance worked out to $6,365 this year.

Average retirement savings are also downright depressing, with those between ages 45 to 54 having just $254,720 saved for retirement, and individuals ages 55 to 64 having just $408,420 according to the survey of Consumer Finances.

Table of Contents

- Financial Advisor (Planner) vs Financial Coach

- What Is a Financial Advisor?

- What Is a Financial Coach?

- How to Decide Between a Financial Advisor and a Financial Coach

- How to Choose the Best Financial Professional for Your Needs

- Bottom Line: Financial Advisor vs. Financial Coach: Unveiling Differences

Financial Advisor (Planner) vs Financial Coach

The fact is, many Americans desperately need to make some changes to their finances, but not enough people take steps to do it. This is true even though financial professionals are easy to find, both online and within nearly any community across the United States.

But that could be a big part of the problem. Not only are there a plethora of financial advisors to choose from, but there are financial coaches offering services as well. Many consumers don’t know the difference, and they may get stuck in a situation where “analysis paralysis” takes over.

If you’re hoping to turn your finances around and looking for professional advice and help, you may be wondering why you would turn to a financial advisor, a financial coach, or potentially even both.

Read on to learn how financial advisors and financial coaches differ and what you should consider before you use either one.

What Is a Financial Advisor?

A financial advisor is a trained financial professional who helps clients invest for the long term, usually for retirement.

Financial advisors assist their clients when it comes to building portfolios of investments that make sense for their investment timeline and goals, and they advise them on planning for life’s big milestones, such as buying a home or paying for college.

Not only that, but financial advisors are the professionals you want to work with if you need help with complex financial matters like estate planning and charitable giving.

Some financial advisors charge a flat fee for their services, yet others charge fees based on assets under management (AUM).

Others earn a living via commissions they earn when they sell investments like mutual funds and annuities. Also note that the best financial advisors are fiduciaries, meaning they are legally obligated to act in your best interests.

It’s also worth recognizing that technology and the internet have made it possible to hire an online financial advisor, which some may refer to as a robo-advisor.

With a robo-advisor like Personal Capital or Betterment, you can get access to a professional financial advisor online and with the help of technology and tools.

Related: How to Pick a Financial Advisor

Financial Advisor Qualifications

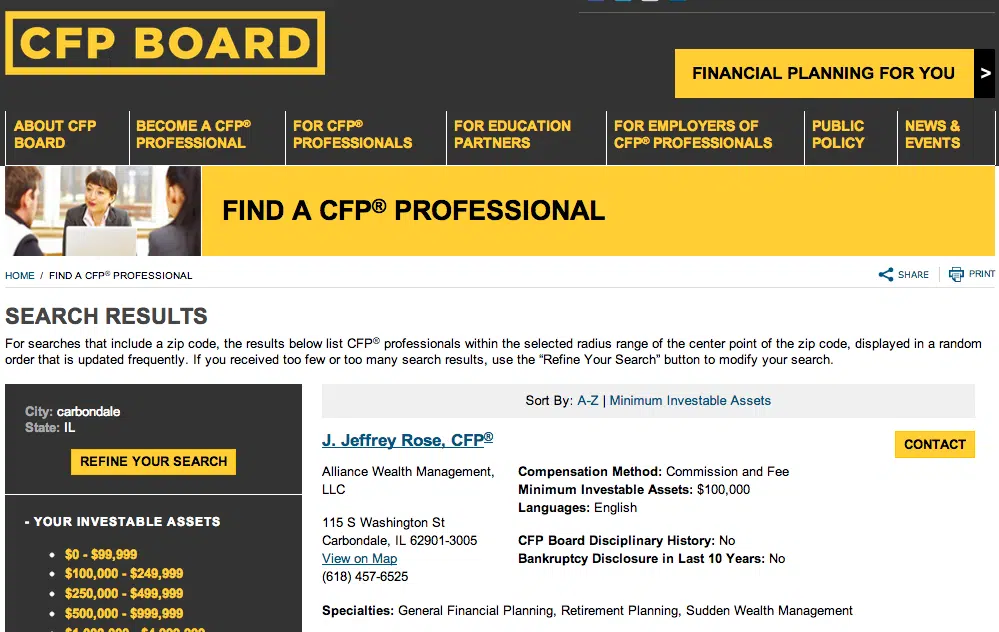

While anyone can call themselves a financial coach, becoming a financial advisor takes several more steps. For starters, financial advisors are licensed and registered with the Financial Industry Regulatory Authority (FINRA), which oversees the industry at large.

