Home refinancing is a strategic financial decision that involves replacing your existing mortgage with a new one, often to take advantage of better interest rates, reduce monthly payments, or tap into home equity. It’s a move that can potentially save homeowners thousands of dollars over the life of their loan or help them manage their monthly budget more effectively.

The current housing market trends play a pivotal role in this decision. With fluctuating interest rates and the economy’s ebb and flow, understanding when to refinance your home can be as crucial as the decision to refinance itself. Proper timing ensures you maximize the financial benefits while minimizing any potential risks.

Table of Contents

- Factors to Consider Before Refinancing

- Benefits of Refinancing

- Costs of Refinancing

- Understanding the Refinancing Process

- Different Types of Refinancing Options

- Tax Implications of Refinancing

- Refinancing in Special Circumstances

- Common Pitfalls and How to Avoid Them

- Bottom Line: Should You Refinance Your Home?

Factors to Consider Before Refinancing

Current Mortgage Rates vs. Your Rate

The general rule of thumb is that if current mortgage rates are at least one percentage point below your existing rate, then it might be time to consider refinancing. However, this is not a one-size-fits-all scenario. Individual circumstances can significantly affect the decision.

Your Financial Goals and Situation

Refinancing is not merely about snagging a lower interest rate. It should align with your broader financial objectives, whether that’s reducing overall interest paid over the life of the loan, changing the loan term, or modifying the monthly cash flow.

Length of Time You Plan to Stay in Your Home

If you plan to sell your home in the near future, refinancing may not be the best option. The costs associated with refinancing can take years to recoup, so it’s crucial to consider your long-term plans.

Equity in Your Home

The equity you’ve built in your home can significantly impact your ability to refinance. Most lenders require you to maintain at least 20% equity in your home after refinancing.

Benefits of Refinancing

- Potential for Lower Monthly Payments: For many, the allure of refinancing is tied to the prospect of lowering monthly payments, which can free up cash for other financial needs or investments.

- Ability to Shorten the Loan Term: Refinancing can also offer an opportunity to reduce the term of your mortgage, allowing you to pay off your home faster and save on interest in the long run.

- Chance to Switch From an Adjustable to a Fixed Rate: An adjustable-rate mortgage (ARM) can be financially stressful due to its fluctuating nature. Refinancing to a fixed-rate mortgage stabilizes your monthly payments, making financial planning easier.

- Opportunities to Consolidate Debt: Homeowners often use refinancing as a strategy to consolidate higher-interest debt, taking advantage of lower mortgage rates to reduce overall debt obligations.

Costs of Refinancing

Closing Costs and Fees

When you decide to refinance your mortgage, the associated closing costs and fees can significantly impact the overall financial benefit. These expenses typically range from 2% to 5% of the loan amount. For example, on a $300,000 loan, you can expect to pay between $6,000 and $15,000 in closing costs alone.

These costs include various fees, such as the loan origination fee, application fee, underwriting fee, and charges for title searches and insurance. Each lender may have different fees, and some may be negotiable or waived entirely, but it’s important to get a complete and detailed list of these charges before proceeding.

Appraisal Costs

An essential part of the refinancing process is the home appraisal, which lenders require to determine the current value of your property. The cost of an appraisal can vary depending on the location, size, and complexity of the property but generally ranges from $300 to $800. This out-of-pocket expense is necessary for the lender to confirm that the loan amount does not exceed the home’s worth.

It’s crucial to ensure that your home’s valuation by the appraiser is fair and accurate, as it can significantly influence the terms of your refinancing.

Possible Prepayment Penalties

Many borrowers are unaware that some mortgage lenders impose penalties for early repayment of the original mortgage. These prepayment penalties can be a percentage of the remaining mortgage balance or equivalent to a set number of months’ interest payments. For example, on a remaining balance of $200,000, a 2% prepayment penalty would cost $4,000.

It’s crucial to read the fine print of your current mortgage agreement to understand if these penalties apply and how they are calculated. Some penalties decrease over time and eventually disappear, while others may persist for a significant portion of the mortgage term.

Break-Even Point Analysis

The break-even point analysis is a critical calculation in the refinancing decision. It’s the point at which the upfront costs of refinancing are balanced by the savings accrued from the new lower interest rate. For instance, if your closing costs are $6,000 and you save $200 per month on your mortgage payment after refinancing, it will take you 30 months to break even.

This analysis allows you to assess the temporal aspect of refinancing benefits—if you plan to stay in your home for a period that exceeds the break-even point, refinancing could be a wise financial move.

