Annuities get a lot of press, both good and bad. What it really comes down to is, that while annuities aren’t recommended investments for everybody, they can be exactly what’s needed for certain investors.

They tend to have high fees, and they make it very difficult to withdraw funds from the plan once it is established. But, at the same time, annuities have certain undeniable benefits:

Purchasing an Annuity Is a Lot Like Setting up Your Own Pension Plan: Most workers these days don’t have access to a traditional, defined benefit pension, so an annuity can be the perfect replacement.

They Enable You to Increase the Amount of Money You’re Saving for Retirement: While virtually every other tax-sheltered retirement plan limits the amount of money you can contribute ($23,000 to a 401(k) plan or $7,000 to an IRA in 2024) there is no dollar limit on the amount of money you can contribute to an annuity.

You can even roll over your 401k or 403b into an annuity, too.

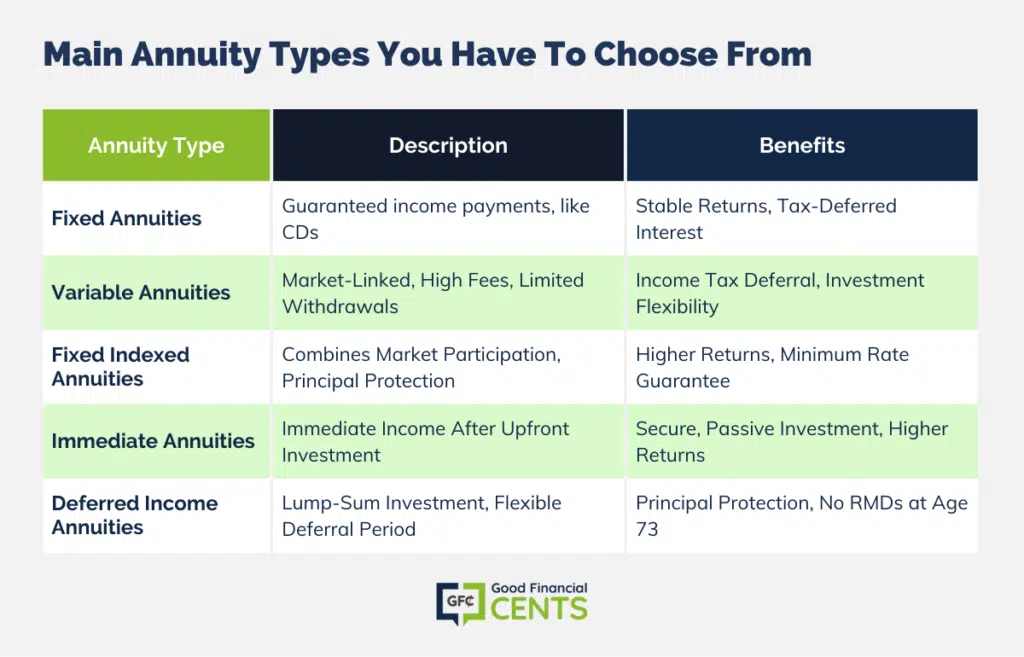

The 5 Main Annuity Types You Have to Choose From

Table of Contents

According to the Insured Retired Institute’s Biennial Study on the American Retirement Experience, 80% of annuity-holding retirees who get lifetime income payments are “very/somewhat satisfied with their annuities.”

Annuities come in different shapes and sizes, so you’ll have to get annuity quotes to make sure that you are investing in the right plan. But, to help you in your initial research, there are five major annuity types:

1. Fixed Annuities

A fixed annuity is exactly what the name implies. It’s an investment plan in which the insurance company agrees to make fixed-income payments to you under the terms of the annuity contract. With a fixed annuity, you can earn a stable rate of return on your investment. In a way, it’s a perfect investment solution for a retiree, since it effectively creates a traditional pension for the growing number of retirees who don’t have one.

Fixed annuities are similar to certificates of deposit, and other fixed-income, stable-value investment vehicles. Your investment pays a fixed rate of return throughout the term of the annuity – which can literally be the rest of your life.

Fixed annuities – and really all annuities – are essentially customized investments. For that reason, you will have to get annuity quotes from various insurance companies in order to determine which will be best for you.

