As Robinhood has become increasingly popular among investors and traders, the question of whether or not it is a safe platform for trading has come under scrutiny.

Many people have asked, “Is Robinhood really safe?” With its easy-to-use interface and commission-free trades, Robinhood has become one of the most popular stock trading apps in recent years. However, questions remain about how secure and reliable it is when compared to traditional brokerages.

In this article, we’ll take a look at what makes Robinhood safe and explore the risks associated with using the app.

What Is Robinhood?

Table of Contents

Robinhood is a stock brokerage that offers commission-free trading through its mobile app and website. It was founded in 2013 by two Stanford roommates, Baiju Bhatt and Vlad Tenev, who wanted to make investing simpler and more accessible to everyone.

Robinhood allows users to buy, sell, and hold stocks, ETFs, options, cryptocurrencies, and more with no commission fees.

They also offer educational resources to help users learn the basics of investing. Robinhood has become popular among young investors looking to get into the stock market without spending a lot of money on fees.

Is Robinhood Regulated?

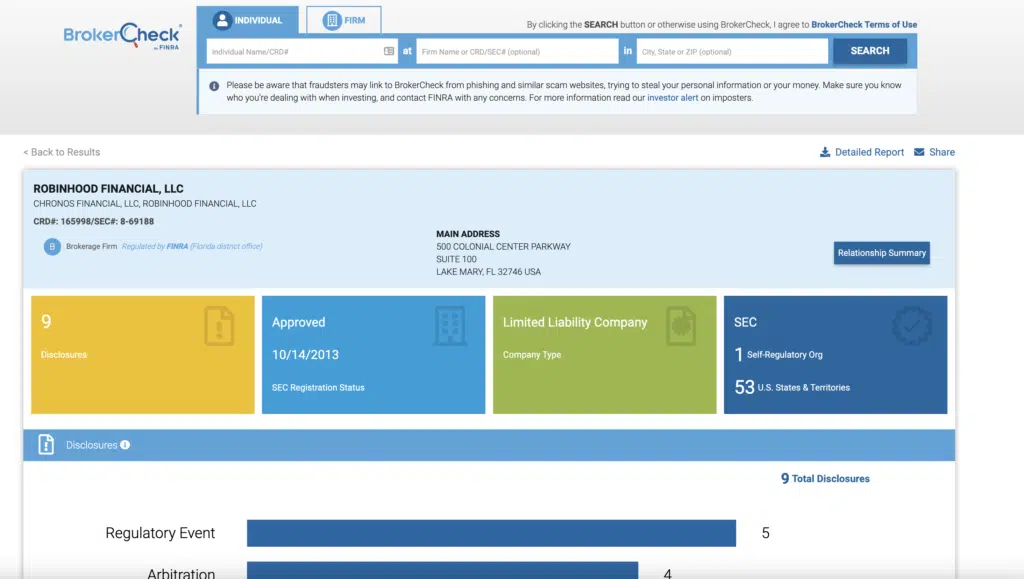

Robinhood is an SEC-registered broker-dealer and member of FINRA and SIPC, meaning that it adheres to a set of rules and regulations established by these organizations. Their CRD # 165998 can be found on their FINRA BrokerCheck firm summary.

These protections help safeguard investors’ funds and securities in the event of a brokerage firm’s failure or other financial losses.

In addition to this protection, Robinhood also follows industry best practices such as Know Your Customer (KYC) procedures and Anti-Money Laundering (AML) laws by verifying customer identities before allowing them to trade.

What About SIPC?

Robinhood’s membership in SIPC provides protection for customers against broker-dealer bankruptcy, with coverage of up to $500,000 in cash and securities.

SIPC stands for the Securities Investor Protection Corporation. It is a nonprofit corporation that provides protection to investors against theft, fraud, and other errors by their broker-dealers, such as the misappropriation of funds or securities.

The bottom line, if Robinhood were to go bankrupt, SIPC would step in to help out their investors.

In addition to this protection, Robinhood has implemented measures to monitor suspicious activity and protect users from financial loss due to fraudulent activity. These measures include fraud screening procedures designed to identify unauthorized trades and suspicious behaviors.

Is Robinhood Safe to Use?

While the safety of any investment platform depends on a variety of factors, Robinhood has taken several steps to increase its security and improve customer support.

New updates include things like improved risk disclosure, additional customer service channels, and tools to help customers make more informed decisions.

Robinhood has improved its customer service support with additional channels such as online chat, email, and phone support. This allows customers to easily get help when they need it most.

Additionally, the company has implemented measures to better monitor suspicious activity and attempt to protect users from financial loss due to fraudulent activity. Ultimately, it is up to individual users to decide if they feel comfortable using the platform or not.

How Does Robinhood Make Money?

