Throughout my military career, I’ve constantly been surrounded by acronyms. The Army is notorious for them: APFT, MOPP, PMCS, AWOL. These are just a handful of the thousands of them that exist. Some I know. Most I don’t. I was constantly having to research what the heck most of them stood for.

Table of Contents

While acronyms were expected in the military, I didn’t imagine how prevalent they would be in the financial services industry. One of the acronyms that I came across that I felt like I was in the military again was QDRO. What makes it even more confusing is that I’ve heard it pronounced both “Quid-dro” and “Quad-dro”. What’s the correct pronunciation? The jury is still out on that one.

What Is a QDRO?

And exactly what does it have to do with your 401(k) or pension plan? A QDRO is a Qualified Domestic Relations Order from the court which indicates the beneficiaries of your retirement account, other than you. These beneficiaries are also called “alternate payees” and this comes into play should you and your spouse get a divorce.

Usually, the beneficiaries of your retirement account(s) might be your spouse, child, or other dependent, or a former spouse, and the QDRO will define how each of these people receive distributions from the retirement account through child support or alimony payments and/or property ownership.

Importance of a QDRO

If you should go through a divorce, the QDRO becomes extremely important. Following the QDRO is the key to avoiding 10% early withdrawal penalties imposed by 401(k) plans because if you don’t follow the QDRO you can be taxed on the money taken from your 401(k) even if it landed in the hands of your beneficiaries! Make sure to enlist professional help (either through your 401(k) plan administrator or a tax professional) to minimize your own tax implications of having to distribute your 401(k) to alternate payees due to divorce.

Take Steps to Verify Information in the QDRO

If your 401(k) plan is subject to a QDRO during a divorce (typically if you have been married at least 5 years before getting divorced), you want to give the administrator of your 401(k) a copy of your QDRO. This allows them to carry out the order. They’ll review the QDRO to ensure it’s valid within 18 months and determine whether or not any payments must be made to beneficiaries. You’ll receive notification of any alternate payee (beneficiary) receiving funds from the 401(k) and provided the QDRO was followed correctly, you will not have to pay a 10% early withdrawal fee from the withdrawal of the funds distributed to your beneficiaries.

The few QDRO’s that I’ve dealt with had been drafted directly by the attorney. All I had to was open the appropriate account (in my cases they were IRA’s) and the money was transferred directly in. I like simplicity.

Who Receives Money From Your 401(k) After Divorce?

Where you live will determine how your 401(k) funds are distributed after a divorce. Most states have equitable distribution rules, which means your 401(k) is divided 50/50 between you and your ex-spouse – but it depends on how long you were married and how much was contributed, as well.

Some ex-spouses win 50% of a 401(k) plan even in states without equitable distribution rules, during the divorce proceedings. If you live in any of the following states, you can count on paying out half of your retirement to your ex-spouse: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin. These are “common property” states.

For the QDRO cases I’ve worked in, all have been in the state of Illinois. Although, not a “common property” state, each spouse did receive 50% of the retirement account balance.

What About QDROs and Pensions?

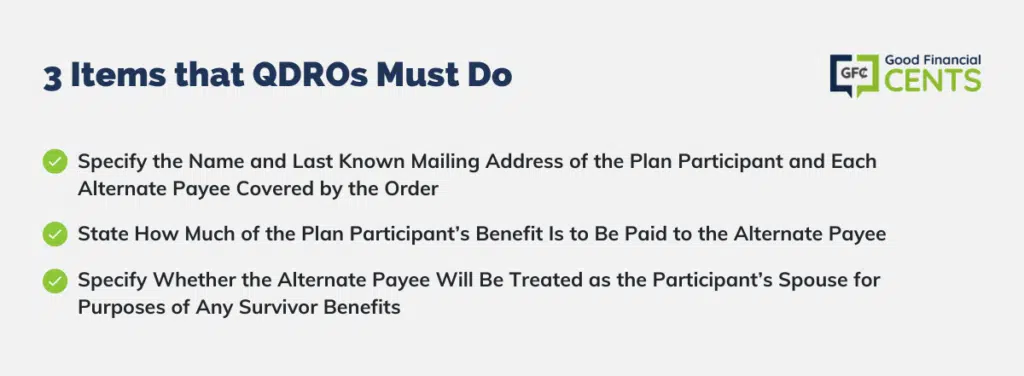

QDROs are most commonly associated with 401(k)s, but while I was doing my research I learned that they can also apply to pensions. According to the PBGC website here are three items that QDRO’s must do:

- Identity of the plan participant, each alternate payee, and each pension plan. A QDRO must specify the name and last known mailing address of the plan participant and each alternate payee covered by the order. A QDRO also must identify the name of each plan to which the order applies—this should be the plan’s formal name.

