This guest post is written by Richmond Howard for Good Financial Cents. Richmond runs the blog MealPrepify.

Four years ago, my wife and I were almost broke. It was our first year of marriage, and I had been out of a job for almost five months.

I wasn’t making money, and I was about to start going to grad school. It’s hard to pay for grad school when you’re broke, so I was applying for scholarships.

One of the scholarships required you to input a monthly budget of how much you were spending. Makes sense — they want to make sure you’re being a good steward of your resources and that you actually need the financial help.

The problem was I had no idea what we were actually spending. We were just kind of going by feeling and trying to be frugal. We created an account with Mint and synced all of our accounts.

I still remember when my wife and I were sitting there watching the screen–waiting for all of the data to get sorted out to see the breakdown of our monthly spending.

It all looked normal at first. Our rent was $725. Car insurance was $200. Wifi was $30. The phone bill was around $100. Gym $40. Everything was checked out except one category.

Food / Restaurants: $825

Neither of us believed it, but it was our anniversary month, so we chalked it up to the fancy dinner we went to. Surely, that’s what it was… We went back another month and saw $760. Then $730. Then back to $800.

For the last six months, while I was unemployed and we were struggling to make ends meet — watching our bank accounts start to dip — we were spending more on food than rent for just our little family of two.

Like most people, we ate out too often for fun and for convenience.

Like most people, we were throwing away too much food that never got cooked.

Our food bill was out of control. We knew we had to find a way to save money on food, but we didn’t know how. We already felt like we were frugal when it came to food, and we didn’t want to go back to the college diet of ramen and the chicken that’s marked down because it’s about to expire.

We wanted to eat real food that was good for us and good for our wallet.

We made a few major changes:

- We completely stopped eating out for about two months.

- We planned out our meals and didn’t let anything go to waste.

That worked for a while! We were eating all of our meals at home, and our food spending dropped from $750+ to around $350.

It was exhausting, though. We were cooking and cleaning multiple meals a day. It felt like we lived in the kitchen.

Then, we started meal prepping.

We’d wake up early on Sundays to pick a few recipes and map out what we were going to eat that week. After church, we’d head straight to the grocery store and spend our afternoons making a week’s worth of food.

It took some time to get the hang of it, but meal prepping was a total game-changer for us. We started saving money, and we weren’t spending 15 hours a week in the kitchen.

Here I am three years later, and I now run a blog called MealPrepify, where I help people learn how to meal prep and find great recipes so they can save time, money, and eat healthy doing it.

Today, I want to give you my best tips and tricks to help you start saving money by meal prepping! I’ve also shared our favorite meal plan that we’ve used almost every single month to save money on food.

Table of Contents

Meal Prep 101: 9 Tips to Start Meal Prepping

- When I first started meal prepping, I was totally overwhelmed.

- How do I pick recipes?

- How much should I make?

- How long will the food last?

- Do I need to make a meal plan or just cook stuff and hope it goes together?

When I started looking for resources on meal prepping, most of it wasn’t helpful. The recipes they recommended were elaborate or unhealthy. The meal plans didn’t fit what I liked, and I usually ended up spending more time and money than I was saving.

Here are some helpful meal prep tips to get you started the right way:

1. Restaurant Spending Freeze

If you want to start meal prepping, the first thing you’ve got to do is stop eating out. If you’re anything like me, this is the hardest part. My wife and I are foodies, and we love to try new places all over Houston, especially BBQ.

But there’s no way around it. If you want to save money on food and make meal prepping a habit, you have to force yourself to do it.

Your restaurant spending freeze doesn’t have to be forever, but commit for one month and see what happens. You’ll be amazed at how much money you save when you stop eating out.

2. Start Small

The biggest mistake people make is trying to meal prep too much the first time. Start small. Pick 1-2 recipes you know you love and double the ingredients. The last thing you want to do is make a bunch of food that’ll go to waste.

3. Look in the Freezer and Pantry

The best place to start meal prepping is with stuff you’ve already got. Go make a list of all the meat you’ve got sitting in your freezer and find a way to meal prep with it. You’ll save money, reduce waste, and clear out space.

4. Create a List of Super Cheap Meals

The key to saving money with meal prepping is to find cheap meals that you can make over and over again. My wife and I have a rotation of 7-10 meals that we absolutely love. They also keep our grocery budget in line and allow us to splurge in other places.

5. Find Ingredient Overlaps

The best meal prep hack is finding ingredients that work for multiple recipes. The fewer ingredients I have to buy at the grocery store, prep, chop, and cook, the better!