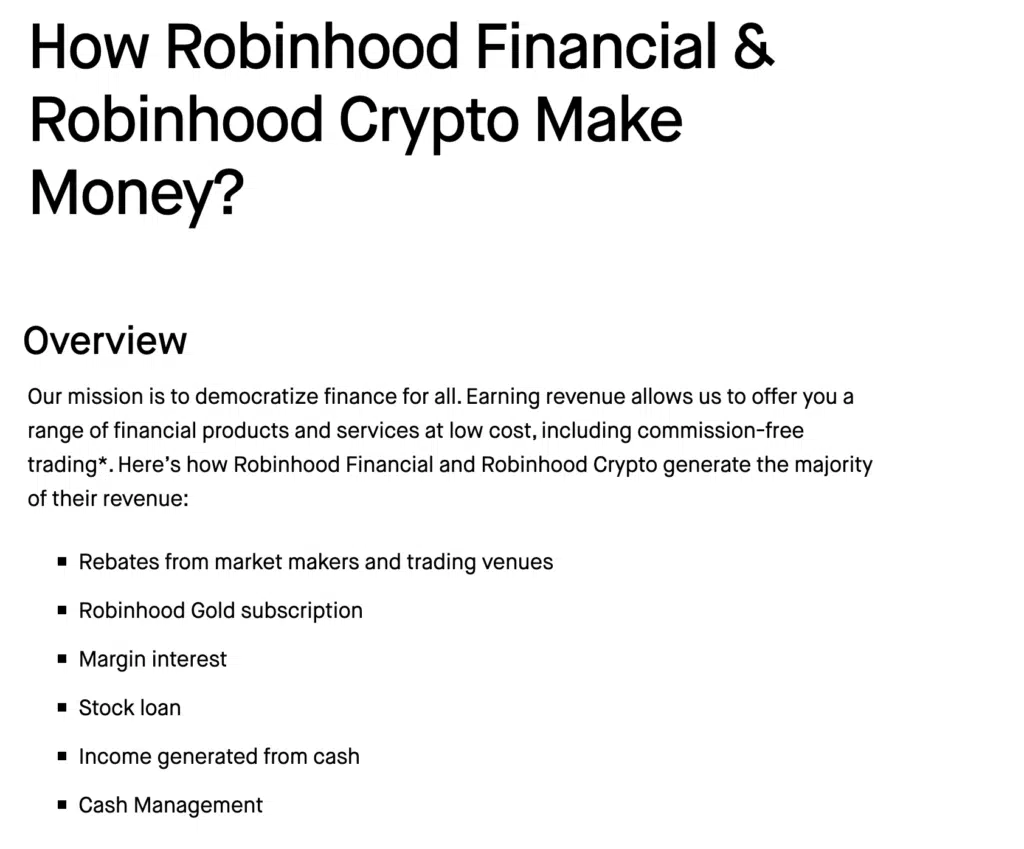

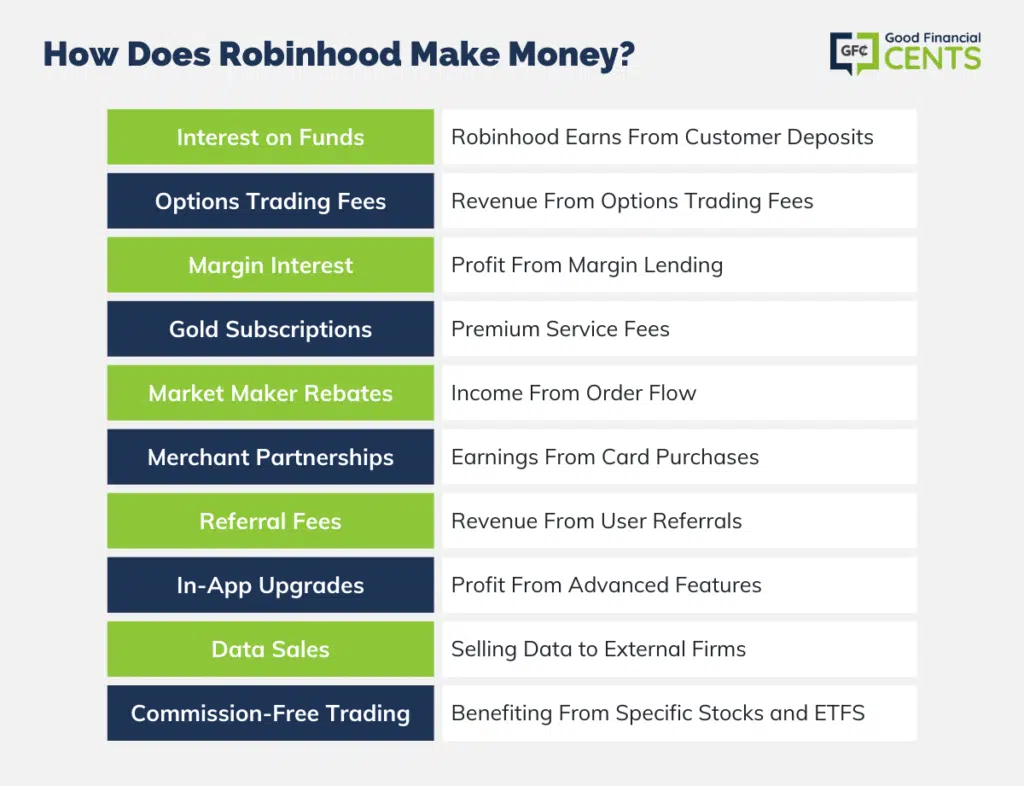

Robinhood makes money in several ways. The primary source of revenue for Robinhood is the interest it earns on customer funds held in Robinhood accounts.

They also earn money through options trading fees, margin interest, Gold subscriptions, and rebates from market makers.

Robinhood capitalizes on the explosive growth of retail investing by offering commission-free trades while still making a profit off its users.

Robinhood also makes money from merchants, such as when customers buy merchandise with their Robinhood debit card.

Additionally, they generate revenue through partnerships, such as referral fees and commissions for referring users to other services.