Most financial advisors also have a bachelor’s degree, although this is not always the case.

Some financial advisors also take additional steps to become a Certified Financial Planner (CFP).

Becoming a CFP requires a bachelor’s degree plus additional courses, on-the-job training, and the passage of the CFP exam. All said, becoming a CFP requires 12 to 18 months after the completion of a bachelor’s degree.

Make sure to check out my guide to How to Become a CFP if you want a more in-depth explanation of the process.

Financial advisors can also work to become an RIA (Registered Investment Advisor), which requires passing the Series 65 Exam, registering with the state of the Securities and Exchange Commission (SEC), and more.

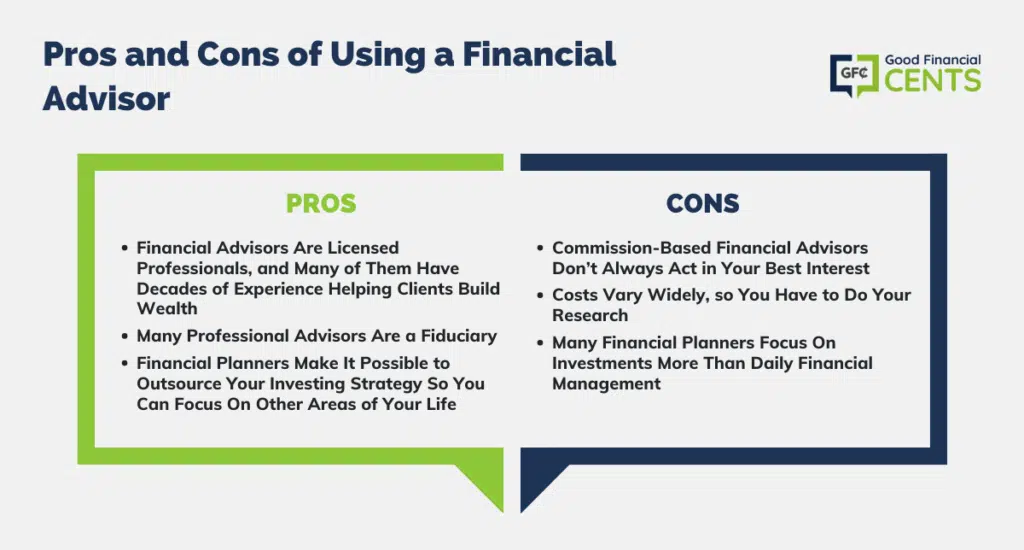

Pros and Cons of Using a Financial Advisor

There are many pros and cons that can come with working with a financial advisor, although some of them depend on the individual advisor you select. Here are the main advantages and disadvantages to be aware of.

Pros:

- Financial advisors are licensed professionals, and many of them have decades of experience helping clients build wealth. Financial advisors are the go-to experts you should turn to when you need help creating a financial plan and portfolio for the future.

- Many professional advisors are a fiduciary. Fiduciary advisors are legally required to act in your best interests, so it’s smart to seek out an advisor with this designation.

- Financial planners make it possible to outsource your investing strategy so you can focus on other areas of your life. Financial advisors tend to have a long-term mindset, so they can help you invest smartly for retirement and other financial goals.

Cons:

- Commission-based financial advisors don’t always act in your best interest. Financial advisors who earn money selling annuities, mutual funds, and other investments can be tempted into stacking their portfolios with financial products that pay them the most.

- Costs vary widely, so you have to do your research. With so many pricing strategies out there, you’ll need to compare financial advisors based on their fees before you decide to work with them.

- Many financial planners focus on investments more than daily financial management. While this isn’t always the case, some financial advisors can be out of touch when it comes to financial topics like budgeting and debt management.

What Is a Financial Coach?

While financial advisors are expertly trained to help you invest in the long run, financial coaches focus on the day-to-day aspects of your personal finances. Coaches help their clients build better financial habits, such as paying themselves first and avoiding long-term debt.

While many financial coaches work full-time, it’s also important to note that it’s possible to become a part-time financial coach.

This path is often pursued by financial professionals who want to keep working in their own industry as well, whether that’s accounting or traditional advising of clients.