You can invest in a fixed annuity that will provide you with immediate income. But you can also include it in a deferred income annuity, which will accumulate interest and provide you with an even higher income in the future.

Like CDs, fixed annuities also come with early withdrawal penalties. Those penalties can be much stiffer than the kind that you will pay on a CD. When it comes to annuities, early withdrawal penalties are referred to as “surrender charges”. They can amount to several percentage points of the value of your annuity and typically work on a sliding scale.

For example, you might be subject to a 5% surrender charge if you withdraw funds from the annuity in the first year. That may drop to 4% in the second year, and down to as low as 1% in the fifth year, before disappearing completely.

If you set up a fixed annuity as a deferred income annuity, where it accumulates investment income, you may also be subject to the IRS 10% early withdrawal penalty on the income portion. This is because the interest accumulation on the annuity is tax-deferred, similar to a retirement plan – which is actually one of the major advantages annuities provide.

Benefits of a Fixed Annuity:

- Guaranteed Interest Rate Returns

- Low Minimum Investment Requirements

- Interest Rates on Fixed Annuities Are Typically a Lot Higher Than They Are on CDs

- Income for Life

- Interest Income Is Tax-Deferred on Deferred Fixed Income Annuities

Get a free report highlighting the best-fixed annuities

2. Variable Annuities

Variable annuities can offer an investor a chance to earn higher rates of return than what is available on fixed-income investments, including fixed annuities. They provide investment participation in both stocks and bonds, but that also brings the risk of principal loss if the financial markets decline.

The money within a variable annuity is invested in sub-accounts, which are basically insurance industry mutual funds since they aren’t listed on public exchanges. The sub-accounts are invested in stocks and bonds, including various industry sectors.

Variable annuities are typically deferred, so that you can increase your investment in the plan to produce a higher income when you finally begin withdrawals. Again, like retirement plans, the investments grow on a tax-deferred basis. You can set up a future date when you will begin receiving income, which could be during retirement or any other date.

That’s the “good news” on variable annuities. I personally don’t recommend them – there’s just too much about them that isn’t investor-friendly.

The returns on variable annuities are neither fixed nor guaranteed, and they also come with limitations as to when you can withdraw money from them. You’ll have to get annuity quotes on specific plans in order to determine the allowed frequency, but you will typically be limited to one withdrawal per year, so long as it doesn’t occur within the surrender period (usually 10 years).

But fees are the reason I don’t like variable annuities. They charge a national average of 3.61% per year, though fees over 5% aren’t unusual. Even if you expect a return of 7% on the annuity, fees of 3.61% will more than chop that return in half (are you getting the sense something’s seriously wrong yet?).

What makes the fee situation even worse is that it’s mostly hidden. It isn’t a single fee, but rather a battery of smaller fees buried deep in the annuity. It can include “mortality and expense risk charge” – at an average of 1.25% – administrative fees, underlying fund expenses (sub-account fees), additional rider fees, and surrender charges.

That’s too many fees in one investment vehicle.

Benefits of a Variable Annuity (If High Fees and the Other Disadvantages Don’t Scare You Off):

- Income Tax Deferral

- Investments Within the Plan Can Be Changed

- Lifetime Income

- Ability to Earn Higher Returns Than Fixed Income Investments Pay

Get a free report highlighting the best variable annuities

3. Fixed Indexed Annuities

This may be the most desirable type of annuity for the largest number of people. It’s a type of fixed annuity, except that it uses different methods for creating income within the plan. While fixed annuities concentrate heavily on the protection of principal and stable returns, fixed-indexed annuities attempt both objectives but also provide participation in rising financial markets.

Like fixed annuities, fixed indexed annuities also provide an annual guaranteed minimum rate of return. But you can also get the returns provided by investment in a specific stock index. The insurance company will then give you the benefit of the higher return between the two. This gives fixed indexed annuities stock market participation on the way up, but protection against market declines.

There is a limitation on market gains that insurance companies use to offset market declines. They impose caps on the amount that you can earn through stock investments.

For example, if the annuity caps your annual stock return at 10%, but the market rises by 15%, your earnings will be limited to 10%. In addition, you typically will not receive dividends paid by the stocks held within the index fund.

