College is becoming increasingly expensive. As a result, it is likely that you will need to seek funds for paying for college from multiple sources.

First of all, though, it is a good idea to be setting money aside in some sort of advantaged account, if you still have time.

Whether this is a 529 plan or a Coverdell, it is a good idea to be in the habit of setting aside money for college.

Table of Contents

However, if you are concerned that what’s in a college account will not be enough to cover the costs of college, it is a good idea to consider additional sources of college financing.

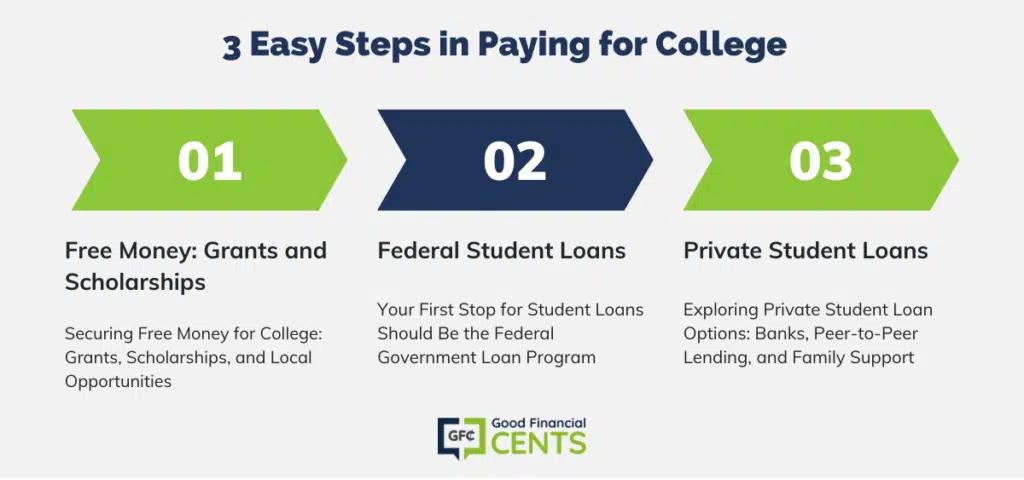

How To Pay For College In 3 Easy Steps

Before we look at some of the specific options for financing college, we are going to look at some of the general types of aid.

There are two categories of aid:

- Merit-Based: As you can probably decipher from the name, this is money that’s given out based on performance. These are typically given out based on academics, but it could be for other skills or abilities.

- Need-Based: This type of aid is given to students based on their financial needs. Typically, there are few requirements other than finances.

Some types of college financing are more desirable than others, as you might imagine.

Below you will find ideas for college financing — in the order you should seek them.

1. Free Money: Grants and Scholarships

Your first efforts should be geared toward getting free money to help you pay for college.

The government offers grants based on your income. If you qualify, you can get government help paying for your schooling.

On top of this, there are scholarships available for different accomplishments. Some of them are available because of certain qualities you might have (such as being tall, or being of a certain ethnicity). FastWeb is one site that can help you locate scholarships to apply for. Check with the school, and in your local community, for scholarships.

Because this is free money, you should be prepared to spend a lot of time researching and applying for these. It might seem cumbersome now, but it will be worth it when you start repaying loans.

There are a lot of local groups and businesses who offer scholarships and grants. These are probably going to be smaller amounts, but there are also going to be fewer people apply. You have a much greater chance of winning these scholarships.

Free money is free money.

2. Federal Student Loans

Scholarships are harder to come by these days, so you might need additional loans.

Your first stop for student loans should be the federal government loan program. You can get loans at a lower interest rate.

You should first get as much as your federal financing in subsidized loans. With these loans, the government pays your interest until you are done with school.

If you don’t qualify for subsidized loans, you can get unsubsidized loans. With these loans, you can pay the interest as you go, or wait until you are done with school and the accrued interest is capitalized.

3. Private Student Loans

You can also get student loans from private sources.

Banks offer student loans, but their interest rates and terms are often not as favorable as those offered by the government.

You can go to websites like teri.org to find sources for private student loans.

Another possibility is to go through a site like Tuition U, which offers P2P lending as well as access to banks and credit unions across the country.

Before you go to a bank, it might be worth it to check the terms you can get with peer-to-peer lending. In some cases, you can get better deals.

Additionally, you can ask friends and relatives to help you with your education by loaning you a portion of the sum through a P2P site.

Financing Tools

When you’re facing those massive college bills, it’s important you get all of the help you can.

You could easily spend days and days researching grants, loans, or scholarships. Thankfully, there are a couple of ways you can make the whole process easier. We already mentioned FastWeb, but that’s not the only resource out there.

We couldn’t go any further without including the Free Application for Federal Student Aid (FAFSA).

Just about everyone is qualified for some type of financial aid.

Depending on the situation, some people qualify for much more aid than other people. The best way to determine your eligibility is to create a FASFA account and complete an application.

FASFA is managed by the U.S. Department of Education, and they hand out over $150 billion every year in student aid.

If you haven’t completed a FASFA yet, you could be missing out on some serious funding. It’s free to fill out the form, and the office will review your application and deliver any loans and financial aid you qualify for. It can save you hours and hours of time.

One common confusion is FASFA is the same thing as a CSS profile, but the two are very different.

CSS (College Scholarship Service) is a form some colleges use to distribute their own funding. These forms won’t get you access to any funding other than what that specific college does in-house.

Bottom Line

Finding financing for college isn’t always easy — and it can be expensive. However, there are a number of options that can help you find some of the help you need to pay for college. Start out by working toward funding yourself through savings and scholarships, and then explore other options if needed.

Well, there are more ways to fulfill college financing priorities you can choose working online part-time or full-time best alternative.