If you’re interested in becoming a part-time financial coach, you can watch more on my video here:

Either way, financial coaches typically work with clients who need help figuring out how to save money or how to pay off student loans or credit card debt.

Also, note that financial coaches are legally prohibited from giving specific investment advice, so this type of professional is not the right option if that’s what you need most.

Examples of popular financial coaches you can find online include:

Financial Coach Qualifications

Unlike traditional financial advisors, financial coaches are not required to have any formal education or training since they are not held to official regulatory standards.

Many financial coaches also get their start after being in debt themselves and figuring out how to improve their financial situation and their own lives over time.

However, many financial coaches do have professional degrees in finance or a related field such as accounting. Also note that there are some training opportunities for financial coaches, and it can make sense to seek out professionals who have achieved these milestones.

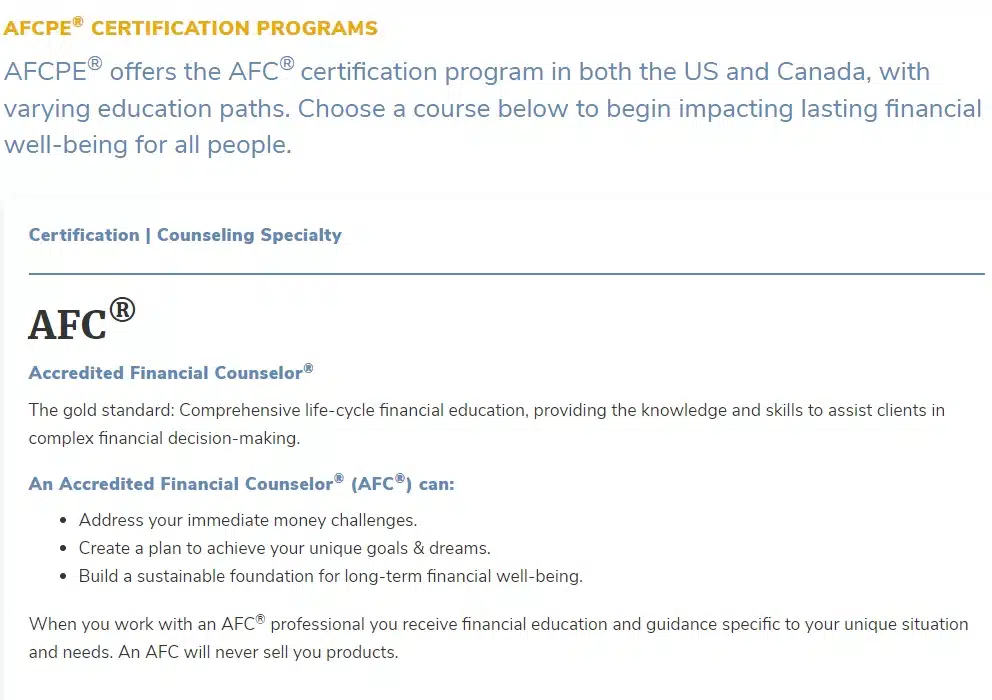

For example, financial coaches can participate in training with the Association for Financial Counseling & Planning Education (AFCPE) to earn their Accredited Financial Counselor® (AFC®) certification.

Dave Ramsey’s Ramsey Solutions also offers training and a path to certification for financial coaches.

This program lets individuals who are passionate about personal finance become a Ramsey Solutions Master Financial Coach who is expertly trained to offer advice on saving money, paying off debt, budgeting for the future, and more.