Once again, the specific details of these terms will depend upon your annuity quotes, so you’ll need to ask questions and take plenty of notes.

Benefits of a Fixed Indexed Annuity:

- No Upfront Commissions

- Protection of Principal

- Low Minimum Investment Requirements

- Tax Deferral

- Higher Returns Than You Can Get On Fixed Investments

Get a free report highlighting the best fixed-indexed annuities

4. Immediate Annuities

An immediate annuity is a type of annuity that is set up to provide you with an immediate income. You invest money in the annuity plan, and it begins making income payments to you as early as the following month.

Immediate annuities are sometimes referred to as single premium immediate annuities, because you make the upfront investment (the “premium”, in insurance terminology), and then begin receiving benefits (income payments). For this reason, they are generally set up at retirement.

The payout terms vary based on the immediate annuity contract. You can have them paid out for a specific period of time, such as 20 years, or set them up so that you will receive payments for the rest of your life. This is all information that you can get upfront when you obtain annuity quotes.

Benefits of an Immediate Annuity:

- A Safe, Secure Investment

- A Completely Passive Investment

- Higher Returns Than Cds

- Immediate Income

- Income for Life

Get a free report highlighting the best immediate annuities

5. Deferred Income Annuities

Sometimes referred to as a longevity annuity, a deferred income annuity is a plan that you start and fund, and then allow it to grow through the accumulated investment income. In this way, they work similarly to retirement plans, except that you generally make the investment in a lump sum, rather than through annual contributions.

The term of the deferral is completely up to you. You can invest money in the plan, and begin receiving income payments as little as a year later. Or, you can invest in the plan, and begin taking income payments when you retire in 20 or 30 years. Once you begin receiving your income payments, they can be set up as a guaranteed lifetime income.

The specific investment terms can vary, but they generally come with a fixed rate of interest that is guaranteed by the insurance company for as long as 10 years. At the end of that term, there will be a reset – which could occur as often as annually – that will establish a new rate of interest based on then-prevailing market factors.

The insurance company will also often offer a minimum rate guarantee for the life of the annuity, so that you will always receive at least that rate of return. And naturally, the longer the deferral term of the annuity, the higher the value of the plan, and the higher your income payments will be.

Benefits of a Deferred Income Annuity:

- Protection of Principal

- You Don’t Need to Be Concerned With the Performance of the Stock Market

- You Can Move Part of Your 401(k) Into a Deferred Income Annuity

- No Required Minimum Distributions (RMDs) At Age 73

Get a free report highlighting the best-deferred income annuities

Final Thoughts on Finding The Best Annuity Rates

Those are the five major categories of annuities. But each annuity type also comes with a large number of potential “riders” that can offer you enhanced benefits. Those benefits include provisions for guaranteed withdrawals, long-term care, death benefits, and cost-of-living adjustments.

These are all potential add-ons that you can learn about through annuity quotes. Annuities tend to be more complicated than most other investment types, so it will help to work with an insurance professional to guide you through the process. Once again, annuities won’t work for everyone, but it might just be the right solution for your particular situation.

Thanks, Jeff! This is such a well written resource on annuities — detailed and very easy to understand. I’m not looking for quotes at this time (I’m 56), however I would have loved to have seen an example of an annuity going across these 5 example types. For example, how much money needs to be invested in these annuities – $50K, $100K, $150K, etc. and what type of payment would they generate using a random rate just for example purposes. For me, this is always the missing piece of fully understanding annuities. Thanks again for the article!

Mary, you didn’t lose money in American Express or Raymond Jones, you lost money because the holdings you held with them dipped. Plus your expense ratios were higher than necessary, as compared to index funds held with the robo-advisors Jeff mentioned. And for Trump and your cash holdings, whatever excuse you have for holding money is cash doesn’t help you fight inflation.

Most helpful, I have lost 50k, with American Express in 2000( which was half my life savings at the time) and also lost money with Ameriprise in 2007. I am currently with Raymond Jamesbut recently moved all my money to cash when Trump became irrational two months ago. I am not really sure what to do.

Hi Mary – After two hits, I can see why you’re concerned. Maybe try working with a robo-advisor that will set up your investments to match your risk tolerance, goals and time horizon. Betterment and Wealthfront are two of the best.