- Amount to be paid and when payments start. A QDRO must state how much of the plan participant’s benefit is to be paid to the alternate payee, such as a dollar amount or percentage of the benefit, or make clear the manner in which the amount is to be determined. A QDRO also must specify or allow the alternate payee to choose when payments to the alternate payee will start.

- What happens on the death of the plan participant and the alternate payee? A QDRO should specify whether the alternate payee will be treated as the participant’s spouse for purposes of any survivor benefits. A QDRO also should specify what happens to benefits when the alternate payee dies.

What a QDRO Must Not Require

There is sometimes a misconception on what a QDRO must and must not do. The PBGC site offers what a QDRO must not require the PBGC to do:

- Pay any benefits not permitted under ERISA or the Code;

- Provide any type or form of benefit, or any option, not otherwise provided by PBGC;

- Pay benefits with a value in excess of the value of benefits that would otherwise be payable by PBGC;

- Pay benefits to an alternate payee when those benefits are required to be paid to another alternate payee under an order previously determined to be a QDRO;

- Pay benefits to the alternate payee for any period before PBGC receives the order;

- Pay benefits as a separate interest to the alternate payee if the participant is already receiving benefit payments; or

- Change the benefit form if the participant is already receiving benefit payments.

My Husband Ex Wife has not removed his name from there house which was suppose to be done 2 years ago , they have a qudo for when he retires. He left his job 60 days ago and we left this pension in as he is going to be going back into law enforcement next month. She is requesting the court to order him to transfer his pension to a Roth IRA so she can get her money now is this possible ? this is when we filed a contempt of court for her to sell the house

Hi Robyn – This is a legal matter and you’ll have to go through your attorney – which it looks like you already have.

I was never told about the QDOR when I got divorced in 2013. He has been order to pay child support and he is not doing so?. Can I ask the court to give me half of his QDOR or is it too late?. I am going back to court for a motion of contempt and enforcement and request for writ of bodily attachment. The sad part about this is that he got more money when we sold the house, he got the Disney vacation property and he got everything that was in the house, from china sets, furniture, electronics, computers, over $40,000.00 on tools, a trailer with all kind of law equipment and the kids game box all of their expensive toys. I on the other hand I am paying mortgage, insurance, car payments for my son and I, medicine, clothing, shoes, school supplies and lunch money for school. Is there something I can do to get him to pay me half of that QDOR?.

Hi Maria – You need to consult with an attorney to determine your rights. I’m guessing that you should be able to go back and get a QDRO on the 401(k), especially if it’s large. It will all depend upon the way that your divorce decree was worded, and the laws in your state. An attorney should be able to help you with all of that.

Jeff, if one spouse has $100k remaining in her 401k and a $50k loan, is the $100k still available to the Court in her divorce to be split via a QDRO? Or, as I have heard, because of the loan, the $100k must remain. Would appreciate your response. Thanks.

I understand that a person wont get hit with the 10% early withdrawl penalty, but will the person have to pay federal taxes on the half given to their ex?

Regarding a QDRO, think of it as more of a transfer or rollover; hence avoiding any early withdrawal penalties. Now if the receiving spouse were to cash it out of the retirement plan, then they would be faced with tax and penalties.

My Dad and Mom were married 30 years. Mom has been Mentally disabled for more than half of those years. Last year Dad divorced Mom. Mom got on SSI and Medicaide.Dad has to pay her 450.000 of his 401k. Mom was given a GAL to settle the money. The GAL said that putting it in a Special Needs Fund would be the best way to handle it. Will this effect Moms SSI and Medicade? The first idea was to just put in my name to save on taxes but because the QRDO has to have a tax ID number that would’t work. Now the GAL wants me to be in charge if the trust is this a good idea?

I am about applying for my ex-husband’s retirement from the state of Arizona. How is this paid, in one lump sum, IRA, 401 K, do I get a monthly amount? What is the best way to take this. I am permanently disabled, 59 years old. My ex-husband passed, never applied for qdro, our 3 sons are the beneficiary.