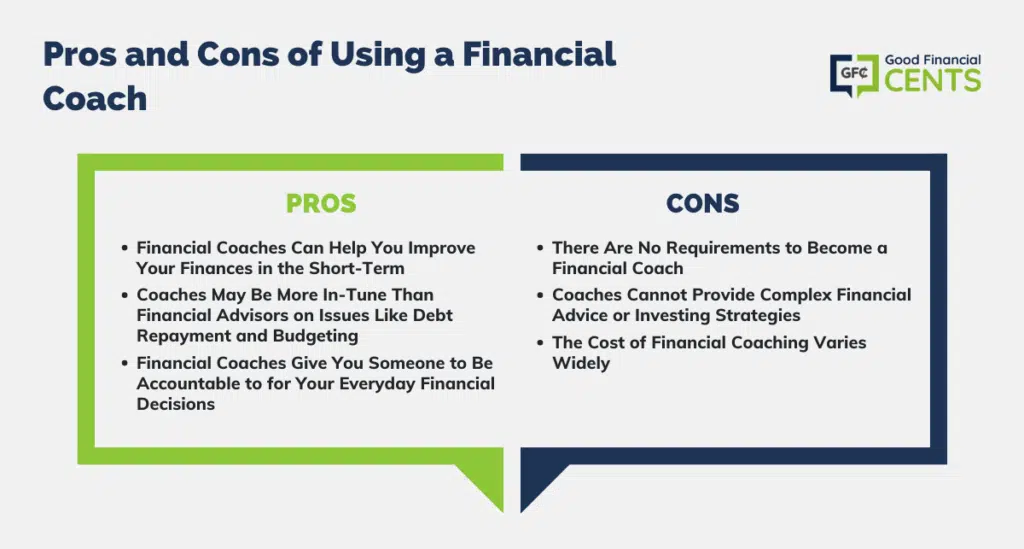

Pros and Cons of Using a Financial Coach

Using a financial coach can make a ton of sense if you’re trying to get a handle on your finances but can’t seem to make any headway. However, there are advantages and disadvantages that come with working with a financial coach, which you should know about ahead of time.

Pros:

- Financial coaches can help you improve your finances in the short term. While financial advisors can help with long-term investing strategy, coaches focus on getting you in shape to invest in the first place.

- Coaches may be more in tune than financial advisors on issues like debt repayment and budgeting. Coaches can help you create a plan to get out of debt or help you make a monthly budget that helps you start saving more money each month.

- Financial coaches give you someone to be accountable to for your everyday financial decisions. Unlike financial advisors, who may only meet with you a few times per year, many financial coaches have weekly check-ins to keep you on track.

Cons:

- There are no requirements to become a financial coach. Since financial coaching is not a regulated industry, anyone can call themselves a financial coach.

- Coaches cannot provide complex financial advice or investing strategies. While coaches focus on helping their clients get their day-to-day finances in order, they are not qualified to give investing advice.

- The cost of financial coaching varies widely. Not only will you need to research and compare coaches based on their qualifications, but you’ll also need to compare based on pricing that can be all over the place.

How to Decide Between a Financial Advisor and a Financial Coach

At the end of the day, the decision to work with a financial advisor or a financial coach is a very personal one. After all, both types of professionals can help you get where you want to be in a financial sense, and either one might work for you, depending on where you’re at with your financial goals.