Grilled chicken is one of these for me. I’ll eat grilled chicken with a side of roasted vegetables, on a salad, or in a sweet potato. When I’m in a big hurry, I’ll grab a baggie of grilled chicken for a high-protein snack.

Bell peppers are another one. You can use bell peppers for fajitas, Asian stir-fries, or by themselves as a healthy snack.

6. Create a Set Time for Meal Prepping

If you want to meal prep consistently, then pick a set time to meal prep every week. My wife and I cook a week’s worth of lunches every Saturday afternoon, and then we’ll double the amount for whatever we cook for dinner on Monday.

7. Get Good Storage Containers

After you’ve finished all your meal prepping, you need to find a way to store and save it all.

We used to use regular plastic Tupperware containers, but after a while, we decided to upgrade to these glassware containers, which are better for heating, storing in the freezer, and cleaning in the dishwasher.

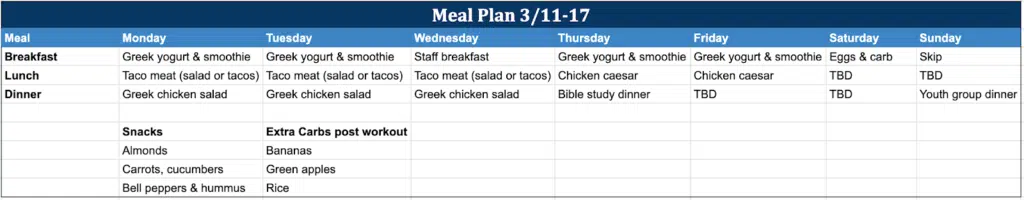

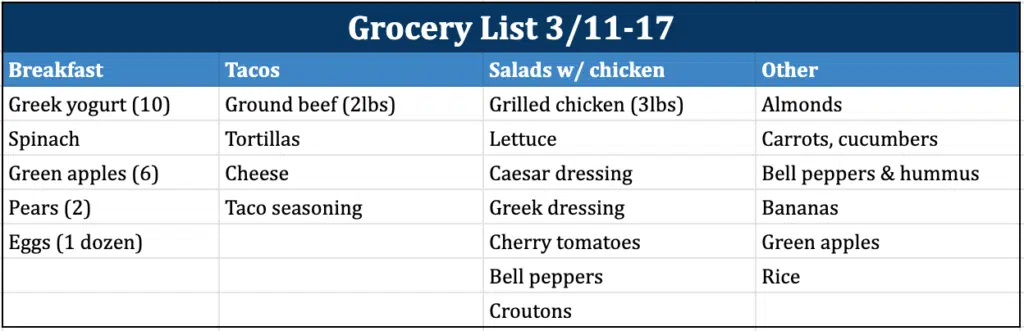

8. Map Out Your Week

Meal prepping takes meal planning. Every Saturday morning, my wife and I wake up, and we map out our entire week of meals.

We actually put our meal plan into a Google spreadsheet so we can see exactly what we’ll be eating. Then, we put together a grocery list of everything we need to buy that week. We usually try to stock up on some healthy snacks as well.

The best part about keeping track of your meal plans is that you have your own bank of meal plans to pull from. Whenever we’re in a hurry, we just pick a meal plan we’ve done before and head to the store!

9. Use the Crockpot

There’s no question that using a crock pot is the easiest way to meal prep. All you have to do is dump in your ingredients, press a button, and wait 6-8 hours.

Turn it on before you go to bed and wake up with lunch and dinner already prepared. Here are some of our favorite cheap crockpot meals you can make for less than $3 a serving!

