Annuities.

You may have heard investment advisors – or insurance advisors – talk about them in the past. In fact, earlier, I described several reasons you should and shouldn’t buy annuities.

If you catch me on the street and ask if annuities are a good investment, I’d tell you the short answer is that it depends.

If you press me further, I’d tell you that most of the time they aren’t a good investment. But, with that said, here are some great short-term investments that I recommend! 🙂

If you demand clarification, I’d probably just shoot you a link to this article – unless you’d like to take me to In-N-Out Burger and pick up the tab. 😉

Here, I’m going to define annuities, show you why some people buy them, present two particular types of annuities, and show you a few alternatives you might like.

If you have any questions, please don’t hesitate to reach out to me! If you would like to find some of the best annuity quotes, I can help you with that as well! Now, let’s get started.

Table of Contents

Annuities Defined

Let’s start out with a definition of an annuity:

A fixed sum of money is paid to someone each year, typically for the rest of their life.

The basic concept is pretty simple. But we’re just scratching the surface of the question at hand.

Why Do People Buy Annuities?

Obviously, people buy annuities because there is some sort of perceived benefit. The main perceived benefit is safety.

Safe annuities include the following:

- Fixed annuities

- Single premium immediate annuities

- Deferred Income Annuities

- Fixed indexed annuities

I’d like to cover fixed indexed annuities in a moment, but first, let’s take a look at an unsafe option . . .

Are Variable Annuities a Good Investment?

One product that isn’t on the safety list is the variable annuity. Now, I don’t always agree with Suze Orman, but I do agree with her here:

Suze is right. And so are many others.

Here’s what Michael Gauthier, CERTIFIED FINANCIAL PLANNER™ from Strategic Income Group, says:

Variable annuities are one of the most oversold products in the financial services industry. Especially for people that are in the Accumulating Wealth Phase of their life, these investment vehicles tend to slow down the process of actually accumulating wealth due to the high fees that are associated with these products. Most investors would be better off owning lower cost options in ETFs and/or appropriate mutual funds.

Here’s what Todd Tressider at FinancialMentor.com says about variable annuities:

. . . consumer advocates argue some variable annuity fees are so steep it can take more than a decade to outperform more straightforward investments, the benefits are misrepresented, and the restrictive features and penalties aren’t adequately understood.

Here’s what Alan Moore, CERTIFIED FINANCIAL PLANNER™ at Serenity Financial Consulting says about variable annuities:

Variable annuities are incredibly complex, and are difficult for most financial advisors to understand, so I don’t expect the vast majority of consumers to really understand how they work.

Jane Bryant Quinn from the Wall Street Journal has written that she’d like to take all variable annuities and smash them into smithereens. How’s that for being blunt? 🙂

John Biggs from TIAA-CREF says it’s never suitable to buy a variable annuity.

AARP has written about many of the pros and cons of variable annuities.

Whoa. Big names hate variable annuities.

Let me explain why…

When you’re buying variable annuities, you’re buying mutual funds through a variable annuity company.

While those companies may boast about how many options you have inside of a variable annuity (around 80 to 300 mutual funds), you have many more options if you just open a Scottrade account (around 29,000 mutual funds).

Here’s another reason variable annuities are bad: fees. The national average for variable annuity fees as of 2023 is 6.00%. Yikes!

Oh, and by the way, just because you read the word “guaranteed” in your policy doesn’t mean you’ll really get a guaranteed return. Take a look at what the SEC has to say:

You may want to consider the financial strength of the insurance company that sponsors any variable annuity you are considering buying. This can affect the company’s ability to pay any benefits that are greater than the value of your account in mutual fund investment options, such as a death benefit, guaranteed minimum income benefit, long-term care benefit, or amounts you have allocated to a fixed account investment option.

You read that right.

Companies do not have to be in financial trouble to take away the death benefit or income riders for new policies, and sometimes, they try to change existing policies when possible. One company offered a lump sum to tempt people to get rid of guarantees. Another required certain changes to be made, or the riders would be eliminated.