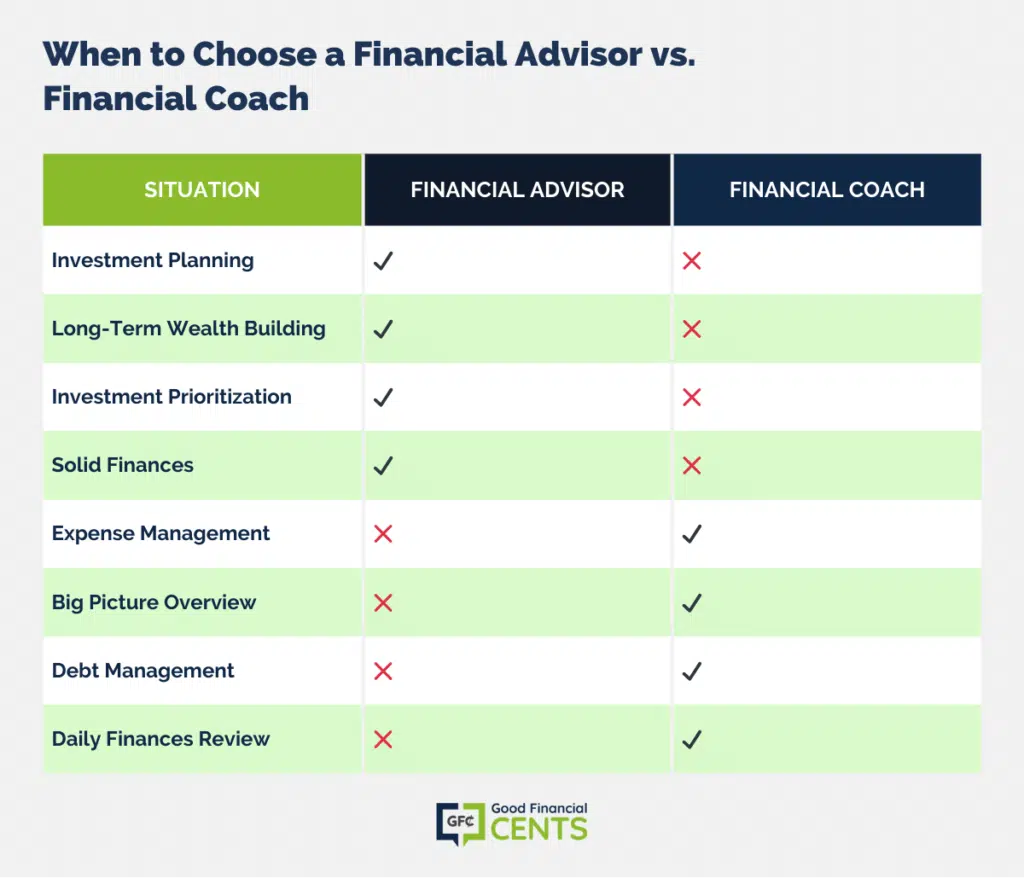

That said, there are some situations where a financial advisor could make more sense than a financial coach and vice versa.

When to Use a Financial Advisor

- You need help creating an investment plan for retirement. If you need help formulating a comprehensive financial plan with investments that align with your timeline and tolerance for risk, a financial advisor can help you do just that.

- Building wealth for the long term is your main priority. Financial planners focus on long-term wealth planning strategies more than anything else.

- Finding out where to invest is more important to you than paying off debt or learning how to budget. If you’re already pretty good at budgeting and saving, a financial advisor can help you take your finances to the next level.

- Your finances are fairly solid, so you have plenty of money to save and invest for the future. Financial advisors can help you invest for long-term growth, but only if you have the cash to save and invest in the first place.

When to Use a Financial Coach

- Even though you theoretically earn enough money to get ahead, you cannot seem to get a handle on your everyday expenses. A financial coach can help you figure out where your extra cash is going each month.

- You need help looking at the big picture of your finances. Financial coaches can help you create a budget that meets all your needs, whether you need to spend less each month or save more for the future.

- You’re in debt, and you need a plan to get out. A financial coach may be better equipped to help you get out of debt than a financial advisor.

- Having someone sit down with you to look at your daily finances is what you need most. It’s difficult to focus on investing for retirement and other goals when your personal finances are a mess.

How to Choose the Best Financial Professional for Your Needs

Whether you decide to go with a financial advisor or a financial coach, there are some common factors to consider before you hire someone.

For example, you should look for a financial professional who is certified in their field, whether you decide to go with a CFP or an RIA or with a financial coach who has completed some official training.

Also make sure to ask about pricing upfront, and steer clear of any financial professional who cannot explain their fees or how they get paid.

While financial coaches likely have an upfront payment schedule they can hand you, and fee-based advisors can clearly explain their charges, beware of financial advisors who get paid on commissions and may not have your best interests at heart.

Also, look for a financial professional who has plenty of experience and a passion for helping others. As you compare all your options, make sure to ask for any references they can give from former or past clients.

If they do a good job, people who have worked with them should be more than happy to tell you all about it.

Finally, make sure your financial planner or financial coach is someone you like talking to and spending time with. Choose a financial professional based on their credentials and experience, but make sure you actually like the person, too.

Bottom Line: Financial Advisor vs. Financial Coach: Unveiling Differences

The choice between a Financial Advisor and a Financial Coach hinges on distinct roles and objectives.

Financial Advisors, licensed and often fiduciaries, specialize in long-term investment planning, offering tailored strategies for retirement, major life milestones, and intricate financial matters. They provide expertise in wealth-building through portfolios.

In contrast, Financial Coaches concentrate on daily financial habits, aiding clients in debt management, budgeting, and financial discipline.

Coaches lack investment advice capabilities but excel in immediate financial transformation. Advisors require qualifications like CFP certification, while coaching lacks uniform regulations.

Selecting the right professional involves considering credentials, fees, experience, and personal rapport. Ultimately, both avenues aim to bolster financial well-being, but their focuses cater to different stages and needs.