Finally, Robinhood also offers in-app upgrades that give users access to more advanced trading options and analytics tools. They disclose on their website the different ways they generate revenue.

How Robinhood Makes Money:

- The fees charged for premium accounts and services

- Interest earned on customer deposits

- Payment for order flow, when buyers and sellers are matched with market makers

- Revenue from credit products such as margin lending and margin interest

- Selling data to outside firms

- Commission-free trading on certain stocks and ETFs

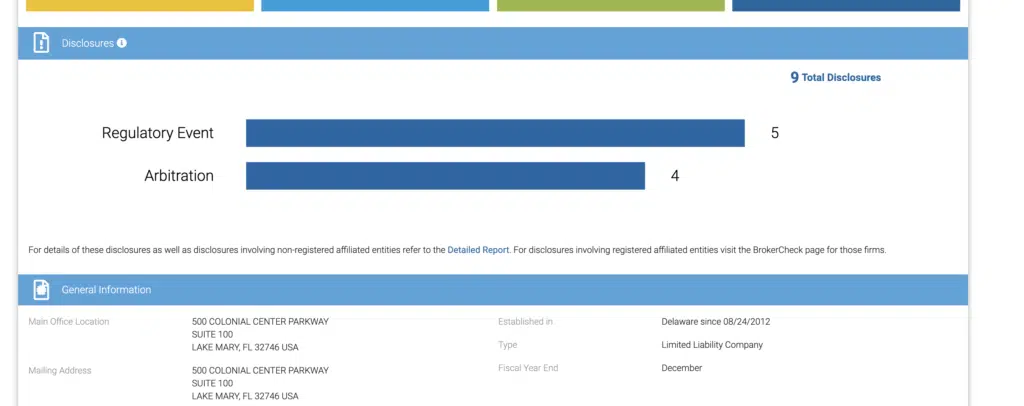

Has Robinhood Been in Trouble?