That’s why it’s important to understand that changes in a company’s policy may affect your ability or willingness to maintain those benefits.

Fixed-Indexed Annuities

One type of annuity that is on my safe annuity list is the fixed-indexed annuity.

The great thing about these is that they actually do have a guarantee that you can’t lose the money you put in. Any deposits you make or gains that are credited get locked in at various time increments – that’s a good thing, people! What this means is that values can only go up, not down.

Okay, so should you go out and buy a fixed-indexed annuity? Not necessarily. While they are so much better than variable annuities, there are other options out there! More on that in a moment.

One other common practice of fixed-indexed annuities is to place caps on growth. For example, if the investment index goes up in one year by 30%, you may be capped at, say, 4% – and therefore miss out on a 26% gain.

There are different caps for each policy, so make sure you research caps related to the fixed-indexed annuity you are considering. And by the way, the caps can change over time.

The good news is that you can get a return of premium (ROP) on some of these policies, which sometimes states you can get your money back at any time for any reason. That’s pretty sweet.

There are also some fixed indexed annuities that are uncapped, meaning there is no limit to the upside potential, and some provide two times the payout for qualifying medical conditions.

The other guarantee that fixed index annuities offer is lifetime income benefits. This will allow you and potentially your spouse to have a paycheck for the rest of your lives.

And unlike a pension, in the event you have money left over, the remaining balance would be passed on to your heirs.

But again, do all these benefits make sense for you?

Annuity Alternatives

Remember that just because there are some great fixed-indexed annuities, that doesn’t mean you should sign your name on the dotted line.

I meet with clients who read about this or that annuity, thought it sounded good, and decided it was the best investment for them.

Instead of taking a step back and considering other investment options, they got excited about a particular investment’s benefits and didn’t think to examine all the possibilities.

That’s why I’d like to take a few moments of your time to discuss annuity alternatives.

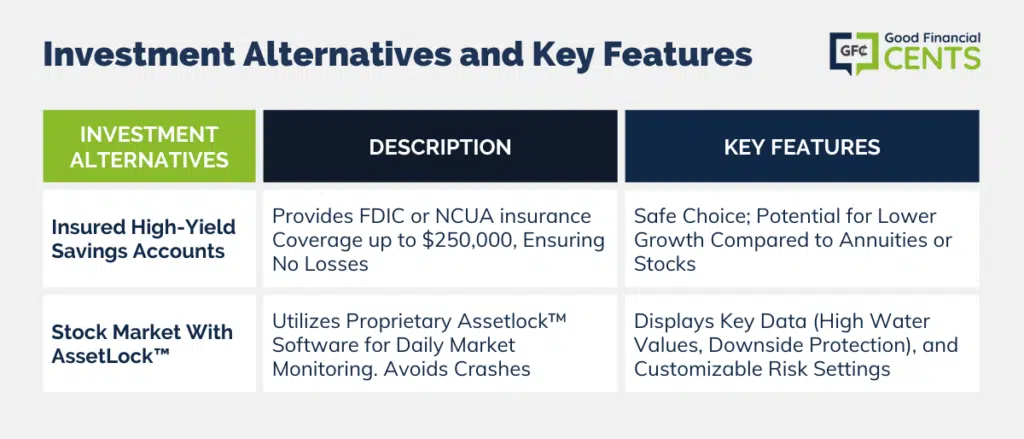

Insured High-Yield Savings Accounts

If you’re looking for a guarantee that you won’t lose money, this is the best option. In the United States, many savings accounts are insured by the FDIC or NCUA all the way up to $250,000.

That’s right, so if the bank or credit union tanks, you’ll still have a guarantee that you’ll get your money back. That’s huge!

I put together a list of some of the best online high-yield savings accounts just for you. But you’ll notice something . . . . You probably won’t grow your money in these accounts as well as you might be able to in a fixed-indexed annuity or the stock market.

Let’s take a look at another option . . . .