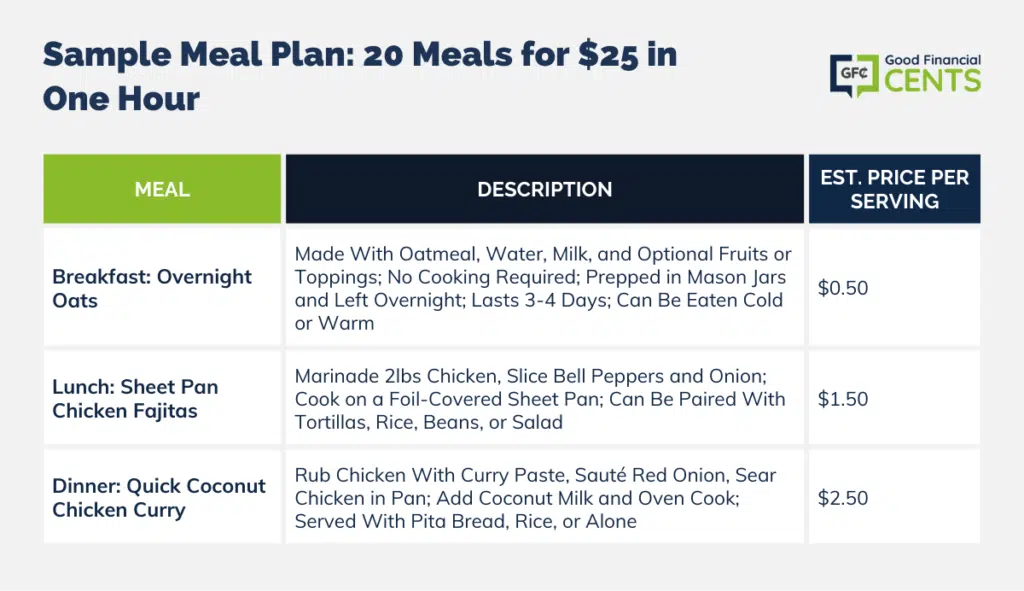

Sample Meal Plan: How We Made 20 Meals for $25 in One Hour

People make meal planning way more complicated than it needs to be. I always pick three recipes that I want to eat for breakfast, lunch, and dinner. Ideally, they are cheap, healthy, and have some overlap in ingredients.

This is one of my go-to meal plans. It takes me about an hour of work to make 20 meals for $25.

Breakfast: Overnight Oats

Meal prepping for breakfast is tough. Leftover eggs are rubbery and gross.

About a year ago, I started making overnight oats, and it was a game changer. Easy to make and incredibly cheap.

Overnight oats don’t require any cooking. Put them in a mason jar the night before with milk or water, and they’re ready to go in the morning. The ratio is typically two parts liquid to one part oats. I typically do 1 cup of oatmeal, 1 cup of water, and 1 cup of milk.

You can add anything you want to the oats to fix them up! My favorites are strawberries, blueberries, bananas, peanut butter, and chocolate chips.

The oats need at least four hours to soak but will last for 3-4 days. I usually add liquid to half my jars, and then on Wednesday, I’ll add milk and water to the second batch.

Every morning, grab a mason jar from the fridge, and you’re ready to eat. Overnight oats are good cold or warmed up.

Est. Price: $0.50/ serving

Lunch: Sheet Pan Chicken Fajitas

My wife and I love using sheet pan recipes because they save time on clean-up, and we can meal prep a week’s worth of lunch in one batch.

You can make these chicken fajitas in a few easy steps.

1. Put 2 lbs of chicken breast/thighs into a Ziploc bag or bowl and cover it with your marinade of choice. I use a store-bought marinade to save time and make it as easy as possible. Marinade for 30 minutes to a couple of hours.

2. Slice 1 green bell pepper, red bell pepper, and onion.

3. Cover the sheet pan with foil and dump the bell peppers & chicken on it.

4. Cook for 20 minutes at 350 or so and check to make sure it’s done.

5. Once the fajitas are made, you can eat them however you want! Stuff some tortillas or eat them with rice and beans. Eat the fajitas with some mixed greens and avocado for a healthy salad.

Est. Price: $1.50/serving

Dinner: Quick Coconut Chicken Curry

This coconut chicken curry recipe is one of our weeknight go-to meals! It’s cheap and healthy.

Here’s how you make it:

1. Put 2 lbs of chicken breast or thighs into a Ziploc or bowl. Rub 4 tbsp curry paste all over them.

2. Add 2 tbsp oil to a cooking pan and get hot. Add red onion and saute with 2 more tbsp curry paste. Cook for 5 minutes.

3. Add chicken to the pan and sear both sides (2 minutes a side).

4. Add coconut milk and put in the oven for 12 minutes @ 400 degrees.

5. When it’s done, you can eat the chicken curry with pita bread, rice, or by itself!

Est. Price: $2.50/serving

Grocery List

If you want to give this meal plan a try, here’s a grocery list you can print off and take with you to the store.

- Oatmeal

- Milk

- Optional oatmeal toppings you want: fruit, berries, nuts

- 2lbs Chicken breast

- 2 green bell peppers

- 1 onion

- 1 can of black beans

- 1 cup rice

- Fajita marinade

- 2lbs chicken thighs

- 1.5 cup coconut milk

- 4-6 teaspoons of red curry paste

- 1/2 cup diced red onion

Take Your Next Step in Meal Prepping

I don’t know where you’re at in life, but I truly believe that meal-prepping can help everyone.

It can help the entrepreneur eat healthy and save money to reinvest in their business. It can help the young professional save money to put towards retirement.

Meal prepping can save the stay-at-home parent hours of time every week in planning, shopping, cooking, and cleaning.

Take your first step today!