Key Considerations in Mortgage Refinancing: Navigating Costs and Analysis

| Aspect | Description |

|---|---|

| Costs of Refinancing | • Closing Costs and Fees: 2-5% Of the Loan Amount • On a $300,000 Loan, Expect $6,000-$15,000 in Costs |

| Closing Costs and Fees | • Include Loan Origination, Application, Underwriting Fees, and Charges for Title Searches • Vary by Lender; Obtain a Detailed List Before Proceeding |

| Appraisal Costs | • Home Appraisal Costs ($300 to $800) Confirm Your Property’s Value, Influencing Refinancing Terms |

| Possible Prepayment Penalties | • Lenders May Charge Penalties for Early Mortgage Repayment • Check Your Current Mortgage Agreement for Details |

| Break-Even Point Analysis | • Calculate When Upfront Costs Balance With Monthly Savings • E.g., Saving $200/Month With $6,000 in Costs = 30 Months to Break Even • Assess If Staying Longer Makes Refinancing Wise |

Understanding the Refinancing Process

How to Evaluate Current Mortgage Rates

Evaluating current mortgage rates is a foundational step in the refinancing process. It’s important to regularly monitor rate trends since even a small drop in interest rates can translate into substantial savings over the life of the loan. The rates offered can vary widely between lenders due to differences in business models and risk assessment.

A crucial part of this process is comparing the rates you’re being offered to the national average and the rates advertised by various lenders. Websites of financial institutions, mortgage comparison tools, and finance-related news outlets can provide current information on mortgage rates.

Application and Approval Process

The application and approval process for refinancing can be as complex and stringent as that for your original mortgage. It starts with submitting a formal application to the lender, which will trigger a series of financial checks and balances. You’ll need to provide detailed information about your income, assets, debts, and creditworthiness, similar to when you first applied for a mortgage.

The approval process can take several weeks as the lender assesses your financial stability and the likelihood that you’ll be able to make your new mortgage payments.

Required Documentation

The documentation required for a mortgage refinance is extensive, as lenders need to reassess your financial standing. This includes proof of income such as recent pay stubs or tax returns, statements for all your assets including savings, investment accounts, and other property, a complete list of debts such as other loans and credit card debt, and often your current mortgage statement.

The lender will also require your identification, insurance information, and any other documents that could affect your financial picture.

Closing the Refinance

Closing on a refinance loan is the final step in the process and bears similarities to closing on a home purchase. It involves meeting with various parties to sign a new loan agreement, paying closing costs, and, if necessary, setting up a new escrow account for things like property taxes and homeowner’s insurance. At this point, you’ll review and finalize all the terms of your new mortgage, including the interest rate, payment schedule, and any other conditions.

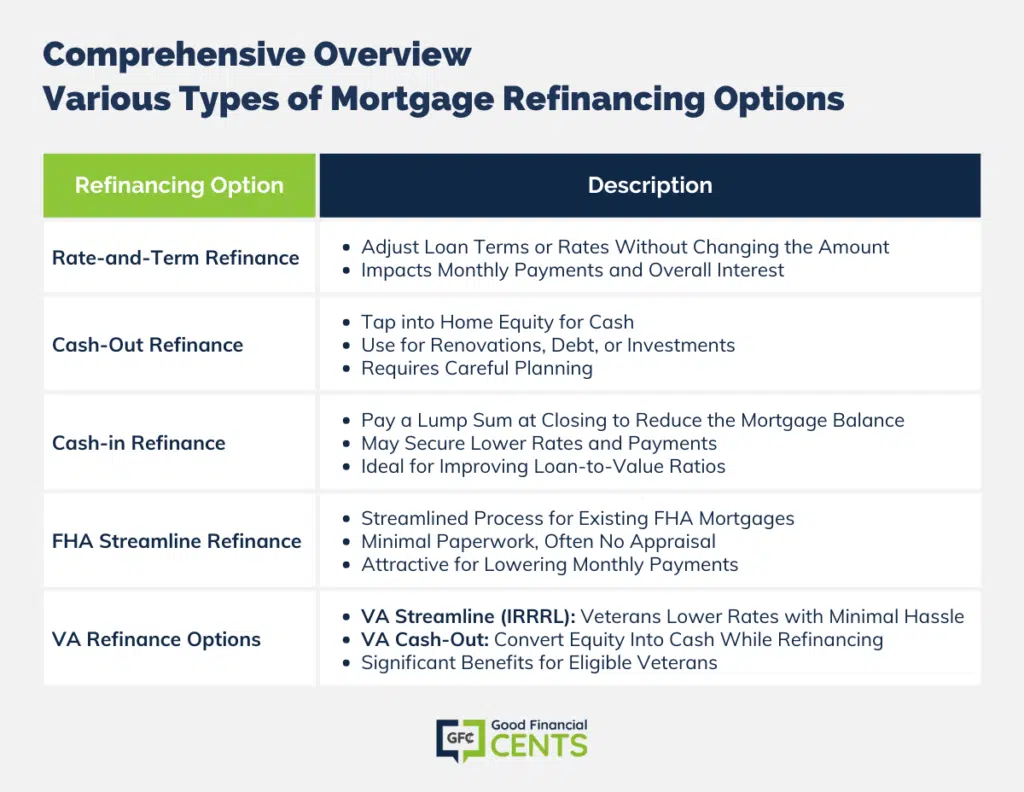

Different Types of Refinancing Options

Rate-and-Term Refinance

Rate-and-term refinancing is an option chosen by many homeowners looking to take advantage of lower interest rates or to change the term of their loan without altering the original loan amount. This can significantly affect monthly payments and the total interest paid over the life of the mortgage.