Stock Market With AssetLock™

AssetLock™ is proprietary software that is only available through a select group of advisors. The software is designed to monitor your stock market accounts every single day.

AssetLock™ will always display four important numbers for investors:

1. High Water Value – The highest value the portfolio has ever reached.

2. High Water Date – The date your portfolio reached the highest value it has ever reached.

3. Current Account Value – The most recent value from the last closing day in the stock market.

4. AssetLock™ Value – The predetermined amount of downside (loss) the portfolio should experience during the period of time that the client is invested.

The software takes into account all of these factors to help you avoid a stock market crash. And the cool thing is that you can view this information yourself right on your computer, smartphone, or tablet computer.

You can set your AssetLock™ Value at 5%, 10%, 15% – whatever makes sense for you! If you’re more conservative and don’t want much risk, you can set it at 5%. Maybe you’re more aggressive and want to set it higher at 15% – it’s your choice!

[vimeo 111029539 w=500 h=281]

I am an AssetLock™ approved advisor. It’s amazing how the software works, and if you give me the chance, I’d be happy to show it to you.

So, Are Annuities a Good Investment?

Hopefully, by now, you have answered that question for yourself. Everyone’s situation is different.

I’ll say again that most of the time, annuities are not a good investment. In those situations, investing in the stock market with AssetLock™ makes a lot of sense as it blends a great deal of safety with potentially higher returns.

In other situations, fixed-indexed annuities may make sense when investors want a guarantee that they won’t lose any money – the stock market with AssetLock™ can’t provide that level of guarantee.

But remember, if your fixed-indexed annuities are capped, you’re limiting your potential upside.

Consider your options, consider your situation, and pick the right investment for you!

Bottom Line: Annuity Investment Evaluation

The question of whether annuities are a good investment depends on your unique circumstances. While annuities offer safety and guarantees, they often come with high fees, particularly variable annuities. Fixed-indexed annuities provide some level of security but may limit potential growth due to caps.

Annuities should be carefully evaluated, considering alternatives such as insured high-yield savings accounts for capital preservation or investing in the stock market with AssetLock™ for a balance of safety and potential returns. It’s crucial to understand the fine print and assess your financial goals before committing to any investment, ensuring it aligns with your specific needs.

SBLI insurance is offering a 5 year fixed annuity at 4% compounded that I can lock into today up until 10/ 7/2019 I have invested a sizeable amount in TD ameritrade managed account, have to pay .47% a year for manage fee, in my case that’s close to $2,500 a year, there set up for me is that I basically would get a return about half of what the market does, do I really think the market is going to average at least 8% a year for the next 5 years? where as with this deal I’m guaranteed the market will do 8% a year for next five years, what do you think, thank you.

What is the best rollovers from a 403b when retiring at age 76?

Hi Pauline – There’s no one answer to that question. I’d start by saying if you’re satisfied with the performance of the 403b you should leave the money where it is. If you feel you’d do a better job investing on your own, move it to a self-directed IRA. You can also move it to an IRA with a managed platform, like a robo-advisor if you want out of the 403b but don’t know much about investing. I’d talk with trusted financial advisors before doing anything with the plan.

So I understand your definition that annuities are basically fixed sums of money you pay to someone each year for the rest of your life, but what are they generally for? I just started working and have been hearing about annuities a lot lately, but like a commenter already said, I am a little confused about how this whole process works. Could you explain the different types of basic annuities and why so many people have them?

Hi Luke – I’ve pretty much explained the different types of basic annuities in the article. Maybe it’s time for you to talk to an advisor or agency who offers them and find out which is best for your circumstances. For example, you could call me!

AssetLock looks interesting. But despite the video, I can’t seem to figure out how it actually protects my money. It doesn’t sell your assets, so how does it actually protect you from a market crash?

Great insight here. I do always like that, like many financial questions, the answer really IS just…. it depends! I think you did a great job overviewing what annuities are and the risks involved, though. Thanks for sharing!