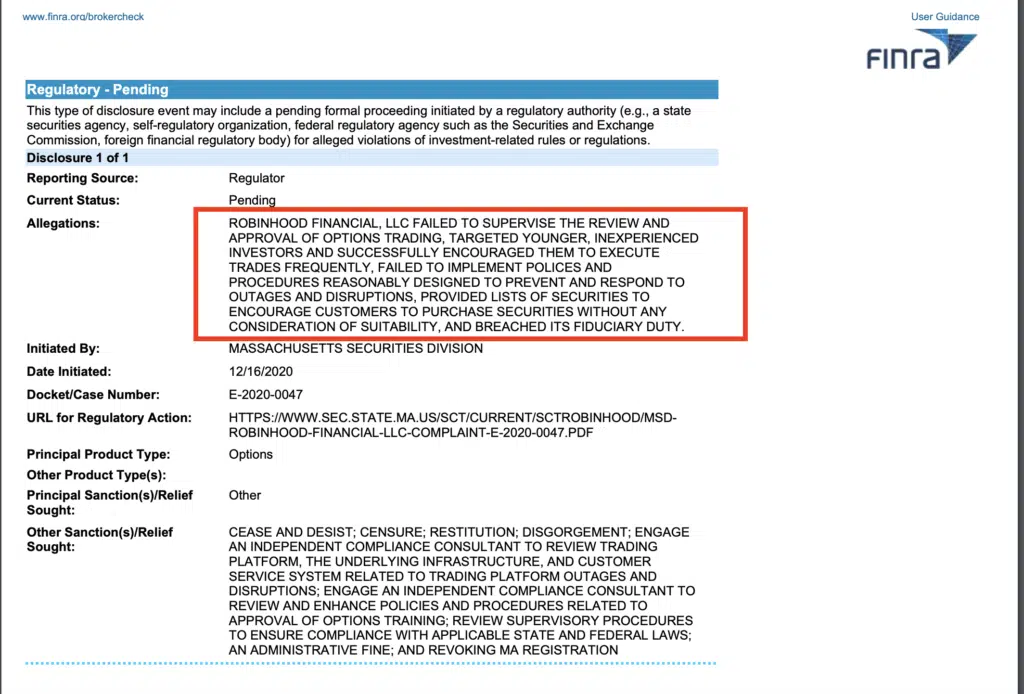

Robinhood has come under scrutiny for its business practices, particularly in regard to customer service and risk disclosure.

In December 2020, the company settled with the U.S. Securities and Exchange Commission (SEC) for $65 million related to allegations of false advertising and misrepresenting their pricing structure.

Robinhood also faced a public outcry after one of its customers, a 20-year-old college student, committed suicide. His family alleged Alexander E. Kearns had suffered financial losses due to the company’s risky trading practices and lack of customer support. Robinhood later agreed to pay an undisclosed sum to his family and released updates to their customer service plans aimed at providing better assistance and safety measures for users.

Additionally, in March 2021, the company settled a lawsuit brought by Massachusetts regulators for $26.5 million related to its seeming “gamification” of trading, which encouraged customers to trade more frequently and take higher risks than appropriate for their level of experience or investment goals.

In June 2021, FINRA fined Robinhood Financial LLC $57 million and ordered the firm to pay approximately $12.6 million in restitution, plus interest, to thousands of harmed customers for a total of $70 million.

The sanctions represent the largest financial penalty ever ordered by FINRA and reflect the scope and seriousness of the violations.

In total, Robinhood has nine total disclosures in its record (see screenshots below):

Here’s one of their pending allegations on their firm summary:

“

FAILED TO SUPERVISE THE REVIEW AND

APPROVAL OF OPTIONS TRADING, TARGETED YOUNGER, INEXPERIENCED

INVESTORS AND SUCCESSFULLY ENCOURAGED THEM TO EXECUTE

TRADES FREQUENTLY, FAILED TO IMPLEMENT POLICES AND

PROCEDURES REASONABLY DESIGNED TO PREVENT AND RESPOND TO

OUTAGES AND DISRUPTIONS, PROVIDED LISTS OF SECURITIES TO

ENCOURAGE CUSTOMERS TO PURCHASE SECURITIES WITHOUT ANY

CONSIDERATION OF SUITABILITY, AND BREACHED ITS FIDUCIARY DUTY.

The Bottom Line – Robinhood App is Safe?

There’s no denying that Robinhood is a registered broker-dealer with the Securities and Exchange Commission (SEC) and is a member of the Financial Industry Regulatory Authority (FINRA).

They also use encryption to protect users’ personal and financial information, and it offers two-factor authentication for added security.

But you can’t deny the amount of trouble they’ve got since they launched their platform. Because of that, I would encourage any new investor to tread carefully.

FAQs on Robinhood App Safety and Security

Robinhood is a SEC and FINRA regulated platform and generally considered safe to use for trading.

Robinhood uses a variety of security measures to protect user accounts, including two-factor authentication, encryption, and regular security audits.

Robinhood has not experienced any major security breaches to date. However, in July 2020, the company did disclose a data breach that affected a small number of users, but no financial information was compromised.

Yes, Robinhood has 9 disclosures on their FINRA BrokerCheck firm profile. One of those instances dealt with the popular meme stock GameStop in January 2021.

Cited Research Articles

1. SEC.gov (17th, December 2020) SEC Charges Robinhood Financial With Misleading Customers About Revenue Sources and Failing to Satisfy Duty of Best Execution (https://www.sec.gov/news/press-release/2020-321

2. FINRA Orders Record Financial Penalties Against Robinhood Financial LLC (30th, June 2021) https://www.finra.org/media-center/newsreleases/2021/finra-orders-record-financial-penalties-against-robinhood-financial

3. BrokerCheck Report (n.d.) ROBINHOOD FINANCIAL, LLC https://files.brokercheck.finra.org/firm/firm_165998.pdf

4. CNBC Robinhood to pay $70 million for outages and misleading customers, the largest-ever FINRA penalty (30th, June 2021) https://www.cnbc.com/2021/06/30/robinhood-to-pay-70-million-for-misleading-customers-and-outages-the-largest-finra-penalty-ever.html