A homeowner may choose to shorten the loan term to pay off the mortgage faster and save on interest, or extend the term to reduce monthly payments.

Cash-Out Refinance

A cash-out refinance is a strategic financial move for homeowners who have built up significant equity in their property. This type of refinancing allows them to access a portion of that equity in cash by taking out a larger mortgage than they currently owe.

The cash obtained can be used for a variety of purposes, such as home renovations, paying off high-interest debt, or investing in other properties. It’s essential to have a plan for the cash that will support your financial goals and not just immediate desires.

Cash-in Refinance

A less common but sometimes beneficial option is a cash-in refinance. In this scenario, a homeowner chooses to pay a significant portion of the mortgage balance at closing to reduce the remaining amount owed.

This can lead to a lower interest rate, reduced monthly payments, and less interest paid over the life of the loan. It’s particularly attractive to homeowners who are underwater on their mortgages or have low equity and wish to improve their loan-to-value ratio.

FHA Streamline Refinance

The FHA Streamline Refinance program offers an expedited path for homeowners with existing FHA mortgages to refinance at a lower rate. This program is characterized by minimal paperwork, no appraisal requirement in most cases, and simplified credit requirements.

It’s designed to lower the monthly payment and is often a good choice for those not looking to take cash out or change the mortgage term significantly.

VA Refinance Options

For eligible veterans and active service members, the VA offers refinancing options that can provide significant benefits. The Interest Rate Reduction Refinance Loan (IRRRL), also known as the VA Streamline Refinance, is designed to lower the interest rate on a current VA loan with minimal hassle and paperwork. Alternatively, a VA cash-out refinance allows qualifying borrowers to convert home equity into cash while refinancing their current mortgage.

Tax Implications of Refinancing

Deductibility of Mortgage Interest

The mortgage interest deduction allows homeowners to reduce their taxable income by the amount of interest paid on their loan, which can still apply after a refinance. However, the Tax Cuts and Jobs Act of 2017 brought changes to this deduction, capping it for debt incurred after December 15, 2017, to $750,000, down from $1 million. It’s critical for homeowners to understand these changes and how they affect their specific situation.

Points and Refinancing

Points, also known as discount points, are fees paid directly to the lender at closing in exchange for a reduced interest rate. This is a form of pre-paid interest that can save you money over the course of the mortgage if you stay in your home long enough.

When refinancing, the points paid can also be tax-deductible, but they must be spread out and deducted over the life of the loan rather than all at once.

Refinancing in Special Circumstances

- Refinancing During a Divorce: Refinancing during a divorce can be a method to remove one party from the mortgage and deed, simplifying the separation of assets.

- Refinancing With Bad Credit: While more challenging, refinancing with bad credit is not impossible. It often requires more extensive shopping around for a lender willing to accommodate your credit situation.

- Refinancing an Investment Property: The process for refinancing an investment property is similar to a primary residence, but the requirements can be stricter, and the rates may be higher.

- Refinancing in a Rising Interest Rate Environment: Refinancing when rates are rising may still make sense if you’re switching from an adjustable-rate to a fixed-rate mortgage or if you’re looking to cash out equity.

Common Pitfalls and How to Avoid Them

- Extending the Loan Term Unnecessarily: Refinancing into a longer-term loan can mean paying more in interest over time, even if monthly payments are lower. It’s important to consider the long-term implications.

- Overlooking Hidden Fees: Reading the fine print and asking questions about all fees associated with refinancing can help you avoid unexpected costs.

- Not Shopping Around for the Best Rates: Loyalty to one lender can be costly. Comparing offers from multiple lenders could lead to significant savings.

- Underestimating the Impact of Credit Scores: A good credit score can significantly affect the interest rate offered. It’s worthwhile to improve your credit score before applying for a refinance.

Bottom Line: Should You Refinance Your Home?

Home refinancing is a powerful tool that can align with your financial strategy when used judiciously. It offers numerous benefits, from lowering monthly payments and interest rates to debt consolidation and term adjustment.

However, it’s accompanied by costs and complexities, which necessitate a thorough understanding of the process, careful consideration of one’s financial situation, and an awareness of the market. Tax implications and special circumstances also require attention.

Avoiding common pitfalls is crucial; hence, diligent preparation, comparison shopping, and professional advice are key. Ultimately, refinancing can be a wise financial move when it’s tailored to your unique goals and circumstances.